Summary:

- Memory is the only IC sector with a significant revenue decrease due to excessive supply.

- The drop in memory revenues in 2022 is a repeat of the crash in 2019 because of excessive capex spend by memory companies.

- They seemingly have short memories because the memory market is currently plummeting for the same reason.

- Significant capex cuts by Micron and SK hynix will negatively impact memory equipment companies Applied Materials and Lam Research.

designer491/iStock via Getty Images

The semiconductor memory market is in freefall, and Micron (NASDAQ:MU) stock is plummeting with its share price down 39.2% for the year. Clearly the cause has been a drop in demand for consumer electronic items like smartphones and PCs. I’ve written extensively on this and my latest Seeking Alpha article of November 14, 2022 entitled “Micron: Even The Best Technology Won’t Help Until 2024.”

But the big question and the focus of this deep-dive article is whether all semiconductors are affected or just memory, because smartphones and PCs contain more types of chips than just memory.

Analysis Of IC Revenues

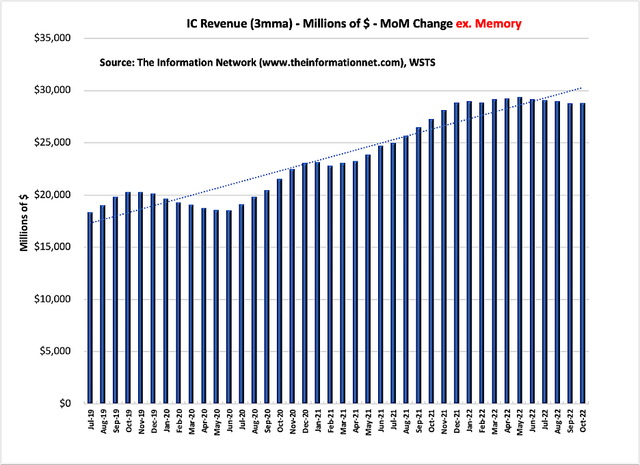

Chart 1 shows monthly revenues of all ICs (excluding memory) between July 2019 and October 2022. It shows a slight drop in revenues beginning in June 2022. The drop from the peak in May 2022 until October 2022 was 2.0%.

The Information Network

Chart 1

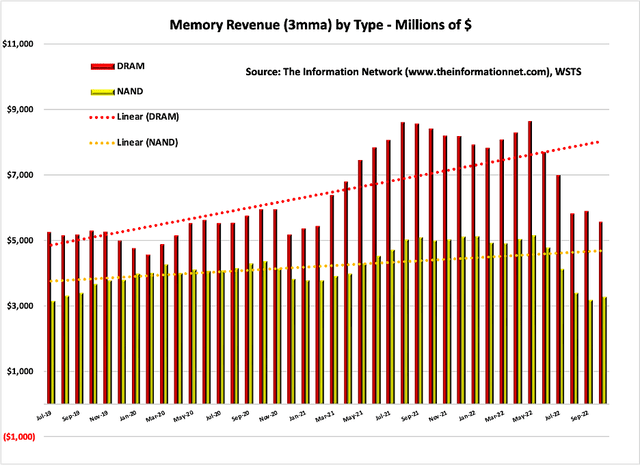

Chart 2 shows a vastly different scenario, where Memory (NAND and DRAM) revenues are plotted for the same period. Memory revenues also began decreasing in June 2022.

According to our report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips,” revenues decreased 4.7% between May 2022 and October 2020 for memory compared to a 2.0% decrease for total ICs excluding memory in Chart 1.

The Information Network

Chart 2

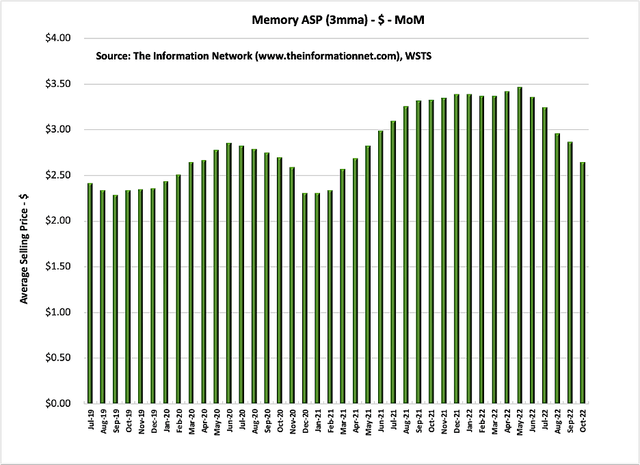

To probe the cause in the revenue drop, in Chart 3 I show ASPs (average selling price) for the same period. Combined memory ASPs started dropping June 2022. Between May 2022 and October 2022, ASPs dropped 23.6%.

The Information Network

Chart 3

Capex Realignment

Memory prices are dropping due to a slowdown in shipments of consumer electronics products such as PCs and smartphones. As demand decreases memory chips aren’t sold, inventory builds up, and spot prices decrease.

