Vale: How The Company Fits Into China’s New Economy

Summary:

- The company has strong competitive advantages with high-quality iron ore amid China’s need to decarbonize.

- Additionally, the company has the best margins and the best return on equity compared to its competitors.

- Despite this, it is traded at an attractive valuation based on the EV/EBITDA multiple compared to its competitors.

temizyurek

Investment Thesis

I recommend buying Vale (NYSE:VALE) shares. The real estate sector contributes around 20% of Chinese GDP, and it is nothing new that the sector is going through a crisis. However, China seeks to change its economic matrix, with incentives for the production of electric vehicles and a goal of peaking carbon dioxide emissions before 2030, reaching carbon neutrality before 2060.

From this perspective, Vale has the highest quality iron ore, which is important for initiatives to reduce pollutant emissions. Additionally, despite having the best operating margins among its competitors, the company’s shares have the worst performance in the sector over the last few years.

Introduction

Vale is one of the largest mining and metals companies in the world, being one of the leaders in the production of iron ore, iron ore pellets and nickel. In terms of market value, the company is the 7th largest in the world. The company has 66,807 employees, and also produces iron ore pellets, platinum, gold, silver and cobalt.

Vale is the largest mining company in Brazil, the company was responsible for producing 321Mt of iron ore, while Brazil produced 410 Mt in 2023, this means that the company has almost 80% of Brazilian iron ore production.

Furthermore, the company has had a major commercial partner for over 50 years, China. Since the opening of its economy in 1979, China has demanded a lot of iron ore for infrastructure, construction, and several other sectors of its economy. Next, we will delve deeper into Vale’s history, and how it complements China’s growth story.

History And Business Model

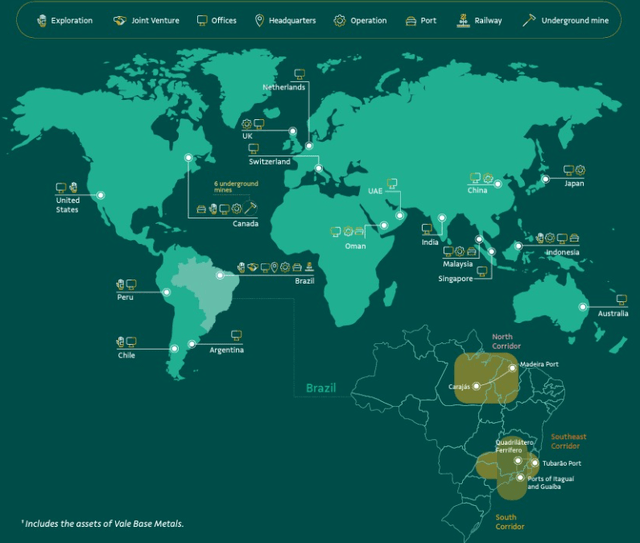

Founded in 1942 as a state-owned company, Vale became a private company in 1997. Present in 30 countries, it is among the largest global mining companies and has an extensive supply chain: 4 integrated production systems in Brazil, 22 mines, 13 pellet plants, 4 railways, 1 waterway, and 4 ports in Brazil. It operates with 350 ships, 1 distribution center in Malaysia and 16 partnerships in ports in China.

Vale In The World (IR Company)

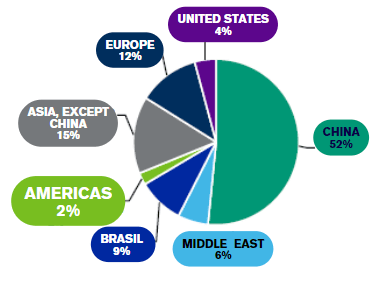

Vale operates in two areas: 1) the main one is iron ore, with a capacity of 400 million tons a year (ore and pellets, 240 million high quality); 2) the other is basic metals: Nickel (largest producer in the world), Copper, Cobalt and Manganese. Around half of revenues come from exports to China:

Revenue Breakdown By Country (The Author)

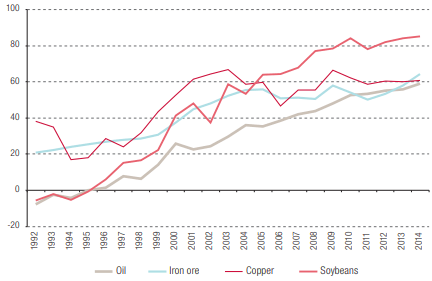

Vale has competition from companies such as BHP, Rio Tinto and Anglo-American. These companies, along with several other companies, sold many commodities to China, a country that had one of the greatest growth stories of the century:

