Summary:

- Merck & Co., Inc. offers 11 years of rising dividends, 8.2% 5-year dividend growth rate, and 2.5% yield.

- Merck has a winning earnings yield of 6.7% and is near fair value price from Value Line.

- Lilly also is a very attractive healthcare stock, with a low EPS yield of 2.15% as it trades at a P/E of 46+.

- Both Merck and Eli Lilly are very close for quality and payout ratios, but differ in margin of safety for price and yield, which will be explained using FAST Graphs and more.

redstallion/iStock via Getty Images

MERCK

Merck & Co., Inc. (NYSE:MRK) is a pharmaceutical and animal healthcare provider developer with a $272.6 billion market cap founded in 1891 and headquartered in Kenilworth, NJ.

Merck has an “A+” S&P credit rating with a #1 safety rank from Value Line.

Pricing Merck

Yahoo Finance shows a suggested average valuation for Merck of $110.35, with a price target range of $100 to $125 from 23 analysts.

The price today, November 29th, is ~$108.

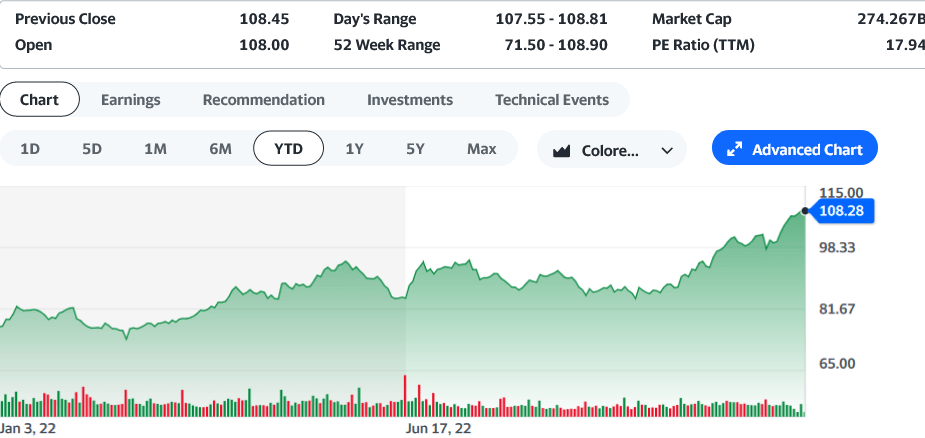

Below is a YTD/ year-to-date chart from Yahoo Finance.

Year to Date Price Chart for Merck (Yahoo Finance Nov 29th, 2022)

Morningstar suggests a fair value of $97 and a low valuation to buy price of $67.90. It generally travels around the $80- $85 price most often and has risen sharply recently.

Value Line analyst suggests a midpoint 18-month-out future price of $102 and offers a range of $73 to $130. The 3-to-5-year range is $115 to $140. It would seem Merck can still offer some more limited price appreciation.

FAST Graph – ”FG”

