Could PerkinElmer Be The Next Danaher?

Summary:

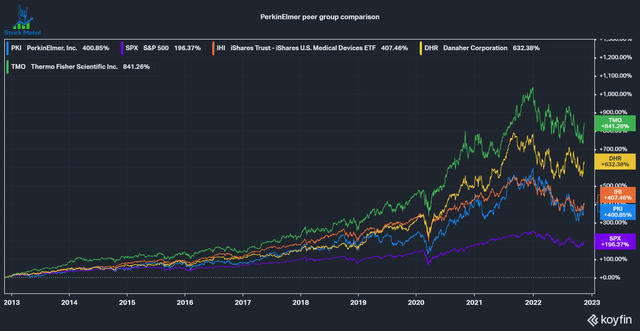

- PerkinElmer, Inc. might have outperformed the S&P 500 over the last decade, but it didn’t perform as well as some of its peers.

- PerkinElmer has many similarities to Danaher Corporation and could be a great buy here.

- Both companies recently announced divestitures to focus on their core Life Sciences and Diagnostics businesses.

- PerkinElmer could be an opportunity to outperform the market over the next decade as well.

FG Trade

Can a restructuring lead to outperformance?

PerkinElmer, Inc. (NYSE:PKI) is an American Medical Devices company focused on life sciences and diagnostics. Over the last ten years, the company outperformed the S&P 500 by a wide margin but did not manage to beat the iShares U.S. Medical Devices ETF (IHI). The company has a significant underperformance compared to direct competitors Danaher Corporation (NYSE:DHR) and Thermo Fisher Scientific Inc. (TMO). PerkinElmer is currently restructuring its portfolio and might offer an opportunity for future outperformance. I will also compare it with Danaher because they have a similar portfolio.

I’d also like to thank @user1416 , @Mean Reversion Investor, and @scorpionblue, who inspired this article after their conversation on my latest Danaher article.

Peer group comparison (Koyfin)

PerkinElmer overview

PerkinElmer is a leading, global provider of end-to-end solutions that help scientists, researchers and clinicians better diagnose disease, discover new and more personalized drugs, monitor the safety and quality of our food, and drive environmental and applied analysis excellence.

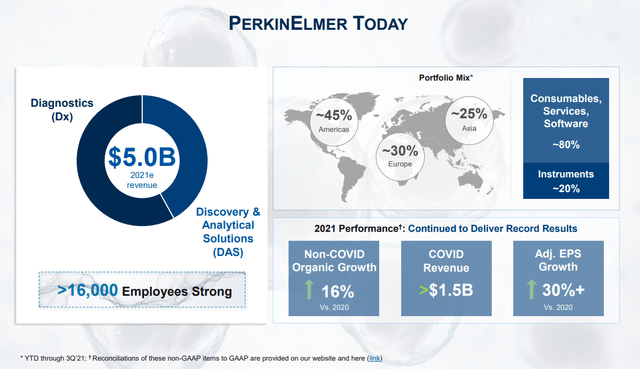

The company currently generates most of its revenues from its Diagnostics and Life Sciences, with a significant portion of it (80%) coming from recurring revenue sources like Consumables, Services and Software. Only 20% of revenue comes from Instruments, which then will have recurring revenues in their life cycle. The company had a big boost from COVID test kits in 2020 and 2021 and contributed over $1.5 billion to its 2021 revenues from COVID. This is now a headwind, as the company expects FY 2022 to see a 60% decline in COVID revenues to $610 million. The company has a global presence, with 55% of revenues outside of the Americas, resulting in strong current FX headwinds.

PKI at a glance (PKI Investor Presentation)

In the latest Q3 earnings report, PerkinElmer saw 12% organic growth in its Discovery & Analytics Solutions (pro forma before divestitures, which we’ll get to later), a 17% inorganic increase and 6% FX headwinds at a 26% operating margin (750bps increase y/y). The Diagnostics segment saw a -33% organic decline due to COVID. If we adjust that out, we get a 5% organic growth rate with a 1% M&A contribution and a 6% FX headwind. Operating margins declined to a still high 30.9% level, down 1300 bps y/y due to COVID revenues. The company expects 9% organic growth for the full year, excluding COVID revenues and adjusted EPS of $7.9.

Danaher overview

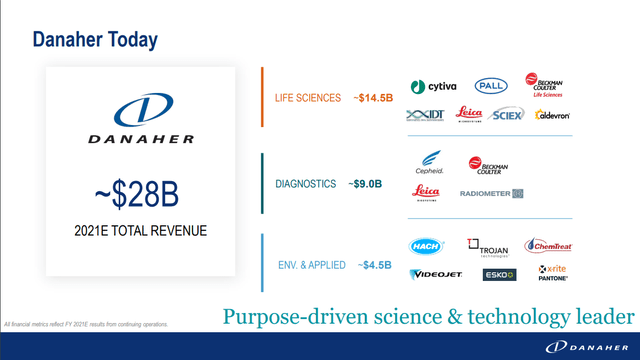

Danaher is a leader in Life Sciences and Diagnostics. The company generated nearly $15 billion in life sciences and $9 billion in diagnostics in 2021. The Environmental & Applied business generated $4.5 billion in revenues. Much like PKI, Danaher generates most of its revenue from recurring revenues, with 75% recurring and 25% from instruments. The company has an overall operating margin of around 27%, with the EAS segment lagging behind. Danaher also profited off the COVID pandemic and is forecasting COVID testing sales of $2.9 billion for 2022. International revenues also account for more than half of Danaher’s sales, leading to an FX headwind.

