Summary:

- Micron Technology, Inc. reported fiscal Q1 2023 earnings and announced cost-cutting measures.

- Macroeconomic trends are still a drag.

- Investors should weather the storm for brighter days.

MF3d

Chipmaker Micron Technology, Inc. (NASDAQ:MU) has been under pressure from an “unprecedented” market downturn this year. Although the valuation metrics are starting to look good for Micron, I believe the stock can still see further downside. Despite that, I think that the long-term outlook is promising for the company and I will detail my thoughts here.

Micron releases first quarter 2023 results

Micron released its first quarter 2023 earnings results this week. The company delivered revenue of $4.09 billion versus $6.64 billion for the previous quarter and $7.69 billion for the same period last year. This led to a GAAP net loss of $195 million. Operating cash flow also suffered, with $943 million being much lower than the $3.78 billion in the previous quarter and $3.94 billion for the same period last year.

The company did deliver record annual revenue for fiscal 2022, but it continues to struggle in the current macro environment, which has been hard for chipmakers. Micron has moved to cut supply in recent quarters to match declining demand and it has also committed to cost-cutting across the business.

“Micron delivered fiscal first-quarter revenue and EPS within guidance ranges despite challenging conditions during the quarter,” said President and CEO Sanjay Mehrotra:

“Micron’s strong technology, manufacturing, and financial position put us on solid footing to navigate the near-term environment, and we are taking decisive actions to cut our supply and expenses. We expect improving customer inventories to enable higher revenue in the fiscal second half, and to deliver strong profitability once we get past this downturn.”

Macroeconomic outlook and sector trends are still negative

Micron also announced on Wednesday that it was cutting its workforce by 10%, and will continue to cut costs in the year ahead due to the negativity hitting the semiconductor market. The latest news marks a cut of around 5,000 staff in the coming year.

Management said that another loss of 52 cents to 72 cents a share is expected in Q2, with revenue at $3.6B to $4B. Micron said that “over the next few months” it expects:

“gradually improving demand trends for memory as customer inventory levels improve further, new CPU platforms are launched, and China’s demand starts to grow as its economy reopens.”

However, the company warned that “industry profitability will remain challenged” in 2023.

Chief Executive Sanjay Mehrotra said that the company will be able to “deliver strong profitability once we get past this downturn.”

It has been a rollercoaster for chipmakers in the last two years as consumer electronics companies struggled with shortages during the pandemic and ramped up demand. Note that demand has fallen off a cliff as shipping and materials costs rise, while recession worries force cost-cutting in the tech industry. Companies that built up strong inventories over the last two years have chosen to reduce orders and use that inventory.

The next headwind has been export restrictions from the U.S. government, which is pressuring firms to stop shipping cutting-edge chips to Chinese companies.

My own thoughts resonate with the current macro outlook. The company’s stock price may be dragged lower in the first half of the year, but a China reopening could be the fuel for a rebound in the stock, possibly as early as Q2. Many analysts are torn on the outlook for corporate earnings in early 2023, but Micron is in a sector that is under pressure and could be one of the strugglers if the overall market moves lower.

I would be bullish on Micron if the stock falls further. However, there are risks involved in the bullish thesis. The decline in revenues is cutting into cash flow, and there is a risk of an escalation in tensions between China and Taiwan, which could lead to further pressure from the U.S. government on suppliers.

Deutsche Bank recently downgraded Micron and said: “We believe investor optimism that the business will soon reach a cyclical trough now looks premature.” Analysts expect book value to decline between 5% and 10% over the next few quarters. That is what I would also expect with further downside as we get closer to a trough in the memory market.

Companies can only tap inventories for so long and will have to come back to the market for new supplies. The reduction in CAPEX and supply across the industry could ultimately lead to a squeeze in chip supply down the line.

