Summary:

- Absci, a Vancouver-based drug discovery company that IPOd in July last year, has seen its market cap fall from >$2bn, to $665m at the time of writing.

- This isn’t unusual for a drug discoverer/developer – Abcellera, also based in Vancouver, has seen its stock fall >80% while even Ginkgo Bioworks stock is -30% since IPO.

- Absci has recently announced a partnership with Merck for up to three candidates which could be worth up to $640m, if all milestones are met.

- That’s not necessarily likely but it does serve as validation of the young company’s technology and approach. Merck is revamping its R&D and Absci could make itself an indispensable part of that.

- The deal will not do much for Merck in the short term, but it may help push Absci’s valuation higher – shares were 44%-plus on the news. Investing with a five-year investment horizon may offer a good ROI.

lakshmiprasad S/iStock via Getty Images

Investment Thesis – Market Has Depressed AI Drug Discovery Firms’ Valuations

Absci (NASDAQ:ABSI) is a biotech focused on early stage drug development that IPO’d in July last year, raising ~$230m via the issuance of 12.5m shares at a price of $16.

That makes Absci one of ~100 biotech companies to have IPO’d last year – a record – following on from a record 75 IPOs in 2020. Unfortunately for the biotech sector, and also for Absci, the sheer weight of recent IPOs has contributed to an unrelenting and unforgiving bear market in the biotech sector throughout 2021, and so far in 2022.

Post IPO, Absci’s shares surged to a price of $30 in early August, but the stock price has since shed 76% of its value, falling to a price of $7.2 at the time of writing.

Absci is a biotech that wants to use technology to streamline the process of drug discovery – in its IPO prospectus the company declares that “our mission is to change the world, one protein at a time,” and more specifically, that:

With our AI-powered Integrated Drug Creation Platform we enable the creation of novel biologics by unifying biologic drug discovery and cell line development into one simultaneous process.

We leverage proprietary synthetic biology technologies and deep learning AI to predict, identify, design, construct, screen, select and scale production of novel biologic drug candidates, and learn from the data we generate.

We believe our approach delivers disruptive efficiency, but more importantly enables our partners to create novel and human/AI-designed new-to-nature biologics (next-generation biologics).

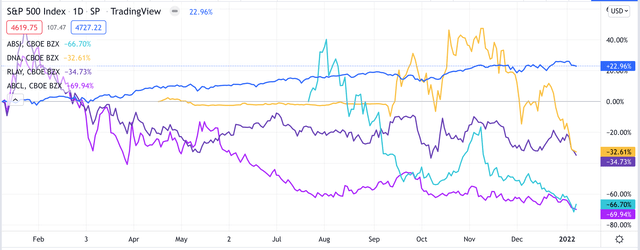

Absci lists its areas of focus as Synthetic Biology, AI Enabled Drug Discovery, and Biologic Drug Discovery, which puts the company in the same sector as companies including Ginkgo Bioworks (DNA), Relay Therapeutics (RLAY), and Abcellera Biologics (ABCL). Unfortunately, these other recently IPOd company’s share prices have also underperformed, as shown below.

Share price performance of ABSI, RLAY, GINK, and ABCL – past 12 months. Source: TradingView.

Share price performance of ABSI, RLAY, GINK, and ABCL – past 12 months. Source: TradingView.

It seems that presently, the market is not buying into AI-driven drug discovery – Relay’s share price is down 35% across the past 12 months, Abcellera’s down 70%, and Ginkgo’s down 33%. But at the same time, the deals keep coming – French Pharma Sanofi recently agreed a collaboration with UK based AI drug discovery firm Exscientia (EXAI), which could be worth up to $5.2bn for the company if all milestones are met.

As of Q321, Ginkgo had earned revenues of $165m, making a loss of $144m, Abcellera had earned $236m of revenue, almost entirely from royalties related to its development of Bamlanivimab – Eli Lilly’s COVID antiviral – earning net income of $123m as a result, Relay – which owns its own drug assets as opposed to discovering / developing assets for partners, as the others do, earned no revenue, and made a loss of $297m, and Absci itself reported revenue of $3.3m, and a net loss of $76m.

