Summary:

- Deutsche Bank downgraded MU, seeing significant risks to the oversupply situation, as Samsung is not keen on cutting its production.

- As such, investors are thrown a curve ball as they parse whether Micron’s supply adjustments could help mitigate the oversupply challenges at its downstream customers.

- We discuss why MU’s estimates have likely reflected the impact. But, a deeper downturn cannot be ruled out.

- Still, MU’s valuation is attractive at the current levels, with a favorable reward/risk profile.

vzphotos

Thesis

Another downgrade on Micron Technology, Inc. (NASDAQ:MU) arrived in pre-market trading as Deutsche Bank (DB) highlighted that Micron should see a longer-than-expected downturn in its downstream markets.

Micron has continued to cut its wafer starts aggressively, with the most recent update on November 16, as it highlighted a “[reduction of] DRAM and NAND wafer starts by approximately 20% versus fiscal fourth quarter 2022.”

But, the DB analyst brought up a valid point, as the firm accentuated that Samsung (OTCPK:SSNLF) has yet to reduce its production, as it didn’t want to “[consider] an ‘artificial’ cut in memory production.” The company intends to continue its planned production ramp with an eye toward a medium-term recovery. As such, DB thinks that Samsung’s move “is likely to prolong the downturn.”

At its Investor Day in mid-November, Samsung management highlighted that the company was more concerned with undersupply than oversupply. Samsung Head of Memory Sales JinMan Han articulated that the company faced significant challenges in ramping production when it cut production due to oversupply challenges in the past. He accentuated:

So [the] memory business has not been so attractive to most of the investors because it is so cyclical and [the] market is so capricious. And during the [undersupply], we tend to invest a lot of money to build more fabs and during the oversupply, we tend to stop investing, which makes all these typical cycles that make everybody frustrated. And one of my sales VP complained to me that he really likes oversupply situation because during the [undersupply] is so tough for him every day, customers calling him, visit us asking for more bits, which is so challenging and frustrating to me. But during this oversupply situation, I think some people prefer to have a [undersupply] cycle. But usually, [undersupply] is really painful time for suppliers like us. Anyway, CapEx volatility and oversupply situation has been not so attractive to most of investors. We know that. (Samsung Investors Forum 2022)

Therefore, with Samsung not playing ball, it does throw Micron’s bid to overcome the oversupply situation off-balance. Micron CFO Mark Murphy also highlighted that the oversupply situation is significant, as he articulated:

It’s going to require all the levers that we can pull. And candidly, we can’t do it alone. It’s got to be an industry level. There’s a gross oversupply in the space. So, our share is such that we do our part. (6th Annual Wells Fargo TMT Summit)

Hence, we can understand why DB sounds pessimistic, given the MU downgrade, even though it also upgraded Lam Research (LRCX), seeing an improvement in the memory CapEx cycle.

Therefore, the critical question facing investors is whether MU’s current valuations have reflected a significant drubbing.

Analysts Slashed Micron’s Estimates Again

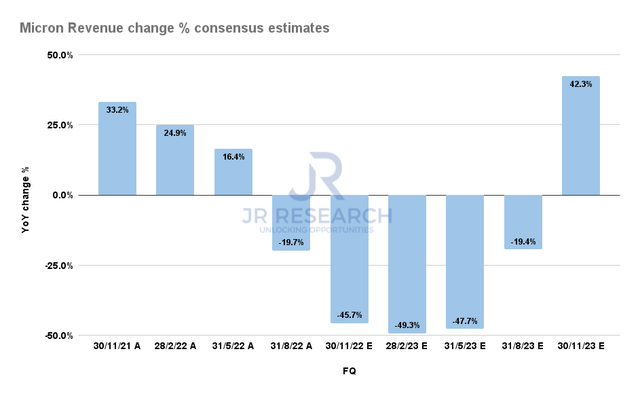

Micron revenue change % consensus estimates (S&P Cap IQ)

With Micron slated to report its FQ1’23 earnings release on December 21, Wall Street analysts have lowered the bar again, given the company’s unexpected supply update in November.

Analysts estimate that Micron’s supply impact should torpedo its revenue growth markedly through May 2023 before recovering by the end of 2023.

DIGITIMES estimates suggest that Samsung is on track to hit 93% of its capacity in 2022, ahead of 2021’s 90% utilization. Hence, we believe the industry headwinds are credible in the near term.

Given Samsung’s production ramp in an oversupply environment, we believe there are significant uncertainties over the Street’s estimates.

Notwithstanding, DIGITIMES estimates suggest that server DRAM pricing could bottom out in H1’23, implying that the supply adjustments by the memory players should help mitigate the oversupply impact.

Hence, it should help Micron to overcome its near-term revenue decline before emerging strong by the end of 2023.

Is MU Stock A Buy, Sell, Or Hold?

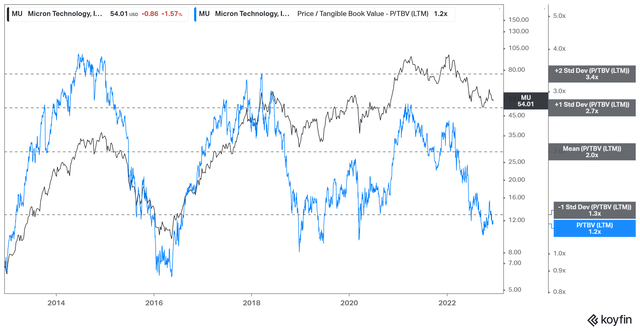

MU TTM TBVPS multiples valuation trend (koyfin)

With MU’s tangible book value multiples at the 1.2x mark, we believe significant pessimism has been reflected. Of course, if a deeper downturn were to occur, it could send MU down further to the 1x mark, which should significantly improve its reward/risk.

Hence, we believe the reward/risk at the current levels is still skewed to the upside, offering investors a solid opportunity to add exposure, as we think Micron’s estimates have been de-risked markedly.

Maintain Buy.

Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!