Summary:

- Meta Platforms, Inc. is the king of social media and reported steady user growth of 4.9% across its Family of Apps which had 2.96 billion daily active people in Q4,22.

- The company beat revenue estimates for Q4, and increased its revenue by 16% sequentially despite a 4.5% decline year-over-year.

- Meta has approximately 2 billion monthly active users on WhatsApp which are not currently being monetized.

- My conservative estimate of a $5/month subscription model which 5% of users signed up to could generate an extra $6 billion per year for the company, on an enhanced version of WhatsApp with extra features.

- My discounted cash flow valuation model indicates Meta Platforms, Inc. stock is undervalued intrinsically and its billions of dollars invested into the Metaverse are not being priced in.

Kevin Dietsch

Meta Platforms, Inc. (NASDAQ:META) is the leading social media giant which, of course, owns Facebook, Instagram, etc. The company has been untouchable for over a decade, and even benefited from the lockdown of 2020 as the use of social media accelerated. However, since the start of 2022, the company has faced challenges after initially reporting a slowdown in both user growth and revenue, which was driven by the macroeconomic environment as well as technical issues and increasing competition.

The good news for Meta is that in Q4 2022 the company reported an improvement in its revenue as it beat analyst forecasts and increased sequentially. Meta also reported continued growth in its monthly active users (“MAU”), which is a solid positive. I believe the market is not fully appreciating this or the fact that Meta owns WhatsApp, which has ~2 billion monthly active users and is only at the early stage of being monetized. Meta also announced a staggering $10.9 billion buybacks in Q4 2022 and increased its stock repurchase authorization to $40 billion. In this post I’m going to break down Meta’s financials for the fourth quarter, the user growth trends, its potential with WhatsApp, as well as the company’s valuation, let’s dive in.

Mixed Fourth Quarter Financial Results

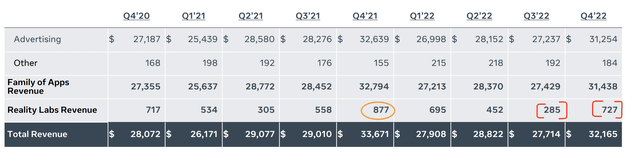

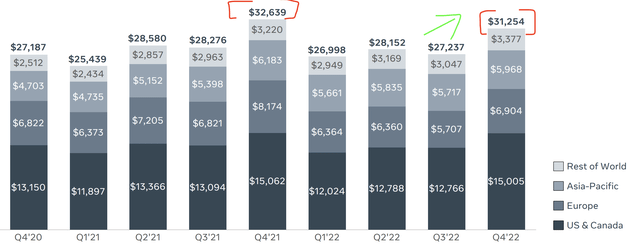

Meta reported mixed financial results for the fourth quarter of 2022. Its revenue was $32.17 billion, which beat analyst expectations by $475 million and increased by 16% quarter-over-quarter. However, it should be noted that the company’s revenue is still down 4.5% year-over-year from the $33.67 billion reported in Q4,2021. This was driven by a decline in its advertising revenue, which was $31.254 billion in Q4,22, down from the $32.639 billion reported in Q4,21. This was caused mainly by the “recessionary” macroeconomic environment which has caused advertisers to pull back advertising spend. This is an industry-wide occurrence, and Alphabet Inc. (GOOG) (the second major advertising giant) reported a similar dynamic in its last earnings report. The good news is this dynamic is usually cyclical by nature and, thus, I don’t deem it to affect Meta negatively long term.

Advertising Revenue (Meta Q4,22 report with author edits)

Another point worth mentioning, is that Meta has previously experienced issues monetizing its “Reels” format, which is the equivalent of TikTok short-form videos. As more users watched reels, this took away attention and thus advertising revenue from Meta’s traditional post feed and story feed posts. As someone who has previously ran a digital marketing agency with multimillion dollar Facebook/Instagram advertising campaigns, I saw this dynamic firsthand with clients. Meta is continuously adjusting its algorithms and initially favored Reels to boost engagement. However, due to the monetization issues and “outrage” from iconic Instagram users such as Kim Kardashian, and a Change.org petition which racked up over 50,000 signatures, Meta caved to the pressure.

