Summary:

- Amazon’s “Buy with Prime” initiative will be open to all U.S. retailers January 31st.

- The trend from product-based revenue to service-based revenue continues.

- Will the program turn the tides on Amazon’s struggles, or is it an imprudent reach?

- Let’s look at how it affects sales, cash flow, and CAPEX.

georgeclerk

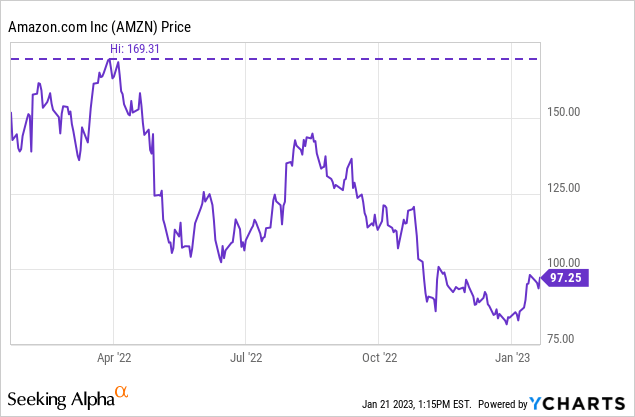

Amazon (NASDAQ:AMZN) has had a rough couple of years, and investors have seen share crater more than 40% off their 52-week highs, as shown below.

The company has been battered by pandemic blowback, including:

- increases in logistics costs due to clogged ports;

- billions of added labor costs because of the shortage of available workers;

- soaring inflation and rock-bottom consumer sentiment; and

- a looming recession.

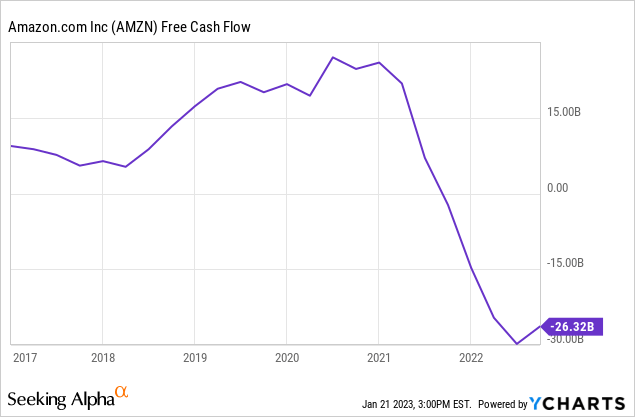

This has left two of the company’s three segments unprofitable and pushed free cash flow into the red for six of the last seven quarters.

Amazon’s gold standard is Amazon Web Services (AWS), but this is also seeing slowing growth as companies scale back spending.

The Buy with Prime initiative is set to go live at the end of the month. Can this turn the tide for shareholders?

What is Buy with Prime?

If you’re like me, you may hesitate to purchase from a lesser-known online retailer. A few poor experiences with difficult returns and high shipping costs at checkout make me wary.

Multiple studies show that well over half of us expect free shipping when we shop online. This is no accident. Amazon Prime has changed people’s expectations over the years. Retailers who don’t offer it often get passed over or lose customers at checkout.

Of course, free shipping isn’t really free. We have to sign up for an annual $139 Prime membership. For casual online shoppers, this may not be a value, but it quickly pays for itself for those who shop consistently online.

Logistics-as-a-Service

Buy With Prime allows online retailers to offer fulfillment services through Amazon even if they do not sell on Amazon.com beginning January 31st.

The retailer places a Buy With Prime button on their site, stores their products at an Amazon warehouse, and the customer gets free two-day shipping, free returns, and other Prime benefits. Customers also may use their stored Amazon Prime payment methods.

Amazon

The service is compatible with most eCommerce providers like BigCommerce (BIGC), Magento, and even Shopify (SHOP).

Buy with Prime began in April 2022 but was only available to handpicked “Fulfilled by Amazon” retailers. Starting January 31st, it will be open to anyone who wishes to sign up.

Merchants that have used Buy with Prime in its pilot stage report more traffic and higher conversion rates.

Amazon is leveraging its massive scale and membership base to build a Logistics-as-a-Service (LaaS) powerhouse with this expansion.

Third-party logistics

Many businesses already use third-party logistics (3PL) services for receiving, warehousing, inventory, and shipping. Smaller retailers know that handling these services internally is cumbersome and expensive because of their limited scale.

Buy With Prime is essentially 3PL expanded.

What does it mean for Amazon and its shareholders?

