Summary:

- Meta Platforms continues to be our favorite stock in the FANG group; the stock is up 99% since our November note.

- We expect Meta to rebound meaningfully after the harsh pullback in 2022 as the company focuses on cost cuts and restructuring.

- We’re more constructive on Meta’s cost reduction measures, as it cuts 10,000 more employees after the initial cuts in November.

- Meta is relatively cheap, trading at 3.2x EV/C2024 Sales versus the peer group average of 4.5x.

- We recommend investors buy the pullback as we believe Meta provides a favorable risk-reward profile at current levels.

Kevin Dietsch

We remain buy-rated on Meta Platforms (NASDAQ:META). When we last wrote about Meta in mid-January, the stock was down 60% over the past year; in comparison, now the stock is up 3% over the past year. Despite weaker ad spending and the harsh macroeconomic environment pressuring tech stocks, we expect Meta stock to rally in the mid-to-long term as management focuses on cost reductions and controlling overspending while still investing reasonably in its Metaverse plans. Meta remains our favorite pick among the FANG group as we expect the company’s restructuring efforts will help improve profitability amid the weaker ad spending environment, negatively impacting Meta’s revenue. The stock is already up nearly 99% since we published our November note on the company, but we still recommend investors buy the stock at current levels before it potentially rallies further.

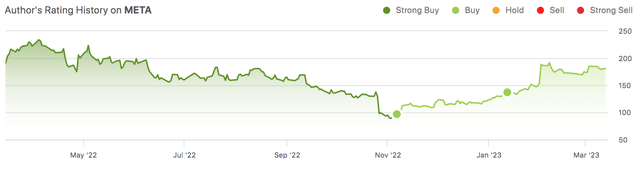

The following graph outlines our rating history on Meta.

Cost cuts on steroids

Meta announced it’d cut an additional 10,000 more workers after the company’s initial layoff of 11,000 employees back in November. The layoffs are part of a broader effort to restructure costs after the stock price crash in 2022 and steer the company to what we expect will be a recovery year for Meta. To put into perspective how drastic Meta’s layoffs are, think of it this way: Meta reported a head count of 87,314 in September 2022, and after the most recent layoff, it is left with 66,000. We’re seeing the company come off the pandemic-led surge in hiring and expanding to maneuver the post-pandemic environment. The company’s part of the broader wave of tech layoffs alongside Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Amazon (AMZN), and others. Meta also plans to restructure costs between $3B to $5B and close 5,000 additional job vacancies. We believe the company is taking a much-needed step to restructure costs and boost profitability amid worsening economic conditions harming Meta’s core revenue driver: ads.

Meta derives the bulk of its profit from its advertising revenue, amounting to nearly $114B in 2022. CEO Mark Zuckerberg’s overspending on the Reality Labs project could be partially to blame for Meta’s declining revenue over the past year. The company posted a loss of $4.28B in 4Q22, making its total loss from Reality Labs investments for 2022 $13.7B. We also attribute the weaker revenue inflow to the pullback on advertising spending amid market uncertainty. Ad firms predict slower advertising growth for the full year of 2023; media investment firm Magna now expects ad revenue to grow 4.8% to $833B this year, revising its previous forecast of 6.3% growth in June. We saw the ad spending pullback reflected on Meta’s 4Q22 earning results, with ad impressions delivered across Meta’s Family of Apps (‘FOA’) increasing 23% Y/Y, but the average price per ad dropped 22% Y/Y. We continue to expect Meta’s ad revenue to be pressured by the economic slowdown during 1H23, making it all the more necessary for the company to cut costs and restructure in response.

4Q22 earnings results & what to expect next

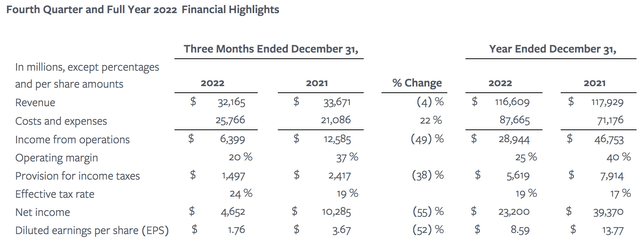

Looking at financials alone, things don’t look great for Meta; revenue declined 4% Y/Y in 4Q22 to $32,165M, and costs and expenses grew 22% to $25,766B. We’re not too concerned about Meta’s FY2022 performance as we believe the stock is rebounding to recover profitability toward 2H23. The following table outlines Meta’s 4Q22 and FY2022 highlights:

Meta 4Q22 & FY2022 earning results

We believe Zuckerberg is bracing for the potentially looming recession and expect to see Meta stock continue to recover this year; the stock is already up 54% YTD. We recommend investors jump on the cost-cut wagon and ride the upward trend as we believe Meta is well-positioned to grow once macroeconomic headwinds ease.

Valuation

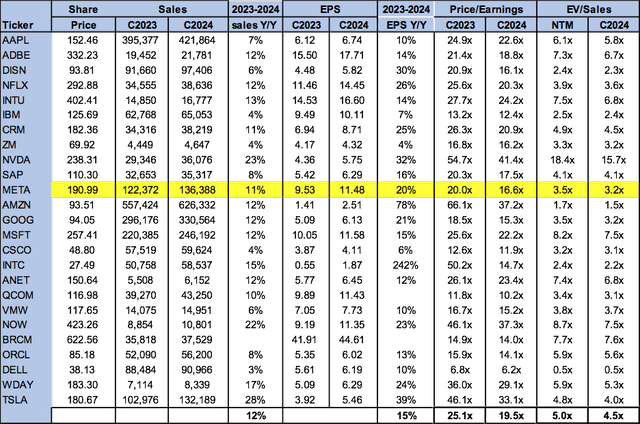

Meta stock is relatively cheap, trading well below the peer group average. On a P/E basis, the stock is trading at 16.6x C2024 EPS of $11.48 compared to the peer group average of 19.5x. The stock is trading at 3.2x EV/C2024 Sales versus the peer group average of 4.5x. We see a favorable entry point at current levels and recommend investors buy the stock at current levels.

The following table outlines Meta’s valuation.

Word on Wall Street

Wall Street seems to share our bullish sentiment on the stock. Of the 58 analysts covering the stock, 40 are buy-rated, 13 are hold-rated, and the remaining are sell-rated. We expect Meta stock is well-positioned for a stock rally in the mid-to-long run and recommend investors buy in.

TechStockPros

What to do with the stock

We’re bracing for Meta’s “year of efficiency” and remain bullish on the stock. We expect Meta’s cost cuts and restructuring to make the company well-positioned to improve profitability and weather the current macroeconomic headwinds. Meta’s had a rough 2022, but we believe the worst is in the past and see the stock outperforming in the mid-to-long run. We will continue to monitor the stock to see how Zuckerberg’s efficiency strategy pans out toward 2H23. We recommend investors buy the stock at current levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.