Summary:

- Micron’s recent insider trading is completely dominated by selling, and you will see why I agree with the insiders’ decisions.

- Micron’s valuations have become ahead of the fundamentals, with overly optimistic growth projections.

- The growth rate of 7.8% projected by the market is too high given its historical ROCE and reinvestment rates.

- The current valuation offers no margin of safety even if the projected growth does materialize.

Vladimir Zakharov

Thesis

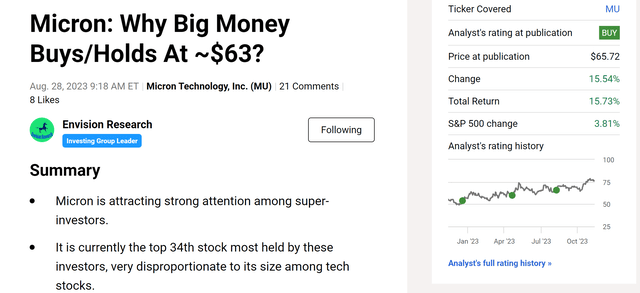

Readers familiar with my writings know that I have been a long-term bull on Micron (NASDAQ:MU). Moreover, it has also been attracting attention among super-investors, as detailed in my recent article (see the chart below). Back in August 2023, MU was the top 34th stock most held by super investors tracked by Dataroma, a very prominent spot if you can consider its market cap.

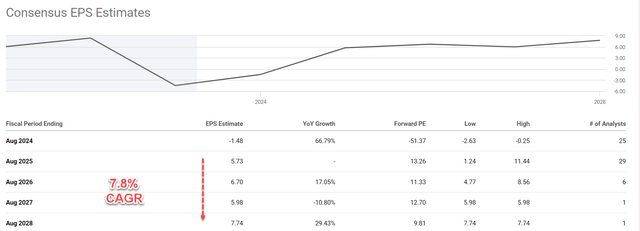

However, at that time, the stock was trading at around $66 per share. Given such large price advancements since then, the thesis of this article is to argue that the valuations have become ahead of the fundamentals. In the remainder of this article, I will argue why I disagree with the market’s forecasts, especially the expected growth curve ahead (as shown in the next chart). To wit, consensus estimates are pretty rosy, projecting 7.8% annual growth in the next 4 years between FY25 and FY28 (a projected EPS of $5.73 in FY25 vs. $7.74 in FY28).

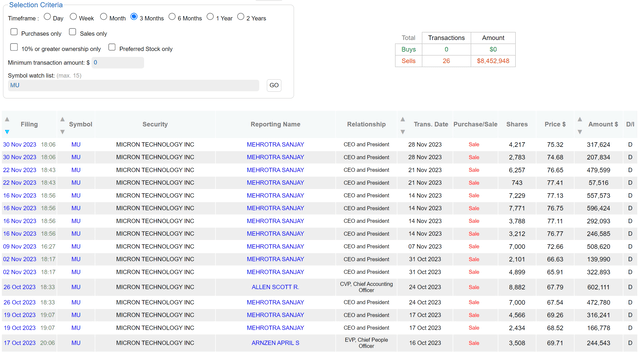

Against such a rosy expectation, its recent insider transactions have been all selling activities as you can see from the chart below. To wit, in the past 3 months, a total of 26 insider activities have been reported and all 26 were selling activities. All told, these activities totaled more than $8.4M. In the past month alone, its CEO sold a series of batches, mostly in a price range of around $75~$76.

Next, I will explain why I agree with the insiders that this is a good price range to sell.

A 7.8% growth rate is overly optimistic

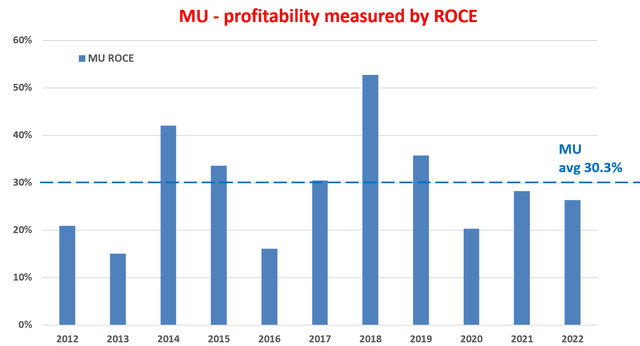

As aforementioned, I disagree with the market’s projection of its growth rate ahead. Surely, I see growth potential ahead despite the stock’s highly cyclical nature (which was a good reason why I was bullish on it). My projection of its long-term growth rate is based on its average return on capital employed (“ROCE”) in the past and also its recent reinvestment rate. The next chart shows its ROCE, which has been averaging 30.3% in the long term (say over 1~2 business cycles). In terms of reinvestment rate, the company has been reinvesting around 7%~10% in the past on average. There are reasons to be more optimistic about going ahead given the CHIPs act and also the possibility that the current contraction phases of its cycle may be over soon (or already). However, even assuming a 15% reinvest rate, the growth rate would be around 4.5%, far lower than the consensus estimates of 7.8%.