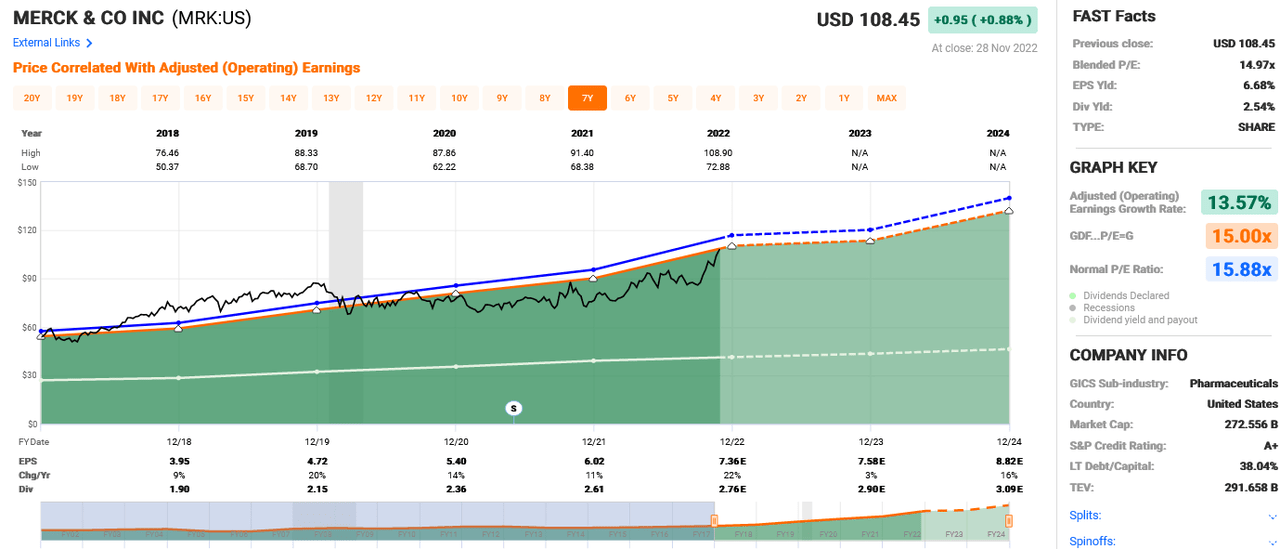

I subscribe to the Chuck Carnevale paid service “FG” where it shows technical analysis for earnings, dividends, and price in one look. Below is a 5-year + 2-year estimate (dotted lines) look at MRK.

The black line is price, the white line represents the dividend, and the blue line is normal P/E. The dark green area is a show of earnings which are rising, just like most all else except for that varying price line.

Note the blue box on the right shows numerically the normal P/E is 15.88. At the price shown below, it is selling at 14.97x, which is still under that 4-year normal.

The orange line P/E = G represents the average P/E from the popular Graham model average, which most often is 15.

All numbers at the top and bottom are shown by year for high price, dividends, earnings and even % earnings change. Great news, all are nicely positive for MRK. It has 13.57% estimated earnings growth, too, for the 2 years shown out to 2024. Remember the dotted lines are future estimates.

Merck Technical Chart 5 yrs + 2 est (FASTgraphs Chuck Carnevale )

It has a nice 6.68% earnings per share yield “EPS” yield (“Yld”) which is just above the desirable 6.5% average, which would be near a 15x P/E.

Dividend Growth

The 2022 dividend paid was $2.76, and at the current price = 2.5% yield.

The 5-year DGR for Merck is 8.2%. The last 2 years are slowing but the average is ~5.8%

The next dividend raise was just announced, making it 73c per quarter = $2.92/ year, a 5.8% raise. The 2024 dividend is suggested to be $3.09, which would be a similar raise.

Merck is a hold; which I intend to do, maybe a trim if the price gets amazingly high.

How does Merck compare to Eli Lilly (LLY)?

Eli Lilly Price

Yahoo Finance 23 analysts suggest an average price of $380.78. The range is $268- $436.

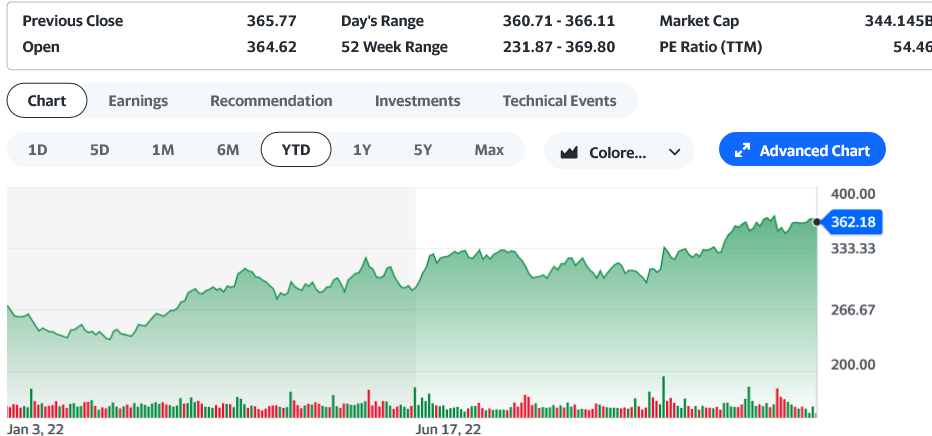

The price today is ~$362. The chart below is their YTD chart for it.

Lilly Price Chart YTD: YF Nov 29th (Yahoo Finance Nov 29th 2022)

Eli Lilly is a $347 billion healthcare pharmaceutical company headquartered in Indianapolis, IN, since 1876. It has an “A+” S&P credit rating with a #1 safety rank from Value Line.

Morningstar has a fair value of $256 and to buy cheaply at $179.20.

Value Line has an 18 month out price target of $400 and a range of $270-531. However, it also has the 3- 5-year price estimate at $315 – $385. Lilly is currently there now.

