Summary:

- We gave JPMorgan a Buy rating in our last article.

- The stock has delivered all our expected returns over the next 36 months within 36 trading days.

- We go over the new risks and tell you why there are better opportunities elsewhere.

jetcityimage

It is rare. For us to give a big bank a buy rating. There generally is very little to get excited about and there is rarely any opportunity to generate alpha. With 30-50 analysts shadowing every CFO move and constant updates of estimates, the consensus is generally “right” at any given moment. To make big money, you have to either make the big contrarian macro call or to tactically buy at extremely attractive points. We did the latter with JPMorgan Chase (NYSE:JPM.PK).

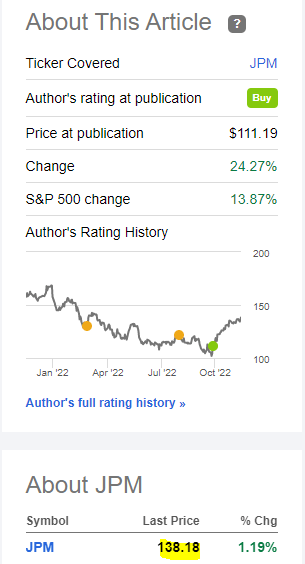

Seeking Alpha JPM ratings By Author

We go over why we are now quickly downgrading this back to a hold and tell you where you might be able to find value in banking.

Valuation Getting Ho-Hum

When we last wrote about it, we were close to 1.65X on a price to tangible book value multiple. While we did not find that number ideal (1.4X would hit the spot), we were ready to compromise in light of the stronger results. Our rationale back then was that we would get decent returns even in a worst-case scenario. The worst case being about $10 in earnings annually ($30 total) over the next three years and tangible book value expanding by about $18 (earnings minus dividends). Assuming the tangible book value multiple held, we would get to a price of about $137 ($83 tangible book value) X 1.65X. Of course, we would get a sweet $4.00 of annual dividends. All in all, it gave us very low risk of losing money. In fact, even if price to tangible book value compressed to 1.3X, we would still have a positive total return. That is a good entry point where your odds of loss are slim, even if valuation compresses.

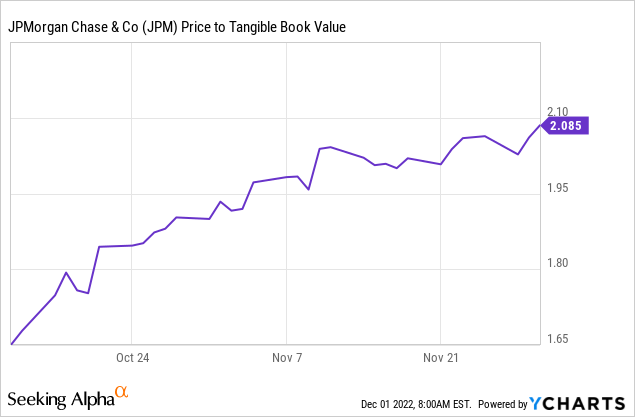

Great, but the market had other plans. Look at where we are today.

Seeking Alpha

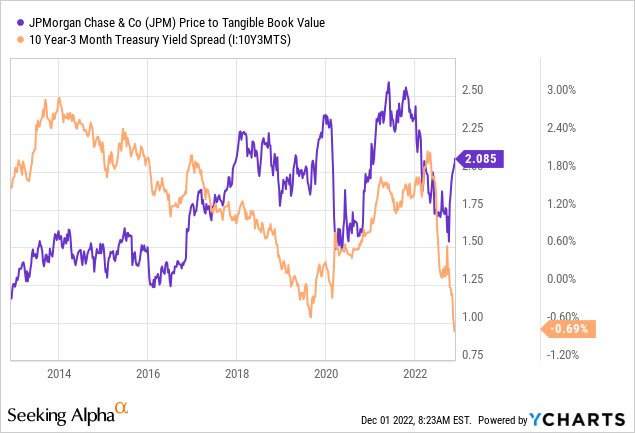

We have gone right past our 36-month target in 36 trading days. Price to tangible book value has ballooned back to almost 2.1X.

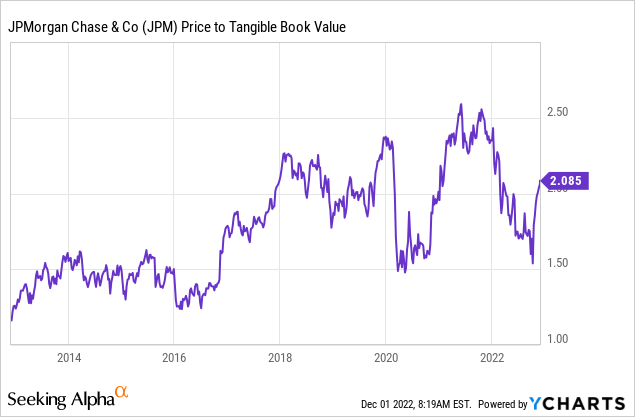

This is not remotely attractive. Just look at the last 10-year history of this number.

