Summary:

- Now is not an easy time to be investing in risk assets, but empirical evidence suggests investors who go against the grain enjoy lucrative returns in the long run.

- The travel sector has made a strong comeback in the last 18 months, but the stock market performance of leading companies in this space does not reflect this comeback accurately.

- Airbnb is heading into 2023 with several challenges threatening to negatively impact its bookings.

Carl Court

The travel sector came under pressure when Covid-19 was declared a pandemic well over two years ago and it took time for the industry to make a strong comeback from the virus-induced demand disruption. Airbnb, Inc. (NASDAQ:ABNB) went public in December 2020 at a time when investors found it difficult to assess the outlook for the travel sector due to mobility restrictions, recession fears, and pandemic fears. Recent data suggests the travel sector has made a strong comeback in the last 18 months, but the stock market performance of leading companies in this space does not reflect this comeback accurately as recession fears coupled with interest rate hikes have pushed the markets lower this year. Now is not an easy time to be investing in risk assets, but empirical evidence suggests investors who go against the grain enjoy lucrative returns in the long run. For this reason, it is prudent to look for anomalies in the travel sector. In this analysis, the focus is on the prospects for Airbnb amid macroeconomic challenges.

How Has Airbnb Stock Performed Recently?

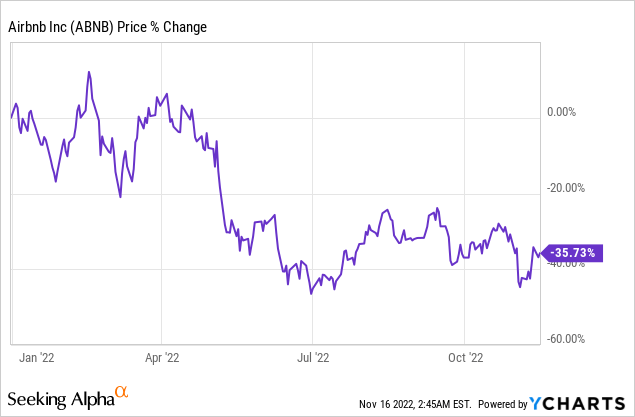

Airbnb stock is down 35% this year despite generating record revenues. The downtrend is caused in part by investors’ general concern about rising interest rates, which can have an impact on growth companies by weighing on profitability.

Exhibit 1: ABNB YTD performance

Recent earnings did not help Airbnb’s cause either. Despite reporting record profits on the back of a surge in bookings, Airbnb warned of a slowdown in bookings in the coming quarters, which led to a selloff in ABNB stock. Wall Street analysts are turning pessimistic about the demand environment for Airbnb on the back of this warning as well, which is proving to be another driver behind the deteriorating investor sentiment for Airbnb.

Challenges To Monitor

Rising interest rates will raise the cost of debt, putting pressure on housing and hotels, which are already dealing with higher construction and transaction costs. Many development projects are being pulled or shelved because of the uncertain economic environment. Furthermore, one of the most significant challenges that hoteliers face is a labor shortage, which has resulted in significant increases in labor costs. Labor shortages surfaced more than a year ago but so far, the industry has not been able to resolve this crisis. According to Deloitte’s Travel Outlook Report, the hotel industry employed 300,000 fewer people in October 2021 than it did two years ago, which goes on to show how the industry was suffering even a year ago. Hoteliers are attempting to reduce the cost burden by slowing development projects.

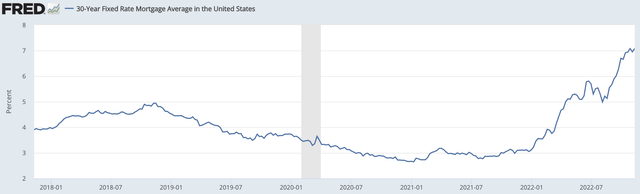

Even though Airbnb is not reliant on hotels and has an asset-light model, the impact on the housing market can have an impact on available rental listings and their hosts. Because of labor shortages, rising material costs, and supply chain issues, the U.S. housing market inventory fell to its lowest level since the 1970s earlier this year, and builders seem to be struggling to build more affordable homes. As a result, the number of prospective home buyers has decreased. In September, the 30-year fixed-rate mortgage surpassed 6% for the first time since the 2008 housing crash, weighing on demand, and limiting supply.