You will notice on the above chart that Meta reported $27.237 billion in advertising revenue for Q3,22 (when it was testing this feature) and this actually increased to $31.254 billion in Q4,22, after Instagram adjusted its algorithm. In addition, this boost was likely helped by seasonal advertising tailwinds spurred on by the holiday shopping season. Personally, I don’t think Meta favoring “Reels” was a bad experiment at all, as despite the uproar from users and Wall Street, the video “shorts” format is becoming increasingly popular. Competitor TikTok specializes in this format and has grown its user base rapidly to an estimated 1.53 billion, with over 1 billion being monthly active users.

By comparison, Instagram (owned by Meta) has ~2 billion monthly active users. YouTube (owned by Alphabet) also previously announced its “Shorts” format, which racked up 30 billion daily views and had 1.5 billion monthly active users in Q3,22. However, YouTube also experienced similar monetization issues, and thus I believe this is a format/technology issue rather than specific to Meta, which in some respects is a positive sign. There has also been a lot of fear about increasing competition for Meta, and I will discuss that in the risks section. However, it should be noted that Meta has still continued to grow its monthly active users.

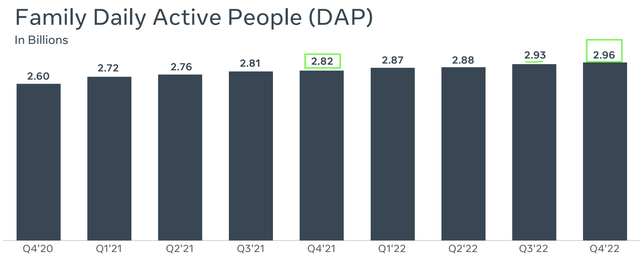

Its Family Daily Active People has increased from 2.82 billion in Q4,21 to 2.96 billion by Q4,22. This metric is also up sequentially quarter-over-quarter with 2.93 billion users reported in Q3,22. Therefore, theoretically if/when cyclical advertising revenue rebounds as economic conditions improve, Meta should report greater revenue as it has more users to monetize.

Note: Meta’s Family of Apps include Facebook, Messenger, Instagram, and WhatsApp.

Family Daily Active People (Q4,22 report with author annotations)

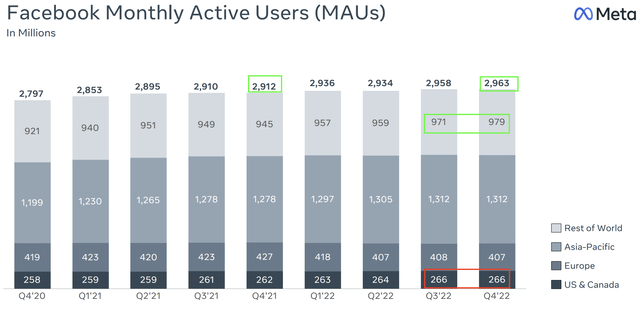

I also saw a similar dynamic for Facebook monthly active users, which increased from 2.912 billion in Q4,21 to 2.963 billion by Q4,22. This also increased sequentially quarter-over-quarter. A negative is mature markets such as the U.S. & Canada (black bar) reported flat user growth sequentially, with 266 million monthly active users. This could be a signal Facebook is feeling the negative effects from the competition and the platform is maturing. In my personal experience (as someone under 35), I don’t really use Facebook these days and most of my friends don’t, either (despite still having an account). Of course, this is not a large number of datapoints, but I believe there has been a demographic shift. The consensus is Facebook is now popular with “Boomers” while Instagram is engaging for millennial and TikTok for Gen Z, although this is a generalization as Meta does not publish its demographics. Despite this dynamic, Meta still has a strong place in the market, albeit with a different cohort.

Facebook Monthly Active Users (Q4,22 report with author annotations)

The WhatsApp Opportunity

Meta acquired messenger App WhatsApp for ~$22 billion (in cash and stock), way back in 2014. Since that point, WhatsApp has grown to approximately 2 billion monthly active users, but Meta still hasn’t fully monetized this vast user base extensively. Personally, I believe this was a mistake by management, as leaving “cash on the table” only works during “good times.”

