Summary:

- Over the summer, I called AI a tailwind during this recession-prone economy.

- Meta Platforms was the first to validate this tailwind as it cuts its labor force by 11,000 employees but plans to grow its CapEx budget to push further into AI.

- As I said in that first article, Nvidia and Micron are two of the top beneficiaries of AI during this economic tailwind.

- Each has its own strengths as an investment; Nvidia the longest revenue growth runway, but Micron the lower risk with good rebound potential.

Thinkhubstudio/iStock via Getty Images

Many investors tend to throw out the baby with the bathwater when it comes to stocks in a recession-prone environment. Instead of seeing each sector or business for what it is, investors tend to put their entire portfolio on notice. I even hear some of my Tech Cache members ask, “isn’t this a bad time to buy XYZ because of the looming recession?” But there are delineations between certain sectors from the rest of tech, and sometimes certain stocks within those sectors. One of these corners of the tech world is AI (artificial intelligence), as AI will replace human efforts in areas they were once needed. The key is to know the business beneficiaries of this trend, not necessarily the users of it.

If you read my first installment of how recession headwinds are tailwinds for AI, you’ll know what Meta Platforms (META) committed to in its latest earnings report was coming. I did. That’s why I wrote it.

But capitalizing on these tailwinds is what’s important.

And there are several at the center of this tailwind, including Nvidia (NASDAQ:NVDA) and Micron (NASDAQ:MU). These are two of the few who benefit from this acceleration into AI.

Now, Meta Platforms isn’t the only one pushing into AI; nearly every North American cloud provider, from Alphabet (GOOG)(GOOGL) to Amazon (AMZN) to Microsoft (MSFT), is pushing deeper into AI. But Meta represents one of the most mainstream as it depends directly on AI for its revenue through advertising targeting and content moderation. The others utilize AI for cloud customers, but they’re not directly improving their targeting to recover from advertising headwinds – its lifeblood – from manual human intervention to automated, accurate processing.

Meta Platforms Calls Out AI Investment As Necessary

Meta clearly stated its expenses are increasing in 2023 while it deals with the worst growth it has ever seen. Many investors and analysts wrung hands over management’s decision to keep investing in the metaverse after saying it would scale back on its Q1 ’22 earnings call. While this management juke is a valid criticism, and I agree with it, I found the key moment was the reason for the increase in the company’s planned 2023 CapEx, on top of its increased operating expenses.

For 2023, we expect capital expenditures to be in the range of $34-39 billion, driven by our investments in data centers, servers, and network infrastructure. An increase in AI capacity is driving substantially all of our capital expenditure growth in 2023.

– Meta Platforms Q3 ’22 Earnings Press Release

But the story continues.

Just two weeks after earnings, Meta announced it’s laying off 11,000 workers, the first of any kind in company history. Those 11,000 workers aren’t relevant to getting Meta back to revenue growth, clearly.

Why is that so clear?

Because it shifted investment from headcount to AI and stated, “Our 2022 expense outlook of $85-87 billion also remains unchanged and includes the estimated severance-related costs we expect to record in the fourth quarter of 2022.” It had already contemplated this move before earnings, though part of the non-impact is likely because it’ll take further charges in Q1 of 2023 to finish the layoffs.

Initially, as stated in the earnings release, Meta planned on increasing CapEx in 2023 to $36.5B at the midpoint. This would have been up from an expected $32.5B in 2022. However, the layoff filing included updated expenses and CapEx guidance for 2023. It now expects CapEx in a range of $34B-$37B. This brings the midpoint to $35.5B.

Regardless of the exact amount, it calls out AI as the reason for the year-over-year growth. This means if Meta hits the middle of its 2023 CapEx guidance – which I expect will trend toward the higher end of the range as the year progresses – there will be $3B alone going purely to AI investments. This is on top of all the other CapEx going toward servers and infrastructure to support this AI initiative, as it points out in its CapEx guidance statement above.

Meta is investing heavily in AI while everyone and their mother knows Meta is in trouble in the revenue growth department. But it’s because of this exact reason Meta is driving investments. To survive these strong advertising headwinds between the macroeconomic reasons and Apple’s (AAPL) iOS targeting changes, it must use AI to get itself back to growth. There is no other answer.

