Summary:

- Johnson & Johnson has solidified its market leadership position over the years.

- The company tends to outperform the market during economic crises, and its operations are less vulnerable to recessions.

- J&J’s strong brand name and its diversified products with extensive global reach make the company attractive for investors looking for stable market performance.

- J&J is highly ranked in our multi-factor system, backed by solid quality, value, and momentum factors.

JHVEPhoto

Introduction

As the probability of a recession increases again, stable companies are attracting more investors looking for firms capable of overcoming this uncertain period with minor negative implications on their stock prices.

Our Factor-Based ranking system identified Johnson & Johnson (NYSE:JNJ) as one of the US large-cap firms with solid quality, value, and momentum factors, suggesting that it’s among the top investment ideas worth checking. Johnson & Johnson has always been on the watchlist for investors trying to find “recession-proof” investments.

In this article, we’ll explain why our ranking system suggested this multinational pharmaceutical company to be among the best US large-cap investing opportunities with a relatively high rank and what factors drove it higher than its peers.

A Robust Business

Johnson & Johnson generated $93 billion in revenue during FY 2021, a 13.6% increase compared to 2020. During the third quarter of 2022, the company reported $23.8 billion in revenues, a 2% year-over-year growth despite the slowing activity. J&J now expects a 7% sales growth for full-year guidance despite various economic pressures.

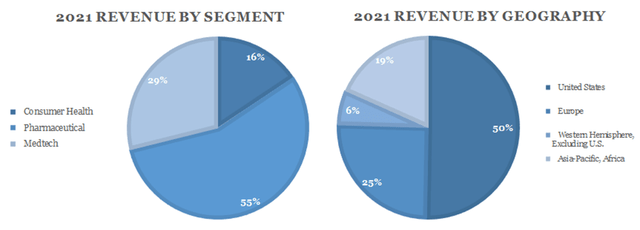

The firm operates through three segments: consumer health, pharmaceuticals, and Medtech. As shown below, the pharmaceutical segment generates most of the company’s sales, and the US is the primary market. J&J plans to solely generate $60 billion in sales from the pharmaceutical segment in 2025.

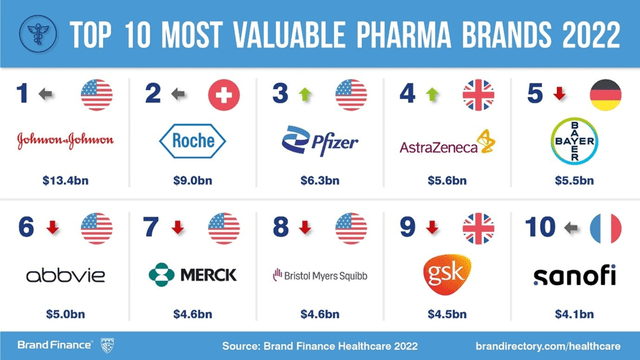

Earlier this year, Moody’s revised Johnson & Johnson’s outlook from negative to stable and affirmed the AAA rating of the company. The updated revision was driven by the robust operating performance and the progress in resolving potential litigation uncertainties. Additionally, the company is on top of the list as the most valuable pharma brand, with a valuation of $13.3 billion.

Impressive Performance During Recessions

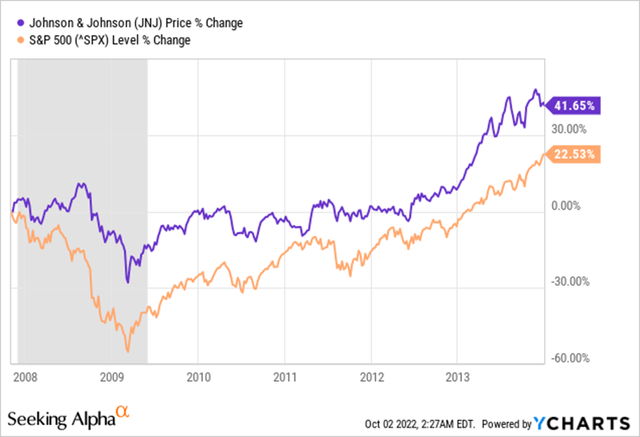

During recessions, consumer spending decreases, but the first items to be excluded from households’ carts are discretionary items. Demand for Johnson & Johnson’s products is relatively less reliant on the economy’s business cycle. J&J showed low volatility and stable performance during recessions. Although its stock was not wholly immune to the 2008 financial crisis, it performed remarkably better than the market during and after the crisis.

