Summary:

- Consumer Staples stocks have underperformed so far in the year, but shares of Pepsi have bucked the poor relative sector trend in recent years.

- The firm’s earnings are on track with solid organic revenue growth, but the stock’s chart shows some weakness in recent months as GLP-1s continue to cast a cloud.

- Despite a revenue miss and tempered outlook reported in January, operational improvements and shareholder rewards are expected.

- Ahead of earnings due out later this month, I highlight key price levels to watch.

Jonathan Knowles

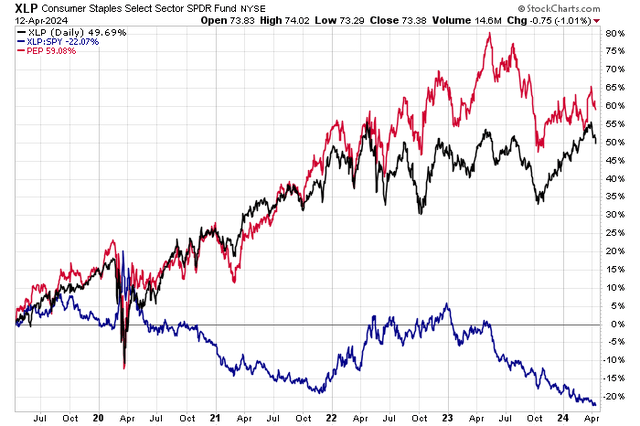

Consumer Staples stocks have been nothing to write home about so far in 2024. The Consumer Staples SPDR ETF (XLP) is not far from the flat line on a total return basis year to date through mid-April. It comes as retail sales trends waver and GLP-1 weight-loss drugs continue to cast a negative shadow on sugary drink and snack-producing companies.

We will know a lot more over the coming weeks as Q1 earnings are released. What’s more, key shareholders’ meetings are on tap, which could provide further color on strategic initiatives from some of the world’s most prominent multinational consumer firms.

I reiterate a buy rating on PepsiCo (NASDAQ:PEP). Earnings are on track for this high-dividend blue-chip company, underscored by solid organic revenue growth. The chart, meanwhile, leaves something to be desired, though.

Staples Drop to Fresh Multi-Year Lows vs SPX, PEP Bucks the Trend

Stockcharts.com

According to Bank of America Global Research, PepsiCo, a global snack and beverage company, manufactures and markets salty and convenient snacks, carbonated and non-carbonated beverages, and foods. Divisions include Frito-Lay North America (FLNA), Quaker Foods NA, North America Beverages (NAB), Latin America, Europe Sub-Saharan Africa (ESSA) and Asia, Middle East, and North Africa (AMENA). Key exposures include the UK, Mexico, India, and China. Brands include Pepsi Cola, Mountain Dew, Gatorade, Tropicana, Frito-Lay, and Quaker, among others.

Back in January, PEP reported yet another bottom-line beat. The firm has topped EPS estimates in each quarter dating back to Q1 2020. Q4 2024 per-share profits verified at $1.78, topping analysts’ estimates of $1.72. Revenue was a miss, though, falling 0.5% from year-ago levels to $27.9 billion.

The problem was really about PEP’s guidance. Full-year organic sales are seen at 4% for 2024, below what analysts were expecting. Shares dipped 3.6% the following session and the options market prices in a small 2.6% earnings-related stock price swing following the April 23 reporting date.

Despite the revenue miss and tempered outlook in the last quarter, operational improvements are expected, especially with increased marketing efforts and product flexibility. Meanwhile, PEP should continue to deliver a solid yield and engage in stock buybacks to reward shareholders.

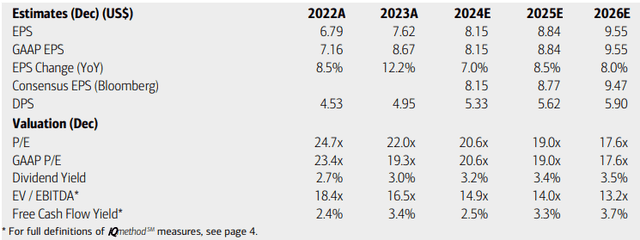

On valuation, analysts at BofA see earnings rising by 7% this year, with continued mid to high single-digit bottom-line growth in the out year through 2026. Seeking Alpha’s consensus EPS numbers show a similar profile, with non-GAAP EPS climbing toward $9 in 2025. Top-line growth is seen steady between 3% and 5% annually.

Dividends, meanwhile, are forecast to increase at about a 6% clip, leading to a potentially higher yield if the stock price remains steady. PEP boasts a 3.4% trailing 12-month free cash flow yield, which helps to mitigate the risk from higher interest rates, but net debt is considerable at $37 billion.

PepsiCo: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

If we assume $8.40 of operating EPS over the next four quarters and apply a 5-year historical average P/E of $24.5, then shares should trade near $206, making the stock a bargain today. Even if you discount the multiple for higher rates, there remains a solid margin of safety. PEP also trades at a 10% discount to historical sales figures.