This demonstrates how a company in growth trouble is upping its investments in AI. It’s not a matter of if it’s happening it’s a matter of who it’s happening to.

It’s also a matter of who is benefitting.

Nvidia And Micron Will Benefit Greatly From AI In 2023

As I pointed out in my June article, Nvidia and Micron are two of the top beneficiaries of this AI tailwind. Nvidia is the leader in accelerated AI computing by combining its hardware with its longstanding software stack. Micron benefits from the hardware side and continues to develop a close relationship with Nvidia with breakthrough technologies such as GDDR6X memory used in the high-performance hardware Nvidia sells.

The success of one benefits the other, and this positive feedback loop propels these two companies beyond others in the AI-driven economy.

Nvidia Shows Strength In Data Center, Macro Picture Notwithstanding

Nvidia is essential in providing AI hardware and software to its clients. The H100 data center GPU is Nvidia’s leading AI-accelerating hardware based on its Hopper architecture, succeeding the A100 Ampere architecture. What’s most interesting is the fact it’s cheaper to own and operate the H100 than the A100 (outside of the initial price tag) and provides a motivation for hyperscalers to upgrade.

H100 also delivers incredible value compared to the previous generation for equivalent AI performance it offers 3x lower total cost of ownership while using 5x fewer server nodes and 3.5x less energy.

– Colette Kress, CFO, FQ3 ’22 Earnings Call

Not only does it dominate in performance, but Nvidia leads data center GPU market share, anywhere from 80.6% up to 90%, depending on which hardware is included in the calculation and which purpose it’s used for. But, regardless of the share, no one disputes Nvidia has a dominant position in the data center AI market. Therefore, when Meta Platforms purchases more AI infrastructure, it will undoubtedly use Nvidia components and software.

What backs these claims is Nvidia’s continued growth in Data Center while other segments of its business struggle. Furthermore, its color around the future of its data center segment proves North American cloud providers are not backing down on investments as a whole.

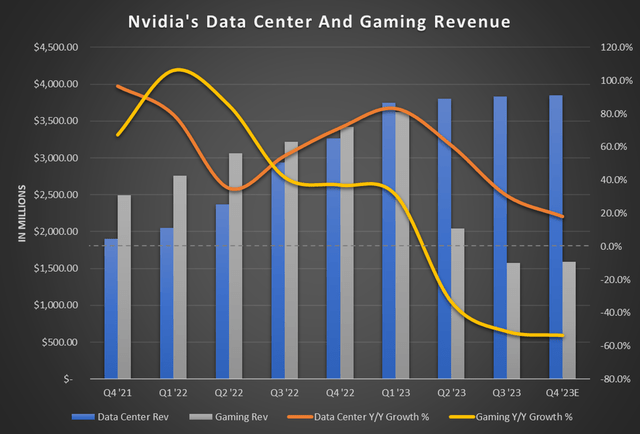

From a revenue growth perspective, Gaming has fallen off a cliff in the last two quarters dipping far into negative year-over-year growth, with guidance for it to remain barely above flat sequentially for the current quarter but deeply still negative year-over-year. Meanwhile, Data Center has sustained its revenue for the last three quarters, with 14.9%, 1.5%, and 0.7% growth sequentially from FQ1 ’23 to the just reported Q3 ’23 quarter.

Chart mine, data from Nvidia’s Quarterly Revenue Trend PDF

This performance comes with expectations for cloud providers to accelerate this trend. This is because AI has become crucial since general purpose computing is no longer scaling at volume. It makes AI the required step forward, and Nvidia not only has the dominant market position but the dominant hardware and software package. This is why the company is seeing a massive demand building as it ramps up production:

The performance over Ampere is so significant that I — and because of the pent-up demand for Hopper because of these new models that are — that I spoke about earlier, deep recommender systems and large language models and generative AI models. Customers are clamoring to ramp Hopper as quickly as possible, and we are trying to do the same. We are all hands on deck to help the cloud service providers stand up the supercomputers.

…

…we’re working hand in glove with every [single customer], and every one of them are racing to stand up Hoppers. We expect them to have Hopper cloud services stood up in Q1. And so, we are expecting to ship some volume — we’re expecting to ship production in Q4, and then we’re expecting to ship large volumes in Q1. That’s a faster transition than Ampere.

