Merck Vs. AbbVie: Which Is Better Buy As The Patent Cliffs Approach?

Summary:

- In this article, I will be comparing AbbVie and Merck to see which is better positioned for its patent cliff.

- With the acquisition of Seagen, Merck will have a fairly broad oncology portfolio. However, this will not fully offset the aftermath of Keytruda’s LOE.

- AbbVie has a pretty decent future after Humira’s LOE, given strategic acquisitions of Pharmacyclics and Allergan and Rinvoq/Skyrizi rise.

- I like AbbVie more than Merck.

igoriss/iStock via Getty Images

Thesis

AbbVie (NYSE:ABBV) and Merck (NYSE:MRK) are the 3rd and the 5th largest pharma companies in the world. Both companies have brought investors a decent profit in a falling market. Looking further, the future may look a bit foggy though as AbbVie is going to lose its key patent for Humira in 2023, while Merck’s Keytruda is set to lose the exclusivity in 2028.

In this article I will be comparing two different stories about big pharma’s patent cliffs. And based on this comparison, I will try to understand which company looks more attractive at the moment

Merck: What after Keytruda?

Keytruda has been Merck’s main growth driver for many years. This miracle drug has already saved the lives of thousands of patients with a wide variety of cancers, and despite the abundance of new competing developments in the field of oncology, there are more and more potential indications for the use of Keytruda.

However, nothing lasts forever and Keytruda’s amazing growth story will eventually come to an end as the US patent protection is only valid until 2028. Investors are asking themselves the obvious question: what will Merck do to offset the sharp drop in revenue after losing exclusive rights to its flagship drug?

Merck also faces Januvia’s key U.S. patent expiring in January 2023 when Indian firms Sun Pharmaceutical and Zydus Cadila launch their FDA-approved versions of sitagliptin. In emerging markets, Indian alternatives are likely to quickly find their niche, but in the US that demand for Januvia will not fall too sharply as Merck has some technological advantages in the production of sitagliptin. However, the loss of revenue will still be very tangible. This only confirms that Merck will need something big to cover up its LOE losses.

Seagen

The company is reportedly in talks with Seagen (SGEN) to acquire it for $40+ billion. Merck earlier invested in Seagen as a part of a partnership and has tested Seagen’s products in combination with Keytruda.

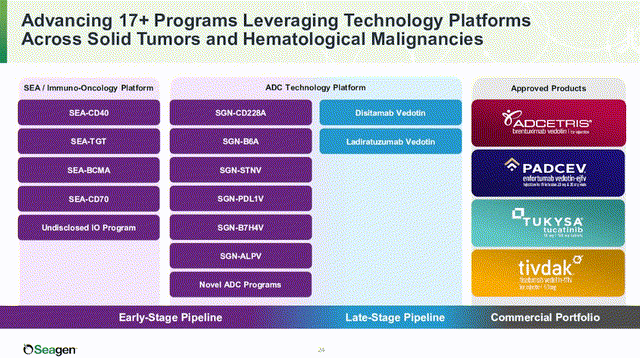

The company is an industry leader in the Antibody-Drug Conjugates (ADC) research intended for the targeted treatment of oncological diseases. While standard chemotherapy destroys all body cells, ADC affects only tumor cells. Seagen was the first to apply this technology and created the drug brentuximab vedotin (Adcetris) in 2011. Its revenue is expected to grow at a rapid pace with the TAM. However, other pharmaceutical giants have already been developing their own products using ADC technology. For example, Roche (OTCQX:RHHBY) makes a drug for the same type of HER2-positive cancer. In addition, Bayer (OTCPK:BAYZF), AstraZeneca (AZN), and Pfizer (PFE) have all entered the market with the treatment of Acute Myeloid Leukemia (AML). Adcetris accounts for 40.5% of total revenue.

Padchev is a treatment for urothelial cancer. In 2019, the FDA approved the company’s drug. It is much more effective and safer than standard chemotherapy. In addition, the FDA has also approved a drug for use with Keytruda. It will be used to treat patients with advanced urothelial cancer who cannot receive chemotherapy.

