Summary:

- PayPal’s Q1 earnings showed improvements in the transaction business and a beat-and-raise in EPS guidance.

- The company is focused on stabilizing its platform dynamics and driving growth in transaction processing volume.

- PayPal’s focus on profitability remains steady, with growth in operating income and adjusted EPS.

- The quarter’s positive earnings developments, along with elevated investor pessimism, is compressing PayPal’s valuation multiples, making the stock attractive.

Ridofranz

Investment Thesis

PayPal (NASDAQ:PYPL) recently reported earnings for the first quarter of 2024, which was, in my opinion, a strong result for the San Jose-headquartered fintech company. Some of the most notable takeaways from PayPal’s Q1 results were the improvements that I continue to see in their underlying transaction business, as well as the beat-and-raise in its EPS guidance.

PayPal had announced changes to its earnings reporting methods that will now include stock-based compensation and other payroll items in adjusted earnings figures. Per my analysis below, this does not appear to be materially impacting my outlook for PayPal.

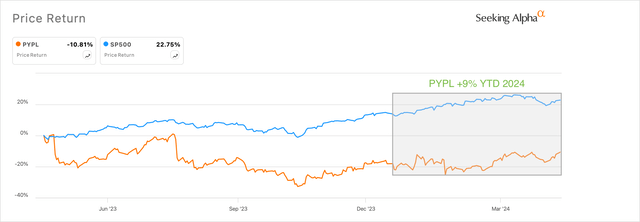

On a trailing twelve-month basis, PayPal lags the S&P 500, as can be seen below. However, with its Q1 results, PayPal now outperforms markets, up 9% year-to-date vs. the S&P 500, which is up ~7% at the time of writing.

PayPal lags the market on a trailing 12 month basis (sa)

I do see upside on PayPal despite my conservative outlook and the few key risks that I have outlined below. Based on my analysis, PayPal still remains a Buy, in my opinion.

PayPal’s Q1 FY24 Earnings Review: Rebuilding its platform dynamics

On the call to discuss PayPal’s earnings, management mentioned that PayPal’s Q1 “results are stronger than we expected earlier in the year.” PayPal’s management highlighted a few key areas that they were making progress in, notably in areas such as innovation and adoption. After listening in on the call, I believe management is demonstrating their efforts in stabilizing its platform dynamics, which were showing stagnation for a long time.

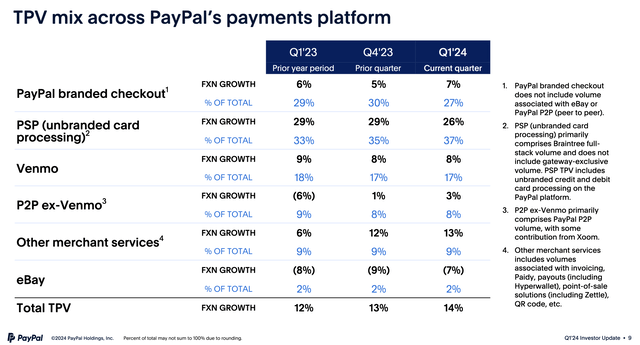

PayPal’s Q1 earnings report showed some hints of growth returning to the platform in terms of transaction processing volume (TPV) and user accounts.

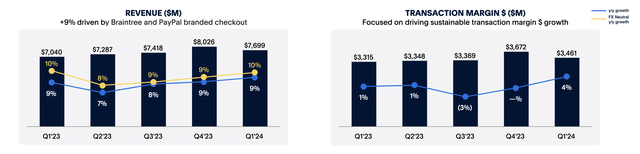

TPV on PayPal’s platform grew 14% y/y to $403.8 billion, reflecting slightly higher growth over the 13% y/y growth the company saw in the same quarter last year. As seen in the chart below, PayPal’s Q1 FY24 saw one of the strongest y/y growth in its transaction margins in the past year, while growth was also seen in revenues, apart from TPVs.

PayPal’s revenue and transaction processing volumes trend (Q1 FY24 Investor Presentation, Paypal)

Per my observation, the main growth drivers continue to be PayPal’s unbranded payment processor solution, Braintree, as well as PayPal’s branded checkout solutions, which now account for 64% of PayPal’s TPV in Q1 FY24. I was pleased to see growth in PayPal’s branded checkout volume, which I think is accretive for PayPal’s margins long term, since branded checkout allows PayPal to maintain higher take rates vs. its unbranded checkout.

PayPal’s Transaction Processing Volume in Q1 FY24 versus previous quarter (Q1 FY24 Investor Presentation, PayPal)

On the call, management mentioned that, in addition to their focus on unbranded checkout, which was a key area of focus under previous management, they’re also focused on driving branded checkout volume. Innovation and adoption were key strategies that were the primary focus, which I believe will help in rebuilding fundamentally strong platform dynamics that had seen erosion over the last many quarters.

Management revealed that on the innovation front, they’re working closely with enterprises and small and medium-sized businesses (SMBs). On the call, management revealed they’re currently engaged with several merchants of all sizes at the annual Commerce360 event in LA to test and work on new innovation. PayPal’s Fastlane is one of those features that helps with faster checkout and is being offered as part of PayPal’s branded checkout solution. Some of the features in Fastlane include robust, security-focused passwordless experiences, which make it easier for the consumer to check out their e-commerce basket while shipping online.

For SMBs, PayPal accelerated the rollout of its PayPal Complete Payments (PPCP) platform in Q1. Complete Payments was launched in April last year, allowing merchants to customize their payment solutions based on their custom needs. The ability for merchants to use the “low and no-code tools” part of the PPCP platform was driving higher adoption. Per management, PPCP is now being rolled out in 34 countries.