– Jensen Huang, CEO, FQ3 ’22 Earnings Q&A

I heard a little bit of a data center guide in this answer for FQ1 ’24 when Huang said, “large volumes in Q1.” Furthermore, data center revenue would be up further if not for the weakness seen in China unrelated to the export ban. But, demand remains pent up, and once China’s COVID restrictions ease, this will provide another tailwind.

Nvidia’s data center business isn’t going anywhere anytime soon except up. The macroeconomic conditions are only fueling it, not hurting it, as labor shortages and the need to replace tens of thousands of tech and tech-related employees only grows.

Micron Is A Hurt Puppy, But Not Everywhere And Not For Long

It’s no secret Micron is hurting as it grapples with the onslaught of canceled DRAM and NAND orders. But where it’s hurting matters. It’s clear, much like Nvidia, the retail side of its business has taken a huge nosedive. This has led to negative year-over-year growth expectations for the coming three-to-four quarters.

But much like Nvidia, it’s seeing continued demand with cloud and servers.

In fiscal 2022, we set a new revenue record for our cloud revenues, which grew more than 30% year-over-year. Cloud end demand remains healthy, driven by secular growth in AI and the digital economy.

– Sanjay Mehrotra, CEO, FQ4 ’22 Earnings Call

The problem for Micron is the supply constraints of other components are putting pressure on its DRAM business. Since Micron has been able to supply the server market with enough DRAM over the last year, it has caused inventories to rise at clients who are short other components to ship final products. Once this inventory correction is over, expect the DRAM server business to see the first increases in ASPs (average selling prices) and the inklings of a rebound in Micron’s business to be seen in this high-margin segment.

On the NAND side, Micron has been taking share in the data center.

Our share gains in client and data center SSDs contributed to record revenue in SSDs and also in our consolidated NAND business.

…

Building on our recent momentum of market share gains in data center SSDs, in the first half of calendar 2022, we continue to make solid progress in ongoing qualifications of our 176-layer NVMe data center SSDs at hyperscalers and OEMs around the world.

– Sanjay Mehrotra, FQ4 ’22 Earnings Call

This NAND is higher margin as the company combines its NAND chip business with its product business to create a single solution package for its customers. In addition, AI is quickly moving toward high-performance SSDs in the data center as new reliability and fault-checking solutions emerge, which aren’t necessarily native to a technology where memory endurance and reliability are a factor.

But the combination of Micron’s situation in the current hurting memory environment, its share gains in SSDs, and lowering supply across DRAM and NAND will create an explosive recovery period driven by AI’s increasing needs. 2023 will be a crucial year for Micron when ASPs recover as cloud providers quickly turn around and start ordering memory again. Add on the continuing tug of Nvidia’s graphics DRAM needs at the beginning of the year, and Micron has momentum already building while its stock wallows in the current situation.

Nvidia Comes Out On Top, But Micron’s Risks Are Far Less

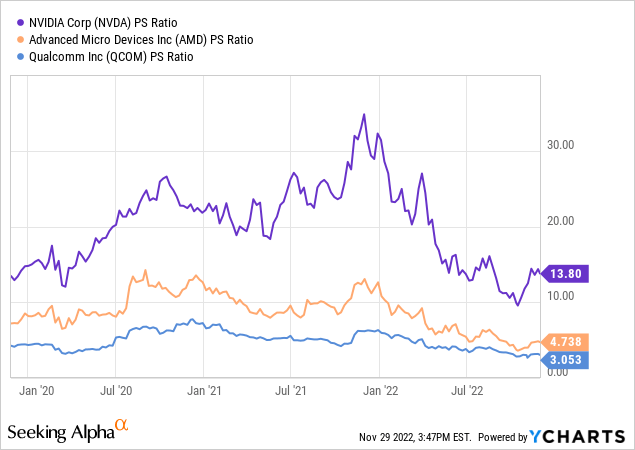

Nvidia is the player with the most exposure to AI build-outs and has the greatest potential to be the dominant name in AI hardware and software. However, its stock’s valuation already hangs onto this, as noted by its relatively elevated price-to-sales ratio among peers.