However, runaway capex spend will at the same time increase supply of chips. These supply-demand dynamics apparently weren’t carefully monitored by memory companies. The consumer electronics products have numerous semiconductors in their circuits such as microprocessors and microcontrollers, yet there is no apparent slowdown in these devices, as illustrated in Chart 1 above.

Micron pre-announced its August quarterly financials on Aug. 9, 2022. It should provide analysts/investors/traders some visibility on Thursday. According to the company’s 8-K and signed by Mark Murphy, Executive Vice President and Chief Financial Officer:

“Recently, due to macroeconomic factors and supply chain constraints, we have seen a broadening of customer inventory adjustments. As a result, our expectations for CY22 industry bit demand growth for DRAM and NAND have declined since our June 30, 2022 earnings call, and we expect a challenging market environment in FQ4 22 and FQ1 23.

To address the near-term environment, today we are announcing new FY23 wafer fab equipment (WFE) capex reductions adding to the WFE capex reductions discussed in our June 30 earnings call, and now expect FY23 total capex to be down meaningfully versus FY22.”

A year earlier during Micron’s company’s Q4 2021 earnings call on September 21, 2021, Sanjay Mehrotra, President and Chief Executive Officer of Micron, noted:

“Given prudent industry capex and very lean supplier inventories, we expect healthy industry supply-demand balance and robust profitability for both DRAM and NAND in the year. Fiscal year ’22 DRAM equipment capex for manufacturing will decline from fiscal year ’21, as we benefit from the capital efficiency of our mature 1-alpha node. For fiscal year ’22, our bit supply growth will be achieved through node transitions alone, as we are a few years away from needing wafer start additions to keep up with the industry demand.”

In less than a year, the memory market plummeted. Did Micron follow its plans that “fiscal year ’22 DRAM equipment capex for manufacturing will decline from fiscal year ’21?”

Micron’s fiscal year ’22 ended on September 1, 2022. I estimate that for CY 2022, Micron’s:

- Memory capex will increase 12% in 2022,

- DRAM capex will increase 22% in 2022 following a -14% change in 2021

- NAND will be flat YoY in 2022 after increasing 110% in 2021.

DRAM Analysis

Certainly a 22% increase in DRAM capex in CY 2022 is far from being a “decline” in FY 2022, as Mehrotra stated, although to be fair, MU’s FY 2022 ended four months earlier that its CY 2022. Also to be fair, capex is a moving target, and decisions made at the beginning of the year often change.

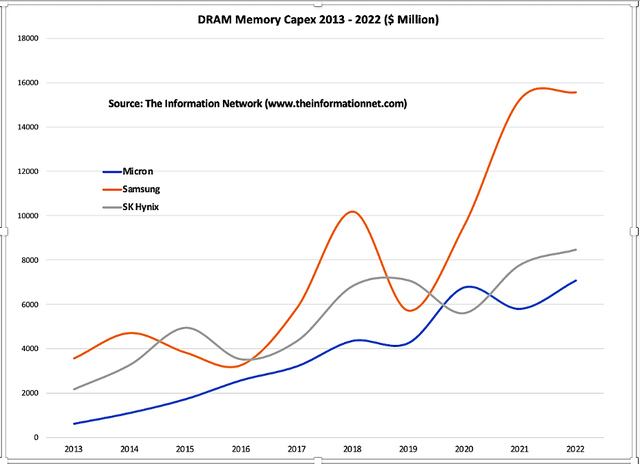

In Chart 4, I show DRAM capex spend between 2013 and 2022 for Micron and competitors Samsung Electronics (OTCPK:SSNLF) and SK hynix (OTC:HXSCL). In fact, Samsung’s capex is 60% greater than the peak in 2018 and the DRAM crash in 2019.

Samsung’s high DRAM capex spend is associated with the move to EUV lithography for its DRAMs. I discussed this approach by Samsung (and SK hynix) in my October 22, 2019, Seeking Alpha article entitled “Micron: DRAM Technology Leadership As Samsung And SK Hynix Push Out EUV.”

The Information Network

Chart 4

Ben Suh, Executive Vice President, Investor Relations of Samsung Electronics, said in the company’s recent earnings call:

“Compared to last year, capex for the year is likely to increase slightly as we plan to preemptively invest in infrastructure and leading technologies to ensure readiness for the mid to long term demand and strengthen our technological competitiveness.

Also, to give you some more color on our capex spending this year, as you know, we were the first to adopt EUV in DRAM, starting from 50 nano, and we have been rolling out EUV, going full EUV to advance nodes. And that is one of the reasons why we have a relatively large equipment capex size. And on top of that, we have been going through a large scale infrastructure investment in P3 and P4, and that explains why our CapEx this year has increased versus the previous year.”

According to Chart 4, Samsung intends to spend $15.5 billion in DRAM capex in 2022, approximately the same as in 2021. If we assume that capex is approximately equally divided between equipment and fab structure, then about $7.75 billion will be spend on equipment.

