Summary:

- One clearly deserved the premium valuations, due to the impressive FCF generation through FY2024, triggering a 6.2% growth in dividends compared to the other at 4.6%.

- However, the other clearly boasted highly competent management and operating strategy, with a fatter EBIT margin and well-laddered debt leveraging through 2098.

- Given the impressive projected growth of revenues and EPS in FY2023, PEP and KO clearly have not received the memo about the impending recession.

- We shall discuss further.

Feverpitched

Investment Thesis

The stellar FQ3’22 earnings call has massively boosted PepsiCo, Inc. (NASDAQ:PEP) and Coca-Cola Company’s (NYSE:KO) stock prices by 10.02% and 12.47% from their recent bottom in October, respectively. The upbeat October CPI report has also fueled the optimistic hopes of an earlier Feds pivot, with the S&P 500 Index similarly reporting an 11.62% recovery at the same time.

Though terminal rates may have to be raised beyond 6%, indicating prolonged inflation pain through early 2024, we expect individual hikes to be more moderate moving forward. 80.6% of analysts are already projecting a 50 basis points hike for the upcoming December meeting, similar to the Bank of Canada’s earlier moderation. Assuming so, we may expect the peak recessionary fears to lift and the stock market to reasonably recover moving forward, thereby easing some of the tragic market-wide corrections witnessed since November 2021.

PEP Remains Overwhelmingly In The Lead Over KO

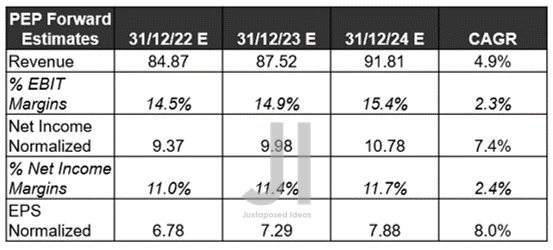

PEP Projected Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

Despite the growing recessionary fears and tougher YoY comparison, it is evident that PEP is expected to outperform with excellent top and bottom line growth of 3.12% and 7.52% in FY2023, respectively, against KO’s 2.53% and 2.41%. Furthermore, the former is expected to record splendid growth in normalized EPS at a CAGR of 8% through FY2024, against pre-pandemic levels of 4.5% and hyper-pandemic levels of 6.4%, while KO reported 5.8% at the same time. That is impressive, since market analysts have quietly upgraded PEP’s revenue growth by 1.54% since our analysis in July 2022.

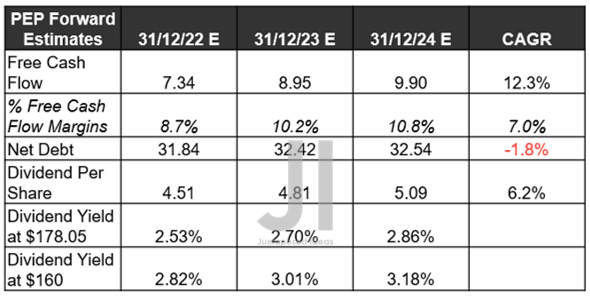

PEP Projected FCF ( in billion $ ) %, Net Debts, and Dividends

S&P Capital IQ

In addition, analysts are very confident about PEP’s forward execution, given the recovery in its EBIT/ net income/ FCF margins from 15.8%/11.6%/8.1% in FY2019, to 14.4%/10.9%/8.8% in FY2021, and finally to 15.4%/11.7%/10.8% by FY2024. Thereby, boosting the growth in its dividends to $5.09 over the next three years at an excellent CAGR of 6.2%, against hyper-pandemic levels of 5.8%.

Furthermore, those who had loaded up PEP at the recent bottom would have enjoyed excellent dividend yields of 3.18% by FY2024. Otherwise, 2.86% based on current share prices, against its 5Y average of 1.25% and sector 4Y median of 2.41%. Combined with its 49 years of consecutive dividend growth, investors should be assured of the stock’s nature in recession.