The good news for Meta is “necessity is usually the mother of invention,” and now that times are tough, monetizing WhatsApp has become more of a priority. I first alluded to this last year when I spotted WhatsApp “click to message” ads inside the Meta advertising platform. Since that point, Meta has grown this business substantially and it now has a “$10 billion run rate.” However, I believe this also includes “click to message” ads for Instagram and Messenger.

The company has also started to scale the WhatsApp business platform, which enables users to answer customer questions and sell product directly inside the chat. Previously, I have seen small businesses do this, but even major companies such as Air France (OTCPK:AFRAF) have begun to use WhatsApp to share flight information and boarding passes.

In the Q4,22 earnings call, CEO Mark Zuckerberg alluded to the fact that businesses tell them that “more people open their messages and they get better results on WhatsApp versus other channels.” This may not seem like a big deal, but a brands power is how well it can communicate with its customers. Think about how rammed your email inbox is, as over 347 billion emails sent each day and the majority go unopened. Therefore, WhatsApp could be used as a much more effective tool for business to customer communication. I recently spent some time in Dubai and found the majority of real estate agents use WhatsApp as a primary communication channel. Initially I found this intrusive, as I was used to email from realtors, however, there is no doubt I opened every message.

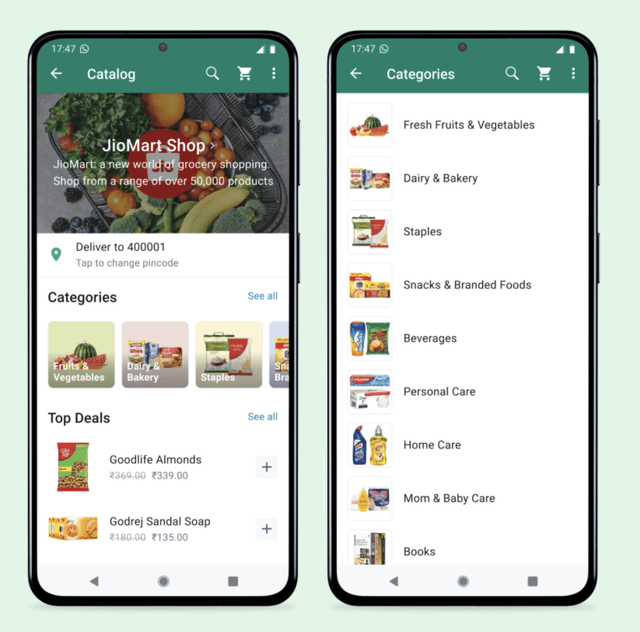

WhatsApp has also partnered with Salesforce (CRM), which now offers direct connection with the world’s largest customer relationship management [CRM] provider. In addition, Meta has launched a WhatsApp partnership with Indian based JioMart to enable “end to end shopping.” This enables users to buy groceries directly in the chat. I believe Meta could take inspiration from the “Super App” of China WeChat, which is like “WhatsApp on steroids.” On WeChat, users can book accommodation, a taxi similar to Uber, and much more. If Meta has this in its plans, the potential could be huge. I would love to see an Airbnb/Uber/Restaurant booking integration, but I’m not on the product team of Meta, so we will have to wait and see if management is savvy enough to execute product plans such as this.

WhatsApp JioMart (Q4,22 report)

It is hard to quantify exactly how much revenue WhatsApp could generate, but we can do an estimate if Meta offered increased functionality and then charged a small monthly subscription to its 2 billion users. We could estimate if 5% of its monthly active users (100 million people) paid $5/month that would be an extra $500 million per month! With three months in a quarter, that would be an extra $1.5 billion per quarter or $6 billion per year. Meta’s current revenue is $32.17 billion, and thus this would equate to a solid 18.5% increase, which isn’t bad. This also isn’t taking into account Meta’s current monetization strategy “click to message” ads. As a caveat to this, I don’t think Meta could charge much for its core WhatsApp platform as it stands, because there is competition with platforms such as Telegram, which has found a niche application in file sharing.