Even during times when risk-free rates were way lower, we got as low as 1.4X. Paying 2.08X now, is asking, if not begging, for trouble.

Risks Have Increased

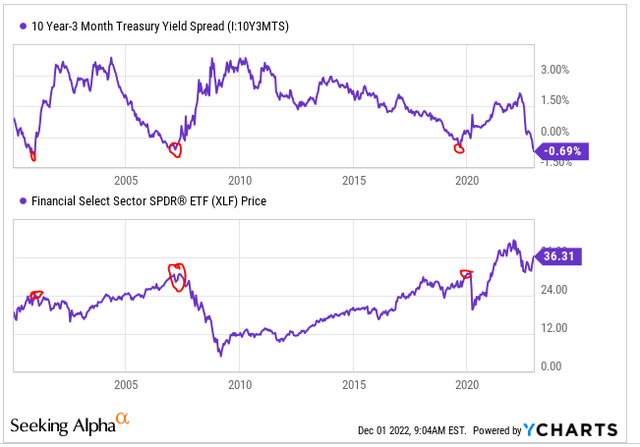

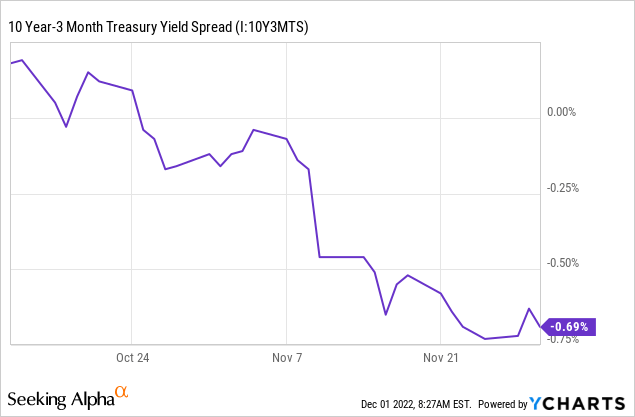

The inverted yield curve is always downplayed as being different this time around. But historically, it has sniffed out trouble rather well. As the 3-month Treasury rate has moved up to price Federal Reserve moves and the 10-Year note yield moved down, we got a solid curve inversion. Note the change since we last wrote on JPM.

The degree of inversion is now at an extreme level with the 3-month 69 basis points below the 10-year Treasury rate.

The borrow short, lend long, model gets into trouble when things break like this. While banks, especially the likes of JPM, are in a great position to navigate the challenges, we just cannot pay a premium multiple at this time.

Better Choices Available

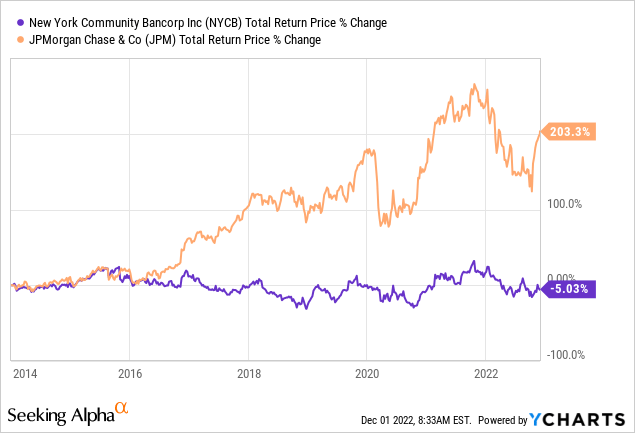

Interestingly enough, there are still good options available if you want financial exposure. One particular one we like is New York Community Bancorp, Inc. (NYCB). It looks really horrible compared to JPM if you compare based on the total returns over the last decade.

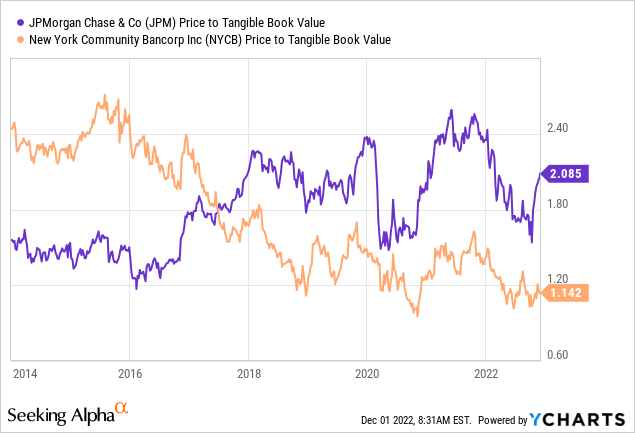

A lot of that was driven by relative valuation moves. JPM’s price to tangible book value expanded from 1.5X to 2.1X and NYCB’s compressed from 2.4X to 1.1X.