These are not the only factors in the growth of Seagen. The company also has FDA-approved Tukysa and Tivdak and 16 programs in testing phases 1 and 2.

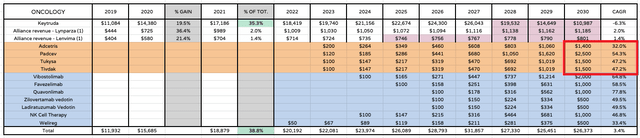

According to Edmund Ingham’s assumptions, peak sales figures of Adcetris, Padchev, Tykysa, and Tivdak for 2030 will respectively reach $1.4bn, $2.5bn, $1.5bn, and $1.5bn.

Seagen has a strong oncology portfolio and offers a portfolio of FDA-approved drugs that will grow with their addressable markets and an extensive pipeline of possible future blockbusters. This would be a good fit for Merck, given the lack of overlap between high-value assets in both companies. The acquisition will create a great revenue synergy and strengthen Merck’s portfolio.

However, the Seagen acquisition will not be able to cover Keytruda’s losses. Some analysts expect Keytruda’s revenue to reach $24.3 billion in 2026, two years before LOE, and then rapidly drop after 2027. With Seagen, total sales are estimated to be around $60.5 billion in 2030. After that, it will likely grow much slower than now. Overall, Merck will become some kind of oncology giant that will have troubles expanding its portfolio as it will face competition from other pharm giants.

Other opportunities

Merck could also see additional opportunities with sotatercept. Acquired through the $11 billion acquisition of Acceleron, sotatercept is a Phase 3 drug that’s in late-stage development for treating pulmonary arterial hypertension (PAH). Given that pulmonary arterial hypertension isn’t expected to be a highly lucrative market opportunity, sotatercept is unlikely to show Keytruda’s growth rates after 2030 but is expected to bring $4 billion by 2031.

Merck is also focused on building a portfolio of transformative therapies for cardiovascular and pulmonary diseases that address the significant unmet needs of patients. The company has set a $10 billion goal by 2030 for its pipeline.

The question of filling the hole of 24+ billion after 2028 and further growth rates remains open. The company has only $10 billion in cash and $31 billion in debt, so it will be difficult to make big deals after the Seagen acquisition.

AbbVie is ready

AbbVie’s key drug, the selective immunosuppressant Humira (adalimumab), is about to lose its key patent in the US in 2023. In 2019, the drug lost its exclusivity in Europe, after Humira’s international decreased by 36%. The segment of immunology is the largest and most stable growing. In recent years, growth has remained at the level of 12-16% per year. However, after the LOE in 2023, I expect the segment’s revenue to drop 10-15%.