Ginkgo earned $1.6bn from its IPO – a record for a biotech, Abcellera $555m, and Relay $400m, which underlines the enormous potential the market believes AI-driven drug discovery has, but Bamlanivimab aside, the commercial output of the field has been negligible to date – firms haven’t yet found the needles amongst the haystacks that AI is expected to find, at a pace and in volumes that humans cannot match.

Companies are creating libraries of data, dedicated to discovering how different druggable proteins might look, and interact with other proteins, in order to uncover new molecules and targets that can be put to work treating diseases. This is important because, as Matthew Weinstock, Absci’s Chief Technology Officer, put it on the company’s Q321 earnings call:

just 10 targets, including the likes of PD-1, CD20, TNF, HER2, VEGF, IL6, EGFR, and CD19 account for roughly half of FDA new drug approvals.

Absci Makes Its First Major Deal With Merck

It’s interesting that Weinstock mentions PD-1 first because after agreeing two apparently minor discovery partnerships – with Xyphos Biosciences – a subsidiary of Astellas Pharma, and EQRx Pharma, Absci landed its first major client win earlier this month, agreeing a partnership with Pharma giant Merck (NYSE:MRK) that could be worth up to $610 million in upfront fees and milestone payments.

Merck is the owner and chief developer of Pembrolizumab – brand name Keytruda – one of the most successful monoclonal antibodies to have ever been produced to treat oncological diseases. The immune checkpoint inhibitor (“ICI”) which targets programmed cell death protein 1, or “PD1,” which is widely expressed on the surfaces of cancer cells and prevents the immune system from attacking the body’s own tissues.

Keytruda is arguably the closest thing that the medical industry has to a cancer wonder drug, indicated for melanoma, lung cancer, head and neck cancer, Hodgkin lymphoma, stomach cancer, cervical cancer, liver and kidney cancers and others besides. In 2020, the drug earned >$11bn in revenues.

The fact that Merck is entrusting drug discovery to Absci, then, is an exciting breakthrough for Absci, serving as an early validation of its technology and science – Absci shares jumped 58% on the news of the deal, to a high of $9.5, after a long bear run triggered by underwhelming Q321 earnings of just $1.54m, well short of analyst estimates.

Merck will be able to select up to three targets to take into a collaborative development process, and Absci will assist with biomanufacturing, as well as drug discovery, leveraging 2 of its 3 biggest strengths.

Merck Is Positioning Itself For Growth With R&D Revamp

Merck itself has had a so-so year, at least from the perspective of its share price, which is currently +0.2% over the past 12 months.

The company looked to have uncovered a multi-billion dollar therapy in Molnupiravir, its COVID antiviral, but after initially showing a 50% reduction in the risk of hospitalization from COVID-19, the pill’s efficacy declined to 30% in later trials, and although it has now been approved in the US and UK, Pfizer’s Paxlovid is widely considered the superior therapy, achieving a 90% risk reduction in its own trials.

Merck took the decision to spin off legacy assets and its biosimilars and Women’s Health businesses into a new company, Organon, at the beginning of the year, leaving the company’s product portfolio a little thin, with only the PARP inhibitor Lynparza – developed alongside AstraZeneca (AZN) and approved for ovarian, prostate and pancreatic cancer – and Lenvima – developed with Japanese Pharma Eisai and approved for endometrial and thyroid cancer – supporting Keytruda sales, with $246m and $188m of sales in Q321.

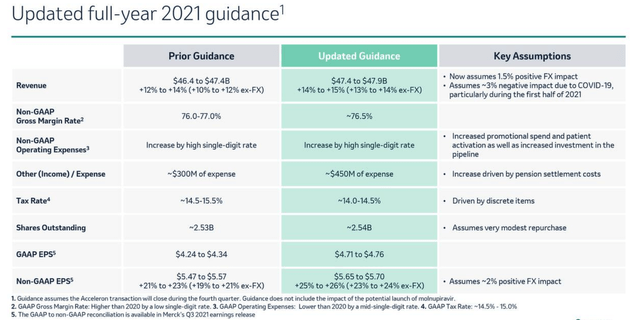

Gardasil – which earned >$2.5bn across the first three quarters of 2020 – leads Merck’s impressively strong vaccine division, while hospital acute care contributed >$1.5bn, immunology ~$850m, and diabetes ~$2.7m. Overall, as we can see below, Merck looks set for a successful and profitable 2021, with revenues likely to increase ~15% year-on-year, and EPS ~25%, whilst a dividend yielding ~3.5% offers an extra fillip for investors.

