Summary:

- Merck is set to announce its Q1 2024 earnings next week, with analysts predicting earnings per share of $1.99 on a normalized basis.

- Some companies within the big pharma sector have underperformed due to government pressure on drug pricing and patent expirations.

- Merck’s future looks promising, however, despite its looming Keytruda patent expiry, with a strong pipeline of drugs and potential for extended patent protection for its top-selling drug.

- There ought to plenty of positives around next weeks earnings – the company’s M&A and R&D spending has brought several new drugs to the brink of approval.

- The dividend yields ~2.5% at a time of writing. And after earnings dropped substantially in 2023, a return to strong profitability – unless further M&A activity happens – will keep the share price buoyant.

avid_creative

Investment Overview

Merck & Co., Inc. (NYSE:MRK) will announce its Q1 2024 earnings next Thursday, April 25. Analysts’ consensus opinion is that earnings per share will be in the region of $1.99 on a normalized basis, or $1.87 on a GAAP basis, on revenues of ~$15.2bn.

Big pharma is generally regarded as a strong sector for investment, with most companies driving wide profit margins – my calculated average net profit margin of the world’s 15 biggest pharma companies is 19% – paying handsome dividends – my calculated average dividend yield is ~3.1% – and delivering solid, S&P-beating share price returns.

Leaving aside Novo Nordisk A/S (NVO) and Eli Lilly and Company (LLY), whose diabetes/weight loss drugs Ozempic/Wegovy and Mounjaro/Zepbound have blown Wall Street analysts away, with peak revenue expectations of >$50bn each, leading to share price gains of >400% and >535%, respectively, on a five-year basis, the big pharma sector, facing government pressure on drug pricing, expiration of key drug patents, and post-pandemic economic headwinds, has, in fact, somewhat underperformed.

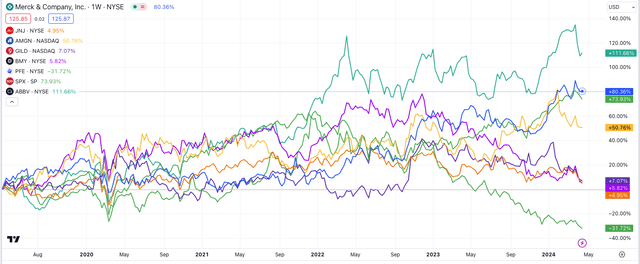

Big Pharma share prices compared (TradingView)

As we can see above, except Lilly, only two of what I generally refer to as the “Big Eight” US pharmas – Lilly plus Johnson & Johnson (JNJ), Merck & Co., Inc. (MRK), AbbVie Inc. (ABBV), Pfizer Inc. (PFE) Bristol Myers Squibb Company (BMY), Amgen Inc. (AMGN) and Gilead Sciences, Inc. (GILD) – have share prices that have outperformed the S&P 500 on a five-year basis: AbbVie, up 112%, and Merck, up 80%, compared to the 74% gain of the S&P (SPX).

We also could include Regeneron Pharmaceuticals, Inc. (REGN), whose share price is +178% on a five-year basis, and Vertex Pharmaceuticals Incorporated (VRTX), whose share price is +138%, in a list of the US’ biggest pharmas, given both have higher market caps than BMY or GILD. However, neither is a dividend payer, and neither has as diverse a pipeline as BMY or GILD or the remainder of the “Big Eight.”

My point is that at least half of the US’ biggest pharmas have struggled for valuation growth in recent years. While drug development remains a lucrative business, investors should not assume that they will realize a substantial gain investing in this sector without performing extensive due diligence beforehand.

Guess correctly, and you can still win big with pharma stocks – e.g., Eli Lilly, but guess wrong, e.g., Pfizer, and you could lose >30% of your investment in just a few years. With that in mind, in this post, I will attempt to provide some color around what to expect from Merck’s Q1 2024 earnings, what factors are most impacting its valuation and share price, and whether now is a good time to be buying, selling, or holding Merck stock.

Let’s begin by reviewing Merck’s full year 2023 earnings.

R&D and M&A Spending Accelerates To Guard Against Keytruda Patent Expiry

In 2023 Merck drove $60.1bn of revenues. Globally, only Johnson & Johnson (JNJ) and Roche Holding AG (OTCQX:RHHBY) drove a higher figure. It was a 1% improvement on Merck’s revenue figure in 2022 – $59.33bn. However, ex-Lagevrio – Merck’s COVID-19 antiviral which earned $5.7bn of revenue in 2022, but only $1.43bn in 2023 – revenues climbed 9% year-on-year, and 12% if we exclude lagevrio and exchange rate fluctuations.