China: reliance on imports of selected raw materials, 1992–2014 ( Federal University of Rio de Janeiro)

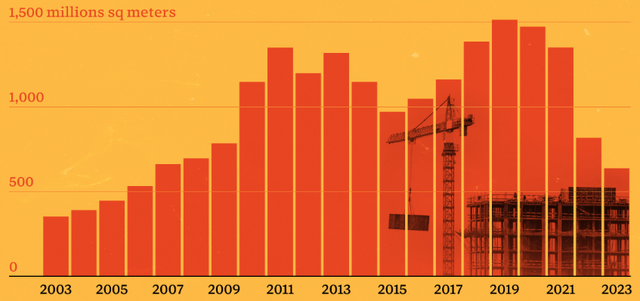

The real estate sector was one of the main drivers of Chinese growth in recent years. As a reference, the sector corresponds to more than 20% of China’s GDP, and it is not news that there is a major crisis in this sector, with experts even questioning whether the Chinese growth model has exhausted itself. We can see this clearly in the decline in new homes in China:

Newly Started Residential Buildings (The Bureau of Statistics)

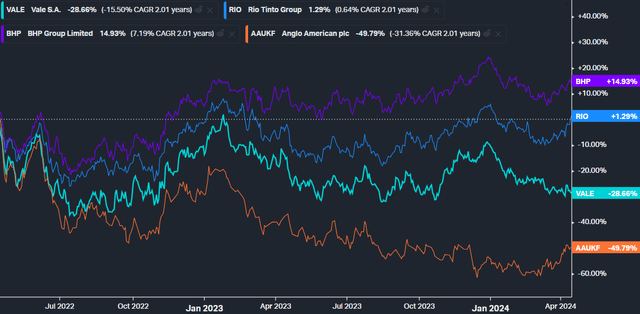

This drastic reduction in sales in the real estate sector brings less demand for the companies’ iron ore sales, which means that these companies have performed poorly in the last two years:

Performance Of Mining Companies (Koyfin)

However, behind every crisis there is an opportunity, and China is looking for a new growth model. Now, let’s talk about the opportunity for Vale (and a pillar of my investment thesis). Furthermore, I want to show how a company’s great competitive advantage can make it stand out compared to its competitors.

China’s Industrial Decarbonization

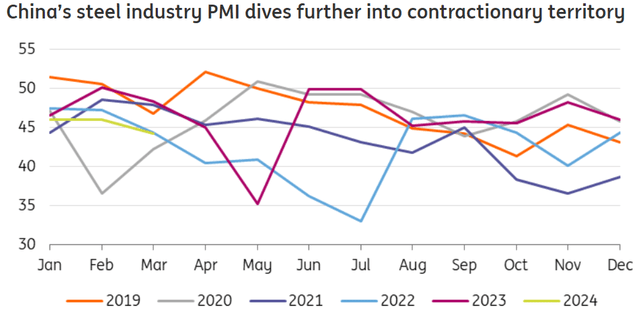

In September 2020, China announced its decarbonization plan. The country must reach peak CO² emissions by 2030 and reach neutrality by 2060. However, according to a study by the Institute for Energy Economics and Financial Analysis, decarbonizing the steel industry will require an increase in the production of high-grade iron ore.

To achieve neutrality, steelmakers must change production methods from coal-consuming blast furnaces to processes such as direct iron reduction (‘DRI’). However, this technology requires a higher iron ore content, greater than 67%.

But how does Vale benefit from this? Vale has the purest iron ore among its competitors. According to the company, the Carajás Mine (one of its main assets) has 67% of iron content. In my opinion, this is a great competitive advantage, and corroborates my bullish thesis for the shares.

