UnitedHealth: Still A Decent Investment In Turbulent Times

Summary:

- UnitedHealth Group Incorporated is a mastodon that is almost impossible to move from its place.

- The UnitedHealth’s addressable market shows that the long-term growth is virtually guaranteed.

- UnitedHealth Group grows at a rapid pace despite its size, along with payments to shareholders.

- UnitedHealth Group Incorporated is an excellent investment in turbulent times.

Wolterk

Thesis

UnitedHealth Group Incorporated (NYSE:UNH) is a well-known mastodon of the global insurance market, which shows steady growth in revenue and profit from year to year. The health insurance market reaches new heights every year, and the pandemic has forced people to rethink their attitudes toward their health. In addition to that, the growth of the company is supported by a long-term trend toward an aging American population.

The macroeconomic issues that are shaking the market today have little effect on UnitedHealth. So it’s clear why UNH has outperformed the S&P 500 (SP500) this year. The defensive history thesis during turbulence remains valid even after this year’s upswing.

Growing addressable market

The company’s addressable market is huge and expanding every year due to the general aging of the U.S. population. The United States remains the world leader in per capita health care spending, which predetermines the stability of cash flows for the country’s key insurance company. The population spends almost twice as much money per year on health care per person than the average for developed countries.

Peterson-KFF Health System Tracker

Statista estimates that healthcare spending will reach $6 trillion a year by 2028, which is almost 20% of GDP.

According to CMS, 73.5 million people will be enrolled in Medicare by 2027 a 28.5% increase from 57.2 million in 2017. Due to the accelerated aging of the population in the coming years, federal, state, and local governments will increase spending at a rapid pace. This is an incredibly positive signal for the industry as a whole and, in particular, for its leader, UnitedHealth.

Position in the industry

Insurance is UnitedHealth’s core business. The UnitedHealthcare segment has 26.5 million private plans with over 8 million Medicaid members and 7 million enrolled in Medicare Advantage. UnitedHealth is ranked 3rd in Medicaid, 1st in Medicare Advantage, and 2nd in commercial plans. Due to high market penetration, it is possible to significantly influence the entry threshold and the further development of the industry. Most Americans follow their relatives to the corporation that they already know about.

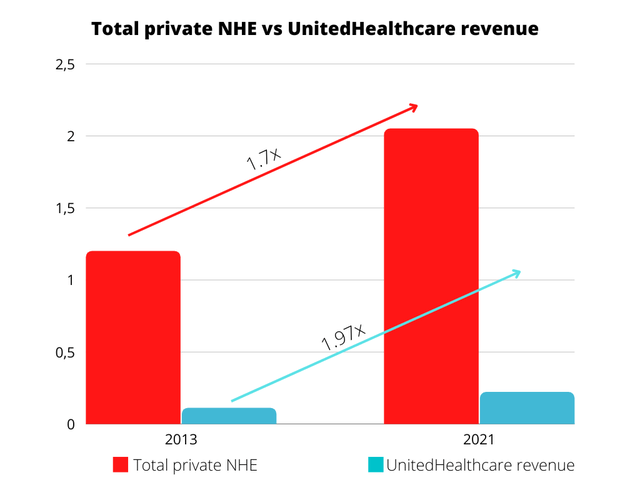

National Health Care (NHE) spending on private health insurance rose from $1.2 trillion in 2013 to $2 trillion in 2021. UnitedHealthcare segment revenue grew much faster, with $113 billion and $222.9 billion, respectively.

KFF, UnitedHealth, chart by author

The OptumHealth segment is no less interesting in the long run. With medical disease analytics, it will be possible to create personalized healthcare. This will not only improve the quality of patient care but also create a new stage in the development of compulsory insurance. Personalization will significantly reduce the cost of insurance, so clients will only pay for the necessary procedures. As part of the OptumRx segment, the company allows consumers to choose the most appropriate drugs based on doctors’ prescriptions and also processes prescriptions and payments for drugs needed by insured individuals. This is the most important and promising growth driver for UnitedHealth.

UnitedHealth’s hegemony looks unshakable. The competitors are either too small or not strong enough to dethrone him. The company’s main competitors in the U.S. health insurance market are Humana (HUM), Aetna, Elevance (former Anthem) (ELV), CVS Health (CVS), and Cigna (CI). The only company that could compete almost equally with UnitedHealth would be a combined Aetna and Humana or Anthem and Cigna. However, regulators blocked those attempts to merge in 2016.

Financial performance & dividends

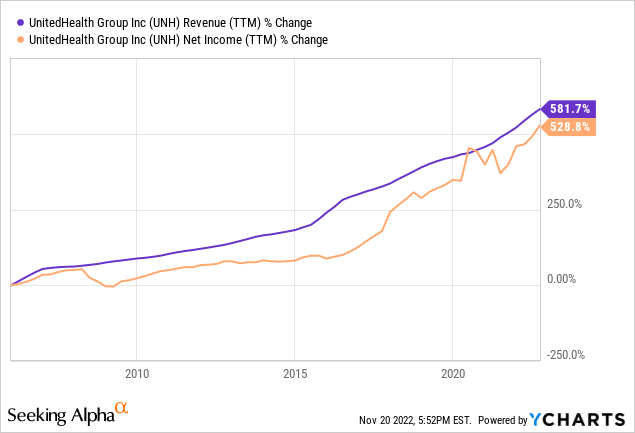

UnitedHealth Group’s annual revenue and net profit show a strong long-term upward trend and a relatively stable growth rate. Over the past 7 years, revenue has more than doubled and net profit has more than tripled. This is impressive considering the company’s already large scale.