Danaher Overview (Danaher Investor presentation)

Environmental divestitures

In a recent article, I covered Danaher’s planned divestiture of its Environmental & Applied Solutions (EAS) business via a spinoff. PerkinElmer actually announced a very similar divestiture a few weeks earlier. The company is selling its Analytical, Food and Enterprise Services business to New Mountain Capital for total after-tax proceeds of $2050 million in cash and future contingent considerations. It is expected to close in Q1 2023. These divestitures will lead to more focused companies in the Life Sciences and Diagnostics markets.

Life Sciences and Diagnostic focus

In my article about the EAS divestiture, I showed that EAS lacked the same operating leverage and growth that Danaher’s other segments showed in the last six years. I like the decision to divest the company and I will most likely sell my shares in the spun-off company when it happens in Q4 2023 (I’ll review the details of the deal when they are available and cover them on Seeking Alpha).

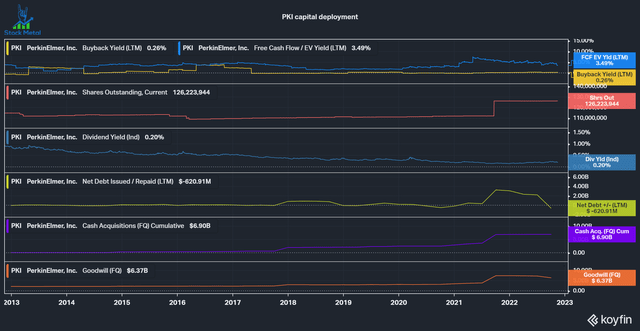

PerkinElmer has similar reasoning for the divestiture and wants to increase its focus on its best businesses. The company expects to grow its focused Life Sciences division in the low-double digits and its Diagnostics division in the high single digits. This would elevate the company’s organic growth rate from high-single-digits to double-digits and drive operating margins above 30%. The company expects to increase its margin by 75-100 bps per year and, with this operating leverage, expects to grow adjusted EPS significantly faster than organic growth. These expectations do not factor in capital deployment, where the company spent a cumulative $6.9 billion in the last decade on acquisitions. We must remember that PKI has also accumulated a lot of Goodwill from these acquisitions($2 billion to $6.3 billion in the same period). At the same time, Danaher spent $58 billion on acquisitions and only accumulated an additional $15 billion in Goodwill.

PKI capital deployment (Koyfin)

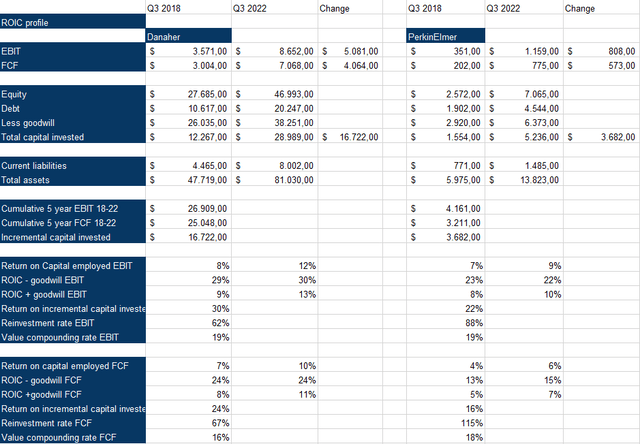

Let’s now look at the Returns on Capital both companies generate. We can see that, generally, Danaher managed to generate higher returns in ROCE, ROIC and ROIIC, both with EBIT and FCF as the numerator. PerkinElmer managed to reinvest at a higher rate due to its smaller size. Lastly, we can’t forget that Danaher spun off Envista during this period, which is not represented in these numbers and contributed over $2 billion to Danaher’s revenue.

Return on Capital comparison (Authors Model)

Valuation

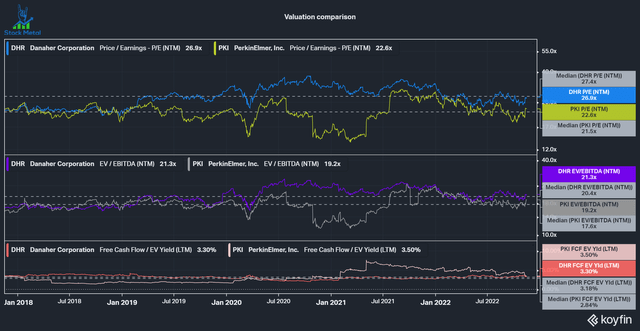

Over the last five years, Danaher generally had a higher valuation than PKI, which still is the case. Both companies currently trade roughly in line with their median valuations; just on the FCF yield, PKI is currently significantly cheaper than its median. Both companies are not cheap, though.

An exciting opportunity if they can execute

PerkinElmer is an exciting opportunity to invest in a smaller competitor in the Life Sciences and Diagnostic industry with market leadership in some niches. The company has many similar traits to Danaher but does not have the same track record. This creates an opportunity for margin expansion in the future if they turn out to execute well and deserve a higher multiple. I wouldn’t emphasize the margin expansion part of the equation too much, though, because PKI still isn’t cheap today. I currently own Danaher (6% position) and I’ll add PKI to my watchlist with a buy rating.

Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: What do you think about PerkinElmer and Danaher? Let’s continue the discussion in the comments below. This is not financial advice.