Metaverse (Reality Labs)

Meta is making a bold better on the “Metaverse,” which is expected to be a combination of Augmented Reality [AR], Virtual Reality [VR] and even social media technology. The company has been criticized for its plans to “waste billions” on the Metaverse, as it seems unrelated from its core business. I understand where investors are coming from, but I actually believe these investments are more closely aligned than you may initially think. Web 2 is often considered to be social media, while Web 3 (VR, AR, Crypto, AI) is the next logical step in my eyes. In addition, Meta acquired the market leader in VR headsets Oculus in 2014 for around $2 billion, so it’s not completely random. There are still major technology and cultural challenges in this space and critics, but that is common in every new technology revolution. If you may recall, Amazon (AMZN) was previously criticized by the media for “wasting” millions of dollars to invest into the cloud and create AWS, which is now the key profit driver for the company.

Meta also showcased some pretty cool technology at its Connect day in 2022, such as “photorealistic avatars” and even an AR wristband which controls smart glasses. In its earnings call for Q4,22, Meta reported there were over 200 apps on its VR devices which have made over $1 million in revenue. This is a good start for Meta as it aims to build the “next computing platform.”

Meta Avatar (Graphic by author at Deep Tech Insights )

Reality Labs (which includes Oculus) is still not a major revenue driver, with $727 million reported in Q4,22. This was up sequentially by a rapid 155% over Q3,22 revenue of $285 million. However, it was down slightly year-over-year, which I believe is due to the cyclical decline in the gaming industry more than anything.

In this next section, I will discuss Meta’s profitability and expenses, including those related to the Metaverse.

Profitability and Expenses

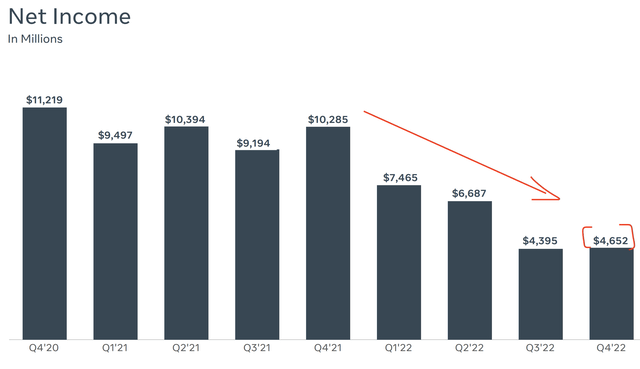

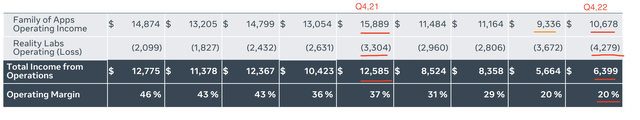

For Q4,22, Meta reported $4.6 billion in net income, which is down an eye-watering 54.7% year-over-year. Its operating margin has also reduced from 37% in Q4,21 to 20% in Q4,22. Its EPS was $2.23, which missed analyst expectations by 21.14%, according to Google finance data.

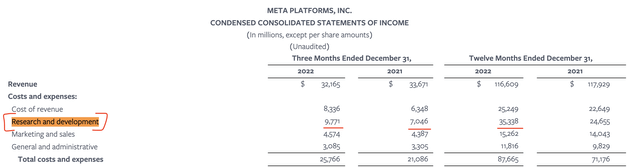

Meta’s poor earnings results were driven by the decline in advertising revenue, as well as reel monetization issues. In addition, the company experienced a sharp (22.19%) increase in operating expenses from $21.086 billion in Q4,21 to $25.766 billion in Q4,22.

Operating Income and Margins (Q4,22 report with author annotations)

Breaking down expenses by segment, we can see its “cost of revenue” increased by 31.8% year-over-year to $8.336 billion. This was mainly driven by a “write-down” in data center assets, as well as growth in infrastructure costs. Overall I don’t deem this to be a major negative, as it is infrastructure-focused. Meta streamlined its workforce in Q4,22 and laid off 11,000 employees or 12.7% of its (86,400) total as a result of a strict cost-cutting program. However, as the company had to keep many employees on its payroll for a period of time due to legal reasons, this impacted three expense line items negatively. A positive for Meta is its G&A expenses actually declined by 7% year-over-year, which was a positive and demonstrates the operating leverage apparent in Meta’s business.