Amazon will make money at each stage with storage, service, fulfillment, and payment processing fees. For some retailers, this may not be cost-effective; however, many are already paying a 3PL, and Amazon’s scale should keep costs competitive.

Progressing to a service-based company

Selling discount products is not a profitable business. Amazon has never made significant profits strictly from retail. Even the most efficient scalers in the world, like Walmart (WMT), have paltry profit margins below 5%. Buy with Prime shifts the burden and allows Amazon to pocket cash from 3PL services.

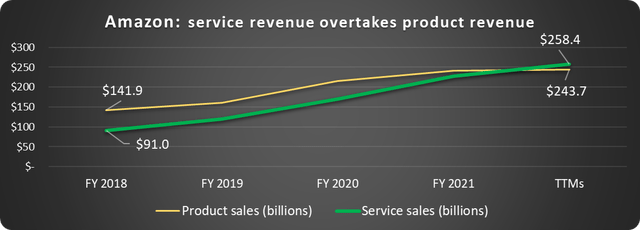

In my last article, I called out something that deserves focus: Amazon now makes more revenue from services than products, as shown below.

Data source: Amazon. Chart by author.

This is no small feat considering the rapid rise in retail spurred by the pandemic.

Service sales are advantageous because they are more profitable, consistent, and predictable.

Amazon has several impressive service revenue streams now, including:

- AWS ($76.5 billion);

- Third-party seller services ($112 billion);

- Advertising ($36 billion); and

- Subscription services like Prime ($34 billion and more than 200 million members).

Sales above are for the trailing twelve months (TTMs).

The company is betting big that its LaaS business can join this list.

It will also spur more Prime memberships, just as the foray into broadcasting NFL Thursday Night Football has.

The pressure is on after massive CAPEX spending.

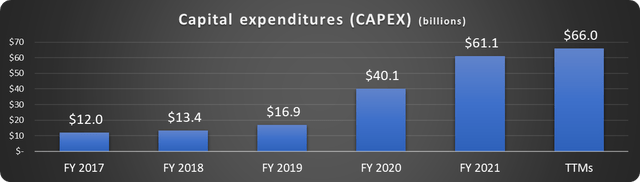

The tough economy is only part of the reason that Amazon’s free cash flow has plummeted. Capital expenditures (CAPEX) are property, equipment, and technology investments that don’t appear on the income statement. These expenses increase logistics capacity, capabilities, and AWS infrastructure for Amazon. The chart below shows the massive CAPEX spending.

Data source: Seeking Alpha. Chart by author.

The effect on free cash flow is plain to see:

This spending has put Amazon’s delivery service on the same scale as UPS (UPS) and FedEx (FDX) and enabled it to extend 3PL services.

Amazon needs to execute well for this investment to payoff.

Andy Jassy needs a big win.

This spending has been detrimental to shareholders. Companies like Google-parent Alphabet (GOOG)(GOOGL) are using the market decline to repurchase oodles of shares ($90 billion spent by Google over the last seven quarters), but Amazon is taking on short-term debt.

Investors are getting restless, and CEO Andy Jassy is feeling the heat. But investors shouldn’t be too quick to turn on him. Jeff Bezos left in 2021 when the company was on top of the world, but he knew that headwinds were coming. Jassy took over in an unenviable position.

The addressable market of 3PL is enormous. The key will be execution. Jassy is the architect of AWS – Amazon’s finest business. It took years to build, but it is now the globe’s dominant cloud service provider.

Is Amazon stock a buy?

There is little consensus in the market today. A recession is coming, stocks are down, and fear is rampant. But consider focusing on bottom-up investing – buying stock in fantastic companies and holding rather than trying to time the market.

“We don’t prognosticate macroeconomic factors; we’re looking at our companies from a bottom-up perspective on their long-run prospects of returning.” — Mellody Hobson, a businesswoman who rose from poverty to run a multi-billion dollar investment firm.

In this recent article, I share examples of massively successful, well-known companies that experienced considerable declines over the years and made stockholders lucrative long-term profits. The historical perspective can be invaluable when the view gets clouded by short-term turmoil.

Amazon stock is trading at prices not seen since 2019 when the company made 40% less revenue, didn’t have a massive ad business, and AWS was coming into its own.

The company is on much firmer footing now, macro conditions notwithstanding. The stock will probably be volatile along with the market this year, but we don’t beat the market buying when everything is rosy. The stock’s slump is an opportunity for long-term investors to accumulate shares in what will soon be a highly profitable service-based company.

Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors’ goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.