While well off its valuation highs, it’s still head and shoulders above its peers. This makes investing in Nvidia a higher risk. But it’s not without a higher reward, as the recessionary environment is driving the investments in AI, creating a counterintuitive trend for Nvidia’s business and, therefore, stock. I would be more amenable to buying shares under $150 and increasing the rate of accumulation under $130. While the stock was already in this territory just a month ago, the added color of the data center’s continued strength and expectations from the conference call for an even better next quarter, plus the Gaming division’s bottoming, is what makes my price targets all the more enticing. You gain the added information, reducing the unknowns from when it was there just a month or so ago.

Micron, on the other hand, is near valuation lows and has the added benefit of being in the deepest part of the inventory corrections going on in the hardware industry. This means the worst is already being priced in, and the market can look for the upside first in the next six to nine months.

In data center, we learned at Tuesday’s Wells Fargo conference call inventories in this segment will need to be replenished at customers mid-next year (May quarter or just after). Of course, most can and should take it with a grain of salt because the fallout is still happening in terms of bad news, and management didn’t have good visibility. But the fact remains cloud customers will need to replenish those inventories as they continue to scale cloud capacity and expand AI’s share of the cloud.

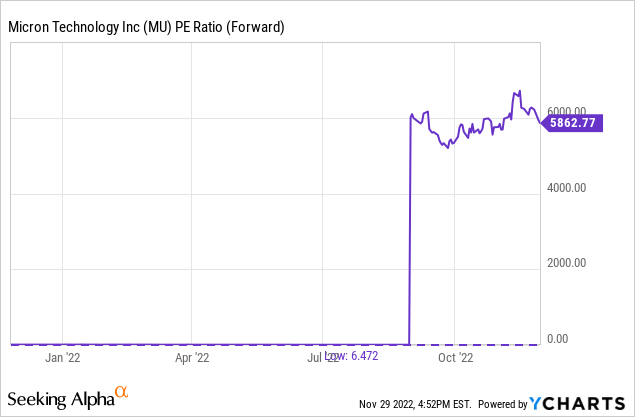

Micron, for its part, is at the bottom of the cycle, with its forward P/E near sky-high values. Don’t mistake this – this is an indicator to buy, not run away. Micron’s forward P/E does not work like other stocks because its industry isn’t like others. Selling should occur when the forward P/E is very low, and buying should occur when its forward P/E is very high.

This is due to the cyclical nature of the business. When things are good, the company’s EPS is very high, but the P/E is low because the market is waiting for the down cycle. The anticipation keeps the valuation low, sometimes only the low double digits. When things are bad, EPS estimates reach lows, but the stock only comes back 50 or 60 percent, as the market anticipates the up cycle.

That chart isn’t a mistake. Notice what looks like a flat PE before September is the 6.5 forward P/E ratio (low indicator) before guidance showed the cycle turning. Now with an astronomical P/E, it’s the time to buy, or at least the season to buy. And by season, it means the period before a turnaround in the share price happens, which is before the financials ever begin to rise. So watch the earnings estimates for an indicator; even then, the stock will be heading higher just before that as the discounting mechanism of the market sniffs it out before it happens.

The decision comes down to risk tolerance and desired reward. Nvidia will have a longer runway of recovery, but it may have to deal with a larger downside in the near term. Micron is closer to the end of its downside but likely won’t have as much return potential over a two or three-year period as Nvidia, but will be quite respectable, nonetheless.

AI Will Provide Tailwinds Through This Economic Time

The bottom line is AI is driving the next tech revolution. Weak economic factors are pulling forward that revolution, legitimate factors but ones that don’t have a linear and parallel effect on technology. In fact, the push for AI comes because of the layoffs and the need to become leaner. Pushing these costs onto the CapEx line allows companies to utilize depreciation and revolutionize their products to perform better than before economic conditions worsened.

There is only a fail-forward option; there is no going back or reigning in AI investments.

Nvidia and Micron are prime beneficiaries of this train gaining momentum in 2023. But because they both have diversified end-markets, their overall business shows weakness; they aren’t immune to retail distress. But they will outperform those without AI-driven revenue centers, which is what I’m investing in.

Disclosure: I/we have a beneficial long position in the shares of META, MU, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.