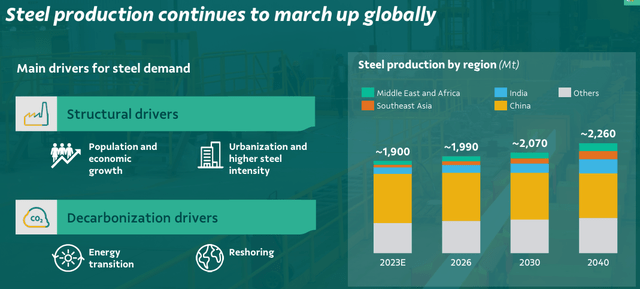

Additionally, Vale has excellent growth projections for the steel sector, and consequently for the demand for iron ore:

Steel Production Forecast (IR Company)

But if the real estate sector is in crisis, where will the demand come from? Well, the energy transition brings options such as solar panels and wind turbines, but I want to highlight the ability that the Chinese have in making electric vehicles.

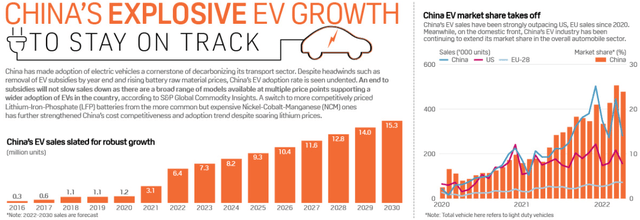

China and Electric Vehicles

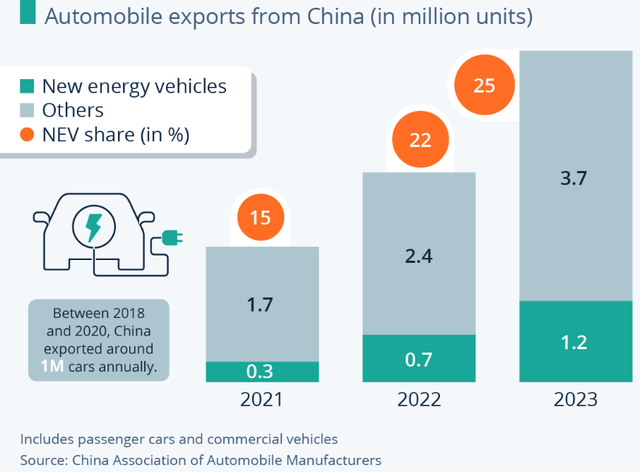

Several sectors are candidates to lead the growth of the “New China”, and take the place of the real estate sector in the medium term. As an example, in 2023 Chinese electric vehicle exports increased 70%, being valued at more than US$34 billion.

Chinese Car Exports (Statista)

S&P has projections of strong growth, with sales exceeding 15 million units in 2030:

This is an example of how there are new avenues of growth for the company’s high-quality iron ore, and how this competitive advantage supports my bullish thesis for the stock.

After learning about the company’s great opportunities, which can help it overcome the real estate crisis, we will understand the company’s finances in more depth and compare it with its competitors.

Vale Fundamentals

In the following, I will use Seeking Alpha and Koyfin to compare Vale with its global peers, like BHP (BHP), Rio Tinto Group (RIO) and Anglo American (OTCQX:AAUKF):

| Ticker | VALE | BHP | RIO | AAUKF |

| Market Cap | $51B | $150B | $115B | $33B |

| Revenue | $43B | $55B | $54B | $30B |

| Revenue Growth 3 Year [CAGR] | 0.3% | 11% | 6.6% | 6.4% |

| EBITDA | $18B | $27B | $19B | $9B |

| EBITDA Margin | 42% | 48% | 36% | 30% |

| Net Income | $8B | $7B | $10B | $0.3B |

| Net Income Margin | 19% | 13% | 18.6% | 0.9% |

| ROE | 20.6% | 19.3% | 18% | 4% |

| Dividend Yield | 11% | 5.7% | 5.6% | 4.7% |

| Net Debt / EBITDA | 0.7x | 0.5x | 0.2x | 1.2x |

When we analyze the numbers of Vale and its competitors, we see how strong the company’s results are. Despite being geographically further away from China compared to its Australian competitors, the company has the highest net margin and the highest ROE.

This strength corroborates my bullish thesis for Vale’s shares, in addition, the company is a great dividend payer, and has healthy leverage. But the big question is: Given this financial strength, does the company trade at a premium to its competitors?

Valuation is Cheaper Than Competitors

When we analyze the commodities sector, it is difficult to obtain relevant information based on the P/E multiple because companies’ profits are affected by hedging operations that exporting companies tend to carry out to protect themselves from changes in the dollar.