Research and Development [R&D] expenses also increased by a substantial 39% year-over-year, from $7 billion in Q4,21 to $9.7 billion in Q4,22. Again, headline news reports will just show “declining profits,” but R&D is an investment. Like any “investment,” a return is expected, and given Meta’s prior track record of strong returns (22.5% Return on Equity), at least some return should be expected, even if investors think the “Metaverse” is too far away. During a New York Times event interview in 2022, Zuckerberg mentioned he was investing 80% of its investment budget into its “core” applications, thus it is a misconception that he is “betting the company” on the Metaverse. Zuckerberg stated that only ~20% of investments are going towards Reality Labs and the Metaverse.

It should also be noted that Reality Labs reported an operating loss of $4.279 billion in Q4,22. This may look negative on the face of things, but I actually believe this expense is wrongly categorized financially or at least from a valuation standpoint. A large portion of this “loss” should really be categorized as a “capital expense,” not an operating expense. This is because “capital expenses” are those with a future expected payoff. For example, if a company invested $4 billion into building a factory for production, it would not record an operating loss from this investment.

You will see in the valuation section next, I “capitalize” R&D expenses by moving them over to the balance sheet. This is a valuation process I have been doing for around 5 years, and accounting regulations have finally started to catch up.

Meta has a solid balance sheet, with $14.68 billion in cash & cash equivalents and $26 billion in marketable securities. In addition, the company has $9.9 billion in long-term debt, which is manageable.

Valuation Model

For Q1,2023, Meta guided for revenue of between $26 billion and $28.5 billion, which would represent just 2% growth year-over-year at the high end. This slow growth is expected to be driven by the “recessionary” environment and a pullback in advertising spend. However, as mentioned before, the advertising industry tends to be cyclical by nature, and as Meta has grown its users, I forecast its growth should improve in the future. In addition, Meta’s revenue is expected to be impacted by a 2% foreign exchange rate headwind.

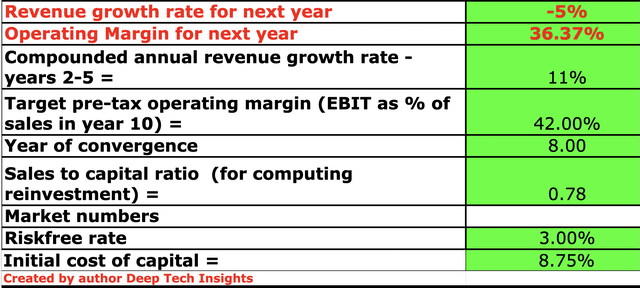

I have plugged the latest financial data into my valuation model, which uses the discounted cash flow (“DCF”) method of valuation. I have estimated revenue to decline by 5% for “next year” (2023 in my model). This is in line with the Q4,22 revenue decline rate of 4.5% and fairly conservative given Meta’s forecast for Q1,22. I expect continued pressure on the advertising market due to the recessionary environment as being the main headwind.

The good news is the advertising market tends to be cyclical, thus I have forecast a rebound in years 2 to 5 and thus 11% revenue growth per year. I am also expecting improved monetization of the reels format and continued growth in WhatsApp business messages. Although, to be conservative, I have estimated the full monetization potential of WhatsApp as that is unknown and unproven at this stage, thus I prefer to see it as an extra bonus.

Meta stock valuation 1 (created by author Deep Tech Insights)

As mentioned above, Meta has accelerated its investments into research and development, thus I have capitalized this expense. This has boosted the net operating margin slightly to 36.37% for the full year. I have also forecast a 42% operating margin in year 8. This may seem optimistic but it is really just a return to the operating margin in the second quarter of 2021. This is also slightly lower than the Q4,20 margin of 45.5%.

Meta has also lowered its expense outlook for 2023, with $89 billion to $95 million expected, down from $94 billion to $100 billion prior. This is due to lower payroll growth and includes a $1 billion restructuring charge related to its offices, which is likely a “one off” expense.