Merck’s GAAP earnings per share in 2023 fell substantially, to $0.14, from $5.71 in 2022, with operating expenses rising to $41bn – up 73%. The main reason for this was a substantial rise in research and development (“R&D”), discussed as follows in Merck’s 2023 annual report:

The increase was primarily due to higher charges for business development activity in 2023, including charges of $10.2 billion for the acquisition of Prometheus, $5.5 billion related to the formation of a collaboration with Daiichi Sankyo and $1.2 billion for the acquisition of Imago, compared with charges of $690 million in aggregate recorded in 2022 related to collaboration and licensing agreements with Moderna, Orna Therapeutics and Orion. The increase in R&D expenses was also attributable to higher development spending, including for recently acquired programs, and higher compensation and benefit costs (reflecting in part increased headcount). The increase in R&D expenses was partially offset by lower intangible asset impairment charges in 2023.

Merck is best known for marketing and selling the cancer drug Keytruda, which earned $25bn of revenues in 2023 – up 19% year-on-year – and accounting for 42% of the company’s revenues.

The PD-1 blocking immune checkpoint inhibitor (“ICI”) is approved for a host of solid tumor cancer indications and is the world’s best-selling drug. However, it’s set to lose patent exclusivity after 2028, at which point generic versions of the drug will be permitted to be launched.

Analysts have speculated that the drug’s revenues could fall to ~$15bn by 2030, although the pharma is working on developing a subcutaneous version of the drug which will help it compete against generics and possibly extend its patent protections well into the next decade.

Nevertheless, Merck is actively trying to develop a wider portfolio of drugs by making strategic acquisitions, such as its $10.8bn buyout of Prometheus Biosciences and its autoimmune drug PRA-023, now known as MK-7240, a humanized monoclonal antibody (mAb) directed to tumor necrosis factor (TNF)-like ligand 1A (TL1A), and its $5.5bn deal with Daiichi Sankyo to develop antibody-drug conjugates, which could rise to >$20bn depending on the success of these highly rated new, dual-acting, cancer drugs.

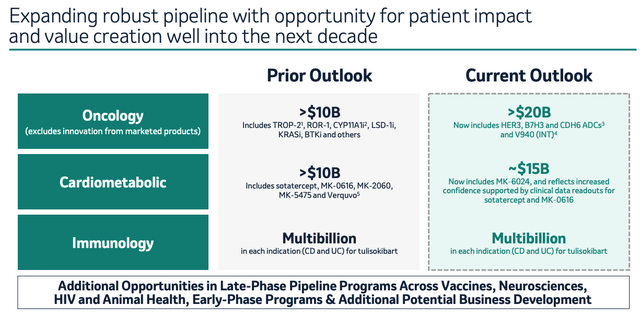

Merck pipeline expectations (earnings presentation)

As we can see above, Merck upgraded expectations around the revenue contributions expected from its existing and pipeline products when presenting its Q4 and full-year 2023 earnings – the company now expects to drive >$20bn in new revenues within its oncology division, ~$15bn from its cardiometabolic pipeline, and multi-billions within immunology.

The company has multiple late-stage assets in development – most notably in oncology, where I count at least 10 therapies (not including any ADCs) in Phase 3 studies or pending FDA review for approval, many of which are used in combination with Keytruda. MK-3475 is the subcutaneous Keytruda being trialed in multiple solid tumor cancers, bomedemstat in myeloproliferative disorders, MK-2870 in endometrial / NSCLC, V940, a cancer messengerRNA “vaccine” chasing approval in melanoma, and possibly NSCLC, MK-1022 in NSCLC, MK5684 in prostate cancer, Vibostolimab in melanoma / NSCLC / SCLC, Favezelimab in colorectal cancer/heme cancers, Quavonlimab in renal cell carcinoma, and Nemtabrutinib in heme malignancies.

Today, Merck only markets and sells Keytruda and co-markets and sells lynparza in ovarian cancer – label expansions into NSCLC / SCLC are pending – lenvima, approved for thyroid cancer, chasing expansions into esophageal and gastric cancers, and Rblozyl, in myelodysplastic syndromes.