PEP Debt Maturities

S&P Capital IQ

In the meantime, PEP’s debts are expected to stay stable at these levels over the next few years, with net debts of $32.54B by FY2024. However, we are not overly concerned, since only $6B will be due then, with $1.9B of annual interest expenses. These are measly sums, against its cash and equivalents of $6.41B in the latest quarter, stellar FCF generation of $6.37B, and $6.07B in annual dividends paid out over the last twelve months. Furthermore, its long-term debts are extremely well laddered through 2060, further freeing its liquidity through the worsening macroeconomics through 2023.

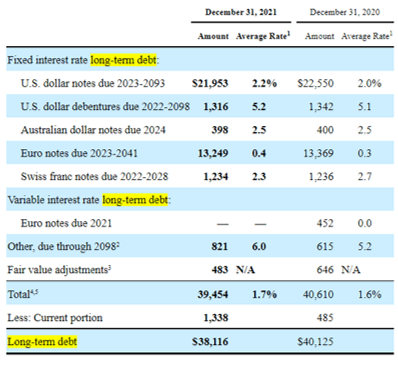

KO’s Forward Execution Is Impressive Indeed

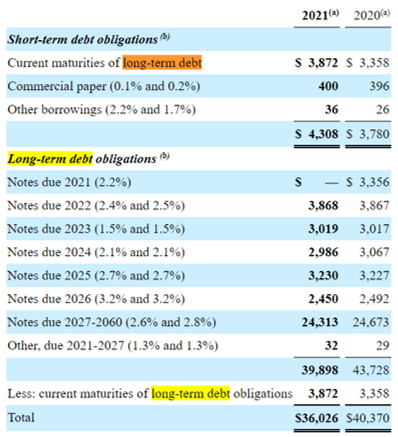

KO Projected Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

KO is expected to report excellent top and bottom-line growth ahead at a CAGR of 5.9% and 5.8%, respectively, against pre-pandemic levels of -3.8%/3.5% and hyper-pandemic levels of 1.8%/4.9%. It is apparent that the global appetite for soft drinks remained robust, given the 2.53% YoY growth in its revenues by FY2023, despite market analysts’ downgrades by -1.41% since our analysis in July 2022. Its gross/ EBIT margins remained stellar as well, at 58.5%/28.9% compared to PEP’s 53.2%/15.1% in the last twelve months, despite the rising inflationary pressures. This is natural, given the company’s strategic choice in only producing concentrates, which are then sold to licensed bottlers and distributors globally.

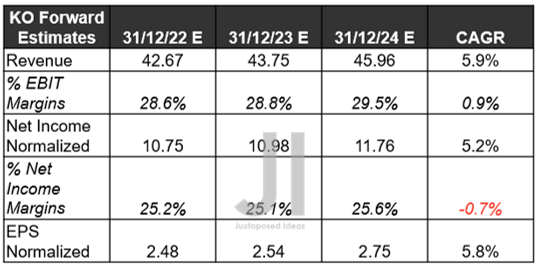

KO Projected FCF ( in billion $ ) %, Net Debts, and Dividends

S&P Capital IQ

However, KO’s margins are expected to remain somewhat stagnant over the next few years, with minimal expansion for its EBIT/ net income/ FCF margins from FY2021 levels. Thereby, explaining KO’s lower NTM Market Cap/FCF valuations of 26.58x, against PEP’s 30.64x. Nonetheless, the former’s dividend yields of 3.13% by FY2024 trump PEP’s 2.86%, indicating the stock’s highly attractive nature as an excellent dividend stock for long-term portfolio growth.

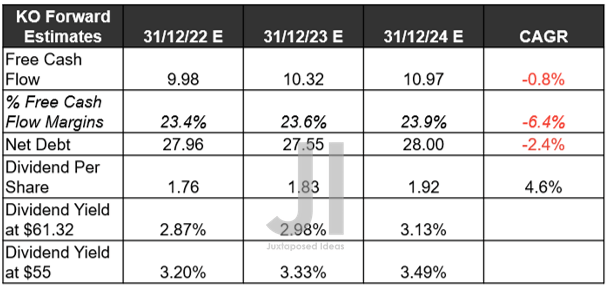

KO’s Debt Maturity

S&P Capital IQ

Furthermore, KO’s long-term debts are even better staggered than PEP’s, with only $2.2B due by 2024 and its last maturity due 2098. Combined with only $743M in annual interest expenses and $7.52B of annual dividend paid out, it is apparent that the management has proven remarkably competent in their debt leveraging thus far, while returning tremendous value to their long-term shareholders. Stellar indeed.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- PepsiCo And Coca-Cola: Perfect Time To Buy, But One Clearly Wins

- Pepsi Keeps Pouring It On – But Do Not Add Here

- Coca-Cola: Premium Cash-Cow Business With Classic Great Taste

So, Is PEP & KO Stock A Buy, Sell, Or Hold?

