Summary:

- Recently, a 13F filing revealed that JPMorgan Chase & Co. stock was Ray Dalio’s second-biggest fourth quarter buy.

- The rest of the top five was rounded out by other financials and an S&P 500 fund.

- The moves weren’t surprising at all, because today’s macroeconomic climate is relatively friendly to banks.

- JPMorgan is much like other banks in its reaction to monetary policy, but it has intriguing characteristics like large investments in AI.

- In this article, I explain why I consider JPMorgan stock a good value at today’s prices.

Ray Dalio Kimberly White

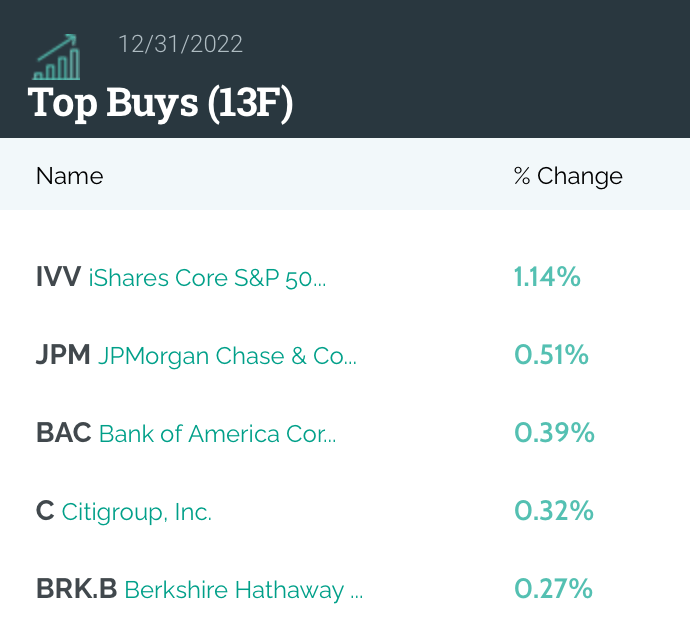

Recently, Bridgewater Associates released its Q4 13F filing, which showed Ray Dalio’s company buying a significant amount of JPMorgan Chase & Co. (NYSE:JPM) stock in the quarter.

Dalio’s biggest buys (WhaleWisdom)

In fact, not only did Dalio buy significant amounts of JPMorgan, his top fourth-quarter buys were dominated by financials, with Bank of America (BAC), Citigroup (C), and Berkshire Hathaway (BRK.B) rounding out the rest of the top 5 individual stock positions.

When I saw Ray Dalio buying JPMorgan stock in the fourth quarter, I wasn’t surprised. As I’ve been saying for about a year now in my coverage of Bank of America and TD Bank (TD), banks are among the best types of equities for today’s economic conditions. They aren’t cheap at today’s prices (11.7 times earnings is high by banking standards), but they’re among the few sectors that can actually gain from rising interest rates. Rate hikes are not guaranteed to increase bank profits: if they trigger a recession, or if the yield curve inverts, the rate hikes may hurt bank profitability. Nevertheless, it is at least possible for higher rates to improve bank profits, which is in contrast to most other industries, for which they simply increase the cost of debt and reduce the present value of earnings.

The only problem is that most banking analysts know this, so banks aren’t cheap right now. However, in December, bank stocks took a major dip, for reasons that aren’t entirely clear. At that particular moment in time, they were great buys. I upped my Bank of America position that month, and I wasn’t surprised to see Dalio buying big as well.

An interesting question is: “why does Dalio like JPMorgan in particular?”

Bridgewater’s 13F showed Dalio and his team buying 30% more JPM than BAC, which was their second most bought bank stock in the period. JPM is currently more expensive than Bank of America, getting close to 12 times earnings – very pricey by banking standards. I personally prefer BAC stock at today’s prices, but as I’ll show in the ensuing paragraphs, JPM has a lot of things going for it that could make it a worthy buy, too.

Investments in AI

One big thing JPMorgan has going for it right now is heavy investment in AI. These investments could provide efficiency gains in the future. In 2017, JPMorgan used AI to complete 360,000 hours of finance work (mainly filings) in a few hours. It has an entire AI research division. It ranks #1 among banks in the Evident AI Maturity Index. In 2023, AI is the talk of the town. Some companies are gaining from it (e.g., OpenAI), others are perceived to be losing from it.

Companies that rush out AI products to consumers may be at risk of issues if the AI creates liability. For example, Tesla’s (TSLA) “full self-driving” has been blamed for many crashes and Microsoft Corporation‘s (MSFT) Bing AI rollout has been marred by inaccurate information and even users being insulted by “Sidney” (the company’s chatbot). It’s not clear that blasting AI products out to the consumer is a wise strategy, but so far, JPM appears to be using AI to automate internal work rather than to sell as a product. So, there is a plausible case to be made that JPMorgan will take the lead in efficiency as long as it continues using AI responsibly.