In short, Merck appears to be doing everything in its power to ensure that it’s not blindsided by a potential Keytruda patent expiry in 2028, with a flood of potential approvals planned, to offset any losses from generic competition around its key asset.

Outside of oncology, in 2024 to date, Merck already has secured approval for its pulmonary arterial hypertension therapy sotatercept, an activin receptor type IIA-Fc (ActRIIA-Fc) fusion protein that addresses the underlying cause of the disease, and, it is speculated, that could drive peak revenues in the $3 – $5bn range, similar to forecasts for PRA023, if approved.

Last December, the company experienced a setback when its P2X3 receptor antagonist chronic cough therapy gefapixant was rejected for approval by the FDA for the second time, casting doubt over whether it will ever make it to market. An FDA advisory committee voted 12-1 against approving the therapy.

Within its vaccines division, where two vaccines – Gardasil, for HPV infection, and ProQuad, for measles/mumps/rubella generated, respectively, $8.9bn, and $2.4bn of revenues in 2023, Merck hopes to win approvals for a pneumococcal conjugate vaccine and Respiratory Syncytial Virus vaccine, both of which are likely to command “blockbuster” revenues.

Within immunology, besides PRA203, MK-0616 is in the running for approval in hypercholesterolemia, and MK-6194 for ulcerative colitis – multi-billion dollar markets.

In short, Merck may have delivered an underwhelming EPS number in 2023, but there’s plenty of evidence that the investments in M&A and R&D can pay off long-term, and that Keytruda’s patent expiry – if it does indeed lose patent protection after 2028 – need not derail the company’s share price and valuation, even if total revenues does suffer a dip later this decade / early next decade.

Merck’s Forward Guidance – What To Look Out For In Q1 Earnings

Merck has provided 2024 guidance that suggests shareholders need not fear that the dip in earnings in 2023 will be sustained.

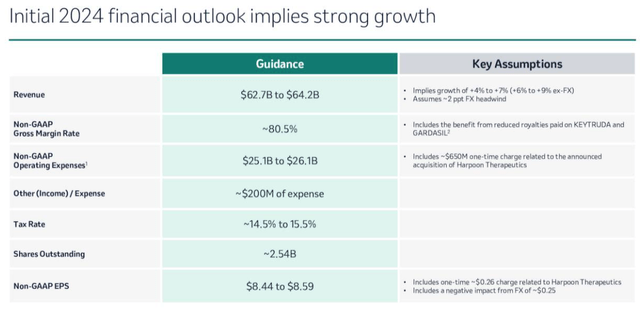

Merck guidance for 2024 (Earnings presentation)

Management expects non-GAAP EPS – which was $1.51 in 2023 – to jump to $8.44 – $8.59 per share in 2024, with a hit of $0.26 as a result of Merck’s acquisition of Harpoon Therapeutics and its armory of t-cell engager drug candidates directed against cancer for ~$680m in January.

Revenues are forecast to grow to $62.7bn – $64.2bn, while operating expenses will return to normal levels – unless, of course, Merck opts to make further acquisitions – something that management says it’s prepared to do, targeting a spend of $1bn – $15bn per company.

There’s arguably some pressure on Merck’s balance sheet, with the company reporting total current assets of $32bn at the end of 2023, vs. current liabilities of $25.7bn, while long-term debt sits at $33.7bn, and total liabilities $69bn – against reported total assets of $107bn, but management’s commitment to business development is clear. On the Q4 2023 earnings call Chief Financial Officer Caroline Litchfield told analysts:

We remain committed to our dividend and plan to increase it over time. Business development remains a high priority. We maintain ample capacity given our strong investment-grade credit rating and cash flow to pursue additional science-driven, value-enhancing transactions going forward. We will continue to execute a modest level of share repurchases.

The great advantage Merck has, until 2028 at least, is that revenues from Keytruda have kept increasing – from $11bn in 2019, to $25bn last year and that they will likely continue to do so for the next 2-3 years, and especially in early stage. During a fireside chat at the Barclays Annual Healthcare Conference in March, Jannie Oosthuizen, Merck’s President of Human Health U.S., told the audience:

If you go back, I think we talked about 25% of Keytruda sales will come from an early stage by 2025. In fact, in 2024, about 27%, 28% of Keytruda sales will be related to or driven by the early-stage indications. And over the past few years, we’ve launched early-stage melanoma, early-stage renal cell carcinoma, and early-stage triple-negative breast, and these have been strong growth drivers.