Merck updated guidance for 2021 revenue and EPS as at Q321. Source: Q321 earnings presentation.

Merck updated guidance for 2021 revenue and EPS as at Q321. Source: Q321 earnings presentation.

Last year, Merck said goodbye to its long-term President of Merck Research Laboratories, Roger Perlmutter, promoting President of Discovery Sciences and Translational Medicine Dr Dean Li to the role.

Could Merck M&A Include A Bid For Absci?

It may be somewhat surprising, given that Absci has positioned itself as a biologics drug development pioneer, that Merck elected to spin out its biologics business into Organon – perhaps Absci will end up working with Organon also, given that biologics is estimated to become a $254bn market in 2020, rising to $418bn in 2026, according to estimates – but Merck itself could certainly do with revamping its early-stage R&D program.

The company has $10bn of cash on its balance sheet, and ~$23bn of long-term debt, and has shown that it is not averse to making acquisitions with its recent deal for cardiovascular disease pioneer Acceleron for $11.5bn.

Could Merck add Absci to its business, also, given the potentially rising importance of AI-drug development, not to mention Absci’s 77,000 square foot campus in Vancouver, Canada.

Personally, I don’t see that deal as especially likely – Absci still has much to prove, and its business model is aimed squarely at working alongside multiple partners, developing different solutions for different companies and earning revenues via participating in future revenues streams once drugs have been commercialized.

Feast Or Famine Business Model

It’s a similar business model to Abcellera, and Ligand Pharmaceuticals – a $2.4bn market cap company that has been around for many years, and whose share price has risen by 35% over the past year, primarily due to its Captisol formulation, which is used with Regeneron’s Remdesivir, boosting revenues generation.

Ligand lacks the cutting-edge AI-driven techniques of Absci, but despite their promise, there are reasons why Absci may find itself subject to the same “feast or famine” revenue growth prospects as its older rival, given it will only succeed financially when its clients’ drug discovery efforts are successful, which can take years. 1 blockbuster drug can make up for literally hundreds of early stage failures.

AI is unquestionably infiltrating all aspects of drug discovery, as discussed above, but equally, AI makes the haystacks where the needles are hidden infinitely larger, creating billions of data points and possibilities for new drug targets – before attempting to evaluate their respective merits.

Would pharmas invest so heavily in AI drug discovery if the low-hanging fruit – the targets mentioned above by Absci’s CTO for example – had not already been claimed, patented, and rolled out to the market? It’s an interesting question, and we may have to wait a decade or more to find out if AI can really uncover new and better drugs using computer models.

What Absci Brings To The Table In 2022

Absci’s rise from a company started in a Vancouver basement by its then 22-year-old founder Sean McClain, to a Nasdaq listed entity with a value (immediately post-IPO) of ~$2bn, makes for an excellent story and PR pitch.

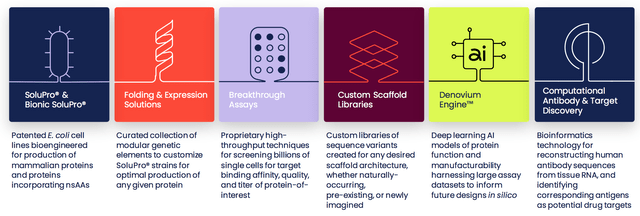

What began as a company developing antibodies from E. coli cells with a handful of employees, has morphed into a major drug development company, with >200 employees and a wide range of tools and techniques, including in silico, manufacturing cell lines, protein scaffolding, and via the acquisition of Totient in June, antibody and target discovery technology, including mRNA sequencing, and the acquisition of Denovium in January, protein behavior.

A recent investor presentation is arguably a little long on theory, and aspirational language more similar to that of a startup tech company than a biotech (e.g. “out-evolving nature”, “what if you could create any drug you can imagine”, while its staff are referred to as “unlimiters”), which may not have too much basis in reality – and a little short on evidence of client commitment and projects in development.