Profitability

Another thing JPMorgan has going for it is profitability. Among the three biggest U.S. banks, JPM is the most profitable, easily trouncing Citigroup and slightly edging out Bank of America. As the table below shows, JPM has the best margins of the group.

|

JPMorgan |

|||

|

Net margin |

30.80% |

29.8% |

21% |

|

Return on equity |

13.7% |

10.6% |

7.5% |

|

Return on assets |

1.03% |

0.9% |

0.61% |

When it comes to the three metrics that bank analysts look at the most closely, there’s no question: JPMorgan takes the cake.

Now, of course, this is reflected in the stock’s valuation. JPM currently trades at 11.7 times earnings, 3.4 times sales, 1.57 times book value, and 4.57 times operating cash flow. By contrast, Bank of America trades at 11.06 times earnings, 3.1 times sales, 1.15 times book value, and 38.51 times operating cash flow. Apart from the cash flow multiple (which can be misleading for banks, for reasons I’ll explain shortly), Bank of America is far cheaper. So, with JPMorgan stock, you’re paying up for the profit and quality you’re getting.

Discounted Cash Flow Valuation

Usually, it’s at this point in an article that I’ll include a terminal value or discounted cash flow model (“DCF”) for a stock. In JPMorgan’s case, using free cash flow as the “earnings”/cash flow metric could cause problems, because when a bank loans money, it creates a cash outflow, but it’s an outflow you want to see occurring, as that is directly used to bring in future income. So, in valuing the present value of JPM’s future earnings, I’ll use earnings per share in place of free cash flow per share.

According to Seeking Alpha Quant, JPM’s ttm EPS is $12.09. If you assume no growth and discount that at the 10-year treasury (US10Y) yield (3.8%), you get a terminal value estimate of $316, an upside of more than 100% to today’s price. If you add a 4.2% risk premium, you get a $150 price target, which is still a slight amount of upside. 8.5% is the discount rate at which JPM ceases to have an upside under the zero-growth assumption. If you add a 5% CAGR growth assumption (well below the historical 10-year CAGR growth), then you get a $147 price target even with a 10% discount rate. Overall, this range of possibilities looks favorable for JPM. It has an upside in more scenarios than not.

Risks and Challenges

On the whole, JPMorgan looks like a good opportunity right now. Its earnings and book value increased last quarter, it’s not overly expensive, and it’s the undisputed profitability champion among big banks. It all looks pretty good. I would definitely own JPMorgan Chase & Co. stock if I hadn’t had the idea to buy Bank of America first, and I have substantial exposure to it via the Vanguard Financials ETF (VFH).

Nevertheless, there are risks and challenges to watch out for, including:

-

Increasing charge-offs and delinquencies. Most big banks are reporting increases in charge-offs and delinquencies this year. JPM itself reported $877 million in charge-offs last quarter. Because of these increasing charge-offs, banks are having to raise their provisions for credit losses (“PCLs”), which is eating into their profit growth. Bank of America’s net interest income grew 29% last quarter, yet its earnings only grew 3.8%, largely because of the PCL build (weakness in investment banking also played a role). JPM is affected by these factors, too.

-

Valuation issues. 11.74 times earnings is fairly pricey for a bank. Investors don’t generally expect banks to deliver vast profit growth, hence many are not interested in them when their multiples climb into the double digits. Last quarter, Warren Buffett significantly trimmed all the banks in his portfolio, apart from Bank of America. Charlie Munger later said that, while banks are doing well, they are starting to get pricey. It appears that big investors are sensing rich valuations in the big banks. Notably, Dalio’s big buys were in December, when these stocks were much cheaper than they are now.

-

Continued weakness in investment banking. Investment banking didn’t thrive in 2022. In its most recent quarter, JPM’s investment banking fees declined 52%. The reason why investment banks are doing poorly is because not many people want to take companies public in this environment. Tech stocks are still way down from their highs, there’s a sense that if you go public today, you won’t raise as much money as you would if you waited. So, the weakness in IB could continue into 2023.

The JPMorgan Chase & Co. risks and challenges above are worth keeping in mind. Nevertheless, it appears that Ray Dalio made the right choice by buying bank stocks in December. He’s sitting on the upside on those buys, and if earnings turn out well, he may enjoy further upside still.

As for an investor considering buying now, he or she should keep in mind that bank stocks are today more pricey than they were when Dalio bought JPMorgan Chase & Co. It’s a point worth mentioning. Nevertheless, you’ve got tech stocks today trading at 20 times earnings while earnings and free cash flow decline by high double-digits year-over-year. JPMorgan Chase & Co. is probably a better buy than many of those names.

Disclosure: I/we have a beneficial long position in the shares of BAC, BRK.B, VFH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.