Summary:

- VZ has had an impressive recovery in the stock prices since the October 2023 bottom, implying the bottomed market sentiments surrounding telecom stocks.

- Its dividend investment thesis remains robust, thanks to the promising FY2024 Free Cash Flow guidance with the peak 5G capex well behind us.

- VZ currently yields 6.62%, more compelling than the US Treasury, highlighting its still attractive dividend investment thesis.

- The management continues to drive growth across the mobile and fixed wireless segments, with 2024 likely to bring forth promising net adds.

- Despite so, readers may want to time their entry points upon a moderate pullback for an improved margin of safety, as certain overhang remains.

DNY59

We previously covered Verizon Communications Inc. (NYSE:NYSE:VZ) in January 2024, re-rating it as a Buy, after falling for the classic bear trap. Even then, we believed that it was impossible to time the market, especially given the extreme pessimism then.

Thanks to the moderation in its capex in 2024 and subsequent improvement in its Free Cash Flow generation, we might see the management achieve its net debt to EBITDA target over the next few years, while also consistently paying out dividends.

In this article, we shall discuss why we are maintaining our Buy rating, despite VZ’s impressive recovery by +28.5% since the October 2023 bottom triggering the moderation in its forward dividend yields from the October 2023 peak of 8.55% to 6.62% at the time of writing.

With sentiments surrounding telecom stocks already tremendously improving over the past few months, we believe that VZ’s dividend investment thesis remains robust.

The VZ Dividend Investment Thesis Remains Compelling, Despite The Recent Rally

With VZ set to report the FQ1’24 earnings call on April 22, 2024, readers may want to temper their expectations for Free Cash Flow generation indeed.

This is attributed to the higher projected cost of wireless equipment as consumers typically upgrade their devices during the prior quarter’s holiday season, on top of the higher promotional incentives, similar to its peer, AT&T (T).

For reference, VZ reported lumpy Free Cash Flow generation of $2.3B in FQ1’23, $5.6B in FQ2’23, $6.7B in FQ3’23, and $4.1B in FQ4’23, mostly attributed to the unpredictable cost of wireless equipment at $6.4B, $5.7B, $6.3B, and $8.2B, respectively.

The reason for this caution is attributed to a similar misunderstanding that has previously occurred to T. This is based on the market’s over-reaction to the supposed miss in the telecom’s Free Cash Flow generation at $1B in FQ1’23, with the stock drastically pulling back by -23% four weeks after the earnings call.

While T eventually achieved the FY2023 Free Cash Flow guidance of $16B, thanks to the $4.2B generated in FQ2’23, $5.2B in FQ3’23, and $6.4B in FQ4’23, it is painfully apparent that the stock has yet to return to its pre-correction trading ranges by the time of writing.

Therefore, while the VZ management has offered a promising FY2024 guidance, with adj EBITDA growth of +2% YoY, adj EPS of $4.60 (-2.3% YoY attributed to higher cash taxes), and an approximate Free Cash Flow generation of $20.2B (+8% YoY) at the midpoint, we expect things to be rather lumpy on a QoQ basis.

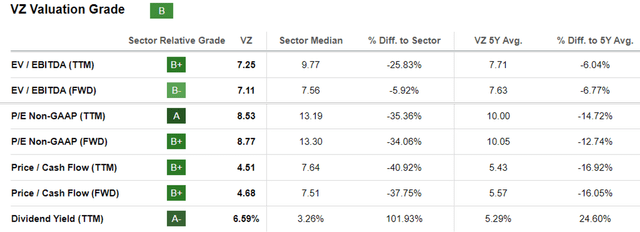

VZ Valuations

Combined with VZ’s immense long-term debts of $137.7B (-2.1% YoY/ +36.7% from FY2019 levels) and single digit growth prospects, we can understand why VZ’s FWD EV/ EBTIDA valuations of 7.11x and FWD P/E valuations of 8.77x have been discounted.

This is compared to its 5Y average of 7.63x/ 10.05x and the sector median of 7.56x/ 13.30x, respectively. The same has also been observed with T at 6.45x/ 7.46x and Comcast (CMCSA) at 6.63x/ 9.48x, implying that VZ is not alone here with the telecom business typically being debt-laden.