As Ben Suh stated that efforts were directed at EUV without increasing bit growth, then $7.75 billion will be spent for equipment to set up an EUV DRAM product line.

My analysis shows that between 2018 and 2021, Samsung installed seven EUV systems compared to five EUV systems for SK hynix – a similar number. Yet in 2021 and 2022, Samsung’s DRAM capex spend is 2X that of SK hynix. Also, SK hynix’ DRAM capex spend is only 1.25X that of Micron, which has purchased EUV systems but are in development, not production. Nevertheless, EUV tech migration by Samsung and SK hynix is driving capex increases. But it’s possible little is going into production, possibly due to low yields.

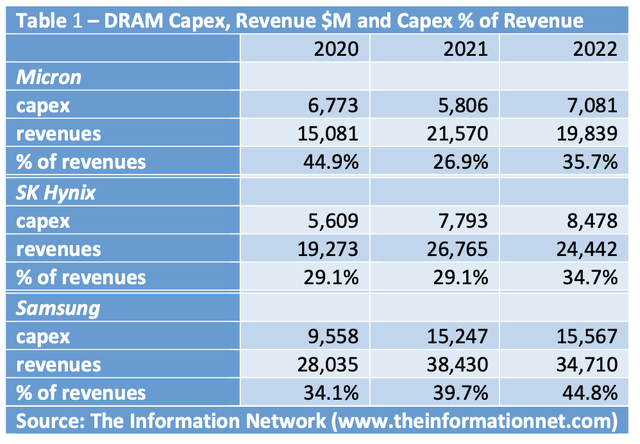

Table 1 shows DRAM capex spend as a percentage of revenues for the three companies for 2020-2022. Micron cut capex in 2021 only to increase it in 2022. Samsung’s increase in 2021-2022 was because the EUV tech migration increased the ratio of capex to revenue to 44.8%.

The Information Network

Investor Takeaway

At the beginning of this article, I raised the question as to why memory chips were significantly impacted by the falloff in demand for consumer electronics products more than suppliers of other types of chips.

The answer to that question is that memory company executive companies seemingly have short memories. The reason for the memory crash in 2019 was because of excessive capex spend in 2017 and 2018, and this clearly apparent in Charts 3 and 4. All through 2017 and 2018 I wrote numerous Seeking Alpha articles pointing to this problem will no avail.

Now that they repeated their mistake, to counter oversupply and high inventory, memory companies have talked about plans to reduce capex spend (combination of construction and equipment). Significant capex cuts on memory expansion by Micron and SK hynix will negatively impact Applied Materials (AMAT) and Lam Research (LRCX), according to our report entitled “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts.“

- Micron indicated it would reduce 2023 capex by 30%, which includes 50% equipment and 50% building, which would imply a 15% cut in equipment. But MU is actually cutting back WFE equipment purchases by 50% in fiscal 2023, a significant impact on equipment suppliers to the company.

- SK hynix announced in late October it plans to reduce its investment next year by more than 50 percent due to poor demand in memory chip business. The move comes after the company’s third quarter operating profit fell to 1.7 trillion won ($1.2 billion), missing analysts’ estimates of 1.87 trillion won. Revenue fell 7 percent to 11 trillion won.

- Samsung electronics has no plan to cut dram output artificially or adjusting capex. Samsung plans a semiconductor capex spend of 54 trillion won, of which 47.7 trillion won ($38.5 billion) of which 33 trillion won (29.1 trillion won for semiconductors) has been spent so far in 2022. In its 3Q earnings call, the company noted that:

“Demand is expected to weaken due to large inventory adjustments at corporate customers, but data centers are expected to expand investment next year. We do not consider making an artificial production cut, as we need to prepare for a demand recovery from a mid- to long-term perspective.”

Memory prices are dropping due to a slowdown in shipments of consumer electronics products such as PCs and smartphones. As demand decreases memory chips aren’t sold, inventory builds up, and spot prices decrease.

However, runaway capex spend will at the same time increase supply of chips. These supply-demand dynamics apparently weren’t carefully monitored by memory companies. The consumer electronics products have numerous semiconductors in their circuits such as microprocessors and microcontrollers, yet there is no significant slowdown in these devices, as illustrated in Charts 1.

Some of the factors responsible for the memory crash deal also with capex spend by SK hynix and Samsung. However, I pointed out in recent articles that Micron was late in identifying a slowdown in consumer electronics products, which the TSMC chairman Mark Liu had identified three months earlier. I also pointed out Micron’s shares plummeted because of it poor guidance that was not updated as the downturn took effect. Because of significant mistakes by MU management, I rate Micron a Hold.

Readers can access this analysis in my July 18, 2022 Seeking Alpha article entitled “Post-Micron Earnings Call: What Samsung’s Pre-Announcement Tells Us.”

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This free article presents my analysis of this semiconductor sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.