American Tower’s Moat Keeps Getting Bigger

Summary:

- American Tower is well-positioned to benefit from the ongoing 5G buildout.

- It’s positioning its CoreSite assets to capture more profits across the communications value chain.

- I also highlight balance sheet improvements, dividend, valuation, and other points worth considering.

bjdlzx

Investing in REITs doesn’t always have to be about immediate income, especially for those who are well a ways away from retirement. For example, American Tower (NYSE:AMT) offers a mix of both worlds, both income and growth, for those who like to see a fast-growing dividend stream.

American Tower fell to truly bargain levels just last month and has participated in the market rally since then. In this article, I highlight why AMT remains a worthy choice in the current market, so let’s get started.

Why AMT?

American Tower Corp. is one of the largest publicly-traded REITs by market cap and has a global presence. It’s focused on owning, operating, and developing multi-tenant communications real estate, with a portfolio of approximately 223K communication sites. It operates on the 6 continents of North & South America, Africa, Europe, Asia (India), and Australia, covering 22 countries. AMT generated $10.5 billion in revenue in the trailing 12 months.

The cell tower industry in the U.S. is dominated by American Tower and Crown Castle Inc. (CCI). This comes with a massive economy of scale, as they enter long-term leases that include rent escalators with the top wireless carriers. This gives both players a more stable and predictable income stream than even that of most other REITs.

AMT continues to post strong growth, as property revenue rose by 10.2% YoY to $2.67 billion in the third quarter. While same tower revenues grew by just 2.6% compared to the prior-year period, this was due more to the Sprint tower cancellations that began in Q4 of last year, due to Sprint’s merger with T-Mobile (TMUS). Without this cancellation, AMT’s organic revenues would have grown by more than 5%.

Looking forward, management expects spending by the top 3 telecom carriers, Verizon (VZ), T-Mobile, and AT&T (T) to remain strong, as they seek to deploy equipment after spending well over $100 billion on 5G spectrum. This was highlighted by management during the third quarter conference call:

Since the start of 2019, 5G spectrum auctions, mainly in the mid band, have collectively driven over $155 billion in purchase price proceeds across our served market. These acquisitions of large swaths of new spectrum have kicked off what we believe will be at least a decade-long period of network investments, aimed at delivering on the promises of 5G’s faster and lower latency applications. We anticipate this will result in $5 billion of incremental annual customer CapEx spend in the United States, on average, as compared to the levels we saw throughout the 4G cycle.

Additionally, in the US, the visibility we gained through the comprehensive MLAs we put in place with AT&T, T-Mobile, DISH (DISH) and most recently, Verizon, supports our expectation that these investments will drive a near-term acceleration in organic new business growth and a sustained level of elevated tower activity over a multi-year period.

Meanwhile, AMT’s moat keeps getting stronger, through its acquisition of data center REIT CoreSite. This helps AMT to expand beyond its scope as merely a cell tower provider into one that offers a more vertically integrated portfolio of communication assets. Management expects to be able to provide new multi-tenant infrastructure to support the demands of next-generation networks and applications in a 5G world. Management provided an update on its positioning of CoreSite during the recent Q3 conference call:

Having now owned CoreSite for more than three quarters, we couldn’t be happier with the performance we’re seeing across the business and the use cases driving leasing activity, which we expect to serve as growth catalysts well into the future.

Importantly, we’re extremely encouraged by the consistently positive customer feedback on this acquisition. Customers continue to view CoreSite as a strong operator in hybrid IT solutions provider with a high-quality ecosystem, which under the American Tower umbrella can now provide more predictable scalability and future incremental value through our combined platform capabilities and expertise.

Turning to the balance sheet, AMT maintains a BBB- investment grade rated balance sheet, with a debt to EBITDA ratio of 5.5x. This is down substantially from 6.8x at the end of last year, after AMT acquired CoreSite through the use of its bank facilities and term loans. Also, at that time, AMT’s floating rate exposure was at 31% of its total outstanding debt, and today, stands at just 20%, making it less vulnerable to rising rates.

Meanwhile, AMT pays a very safe 2.7% dividend yield that’s well-supported by an AFFO payout ratio of 62%. The dividend also comes with an appealing 18% 5-year CAGR and 9 years of consecutive growth.

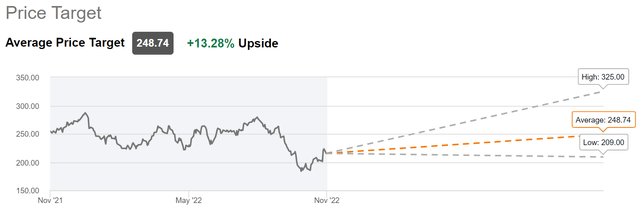

While AMT is no longer cheap at the current price of $219.58 with a forward P/FFO of 17.4, I find the valuation to be reasonable considering AMT’s moat-worthy characteristics and strong forward growth potential. Analysts have a consensus Buy rating with an average price target of $249, equating to a potential one-year 16% total return including the dividend.

AMT Price Target (Seeking Alpha)

Investor Takeaway

American Tower’s moat continues to grow as it positions its CoreSite assets to capture more profits in the communications value chain. It’s also very well-positioned to benefit from the ongoing 5G buildout from the big 3 wireless carriers.

The company has a strong balance sheet and pays a safe, growing dividend yield of 2.7%. While the stock is no longer cheap at 17.4x forward P/FFO, I believe it’s worth paying up for given AMT’s moat-worthy characteristics and strong growth potential.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!