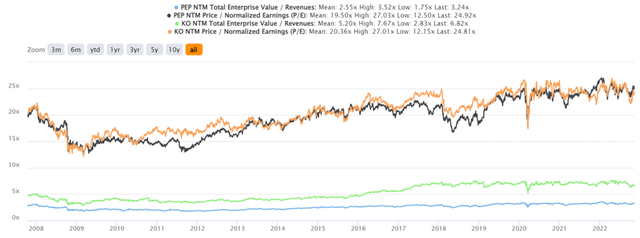

PEP & KO 5Y EV/Revenue and P/E Valuations

Given their defensive stock positions, PEP and KO have been consistently trading above their 15Y means across the board, nearer to their higher range, discounting the brief plunge in 2018 and 2020. PEP is currently valued at an EV/NTM Revenue of 3.24x and NTM P/E of 24.92x, higher than its 15Y mean of 2.55x and 19.50x, respectively. In the meantime, KO trades at an EV/NTM Revenue of 6.82x and NTM P/E of 24.81x, similarly higher than its 15Y mean of 5.20x and 20.36x, respectively.

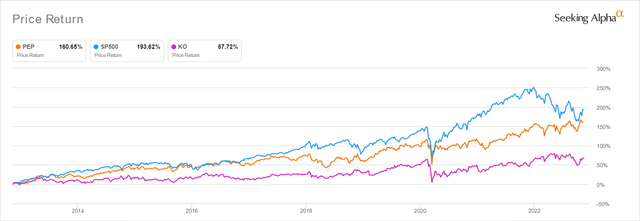

PEP & KO 10Y Stock Price

PEP is currently priced at $178.05, down -3.01% from its 52 weeks high of $183.58, though at a premium of 16.09% from its 52 weeks low of $153.37. KO is similarly elevated at $61.32, nearing its 52 weeks high of $67.20. Despite the sustained rally thus far, consensus estimates remain bullish about PEP & KO’s prospects, given their price target of $183.00/$64.50. However, with minimal upsides of 2.78%/5.19% from current prices, it is apparent that any investors that add at current levels may experience significant underperformance moving forward.

In the meantime, PEP and KO investors would be well advised to hold on to these dividend kings. Though past performance is not always the best indicator of future performance, PEP and KO remains solid stocks for the next decade of investing. The former has had improved 5Y total price returns of 78.1% and 10Y returns of 248.6%, against the latter’s decent returns at 5Y – 51.7% and 10Y – 133.2%. On the other hand, some have touted Keurig Dr Pepper (KDP) as the superior choice, with a comparatively higher 5Y return of 84.4%. Based on current stock prices, its dividend yields of 2.3% by FY2024 are satisfactory as well, against PEP at 2.86% and KO at 3.13% at the same time.

Depending on the actual impact of the recession, we may see more retracements in the short term as well. PEP has previously plunged by over -36.11% and KO by -33.85% during the previous recession in 2008. Then again, both companies are in relatively better shape now, with expanded FCF generation though elevated debts and dividend expenses as well. It remains to be seen if the Feds will truly pivot and, consequently, if the stock market will recover this early.

Though it could be a soft landing through 2023, anyone who chooses to add at current levels should also size their portfolios appropriately, in the event of volatility. Being patient would be more worthwhile, with our price target of mid $150s~160s for PEP and mid $50s for KO, while KDP looks relatively interesting at the low to mid $30s. Wait for this rally to be digested first.

Disclosure: I/we have a beneficial long position in the shares of PEP, KDP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.