Absci’s facility and expertise is very real, however, and even if the company is taking an “if we build it, they will come” approach, it has had no problem attracting major investment from biotech-focused VCs, including Redmile Group and Casdin Capital, who both have a seat on the Board of Directors.

At the end of Q321, Absci had nine active programs ongoing with seven partners that have downstream economic potential (as per the Q321 earnings call), which fell short of analyst expectations. The company is currently capable of almost any sort of drug discovery, manufacturing, and synthetic biology, but is not yet engaged in very much of either.

It’s difficult for a layperson to fully understand all of the techniques that Absci is engaged in, but equally, they’re not necessarily as different from those used by companies like Abcellera, Relay, Ginkco, and even Ligand, despite Absci’s claims to be differentiated and groundbreaking.

That’s not necessarily a bad thing in my view as these are the techniques that biotechs and pharmas are familiar with, and as well as being a thought leader, Absci needs to find ways to bring clients in the short to medium term, to build its client base and recapture the faith of analysts and the market before getting too far ahead of itself, possibly.

Personally, I think Absci’s approach to biologics drug development looks like one of its most promising fields – even if Merck is not in the biologics space, Organon certainly is, and on a much larger scale, so is Viatris (VTRS) – another spin out – this time of Pfizer’s (PFE) legacy assets, which have been merged with the generic drug development company Mylan to form a potential biologics super power.

Absci’s approach to the biologics drug discovery and development process. Source: company investor presentation.

Absci’s approach to the biologics drug discovery and development process. Source: company investor presentation.

Conclusion – Merck Deal Offers Valuable Validation For Absci – Current Valuation Attractive Based on 5-Year Timeframe

Although I have been critical of Absci’s post-IPO valuation of >$2bn, lack of revenue generating clients and partners to date, and slightly over the top rhetoric in this post, the Merck deal is an important milestone for the company, and Absci’s declining share price has reached a point where shares are beginning to look like relatively decent value, in my view.

Absci may not be as cash rich as some of its rivals i.e. Ginkgo or Abcellera, but with ~$280m in cash, and with a cash burn of $50m to Q321 in 2021, it has few financial concerns, and can afford to invest heavily in both R&D – fleshing out its various areas of business – and marketing – attracting new clients and partnerships.

The “if our clients win, we win” approach to revenue generation that most drug-discovery firms employ is definitely a “feast or famine” model, as it relies upon drugs successfully making it through the discovery, development, clinical trial and approval process, then making multi-billion dollar sales in tough commercial markets – although clinical development milestones make the operating environment less harsh.

With Abcellera also being based in Canada, I see Absci’s fortunes irretrievably tied up with Abcellera’s, as the city of Vancouver positions itself to be the future home of drug discovery.

It’s a bet that many VCs and investors appear to have made in the private market, that so far has not translated well in the public markets, with both companies’ share prices crashing heavily in 2021.

2022 may be too early for either stock price to make a full recovery, but personally I prefer Absci’s ~$650m valuation to Abcellera’s $3.3bn one, which has been swollen by its Bamlanivimab success.

As such I would consider making a speculative investment into Absci, although it would be with a five-year horizon in mind, as this young company has some tricky hurdles to overcome over the next two to three years, in my view.

As for Merck, I doubt that we will see the benefits of its investment into Absci make any material difference to the company’s valuation in the short term, but the company that developed one of the most important monoclonal antibodies ever to have been brought to market can make a real difference to Absci over the longer term.

Merck shares will perform satisfactorily in 2022 I believe, despite the Molnupiravir disappointment, as Keytruda continue to grow sales (some analysts believe peak sales could >$20bn), and in three to five years’ time shareholders could begin to see the benefit of the Organon spin-out and R&D revamp.

AI-driven drug discovery is still the future of drug-discovery, rather than the present, in my opinion – a deal such as Pfizer’s with Codex DNA – which I recently covered for Seeking Alpha – is one to watch in the near term – but Merck’s collaboration with Absci is exciting in a different way, and ought to pay off for both companies in the long run.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.