Intel: Q4 Earnings Will Be The Moment Of Truth

Summary:

- The PC market slowed down dramatically in the fourth quarter, indicating that Intel will report weak earnings next week.

- The PC market down-turn accelerated in Q4’22 and it will likely result in a very disappointing FY 2023 outlook for Intel.

- Intel’s projected FCF loss of $2-4B in FY 2022 could have been avoided if the company decided to eliminate its dividend.

- Continual PC market weakness and deteriorating consumer demand could force Intel to cut its dividend in FY 2023.

Sundry Photography

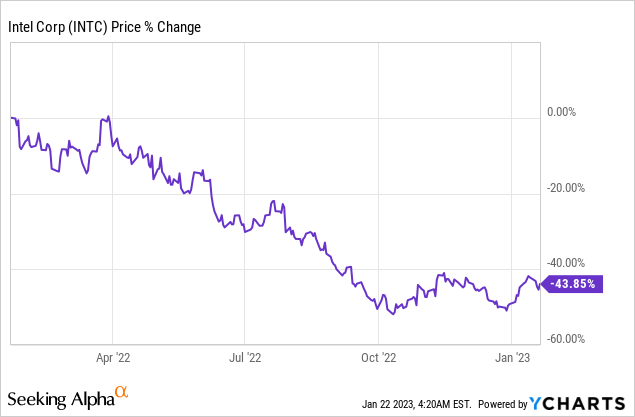

Intel (NASDAQ:INTC)’s business is going through a major cyclical post-pandemic adjustment period and it has resulted in a major down-ward revaluation in the chip maker’s valuation this year: Intel’s shares have declined 44% in the last twelve months and although they have recently moved into a new up-leg, I don’t believe the recovery is sustainable given the accelerating down-turn in the PC market in the fourth-quarter.

Intel already lowered its revenue guidance twice in FY 2022 due to a sharp post-pandemic correction in the PC market and since Intel’s important Client Computing Group is taking the brunt of impact, I believe the firm is set for a very weak earnings release on January 26, 2023. The revenue/EPS outlook for FY 2023 is likely going to be disappointing as well and Intel may even have to cut its dividend to make it through the current correction!

Accelerating down-turn in the PC market set to hurt Intel’s revenue and earnings prospects

Device shipments boomed during the pandemic and reached a peak in 2021 as laptops and PCs flew off the shelf. Consumers upgraded their equipment to work and study remotely during the pandemic which is creating a major demand problem for the PC industry.

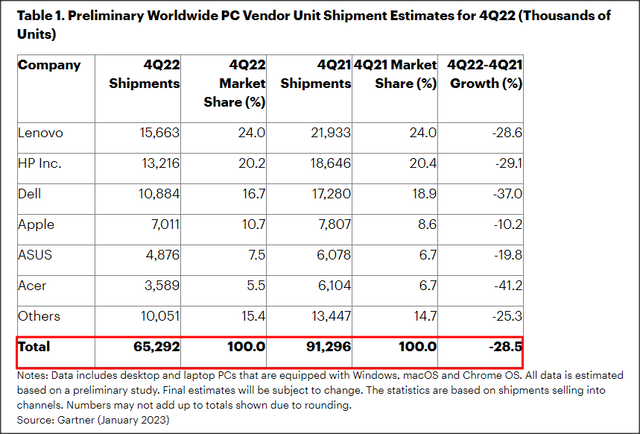

In the third-quarter, global shipments of PC, laptops and mobile phones dropped 19.5% year over year due to softening consumer demand and sticky inflation, resulting in all major OEMs reporting high volume declines year over yar. I warned in my last work on Intel that there was a profound risk of an acceleration in the decline in global PC shipments due to further weakening customer demand in the fourth-quarter.

According to the latest projection made by Gartner, a consulting firm, global device shipments in the fourth-quarter collapsed by an astonishing 28.5% year over year… which was, according to Gartner, the single largest drop in device shipments since the company started tracking global sales of PCs, laptops and mobile phones in the mid-1990s.

Acer and Dell saw the largest percentage declines compared to the year-earlier period with declines of 41.2% and 37.0%. The accelerating down-turn in Q4’22 has deep implications for Intel’s upcoming fourth-quarter results as well as for the revenue outlook for FY 2023 and the firm’s dividend.

Source: Gartner

Intel’s precarious financial position may result in a dividend cut in FY 2023

So far, Intel has lowered its FY 2022 revenue forecast twice and since the down-turn in the PC market gained momentum in Q4’22, Intel is facing a highly challenging operating environment in FY 2023.

Intel, based off of its latest forecast, is projecting revenues of $63-64B for FY 2022, which calculates to an expected decline of 15% year over year. Fourth-quarter revenues are projected to fall to $14-15B, showing a decline of 23-28% year over year and the sequential revenue drop could be as high as 9%.

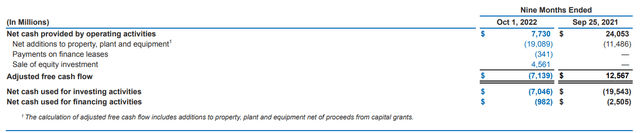

Intel has also guided for negative FY 2022 free cash flow of between $2-4B, so the chip maker doesn’t really earn the cash it needs to support its dividend. In the first nine months of FY 2022, Intel’s free cash flow was $(7.1)B, showing a massive decline of $19.7B compared to the year-earlier period chiefly due to lower operating cash flow (which is the result of weakening business fundamentals and lower chip sales) and the sale of Intel’s NAND business to South Korea’s SK Hynix and investments.

