Transocean: Still A Strong Buy As Shares Rip Higher

Summary:

- Shares of Transocean have ripped higher to start 2023 and are up nearly 40% YTD.

- The company has been refinancing its debt to extend maturities. The backlog, which is over $8B, also continues to grow.

- The company does have a heavy debt load, but that means a greater potential reward for investors, especially if things improve for the offshore sector.

- Day rates in the offshore sector have been rising steadily and that trend will likely continue. With a market cap just over $4B, Transocean looks like a slam dunk.

- I’m considering adding to the position, potentially with LEAPS expiring in January 2025.

joebelanger/iStock via Getty Images

It has been a couple months since my last article on Transocean (NYSE:RIG), and I figured it was time for an update heading into 2023. In that article, I talked about the OTM calls I bought on Peabody Energy (BTU) and Transocean. The call I bought on Peabody expired worthless, and I have had more luck selling puts on Peabody, but the calls on RIG have more than doubled since I bought them and are now in the money with shares above $5. Shares have ripped higher in recent weeks and are up nearly 40% YTD, but I think the run could just be getting started.

I wasn’t completely sold on the offshore sector because of the checkered past of many companies in the sector. The RIG calls I bought started as an informed speculation, but my continued research into the space has convinced me that the next couple years are going to be good for the offshore sector. If you have an hour to spare and are interested in the space, I would strongly recommend listening to the recent Yet Another Value Podcast on Tidewater (TDW) and the whole offshore space. They cover their outlook for the sector, day rates, and other important factors. The host also had Tidewater’s CEO and CFO on in a previous podcast, and there was a ton of valuable information in both podcasts that could help curious investors make an informed decision on companies in the sector.

Investment Thesis

Energy has been the best performing sector in the last couple years, and the offshore segment looks like it is just showing up to the party. Day rates continue to rise and Transocean’s backlog grew rapidly in the second half of 2022. Transocean has a lot of debt on the balance sheet, which increases the risk, but also increases the potential reward for investors over the next couple years. In January the company has completed debt offerings to improve their financial position and the business is poised for a good run over the next couple years. If things play out in the offshore sector like I think they will, Transocean could easily blow past $10 a share in 2023 and potentially higher in coming years.

Debt Refinancing & A Growing Backlog

Transocean has been busy in January, with two separate debt offerings. The first offering was priced in early January for $525M at an interest rate of 8.375%, due in 2028. The debt is a secured offering, with the proceeds going towards the operations of Deepwater Titan. The second offering was even bigger, at $1.175B. It carries an interest rate of 8.75%, and the proceeds will be used to pay off four notes secured by rigs.

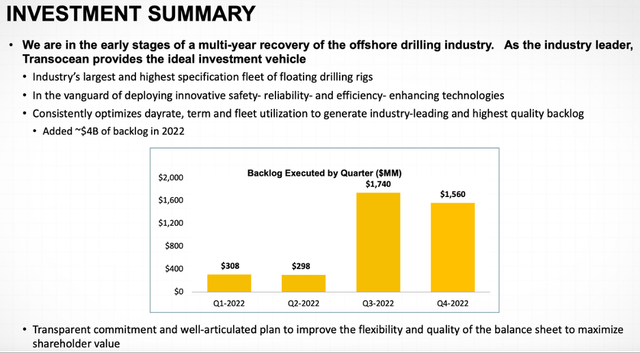

The interest rate is higher than the existing debt, but it extends the maturity significantly to 2030. Three of the current bond issues are due in 2024, with the last due in 2025. I’m curious to see what happens in the next year with the company’s debt level, but I think things are turning in the right direction for the company. You can also see the positive changes with the company’s backlog, which increased dramatically in the back end of 2022.

Backlog Update (deepwater.com)

While the heavily levered balance sheet is a reason for caution, the rapidly growing backlog leads me to believe the company is set for a solid couple of years. Based on what was talked about in the podcast I mentioned above, most of Transocean’s fleet will reprice by the end of 2023, which is likely to bring higher day rates and significant cash flows. At the beginning of the year, the backlog was at $8.3B. A couple weeks ago, they announced several new contracts, adding almost $500M to the backlog.

Valuation

The valuation isn’t as simple as it is for a REIT or stable business with consistent earnings. This is where listening to the podcast helped convince me that Transocean is undervalued. The guest, Judd Arnold, put the estimated cost for a large new rig build comparable to what Transocean has at $1B (on the low end), and the whole industry isn’t building any new ones right now. He also is expecting day rates to go significantly higher as utilization increases, and nearly all that increase in revenue flows directly to the bottom line.

This isn’t going to be some exact calculation where I tell you my opinion on how undervalued Transocean is. What I can say is that even with Transocean’s debt laden balance sheet, my guess is that shares will be trading higher than $10 in the next twelve months, and possibly much higher. The assets they have aren’t replaceable, and even if new supply for drill ships does start to come online, it will take at least 3 years to build new ones.

Conclusion

It might be tough for investors to buy Transocean with shares up almost 80% in the last year and nearly 40% since the start of 2023. However, I still think that the rally has legs for a long-term investor with a one to three-year time horizon, despite the short-term volatility that is likely to continue. The company’s balance sheet, which admittedly carries a heavy debt load, is improving as the company has issued debt to start 2023 to extend several upcoming maturities.

The backlog has continued to grow in 2023 after rapidly increasing in the back half of 2022. The valuation is hard to peg, but I think if you look at where the puck is likely going for the industry with day rates, I think buying Transocean at a $4.1B market cap is a slam dunk. I plan to hold my calls until late in the year because I think the rally could just be getting started. I’m actually considering adding to the position and have been taking a closer look at the January 2025 calls, which I might nibble on if shares sell off in the next couple weeks. I also plan to take a closer look at Tidewater in the next couple days, because I think many of the same reasons to be bullish on Transocean apply to Tidewater. For investors looking to add a holding with some speculative upside for 2023, Transocean might be a good fit.

Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.