Summary:

- Micron Technology, Inc. missed on top and bottom lines in its fiscal Q1 report.

- Micron’s guidance was weaker than expected yet again.

- Inventory surge not a welcome sign.

vzphotos

After the bell on Wednesday, we received fiscal first quarter results from memory and storage leader Micron Technology, Inc. (NASDAQ:MU). The company is in the midst of one of its revenue downswings, and investors have seen some very disappointing results in recent quarters. Unfortunately, the latest earnings report was again quite lousy, which will likely limit any recovery in shares in the near term.

For the quarter, Micron reported revenues of $4.085 billion. While this number was within management’s somewhat wide guidance range for the December 1st ending period, the top line figure missed street estimates for $4.14 billion. Don’t forget that expectations had dropped quite a bit just in the past three months, as the company called for a Q1 revenue midpoint of $4.25 billion at the September report, which itself was nearly a billion and a half dollars below the average street estimate at that time.

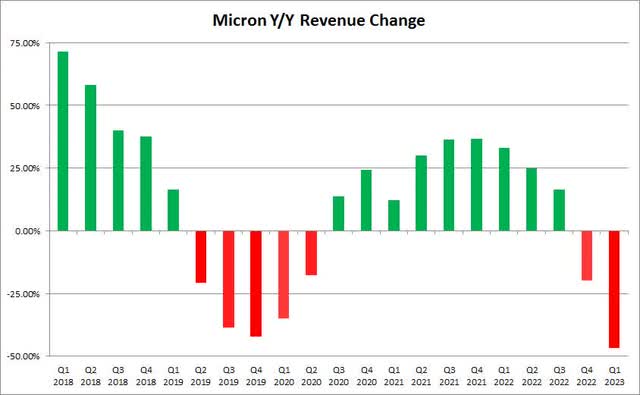

That huge guidance disappointment a few months back doesn’t even include the fact that street estimates had dropped almost $4 billion in the prior three months to that point. Going into Wednesday’s report, analysts were calling for a more than 46% plunge in revenues over the prior year period, and Micron ended up doing worse than that. As the chart below shows, this is the worst percentage change in the top line in the last five years, even surpassing the worst print of the last down cycle.

Micron Quarterly Revenue Growth (Seeking Alpha)

While revenues fell short of expectations, things further down the income statement were just as bad. Non-GAAP gross margins came in at just 22.9% for the period, compared to the midpoint of guidance at 26.0%. While operating expenses were in-line with guidance, they were still up more than $100 million over the prior year period, despite the revenue plunge. Micron ended up losing 4 cents per share on a non-GAAP basis, double what the street was looking for, as compared to a massive $2.16 per share profit in the year ago period.

If the Q1 results weren’t bad enough, Q2 guidance was perhaps the worst part of Wednesday’s report. Revenues are forecast to be $3.80 billion, plus or minus $200 million, and that midpoint missed the street’s average estimate for $3.84 billion. Analysts were already looking for fiscal Q2 revenues to be more than cut in half, and yet after all those substantial revenue estimate cuts that we have seen in recent months, Micron still found a way to guide light.

The company’s Q2 gross margin guidance midpoint for just 8.5% on a non-GAAP basis was horrible to say the least, with a non-GAAP loss midpoint of $0.62 per share being nearly double what the street was looking for. During the last down cycle, the company’s worst quarter still showed a 45 cent per share adjusted profit, but now Micron is now swinging into the red quite meaningfully here. It doesn’t help that a bit of high-rate debt was taken on in recent months.

The company’s balance sheet also is in a very interesting spot currently. Micron finished Q1 with over $8.35 billion in inventory, up about $1.7 billion sequentially and dramatically above the $4.83 billion level seen a year earlier. That’s quite a lot of inventory to be showing on your books at this greatly reduced sales level, which will likely take a few quarters and a bit of losses to clear out. The bloated inventory balance was a main reason why Micron detailed negative adjusted free cash flow of more than $1.5 billion for Q1.

When you combine the cash burn plus the share repurchase program, the company’s net cash balance more than halved in the period to just $1.81 billion. While Micron is not in any financial trouble currently, the low cash balance and loss situation likely means less share repurchases in the near term, especially since the company continues to pay a quarterly dividend. It’s also part of the reason why you saw some $3.3 billion plus in borrowings during the period, and that hurts the long-term profitability picture.

As for Micron shares, they traded almost 2% lower in the after-hours session, holding just a bit over $50. The stock remains just a few dollars away from its 52-week low, and it’s nearly been halved from its yearly high. Since my article at the last earnings report, the average price target on the street has come down by another $5, although at $66 and change that still implies quite a bit of upside from current levels. It wouldn’t surprise me to see more target cuts after this lousy report, although analysts seem to be late to the party here, only cutting after the stock has dropped so much.

In the end, Micron announced another very disappointing set of results on Wednesday. The company couldn’t even meet dramatically reduced street estimates for revenues, and weak gross margins led to a larger adjusted loss than the street was looking for. Management’s guidance was again worse than expectations, tremendously so on the bottom line, and inventories are quite bloated at the moment. While there likely will be better days ahead, year over year revenue growth isn’t currently expected to return for another year, so I wouldn’t be rushing to get into Micron Technology, Inc. shares here today.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.