Therefore, I will use the EV/EBITDA multiple. Now let’s see how the market prices Vale in these multiples using Koyfin:

EV/EBITDA (Koyfin)

When carrying out the analysis, we found that although the company has the highest margins and the best return on equity, it is traded at the lowest EV/EBITDA multiple. If we calculate an average EV/EBITDA for the sector, we arrive at a multiple of 4.7x, and this implies an upside of 30% in the company’s shares.

The risk-return ratio seems very attractive in this case, which is why I recommend buying Vale shares. Now let’s check the results obtained by the Seeking Alpha tools.

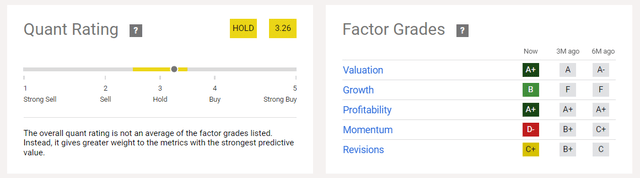

Vale – Seeking Alpha Quant & Factor Grades

According to Seeking Alpha Quant, Vale has excellent valuation, growth and profitability:

Quant Rating & Factor Grades (Seeking Alpha)

However, Seeking Alpha’s Quant Tool recommends holding shares, mainly due to the Momentum score. However, in my opinion this is an opportunity, given the company’s prospects and its attractive valuation.

Latest Earnings Results

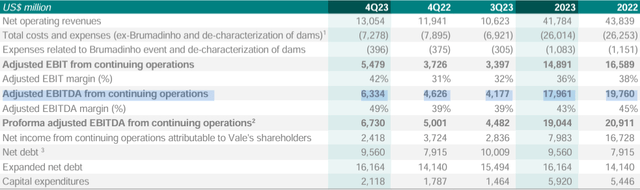

Vale presented good numbers in 4Q23, driven by strong operational progress, as there was a recovery in volumes in ferrous minerals, copper, and by the higher average prices realized for iron ore in the period, which resulted in an increase of 36% y/y in adjusted EBITDA, which reached $6.3 billion. Along with the release of the results, Vale announced the approval of the distribution of $2.4 billion in dividends.

Financial Reports (IR Company)

However, the recognition of an additional $1.2 billion in the provision related to the collapse of the Samarco dam had a negative impact on net profit, which was $2.4 billion. According to the company, the incremental value of the provision is based on the company’s best estimates, considers all available information about a potential agreement and amounts to $4.2 billion in the 4Q23 balance sheet.

Potential Threats To The Thesis

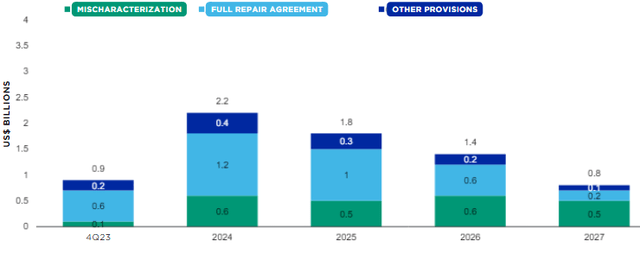

As occurred in the last earnings release, one of the major risks to the thesis are new dam failure events, new liabilities related to Brumadinho and Samarco, or loss of licenses that impact operations. Below is the accident disbursement schedule:

Amortization Schedule (The Author, IR Company & Moodys)

Another relevant risk is global industrial activity at a slower pace than expected and expectations of a strong recovery in China not materializing, affecting demand for iron ore:

Finally, the increase in the supply of ore by the world’s main producers, unbalancing the supply and demand relationship. Vale is an example, the company’s iron ore production was 66.8 million tons in 1Q23, 78 million tons in 2Q23, 86 million tons in 3Q23, and 89 million tons in 4Q23. Investors must be aware, as in addition to conventional risks, the company has businesses that have major environmental risks.

The Bottom Line

The valuation shows that Vale is trading at a significant discount compared to its peers. The company is one of the cheapest among its peers in EV/EBITDA. Additionally, the company has higher margins and the best return on equity compared to its international peers, which are also large companies.

Furthermore, the company has short, medium and long-term catalysts for its results. I believe that its sales will increase further in the future, due to its high quality iron ore, which is in line with the decarbonization thesis in China and the world.

Based on these analyses, the recommendation is to buy Vale shares. Investors should pay attention to the healthy balance sheet, discounted price compared to peers, and a product well positioned to capture decarbonization in the near future. In my opinion, the risk-return ratio is very attractive in this case.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.