And in early 2023, we launched our first early-stage lung indication with KEYNOTE-091, which is a Keytruda adjuvant setting. Towards the end of last year, we launched KEYNOTE-671, which is the perioperative, pre-surgery followed by surgery and Keytruda in the adjuvant phase with 671. And it’s really going really well. The early stage is driving close to 60% of our oncology growth right now, yes.

It was also interesting to hear that Merck expects subcutaneous Keytruda could be “more or less 50% of the KEYTRUDA volume by 2027-2028.” With so many new approvals, and so many more in the pipeline, in combo with new pipeline drugs, I would expect Keytruda numbers to impress analysts in Q1 2024, and I would expect that Wall Street will have plenty questions around upcoming subcutaneous data which was promised “over the next 12 months” in October last year.

With a subcutaneous Keytruda potentially able to extend patent protection into 2039, this is likely to be the most discussed element of Merck’s business on the Q1 2024 earnings call, but there are other key updates to look out.

Early sales data from sotatercept – which will be marketed and sold as Winrevair – ought to be revealing, while the FDA is expected to rule on whether to approve Merck / Daiichi’s antibody-drug conjugate directed against HER2 for later-stage metastatic, EGFR-mutated non-small cell lung cancer.

There will likely be updates on the future of gefapixant, whether Merck will attempt to secure a ” third-time lucky” approval, and news about the pneumococcal vaccine V116, which also has its “PDUFA” date – when the FDA announces whether the drug is approved or rejected for commercial use – this June. Revenue figures for the newly launched kidney cancer drug Welireg, yet another potential blockbuster, will be intriguing, as will any update on the Moderna partnership on V940, in melanoma. Progress here should be carefully monitored with a follow-on approval in NSCLC if possible, should this drug make the grade in melanoma. Study results have been impressive to date.

Vaccine revenues: Merck’s vaccine division accounts for 22% of all revenues, second only to oncology, with hospital acute care and animal health accounting for the next level, 6% and 9% respectively. Last year, Gardasil and ProQuad revenues increased by 29% and 6% year-on-year, respectively. Can this momentum be maintained?

Merck’s dividend will likely remain at $0.77 per quarter as the company raised it in December, as it has done in most years going back to before 2010. But shareholders may wait for an update on share buyback programs – and may be disappointed, given Merck’s commitment to M&A and R&D spending.

Concluding Thoughts – No Reason To Fear Upcoming Earnings – Merck’s Future Seemingly Teems With Potential

As mentioned in my intro, while some pharma companies have been floundering in recent years, and struggling for growth, especially when it comes to valuation and share price, Merck has largely resisted this trend and continued to reward shareholders – the stock price is 15%-plus year-to-date.

I don’t see this positive being checked when earnings arrive next week – in fact, I’d expect good news and better news. Merck’s revenues, dominated by a drug that continues to find new markets to grow into, while continuing to dominate in the most lucrative markets such as NSCLC, makes an earnings miss unlikely, in my view.

Meanwhile, Merck’s near-term pipeline teems with life, and having absorbed a hit with gepafixant, I expect that the upcoming PDUFA dates will bring more positive news, and Q1 earnings potentially some positive updates.

The only area in which I see Merck potentially disappointing Wall Street in the near-to-medium term is in the field of M&A. If Merck does decide to make further investments, its view of what constitutes a good deal may differ from the market’s, and give Wall Street the jitters. I would not necessarily rule out Merck dropping a big announcement on the eve of its earnings data next Thursday – but any share price negativity will likely be shaken off longer term.

Ultimately, the company is planning for life post-Keytruda patent expiry with substantial investment in its pipeline and some inorganic M&A, and I believe these projects and any doubts around their viability are baked into Merck’s share price. But bear in mind, the formulation of the drug could extend patents to 2039, and that upside has not necessarily been baked in.

As such, Merck shareholders can look forward to next week’s earnings with confidence, and if you’re considering investing into the big pharma sector, Merck continues to represent a very solid pick, in my view.

Merck may not have a GLP-1 agonist with miraculous weight loss qualities like Lilly and Novo, whose valuations have risen so high it would take a brave analyst to expect any further upside (although I could count myself as one of those brave analysts!), but it does have the world’s best-selling drug, and a seemingly watertight plan in place to make sure it’s not blindsided by a looming patent expiry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.