Exhibit 2: 30-year fixed rate mortgage average

Federal Reserve

Source: Federal Reserve

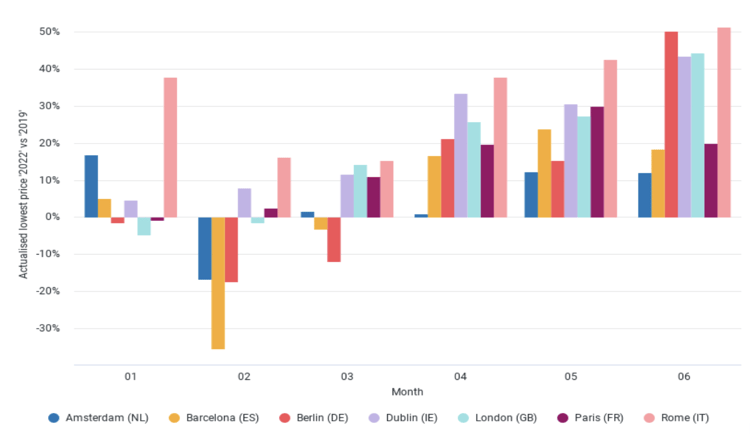

Add to that the growing global energy crisis, which is concerning and may have an impact on travel demand this winter. According to data from A Renovation Wave for Europe, a report published by the European Commission in 2020, more than 220 million building units were built before 2001, accounting for 85% of the EU’s building stock. The majority of existing buildings are unsuitable in terms of energy efficiency because they rely on fossil fuels for heating and cooling. Not only do these buildings emit greenhouse gases, but they also account for roughly 40% of total energy consumption in the EU. The prices of natural gas, which heats more than half of all homes, and electricity, have skyrocketed as Europe lacks access to Russian gas supplies. Even though EU members have agreed on voluntary targets to reduce gas and electricity demand by 15% this winter, the policy is unfavorable for vacationers, hosts, and hoteliers. Governments are encouraging consumers and businesses to conserve energy by turning off night lights on monuments and buildings, reducing the use of warm water, ceasing to heat public buildings, and limiting the temperature to a maximum of 19 degrees. As a result, hotels/rentals are either shortening their operating hours or raising their room rates. According to OTA Insights, room prices in key European cities were significantly higher in June compared to the previous year. Prices in Rome, Berlin, Dublin, and London were up between 40% to 50% compared to the pre-pandemic level.

Exhibit 3: Pricing comparison of popular European destinations (2019 vs 2022)

OTA Insight

Source: OTA Insight

Increased demand also affects prices, and given how popular summer travel is, these price increases are not surprising. Winter travel demand, on the other hand, will be less holidayesque, as vacationers will likely avoid compromising their stays by dealing with a chilly vacation while paying a higher price. Most travelers are postponing their vacation plans as inflation weakens their purchasing power as well. As a result, rising average daily rates (ADRs) paid by guests to compensate for rising energy costs may result in customer loss. According to TravelBoom, a digital marketing agency for hotels, resorts, and vacation rental companies, 36% of travelers are considering canceling planned vacations due to financial constraints. As charging higher prices does not appear fair, some vacation rental and hotel owners are leveraging technology to allow guests to cooperate by learning about their energy consumption in real time. New constructions and unique properties, on the other hand, are investing in energy storage and rooftop solar to become more energy efficient and save money, which may not produce results in the near term but will be highly attractive features in the future.

Where Will Airbnb Head In 2023?

