Summary:

- Company missed Q3 revenue estimates.

- Reservation count declines from Q2 report.

- Cash burn results in capital raise.

jetcityimage

After the bell on Tuesday, we received third quarter results from electric vehicle maker Lucid (NASDAQ:LCID). The company has been one of the biggest disappointments in this space so far this year, having reduced its production forecast multiple times. The latest set of results were not very good, making me wonder if this stock is headed to the single digits.

For the quarter, Lucid announced revenues of $195.5 million. While this was a quarterly record as the company is just starting to ramp up deliveries, the number missed street estimates for a little over $200 million. This is the company’s fifth earnings report since going public, and it has missed street estimates on the top line four times. That is not a good track record.

Lucid delivered 1,398 vehicles in the quarter, more than double the 679-figure announced for Q2 of this year. Quarterly production came in at 2,282 units, which was more than triple what was seen in Q2. In the above release, management reiterated its guidance for production of 6,000 to 7,000 vehicles this year and noted that it has proven its ability to hit 300 vehicles in a single week. However, one must remember that the company was originally calling for 20,000 vehicles this year, so the growth story has been rather lackluster to this point.

One thing that might worry investors is that the company’s reservation count was detailed as being “more than 34,000” as of November 7th. That’s down about 3,000 units from the Q2 earnings release, and I don’t think the company has delivered that many units in that just over three-month time frame. Thus, it would appear that some customers have cancelled their reservations, which might not be a surprise given ongoing delays, or perhaps the weakening global economic climate we are currently seeing.

As it continues to be a very low volume manufacturer, Lucid is losing a lot of money right now. In the third quarter, the company’s operating loss was more than $687 million, as compared to $559 million in the second quarter, despite the sequential surge in revenue. For the first nine months of the year, the company’s operations have lost over $1.84 billion, which is about $800 million more than 2021’s first three quarters. A quick look at the income statement currently doesn’t provide any hope that this company can turn an operating profit anytime soon.

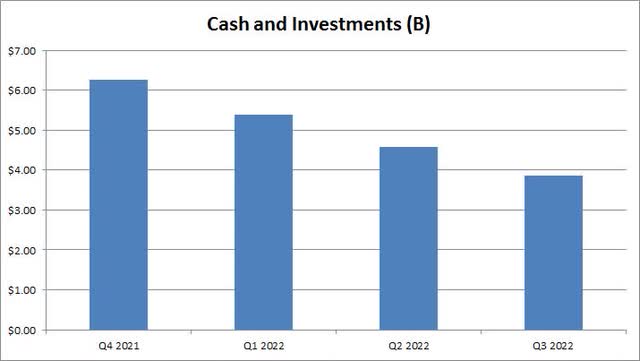

With these massive losses ongoing, Lucid is burning through a ton of cash. The company burned almost $860 million in Q3 alone, up more than $35 million from what we saw in Q3. The year-to-date total cash burn at the end of September was over $2.36 billion, leading to the decline in total cash and investments seen in the chart below. Lucid ended the third quarter with approximately $3.85 billion cash and investments on its balance sheet, which was expected to fund the company at least into the fourth quarter of 2023.

YTD Cash Balance (Company Earnings Reports)

However, if results continued to come in worse than expected, another capital raise didn’t seem out of the question when I initially went through the Q3 report. Just an hour later, the company in fact announced a $600 million at-the-market equity sales offering, along with an up to $915M additional investment by Ayar Third Investment, its majority shareholder and affiliate of Saudi Arabia’s sovereign wealth fund PIF. With shares nearing their 52-week low, this dilution will really start to pile up. It was certainly a bit odd to see the statement about funding through Q4 of next year followed by the capital raise so quickly.

Shares of Lucid lost about 10% in Tuesday’s after-hours session, putting the company’s market cap at about $20 billion. In my opinion, that’s just too much for a company at these volume levels, even though this is the luxury part of the market so selling prices are much higher than your average brand. Wall street seems to like the name, with an average price target of $23, but that figure is down from almost $43 late last year. Trading at just over $12 now, the stock is very close to its 52-week low.

In the end, Lucid’s Q3 report was another disappointment for the luxury EV maker. Revenues again missed street estimates, and reservations seem to be declining while delivery volumes remain quite low. With large losses continuing to result in significant cash burn, the company announced a capital raise coming at a time of extreme weakness. With execution at the name continuing to fall short of long-term targets, I could easily see this stock in the single digits unless Lucid really gets its act together in 2023.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.