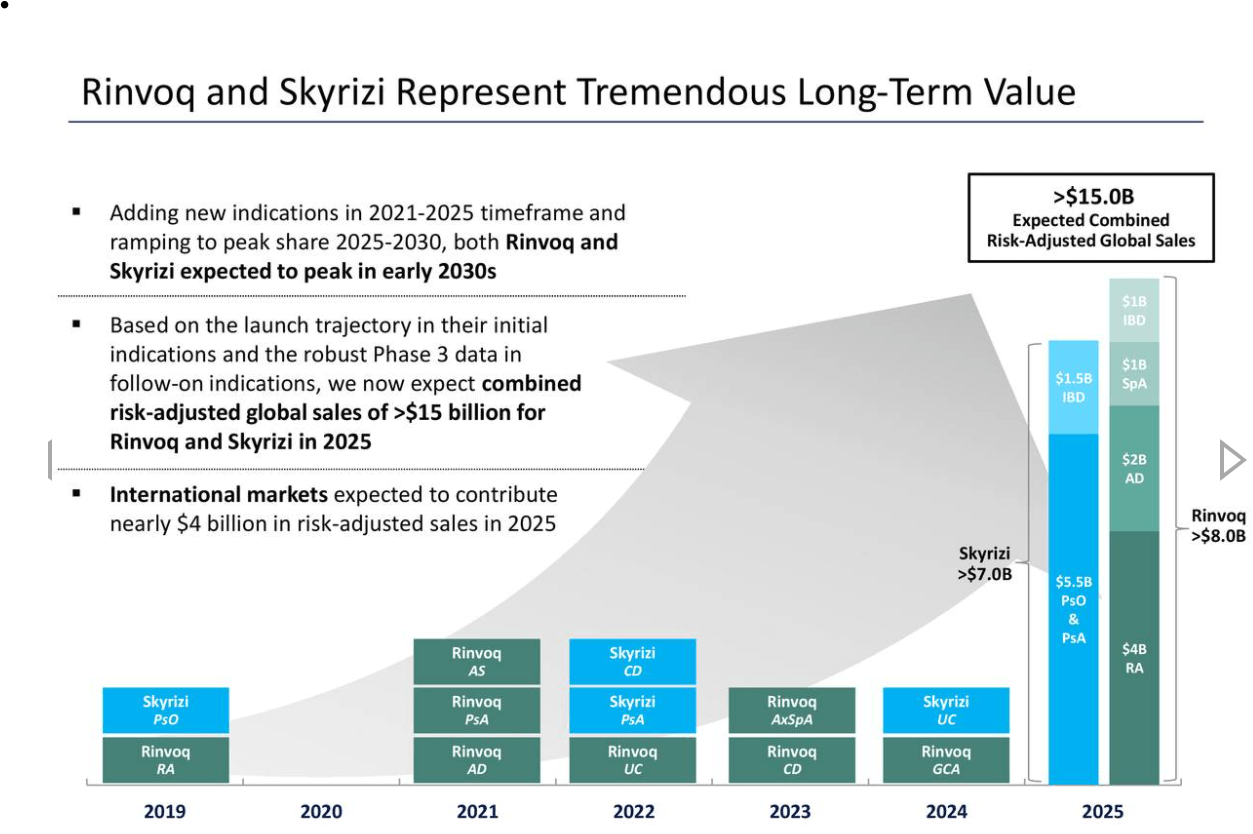

Nevertheless, the company has already found other blockbuster drugs that can prolong sales growth. AbbVie management believes that in 4 years, Rinvoq and Skyrizi sales under a neutral scenario will exceed $15 billion, an increase of 230% from 2021.

Abbvie

Despite excellent results in the core segment, which generated more than 49% of total revenue in Q2, the company is looking to expand the number of drugs in other segments. This will be possible thanks to the large transactions that AbbVie makes every two years. For example, in 2017, Pharmacyclics and its main product, Imbruvica, were bought for $21 billion. This improves the prospects for AbbVie’s second-largest segment, Hematologic Oncology.

AbbVie also acquired medical sector giant Allergan for a whopping $63 billion in 2020. Allergan’s flagship product is Botox, which is used in cosmetic clinics around the world and it is very unlikely we will see a biosimilar against Botox in the nearest future. The acquisition boosted the company’s revenue by more than $11 billion. Thanks to Allergan’s unique technologies and products, Neuroscience and Aesthetics segments’ revenue can grow at low-to-mid teens for the next five years.

AbbVie, unlike Merck, already has areas in which the company will work hard after Humira’s loss of exclusivity. The drugmaker is working on growing sales for Allergan’s lucrative Botox which hit $671 million in 2021, Pharmacyclics’ Imbruvica and Venclexta, and Humira’s successors Skyrizi and Rinvoq, which, according to CEO Richard Gonzalez, could peak $20 billion.

Conclusion

Out of those two, AbbVie looks better positioned. Its strategic acquisitions of Pharmacyclics and Allergan and, most importantly, the development of Rinvoq and Skyrizi make its future look brighter than Merck’s. I believe that AbbVie is a better buy in the long run as I see that the management has understood where everything is going and will be able to compensate for the losses from the LOE.

I am changing my long-term MRK rating to Hold as I await further news on what steps Merck will take to reduce its dependence on Keytruda and keep up its growth rates after LOE. I don’t see any clear action from management yet.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.