Summary:

- Micron’s earnings eased oversupply fears as investors realized they had been too pessimistic.

- Micron’s business cyclicality has heightened fears. However, the AI growth inflection could sustain its current upcycle momentum.

- MU has highlighted its focus on gaining more share in higher-value segments, underpinning its profitability growth.

- I explain why MU’s bullish thesis is increasingly sustainable, notwithstanding potentially oversupply risks.

- MU investors looking to accumulate more aggressively shouldn’t miss buying into its recent recovery. Read on to find out more.

vzphotos

Micron Bulls Aren’t Concerned With Oversupply Risks Yet

Micron Technology, Inc. (NASDAQ:MU) investors returned with a vengeance as the leading memory chipmaker’s earnings scorecard calmed the market’s nerves about potential oversupply fears. Given Micron’s cyclical operating performance and a more commoditized market (relative to its logic peers), I assess that the market’s caution is justified. While the memory oversupply risks have not been ruled out, robust underlying demand across MU’s critical market segments is expected to underpin a solid FY2025.

In my previous bullish article on MU, I upgraded the stock, even as it plunged into a bear market following the early August collapse. Samsung’s impending entry into the HBM3E segment is anticipated to intensify the competitive risks as Micron and its peers vie for market share. Consequently, I’ve not been surprised with MU’s recent market outperformance, as it reached an inflection point, attracting dip-buyers to return.

In Micron’s FQ4’24 earnings release, management assured investors that demand has remained robust, driven by secular growth levers across the PC, smartphone, and data center businesses. Micron has also stepped up efforts to gain more market share against SK Hynix in the critical HBM3E segment, assessed as a two-horse race with Micron. As a result, speed-to-market is pivotal to MU’s success in potentially upending SK Hynix’s leadership. I assess Micron’s confident outlook and solid profitability corroborate the upcycle in its core businesses, particularly in AI servers. Furthermore, the ongoing shift to AI PCs and AI smartphones should diversify concentration risks in its data center business, driving Micron’s growth inflection further.

Given the cyclicality in Micron’s business, I’m satisfied with management’s assurance that the demand/supply dynamics are expected to remain healthy. However, investors must scrutinize the downstream inventory buildup, even as its customers anticipate a more robust sell-through as they prepare for new launches and product refreshes. In addition, there are concerns about whether the potential oversupply in the HBM market could worsen as Samsung steps up its efforts to regain control of the market leadership from SK Hynix. Notwithstanding my caution, adverse pricing dynamics have not been assessed, given the solid demand drivers attributed to the data center customers. However, investors must be prepared for possible oversupply risks from FY2026 unless we observe much more significant enterprise AI infrastructure investments and a demand surge attributed to the Sovereign AI opportunity.

Micron’s AI Growth Inflection Could Sustain

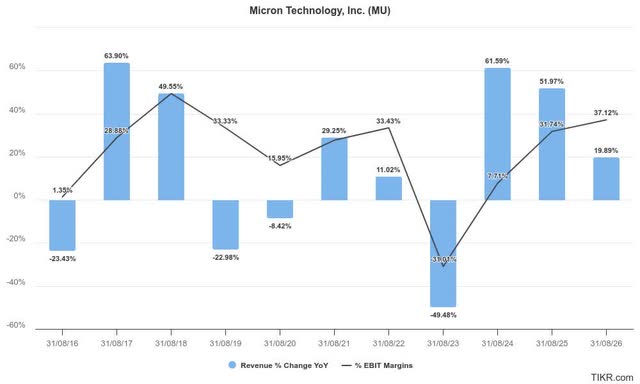

Investors must consider how Micron’s cyclical swings markedly impacted its operating profitability. MU saw a collapse in FY2023 but also experienced a rapid recovery in FY2024, bolstered by the AI upcycle.

Therefore, investors must ask whether more intense competition and possible demand/supply risks in FY2026 could scupper Micron’s AI growth thesis. Wall Street estimates suggest MU’s upswing seems sustainable, given the underlying investments made by the leading hyperscalers and data center operators. As a result, Micron might be able to sustain its pricing levers while raising CapEx estimates to approximately in the mid-30% range of its FY2025 revenue.

Management has assured investors it anticipates building up its market share in the “higher value” DRAM products, including in the HBM segment. Therefore, it should help improve the company’s operating leverage as it scales. I also assess that Micron is more cognizant of the challenges that affected its previous cyclical downswing, which collapsed its operating profitability.

The company has demonstrated the need to focus on inventory levels to align its production closer to underlying demand signals. As a result, I have confidence that Wall Street estimates are reasonable, suggesting the upswing could persist through FY2026, notwithstanding a growth normalization phase after FY2025.

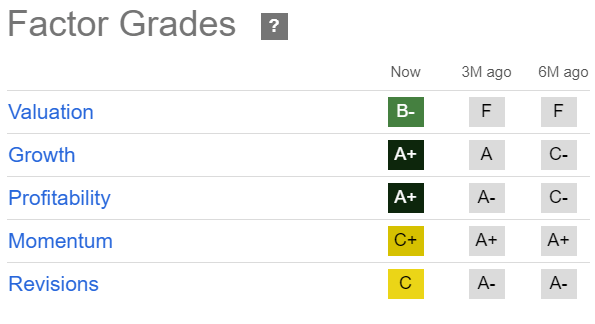

MU’s Factor Grades Have Improved

MU Quant Grades (Seeking Alpha)

MU’s valuation has also improved markedly (from “F” to “B-“) as it benefited from an upswing in its operating profitability. The surge in its critical revenue segments (especially in data centers) has lifted its growth grade from “C-” to “A+” over the past six months.

Despite that, the stock has struggled with recent buying momentum (fell from “A+” to “C+”) even though MU recorded a historic post-earnings surge. The market is likely increasingly concerned with competitive risks as Samsung and SK Hynix seek to regain the narrative as the South Korean memory makers lift their game against MU.

Is MU Stock A Buy, Sell, Or Hold?

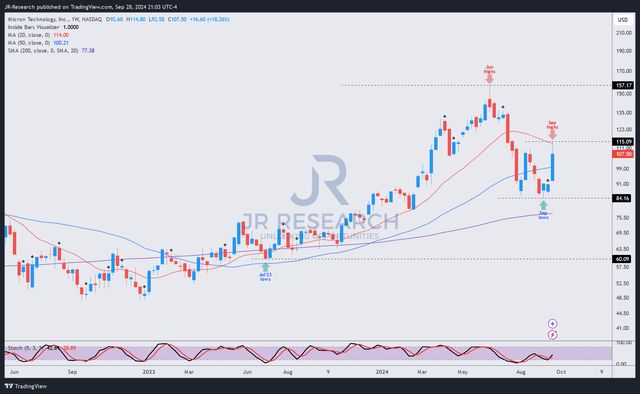

MU price chart (weekly, medium-term, adjusted for dividends) (TradingView)

It should have reassured MU investors, as buyers have held the $85 support zone constructively since early August 2024. The consolidation phase helped set up a base for the recent post-earnings spike, as investors downplayed the pessimism about potential oversupply in the HBM market.

Notwithstanding the recent improvement in buying sentiments, MU must stay above the $115 resistance zone to convince more momentum investors to return. Based on MU’s price action, late profit-taking returned toward the end of last week, as investors likely took some risks off the table.

Despite that, I assess that MU’s risk/reward remains favorable, given its relatively attractive valuation. Therefore, a further valuation re-rating seems increasingly likely. MU should benefit from improved investor confidence as Nvidia (NVDA) ships its Blackwell architecture AI chips in higher volume through 2025.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!