Valuations and long-term outlook are positive

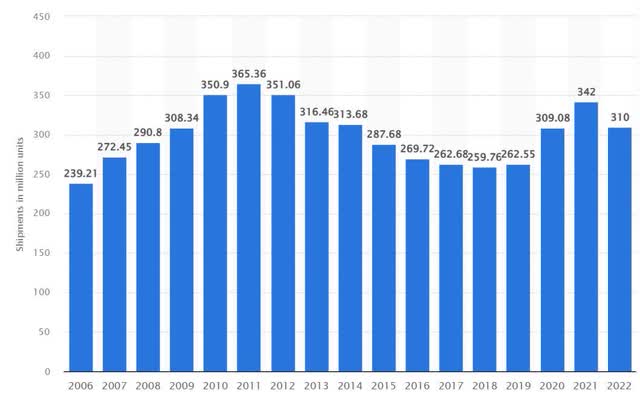

One area that has been a negative for Micron recently has been a slowdown in the PC market. However, the PC market was already in a decline and was artificially pumped up by the demand for home offices during the pandemic lockdowns.

PC demand could continue to fall back to the 2019 levels around the 260 million unit mark. But this is being driven by increased usage of mobile devices, and Micron still benefits.

Investors should look beyond PCs and Micron is growing a market-leading position in electric vehicles.

“Artificial intelligence, cloud computing, electric vehicles, and the ubiquitous connectivity offered by 5G are strong long-term demand drivers for memory and storage,” said the CEO in the full-year results.

“In fiscal Q4, our automotive business delivered another record revenue quarter, and fiscal 2022 auto revenues grew 30% year over year, setting a new all-time high,” he added.

Micron is building a strong product portfolio, and its data center and graphics revenue grew by approximately 35%, while auto, industrial, and networking revenue grew by 40%. The revenue mix from these products grew from around 45% of total revenue in 2021 to 52% in 2022. The company has set a target of 62% by fiscal 2025.

The company also has a strong balance sheet in place for when the market storm clears up:

“Our balance sheet is rock-solid with strong liquidity, low leverage ratio, and a net cash position. We ended fiscal 2022 with $13.6 billion of liquidity, exceeding our mid-30s percentage of revenue target. Fiscal Q4 ending cash and investments were $11.1 billion, and total debt was $6.9 billion,” CFO Mark Murphy said.

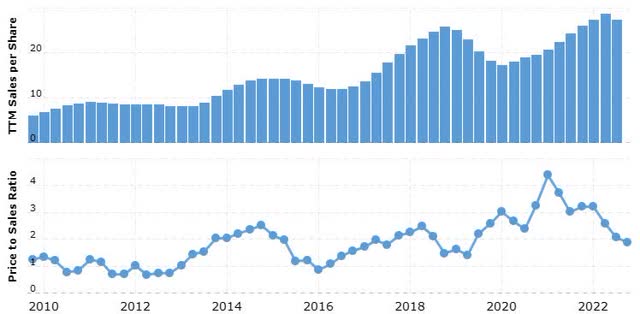

On the valuation side, Micron is currently trading at a price-to-earnings ratio of 6.55x with a forward P/E of 16x. The current price-to-sales is 1.80x and that is near historical lows.

P/S Ratio Micron (Macro Trends)

If the price of Micron does continue to slip, then a P/S ratio near the 1.00 level is a strong buying opportunity historically.

Conclusion

Micron Technology has seen mixed fortunes since the pandemic with soaring demand for chips that hit a brick wall due to inflation and supply chain issues. The company is cutting costs and production to counter the gloom as analysts look for a bottom in the memory market. Investors should capitalize on this weakness in Micron Technology, Inc. stock, as the valuation metrics are becoming very attractive and the company is positioned for growth in the future as a market leader in the EV market. That could also buffer the company from any China-related supplier pressure from the U.S. government.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My Global Markets Playbook Marketplace service can save investors from the common investment mistakes that are driven by psychology. My technical analysis, proprietary timing model, and sentiment studies can help you time the markets better and hang onto valuable capital. Sign up now for a 14-day free trial to the service and join us in 2023.