Per my observation, a large part of the innovation that PayPal talked about even as part of their First Look presentation earlier this year has so far already been seen in merchant and enterprise solutions. I expect more features to be rolled out on the consumer front as the year progresses.

So far, PayPal has redesigned their app and launched customer rewards programs as well as debit cards, but the much-hyped CashPass that was part of the First Look presentation is still to be seen. I suspect management may have internally changed their timelines to align them closer to the summer when retail spending usually picks up.

I was pleased to see a marginal uptick in their monthly active accounts. Active accounts grew 1% in Q1, much better than the low single-digit declines seen in the past four quarters. But in Q1, I also noticed monthly active accounts—user accounts that have completed a transaction at least once in the past month on PayPal’s platform — grew by 2%. This was the first uptick in growth rate in six quarters, per my observations, which show users coming back to the platform.

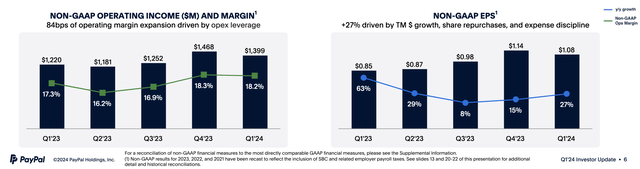

PayPal’s focus on profitability remains steady

In Q1, PayPal grew its operating income by 14.7% to $1.4 billion, on an adjusted basis. Adjusted operating margins expanded to 18.2%, up from 17.3% seen a year earlier, as seen below.

PayPal’s margins and EPS trends (Q1 FY24 Investor Presentation, Paypal)

In terms of adjusted earnings, PayPal reported an EPS of $1.08, up 27% y/y. Without the adjustments made for SBC expenses, adjusted EPS for PayPal would have been $1.4, which would have beaten market expectations of $1.22 earnings per share for PayPal. Therefore, I believe PayPal demonstrated an earnings beat in Q1. With their new guidance that was published, PayPal now sees mid- to high single-digit growth in earnings per share, higher than the flat y/y EPS they were projecting a quarter earlier.

While doing a quick check on their balance sheets, I noticed cash and cash equivalents grew 35.5% to $9.69 billion, while long-term debt declined 7.6% to $9.68 billion. Although I will wait for the 10-Q filing, the company’s balance still looks robust. On the call, management mentioned that they “continue to expect free cash flow for 2024 to be approximately $5 billion and for at least $5 billion in share buybacks.”

PayPal’s stock shows upside

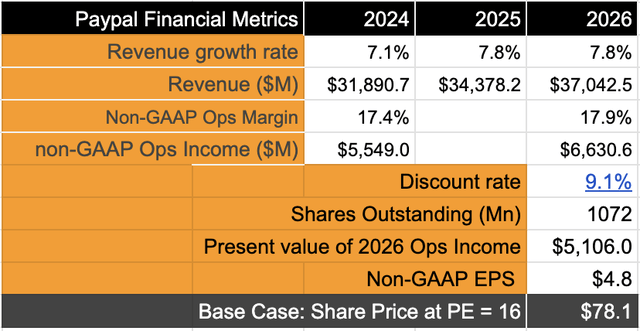

To assess my target for PayPal, here are my assumptions:

- Over the next three years, I expect PayPal’s revenue to grow at a compounded growth rate of ~7.5%. I expect growth to be slightly lower this year as the transformation continues. But as more innovation-focused and adoption-driving products and features are launched this year, I expect the innovation roadmap to set up PayPal nicely for future growth. I have taken the midpoint of their previous long-term low-to-high single-digit growth model.

- Over the same investment horizon, I expect adjusted operating income to grow at a CAGR of 9%, driven by the improved operational efficiencies that it has already demonstrated over the past few quarters. My assumptions here now also include the reporting changes that were mentioned at the start of this research note.

- Discount rates of 9.1% factor in current beta and risk-free rates; further assumptions are made here.

- Shares outstanding are based on current diluted outstanding share volume per Q1 report. I expect its outstanding share volume to decline by ~2.5% on average per year, but for the sake of being conservative, I will use its current outstanding share volume.

PayPal’s stock has upside based on its valuation (Author)

Based on these assumptions, I see PayPal’s earnings to be growing slightly higher than the 8% long-term growth rates of the S&P 500. Given these growth rates, I believe a forward PE of ~17 is warranted, which is still below the 10-year average of the S&P 500’s forward PE of 17.8.

As seen above, there’s roughly 14%–15% upside from current levels of PayPal’s price of ~$68 at the time of writing this. I believe the severe pessimism in PayPal today is also compressing the current forward PE of PayPal, currently ~13, which is making the stock reasonably attractive today.

Risks and other factors to look for

The biggest risk is if PayPal themselves drop the ball on their innovation and adoption goals and do not push out features and products at the pace they had originally planned for. This means PayPal would cede more market share to its competitors. This is a transformation year for PayPal, so I expect some volatility not only from management’s deliverables but also from investor expectations of PayPal.

Last month, the CFPB passed a rule to lower credit card late fees by $24 to $8. There’s still no date on when the rule will be enacted, but it will be at some point this year. While PayPal is not directly impacted, the company is not immune. The revenue share agreement that PayPal has with its consumer credit partners will have some impact.

On a positive note, for the first time, management stated its intentions for how it plans to use its stablecoin PayPal USD (PYUSD-USD), stating that it may use the stablecoin to drive cross-border payments and transactions. This would drive further adoption and higher customer balances for PayPal, which helps increase interest income for the company.

Takeaways

PayPal’s turnaround is starting to take shape, but it’s not there yet. Management’s initiatives to drive adoption, deepen engagement, and build a better network with its partners and merchants are looking very promising. The pessimistic sentiment has driven down PayPal’s forward valuation multiples, which makes the stock look relatively attractive per my analysis at current levels.

I rate PayPal as a Buy here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.