Moreover, the company’s sustainable business model allowed it to increase its dividends for 59 consecutive years, with an average yearly dividend growth rate of 5.95% over the last 5 years.

Competitive Advantage

Johnson & Johnson is continuously working on maintaining its position as one of the global market leaders in the pharmaceutical industry, which was evident following the efficiency of its COVID vaccine and its ability to supply a massive number of doses within a very tight timeframe. As the economy is heading into a recessionary business environment, we’ll evaluate the firm’s current market positioning and competitive edge to assess its ability to stay ahead of other market players. We’ll use the Porter Five Forces, a framework that helps evaluate the company’s current strategic position within its industry.

Threat of New Entrants (Low)

Due to several factors, new entrants present a low threat to a leading company like J&J. First, J&J’s research and development allocation, over $24.4 billion during the last twelve months, can’t be matched easily by any new entrant. Second, it is not easy for new firms to overcome the legal and regulatory requirements, which J&J has already done over the decades. Third, trust is a crucial driver for companies in the medical field, and J&J has a strong brand trusted by millions across the globe.

Threat of Substitutes (Medium)

Although patents can prevent replication, generic or bio-similar products present a continuous threat to J&J’s drugs due to their lower cost and easy substitution. Still, the company can introduce cheaper products and offer discounts for its drugs to target the lower class and reduce the impact of these alternative products.

Bargaining Power of Customers (Low)

Customers in the consumer health segment have several alternatives with meager switching costs, giving them significant bargaining power. But as the customer base of J&J is extremely large and diversified, the actions of a few customers do not present a real threat to the company’s sales. On the other hand, patients, doctors, and hospitals are the primary clients for the pharmaceutical and Medtech segments. Here, the company’s brand and credibility reduce the bargaining power of customers.

Bargaining Power of Suppliers (Low)

Johnson & Johnson has a massive pool of over 50,000 suppliers worldwide who provide products to all three business divisions. As such, the company is not dependent on a few suppliers and can easily negotiate better terms with them.

Competitive Rivalry (High)

Among the well-known companies that compete with Johnson & Johnson are Pfizer (PFE), Roche (OTCQX:RHHBY), Novartis (NVS), and AbbVie (ABBV). Innovation and being a first-mover are vital advantages that distinguish a company from its competitors in the healthcare sector, which J&J has done successfully over the years. Indeed, following the emergence of the COVID pandemic, the firm’s extensive and competent research team was able to develop an efficient vaccine, which was successfully approved and launched on the market.

Rankings

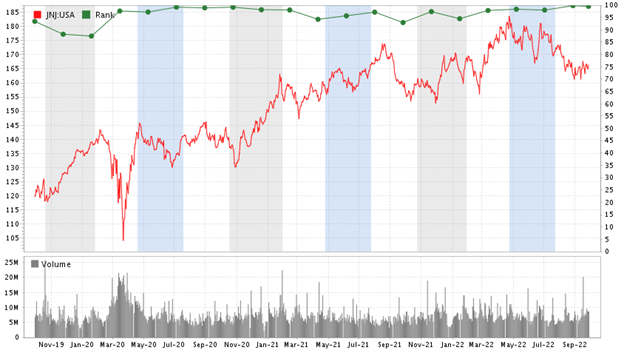

Johnson & Johnson has a high rank of 99.7 according to our multi-factor ranking system, which includes a mix of 9 quality, value, and momentum factors, and is included in our Factor-Based US Large Cap Strategy.

|

Ranking (%) |

Quality (35%) |

Value (30%) |

Momentum (35%) |

|

99.7 |

75.8 |

90.6 |

95.6 |

Source: Factor-Based

After conducting extensive back-testing for the results of our ranking system, we concluded that firms ranked above 90 (top decile) have an attractive upside potential compared to other companies in the universe. As shown in the below chart, J&J’s rank jumped above 90 in 2020 following the pandemic emergence.

Factset

To get the final rank, we begin by assigning a weight to every factor, then normalizing it to a percentile. The latest Factor-Based US Large Cap Strategy presentation on our website illustrates the whole process. Let’s take a deeper look at some of those factors and see how they contributed to J&J’s high ranking.