Source: Intel

Strictly speaking, Intel can already not afford to pay its dividend out of free cash flow and the global demand problems illustrated above strongly indicate to me that both Intel’s operating and free cash flow will likely have weakened in Q4’22.

According to Intel’s latest cash flow statement, Intel paid $4.5B in the first nine months of the year in dividends to shareholders, or about $1.5B a quarter. The dividend is going to cost Intel about $6.0B in FY 2022 which means the dividend payment is the primary reason for Intel’s projected negative free cash flow of $2-4B. If Intel were to cut its dividend to zero, which I believe the company will have to do in FY 2023, its free cash flow could turn positive.

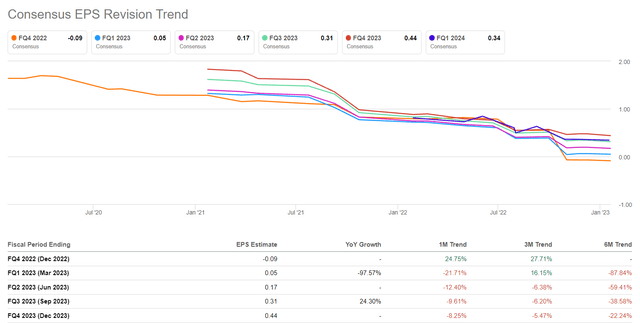

Negative estimate trend ahead of Q4’22 earnings

The EPS estimate trend for Intel ahead of the Q4’22 earnings release is very negative. In the last 90 days, there were 30 down-ward EPS revisions and zero up-ward revisions for Q4’22. The expectation is for $0.20 per-share in normalized EPS and I believe there is a very high chance, given Gartner’s preliminary estimates about Q4’22 volume shipments, that Intel will fail to meet even lowered expectations for its fourth-quarter.

Source: Seeking Alpha

My expectations for FY 2023

I believe we have not yet seen the bottom in PC shipments considering that the down-turn in Q4’22 sharply accelerated. With shipments dropping as fast as they did in the fourth-quarter, I believe Intel’s outlook for FY 2023 is not going to be great. Intel guided for a total of $63-64B in revenues in FY 2022 and I would expect Intel to see negative top line growth this year. It is hard for companies to forecast a bottom in device sales, as it is for analysts, but the current operating environment is extremely challenging. Intel is facing a moment of truth on January 26, 2023 and it could lead to new lows for Intel’s shares as well.

Intel’s shares are “cheap” for a good reason

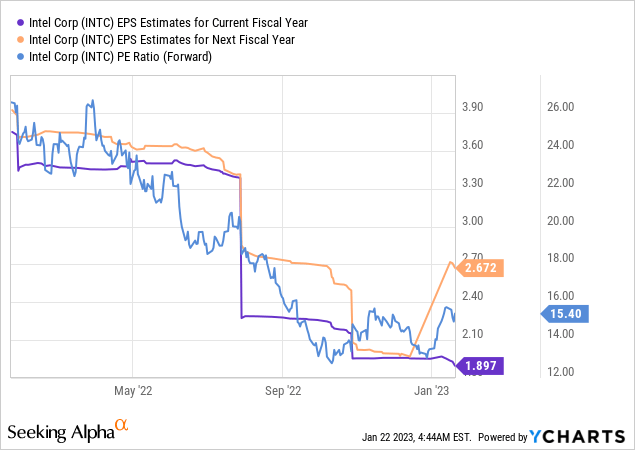

After seeing a 44% downside revaluation in the last twelve months, Intel’s shares now have a FY 2023 P/E ratio of 15.4 X. I don’t believe Intel is cheap here, however, because a continual down-turn in PC shipments in Q1’23 and FY 2023 could add material earnings and margin pressure for the chip maker. Since Intel’s earnings estimates are falling, the company’s P/E ratio could further reset to the upside.

Risks with Intel

Intel has considerable risks right now and these include a continual down-turn in the device market, slowing top line growth, contracting operating margins and negative free cash flow… all of which make the dividend payment more and more difficult to defend.

I also consider the botched and repeatedly delayed release of Intel’s server processor Intel Sapphire Rapids to be a self-inflicted wound that has helped AMD (AMD) make massive strides in the server market in recent years. Further disappointments related to the sale of the Sapphire Rapids chip could not only impact the market’s reception of Intel’s server processor but also further weigh on investor sentiment.

Final thoughts

Intel is facing a moment of truth on January 26, 2023: PC shipments are falling at an even quicker pace than expected in the third-quarter which indicates that Intel may fail to beat even lowered EPS expectations. Considering that Intel’s free cash flow losses are entirely due to the firm paying its $0.365 per-share quarterly dividend, the firms has an easy fix to solve its free cash flow problem: it should cut or completely eliminate its dividend. I also believe it is entirely possible that Intel will guide for negative top line growth in FY 2023 which I would expect to weigh heavily on the firm’s already bruised valuation. I see very little up-side for Intel’s shares before or after Q4’22 earnings and believe the risk profile is heavily skewed to the down-side!

Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.