Although the current macroeconomic picture appears depressing, there are some signs that the travel sector will continue its recovery from pandemic woes. Travelers are still booking holiday vacations despite limiting discretionary spending in other areas. Travelers are currently in a “revenge travel” mode, attempting to make up for two years of missed travel, which is outweighing the cost-of-living crisis. This summer, consumers have been paying and saving more for their vacations than for other expenses. According to Outdoorsy’s Vacation on a Budget survey results, 58% of Americans have set aside money last summer to keep their vacation plans alive despite rising inflation. A more recent survey conducted by Destination Analysts in October found that 82% of respondents are planning to travel in the coming months although they have slashed their travel budgets.

Development projects are focusing on leisure markets with high hotel demand from remote workers. According to Deloitte, remote workers have above-average purchasing power and are more than twice as likely to increase their leisure trip budget compared to 2019. The workcation trend is promoting business and leisure, and most travel companies are now focusing on “Bleisure,” a blended travel experience that began with the rise of Zoom and video conferencing during the COVID-19 outbreak. The Deloitte report also highlights that during the holiday season, Americans earning more than $100,000 per year are nearly twice as likely to travel as those earning less than $50,000. While this appears to be a relief for luxury and high-end travel companies in the face of rising travel costs, vacation rentals focused on low-cost stays may need to find a way to keep up with costs while maintaining demand.

Airbnb caters to all types of customers and focuses on providing experiences, which distinguishes the platform from most of its competitors. So far, “revenge travel” has benefited Airbnb, and it will continue to benefit in the coming months because of the wide selection of unique stays and experiences that today’s vacationers are looking for.

The company, commenting on its ability to remain relevant at times of economic instability, said last August:

We have nearly every type of space in nearly every location, so however travel changes, we are able to adapt. And regardless of the economic environment, our guests come to Airbnb because they can find great value, and our Hosts can earn extra income.

Currently, overnight stays booked on Airbnb appear to be returning to pre-pandemic levels, which is an encouraging sign. Because of the work-from-anywhere trend, long-term stays have become the fastest-growing category for the company, up nearly 90% from three years ago. The company is focused on improving the average daily rates realized from long stays to push its margins higher.

Travel demand is overcoming strains caused by Covid-related challenges, and despite high inflation and a growing energy crisis, the new breed of travelers will maintain the demand in the coming months. The company believes that the cost-cutting and investment strategies implemented during the pandemic have well-positioned Airbnb to thrive against the backdrop of a slowing global economy. The next year will, however, test Airbnb’s resilience yet again and the company may find it difficult to top the growth rates reported so far this year. A slowdown in growth will not bode well for Airbnb shareholders in the short run as this could lead to further erosion of the company’s market value.

Is ABNB Stock a Buy, Sell, or Hold?

Airbnb shares remain under pressure as Mr. Market continues to be wary of the prospects for the travel industry. As the Federal Reserve raises interest rates in an attempt to combat inflation, investors have been reducing their exposure to high-growth stocks, which is a theme that is likely to continue in 2023 as well – at least in the first half of the year. Investors are also concerned about the deteriorating outlook for the global economy and the implications of rising energy costs. Airbnb, although well-positioned to emerge as a big winner in the long run, is heading into 2023 with several challenges threatening to impact bookings, and therefore, both revenue and earnings. ABNB stock might not be the best bet for investors who are looking for trading opportunities in 2023. However, growth-oriented investors with at least a 5-year investment horizon may find ABNB stock very attractively priced today as the company breaks through to profitability for the first time ever.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The unexpected moment is always sweeter

At Leads From Gurus, we strive to achieve sweet returns by predicting which companies would report unexpected earnings. Join us to discover the power of earnings surprises.

Your subscription includes access to:

- Weekly actionable ideas that would help you beat the market.

- In-depth research reports on stocks that are well-positioned to beat earnings estimates.

- Three model portfolios designed to help you beat the market.

- Educational articles discussing the strategies followed by gurus.

- An active community of like-minded investors to share your findings.

Act now to secure the launch discount!