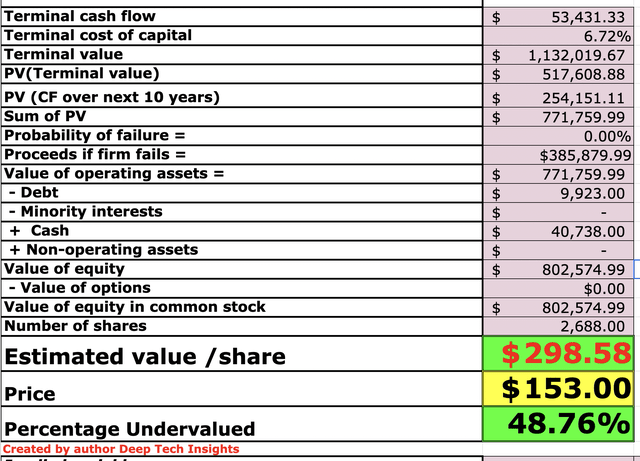

Meta stock valuation 2 (created by author Deep Tech Insights)

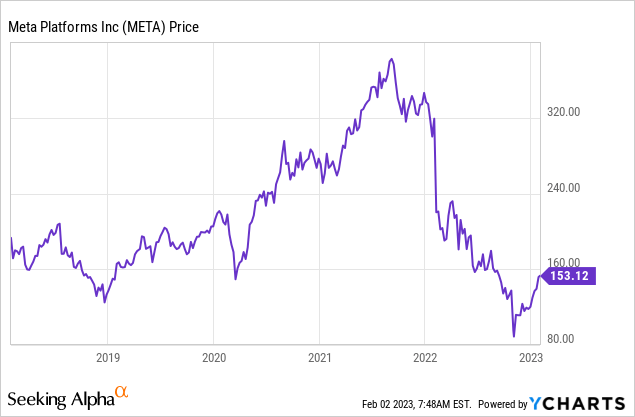

Given these factors, I get a fair value of $298.58 per share. META stock is trading at $153 per share (at the time of writing), and thus is nearly 49% undervalued, according to my forecasts and model.

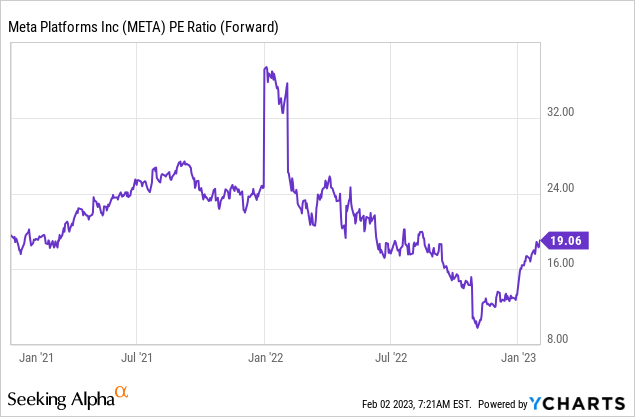

Meta also trades at a forward Price to Earnings [P/E] ratio = 18, which is 20.84% cheaper than its 5-year average.

Risks

Competition/Recession

As mentioned above, Meta is now facing more competition in the social media space than ever with the rise of TikTok, which has over 1 billion monthly active users. In addition, the company faces competition from YouTube with its Shorts format, and even Twitter, as Elon Musk plans to launch video capabilities. These dynamics could impact growth rates and eat market share long term, although I don’t see them destroying Meta’s entire business yet. In 2023, many analysts have also forecast a recession, so I would expect advertising revenue to be muted for the year.

Final Thoughts

Meta Platforms, Inc. is still the king of social media and has a dominant advertising business with advanced capabilities. The company has reported a beat on its revenue estimates for Q4,22, despite a tough advertising backdrop. The positive for Meta Platforms, Inc. is these dynamics are likely to be temporary and the company has still been growing its monthly active users despite tough competition. Meta Platforms, Inc. stock is undervalued intrinsically according to my valuation model and estimates. Meta also has a huge opportunity with WhatsApp and of course the Metaverse. Thus, Meta Platforms, Inc. could be a great long-term investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.