Then again, we believe that VZ’s discounted levels offer opportunistic investors with the chance to dollar cost average, since its dividend remains secure.

Based on the annual ~$11B in dividend obligations, we may see the telecom accelerate its deleveraging with the balance sheet likely to improve from the net-debt-to-EBITDA ratio of 2.83x reported in FQ4’23, compared to 2.88x in FQ4’22, 2.07x in FQ4’19, and its target ratio of between 1.75x and 2x.

Much of the tailwinds are attributed to VZ’s moderation in capital expenditures with the peak 5G capex of $23B in FY2022 (+13.8% YoY) well behind us, further aided by the management’s sustained capital and network efficiencies.

At the same time, market analysts expect 6G to be introduced only by 2030, implying that the telecom’s capex is likely to remain muted over the next few years, allowing the management to sustain its dividends while deleveraging.

If anything, VZ continues to hint at decent growth ahead, thanks to the aggressive rollout of its C-Band spectrum boosting the expansion of its fixed wireless access business, with the quarterly target of approximately 350K in net adds.

As of March 2024, the company already achieved over 3M in fixed wireless access customers, well ahead of its original 2025 target of 4.5M customers at the midpoint.

In addition, VZ’s new mobile plan launch in May 2023, myPlan, has generated new growth, thanks to the enhanced flexibility for consumers along with the exclusive streaming partnerships with major media companies, naturally triggering higher ARPAs and lower churns.

It is apparent by now that that the “management shake-up” has delivered great results, as observed in the relatively promising FY2024 guidance, further aided by the growing appeal/ value surrounding its bundled mobile and fixed wireless offerings.

So, Is VZ Stock A Buy, Sell, or Hold?

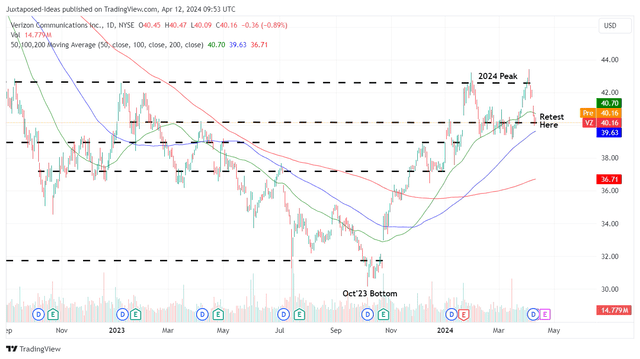

VZ 1Y Stock Price

For now, VZ has failed to break out of the 2024 peak of $42s twice, while appearing to be well supported at the $40s.

As with dividend stocks, we believe that the key gauge to the entry point will be its forward yields, currently at a more than decent number of 6.62%, inline with our previous article, though moderated from the October 2023 peak of 8.55%.

Compared to the US Treasury’s yields of between 4.52% and 5.39%, we believe that VZ’s rich yields remain compelling, especially since the market has priced in a Fed rate cut in 2024 as the EU Central Bank similarly signals the first cut by June 2024.

At the same time, we concur with the Seeking Alpha Quant’s C rating in Dividend Safety Grade, attributed to the management’s promising profit guidance growth for both adj EBITDA and Free Cash Flow in FY2024.

As a result of its robust dividend investment thesis, we are maintaining our Buy rating for the VZ stock, though with no specific entry point since it depends on individual investors’ dollar cost averages and portfolio allocation.

With VZ’s rally of +28.5% since the October 2023 bottom well outperforming T at +14.1% and the wider market at +19.2%, readers may want to time their entry points upon a moderate pullback for an improved margin of safety.

It goes without saying that anyone whom continues to hold US-based telecom stocks here, VZ included, may want to monitor the lead cable discussions with the regulators, since no resolution has been reached, with it remaining to be seen if the telecom has to bear the cost of remediation.

Investors may also want to note that there may be a deliberation on this issue in the upcoming annual shareholder meeting on May 09, 2024, with the Association of BellTel Retirees putting up a proposal for a vote in conducting a comprehensive independent study.

A pessimistic development may trigger another painful correction, potentially triggering drastic capital losses indeed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.