The setup is now more in favor of NYCB and its rich dividend yield provides a better buffer.

Preferred Shares

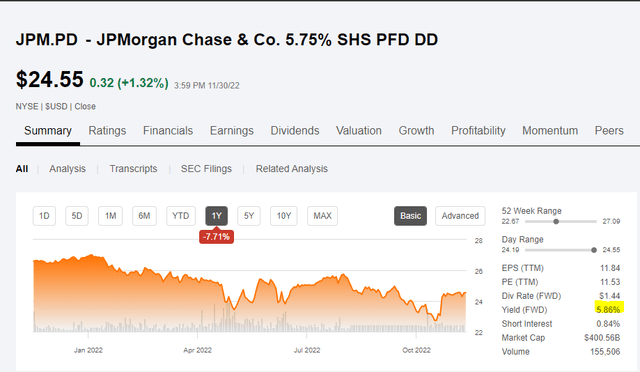

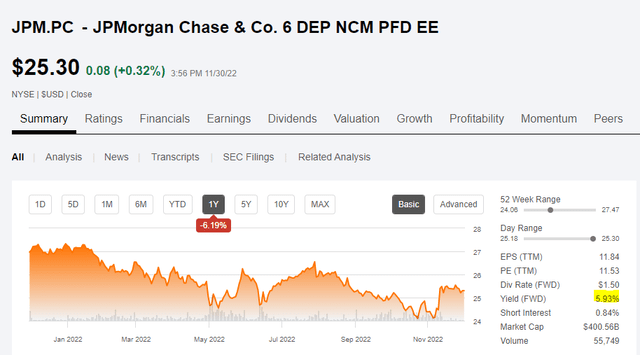

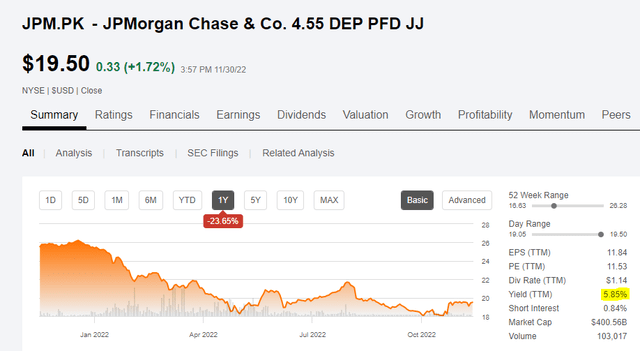

Investors often look to preferred shares as a source of better and safer income. This also works out well when they like the company but are not too thrilled with the valuation of the common shares. JPM has some interesting choices in terms of publicly listed preferred shares as well.

The common characteristics they have is that they are all are non-cumulative (as with almost all bank preferred shares currently in existence) and they all yield about 5.85%. They are all also eligible for the 15% tax rate and rated BBB- by S&P.

1) JPMorgan Chase & Co. 5.75% SHS PFD DD (NYSE:JPM.PD)

This one is callable in December 2023 and offers a slight additional upside if we are in a furious rate-cutting cycle and JPM decides to call it.

2) JPMorgan Chase & Co. 6 DEP NCM PFD EE (NYSE:JPM.PC)

This one offers a slightly better yield on current price, but it is trading over par and it is callable in March 2024. You have to hence balance the possible loss of 30 cents on redemption with the higher yield. This is a good one for those who believe in the “higher for longer” interest rate outlook.

3) JPMorgan Chase & Co. 4.55 DEP PFD JJ (NYSE:JPM.PK)

This is a better choice for deflationary outcomes as the stock would likely rally quite a bit. You can see that at the beginning of 2022, it traded over par. Unlike JPM.PC or JPM.PD, both of which don’t have much upside in a heavy rate cutting cycle, this one can offer you capital gains as well.

Verdict

We certainly did not expect such a huge rally so quickly. Can you make money on JPM from here on the long side? Of course, you can. But there is less scope today for good outcomes and the risks are substantially higher. Below we show Financial Select Sector SPDR ETF (XLF) when the curve is heavily inverted.

History is not on your side at this point and you also have better choices available. Don’t chase here.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have a beneficial long position in the shares of NYCB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.