Valuation is no longer cheap

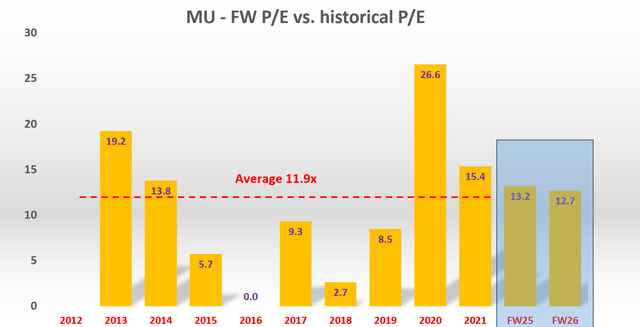

Another reason that I have been bullish in the past was its very decompressed valuation during the past ~2 years or so. But under current conditions, the valuation has largely been renormalized already. If you recall from the first chart in the article, its current stock price implies a P/E of 13.2x based on its FY2 EPS and 12.7x based on its FY3 EPS, respectively.

To contextualize these multiples, the next chart shows its annual average P/E multiples in the past 8 years (roughly ~2 business cycles). As seen, the average P/E is about 11.9x. That is, even if the stock grows its EPS at the expected 7.8%, its implied P/E still offers no margin of safety under current conditions.

Other Risks and Final Thoughts

Besides the above risks, there are a few other risks, both in the downside and upside direction, that are worth mentioning.

First, the stock faces considerable geopolitical risks. For example, the Cyberspace Administration of China (CAC) recently decided to ban MU products, representing a big challenge to a key market. Of course, such policies could uncertainly change in the future.

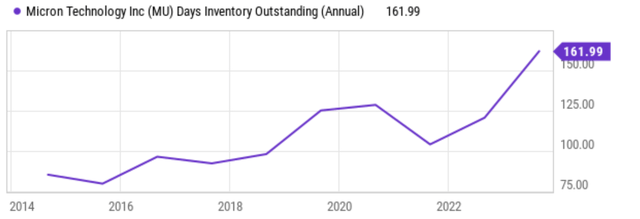

Second, the company still sits on a large inventory (see the next chart below). I could see a possible scenario where its inventory situation gradually improved from here on. There are some signs that some markets (e.g., mobile) are entering a better condition and demand growth could resume to ease the hoarded inventory. However, for now, I am seeing risks of high inventory and oversupply in the sector in general, which could keep pressuring prices and margins. At the same time, a high inventory also creates balance sheet risks.

On the upside, the company has a strong balance sheet. It has plenty of liquidity and working capital. At the same time, it generates significant cash flow even during the contraction phase of the business cycle. The company has been investing in new technologies continuously, such as 3D NAND and EUV lithography, which may start bearing fruit and help to gain market share in the semiconductor sector.

Looking further out, there are a few secular catalysts afoot, with the most notable two being the adoption of 5G technology and the increasing demand for artificial intelligence (AI). 5G networks require more sophisticated semiconductors than 4G networks, and Micron is well-positioned to supply these chips. Similarly, as AI technologies become more widely adopted, Micron’s memory chips, as essential components of AI systems, could enjoy a secular tailwind.

Although my overall conclusion is that in the near term (say the next 1~2 years), the downside risks outweigh the upside risks. To me, many of the upside risks (new technologies and futuristic applications) have a more speculative flavor than the downside risks. To recap, the key downside risks analyzed in this article are twofold. First, I am suspicious about the market’s growth projection considering its ROCE and reinvestment rates. Second, the current valuation leaves no margin of safety even if the market’s growth projection does materialize.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

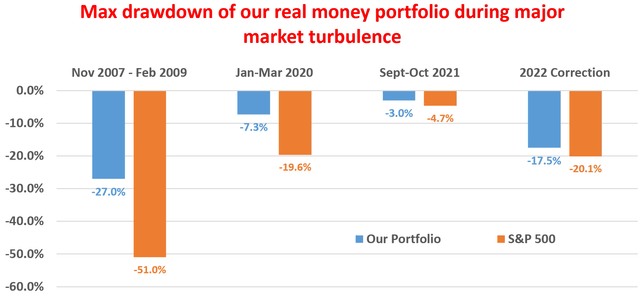

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.