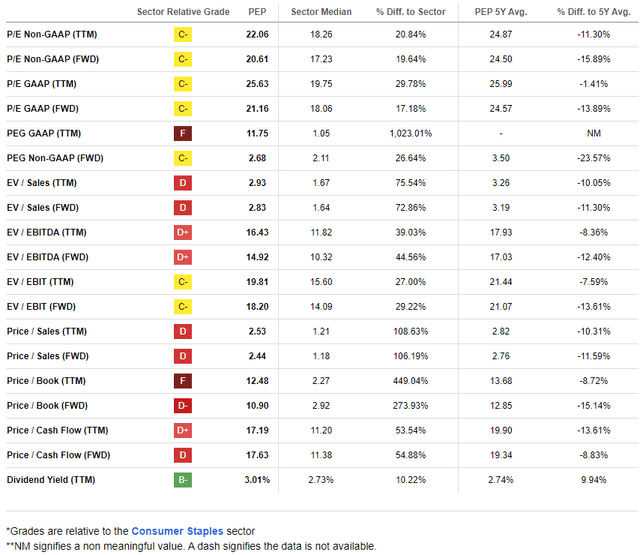

PEP: Attractively Priced on Earnings, Solid Yield & FCF

Seeking Alpha

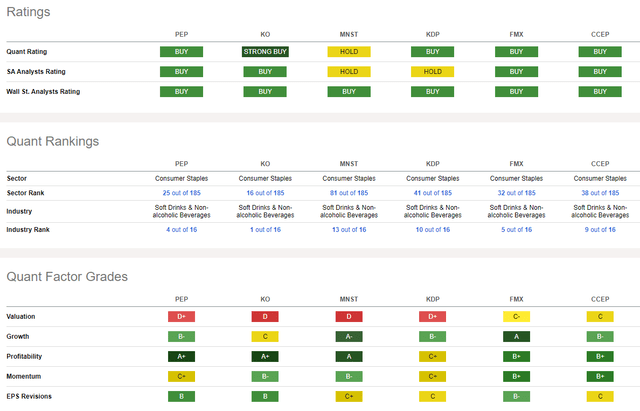

Compared to its peers, PEP sports a premium valuation, but that is fairly common among large-cap Soft Drinks & Non-alcoholic Beverages industry firms. Moreover, the growth trajectory is solid despite fears regarding the GLP-1s. Fundamental strength is seen clearly in its healthy profitability trends and positive EPS revisions. Share price momentum could use some work, however, and I will detail key price levels to monitor later in the article.

Competitor Analysis

Seeking Alpha

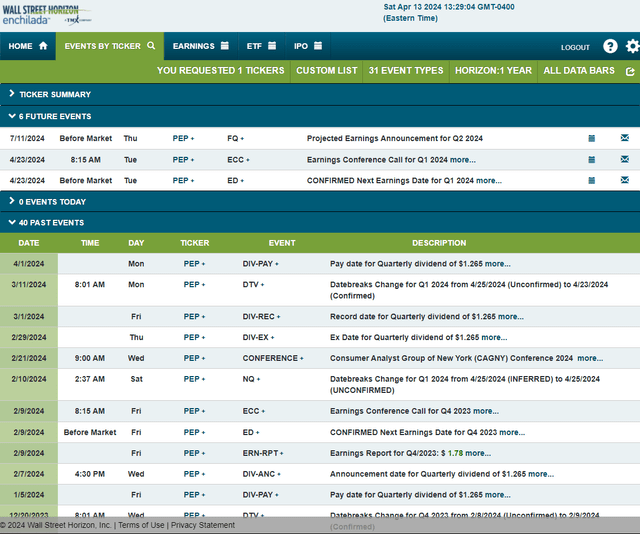

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2024 earnings date of Tuesday, April 23 BMO with a conference call immediately after the numbers hit the tape. You can listen live here. Be advised that Coca-Cola (KO) earnings come on April 30 and KO’s shareholders’ meeting happens May 1.

Corporate Event Risk Calendar

Wall Street Horizon

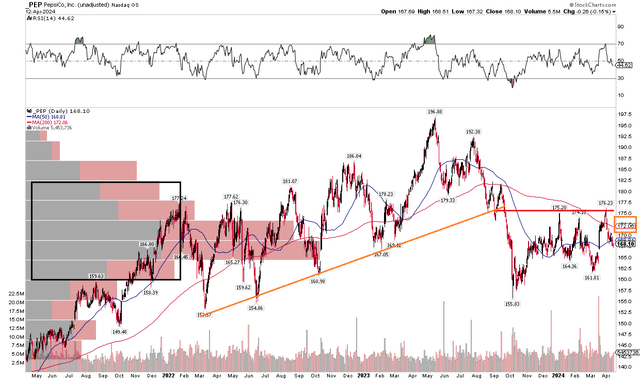

The Technical Take

With shares priced inexpensively and a solid fundamental foundation, the technicals are not as impressive. Notice in the chart below that shares are now below the 200-day moving average. Making matters worse for the bulls is that the 200dma is negatively sloped, suggesting that the bears are in control. RSI momentum trends don’t show increasing interest in the stock either. I see resistance just above the $175 mark. Last year, I noted weakness on the chart at the same area – between $175 and $180, and that holds true today.

After breaking an uptrend support line in September 2023, the bulls were never able to re-assert themselves. Support remains in the $155 to $162 area, but I would be concerned if the stock re-tested the low from October 2023. I would like to see shares rally through $180 before turning bullish technically.

Overall, PEP’s momentum is lackluster, like much of the Consumer Staples sector.

PEP: Shares Range Bound in 2024, Unimpressive Momentum

Stockcharts.com

The Bottom Line

I reiterate a buy rating on PEP. Shares are significantly discounted compared to intrinsic value, in my view. I expect another EPS beat to be reported later this month, while the relative strength view remains soft.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.