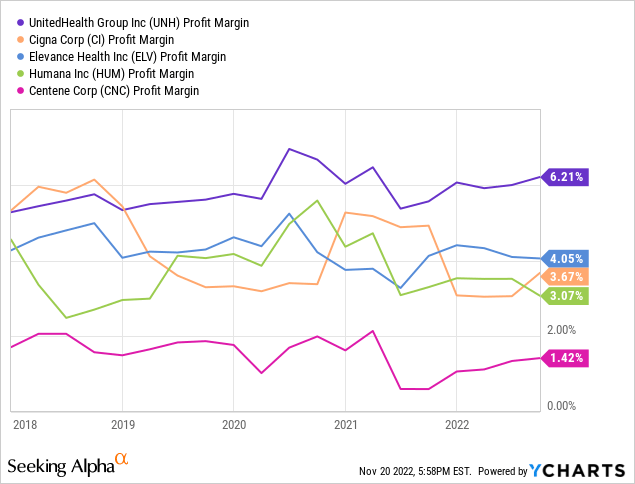

The group’s net margin is 50% higher than Elevance’s and 70%+ higher than the others’.

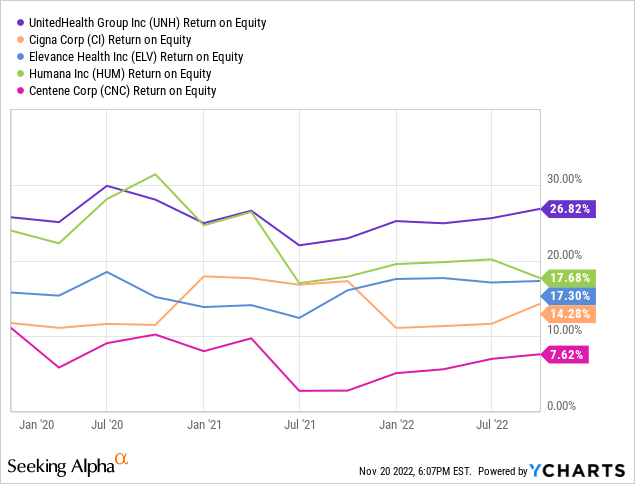

The corporation also stands out for its higher ROE, ROA, ROIC, and operating margins.

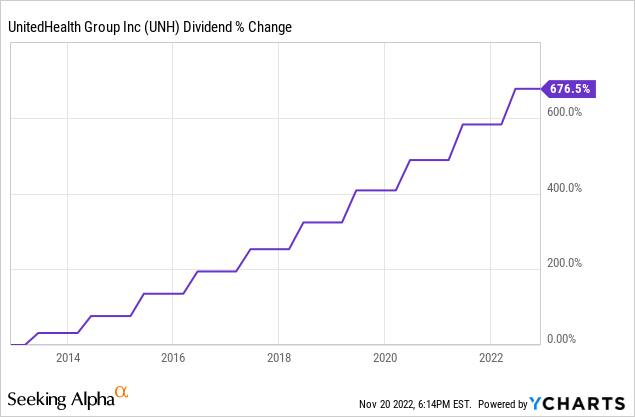

And, of course, the healthcare company cannot be considered defensive without dividend payments. UnitedHealth has no problems with it. The company has been raising dividends for over 10 years at a CAGR of over 25%.

At the same time, the payout ratio is only 29%. While key competitors have lower ratios, this is a rather low value both for the market and for the sector. This allows the company to maintain further growth of dividends at the same pace.

I have done a comparative assessment of UnitedHealth Group based on the 2023 financial outlook. The company may look expensive compared to its competitors, but it’s worth remembering that industry leaders are always valued by the market for much more. Take Apple (AAPL) or Nike (NKE) as examples. At the same time, UnitedHealth looks fairly valued right now compared to the broader market, given the group’s financial performance.

| Forward (2023) | P/E | P/S | EV/S | PEGY |

| UnitedHealth | 24 | 1.5 | 16.2 | 0.9 |

| Elevance | 17 | 0.72 | 10.3 | 1.2 |

| Humana | 21.1 | 0.75 | 10.5 | 3.4 |

| Cigna | 13.7 | 0.54 | 9.2 | – |

Conclusion

There are numerous signs that something like an economic storm is coming our way. The risks of a recession and near-zero economic growth next year cast doubt on investing in risky assets in the form of cyclical companies. UnitedHealth is not acyclic, but it will be much less affected by a recession, if at all, than many other companies. This is largely due to the specifics of the sector, but it is also worth considering the excellent stability of the company within the industry.

At the same time, I think that UnitedHealth is a Hold as, in my opinion, the upside is limited, and the smart money has already priced in a sort of safe haven in UNH shares.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.