Quality

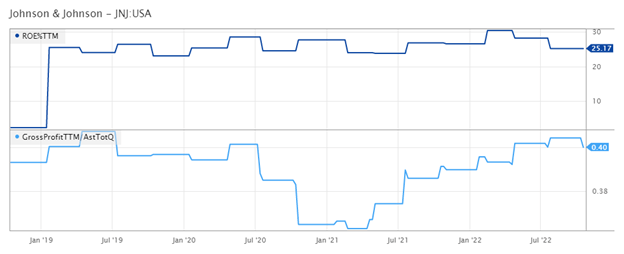

Johnson & Johnson has a fair quality ranking of 75.8, which considers the profit quality of the firm. The twelve-trailing month return on equity (ROE TTM) and the gross profitability ratio are among the quality factors we use.

J&J’s ROE (TTM) has increased significantly in 2019 and has maintained this high level during the following years (25.17% currently). Furthermore, gross profitability, calculated as Gross Profit / Total Assets, has increased significantly in recent years, indicating improved profitability, and is presently upholding its upward trend.

Factset

Value

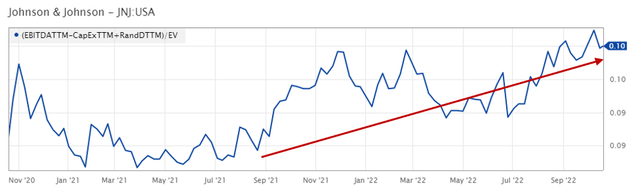

Following our back-testing results, we learned that evaluating how much EBITDA a company generates per unit of Enterprise Value (after adjusting for R&D) is a value-driven factor in identifying undervalued companies. Johnson & Johnson’s ratio has been soaring and is still on the rise, as shown in the chart below.

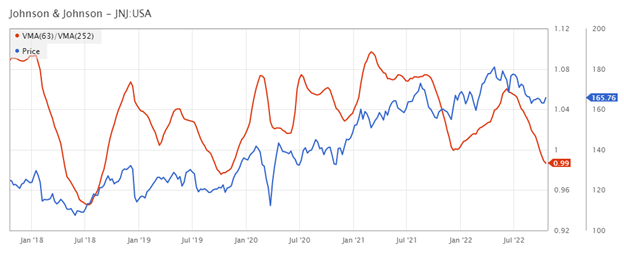

Momentum

One of the momentum factors used is the price slope, which facilitates identifying medium-term upswings. Even though this factor has declined since June due to the market’s bearish sentiment, it remained above 1.0, and the company’s price maintained its stability. As such, once the trend reverses, the price is expected to continue its upward swing. To determine this factor, we divide the 63-Day VMA (Volume Weighted Moving Average) by the 252-Day VMA.

Factset

Investment Risks

Even though Johnson & Johnson is one of the leading companies in the healthcare sector, investors should be aware of some potential risks for the company. In addition to the risks faced by firms in this industry, such as lawsuits and product recalls, we would like to highlight the following two risks specific to J&J:

- Debt renewal: J&J’s short and long-term debts increased significantly following the pandemic. Moreover, the cost of borrowing increased with several rate hikes this year. Hence, rolling over maturing debt will weigh on the company’s future profitability margins.

- The stronger USD will weigh on the company’s future income as overseas earnings constitute a significant part of its operations, thus reducing their values when translated to USD. In fact, during their latest earnings call, management trimmed their full-year revenue guidance from $94.8B-$95.8B last April to $93B-$93.5B.

- Reliance on the pharmaceutical segment: The pharmaceutical segment has been J&J’s principal source of growth. However, relying heavily on this segment comes with several risks. First, branded drugs have a limited period of patent protection and are exposed to generic competition. Second, the pricing strategies of several drugs are subject to drug-pricing reform risks. Finally, there is always a significant risk that the drugs in the pipeline may fail to gain the approval of the Food and Drug Administration (FDA).

Final Thoughts

In conclusion, Johnson & Johnson has established its market leadership and dominance over 136 years of operations. The multinational pharmaceutical company demonstrated strong performance during recessions, with the ability to maintain stable operations and low stock volatility. As the market entered the bearish territory with an increased probability of a recession occurring by the end of 2022, J&J is considered an attractive investment opportunity. Its financial outlook is promising, supported by consistent demand, a strong credit rating, and a massively diversified product portfolio. According to our multi-factor ranking system, the recent price drop to $165 combined with an extremely high rank makes J&J an ideal investment for this uncertain period. Hence, it is currently part of our US Large Cap Equity Strategy.

Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.