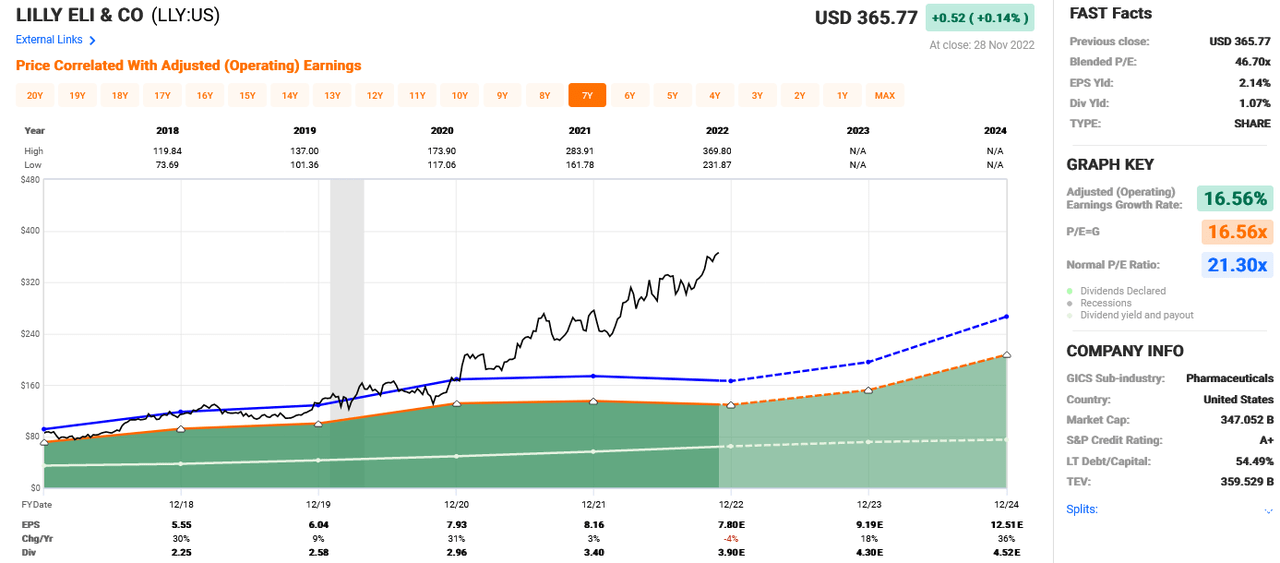

Lilly is selling at a P/E of 46.7x, which is extremely over the normal P/E blue line of 21.3x. The Graham average normal P/E would be 16.56x. The chart does show the love even with 18% earnings growth estimates in 2023 and 36% for 2024.

Lilly Technical FG Nov 29th 2022 (FASTgraph Chuck Carnevale)

Dividend Growth

The 2022 dividend paid was $3.92, and with the current price of $366 = 1.07% yield which would be expected with such a high P/E.

The 5-year DGR for LLY is 10.9%. The estimated years are choppy, ranging from 10.2% to 5.1% for 2024.

With the low yield, LLY must continue to offer a rising dividend, which seems to be the case for at least 2023.

Summary/Conclusion

Merck can still offer some price appreciation, nice dividend growth, and that 2.5% yield to consider as a great buy on any price dip.

Lilly is expensive, loved, and price appreciation is probably near a maximum level. It is quality in most all regards and has had a delightful past and shows excellent future earnings estimates. The yield is just too low to compensate for the suggested future dividend growth, however nice that would be for a better-yielding stock.

I am long MRK with no position in LLY, but would enjoy owning it one day at the right price.

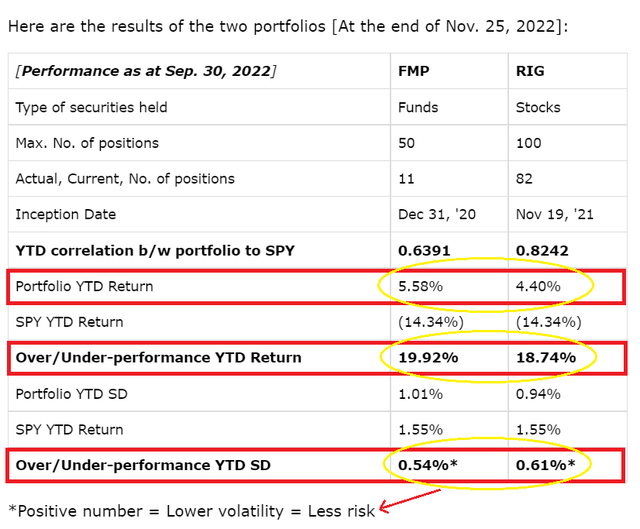

Just some quick results about my own portfolio “RIG,” Rose’s Income Garden, which has a large position in MRK, and the FMP portfolio at The Macro Trading Factory where they both are found.

Performance MTF Portfolios: FMP/RIG (Macro Trading Factory- Macro Teller)

Happy Investing to All!

Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Rose owns 82 stocks in RIG with Merck being the 2nd largest holding in the healthcare sector.

Macro Trading Factory is a macro-driven service, run by a team of experienced investment managers.

The service offers two portfolios: “Funds Macro Portfolio” & “Rose’s Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.