Summary:

- Micron Technology, Inc. shareholders are pre-emptively celebrating that perhaps the worst is over.

- China represents a major risk to the company and a potential boon for its competitors hurting its market share.

- The company argues that the worst is over, but that doesn’t mean it won’t keep losing more money.

- Even counting bull markets, the company’s shareholder returns are nowhere near enough to justify its valuation.

hapabapa

Micron Technology, Inc.’s (NASDAQ:MU) share price increased to almost $70 per share after-hours as the company announced that losses appeared to be slowing down. That put the company at a market cap of more than $75 billion despite negative free cash flow (“FCF”) each quarter. As we’ll see throughout this article, the volatile cash flow of the company’s portfolio means it’s a poor investment.

Micron Overview

The company has a strong portfolio of assets, but has continued to perform within guidance.

The company managed to beat its strongly negative guidance for margin and EPS with revenue within the company’s guidance. The company is supported by production cuts as pricing trends are improving, and the company thinks that the worst has passed. We do cautiously agree with that sentiment, minus the risk of China (discussed below).

The company expects calendar 2025 will lead to a record market, which is likely true, but also indicates that 2024 will be another year of relatively weakness, even if earnings aren’t negative. That amount of negative time will need to eventually be made up to customers.

Micron China

The company maintains massive risk.

China and the United States are in the process of cutting each other out of the other one’s life. The Biden administration is concerned about China’s increased influence and authoritarian nature. China is trying to maintain the status quo that’s helped it so much. Micron, given the commodity nature of its products and U.S. headquarters, represents a strong retaliatory decision.

Micron earns 25% of its revenue from China and estimates that half of that remains at risk. The commodity nature of the markets means that the company can potentially redirect products not sold elsewhere, and the company expects to retain worldwide market share. However, in an oversupply market, this could quickly hurt market prices outside of China.

Optimistically, an immediate double-digit increase in the non-U.S. oversupply would delay a recovery in those markets substantially. Pessimistically, the company will see a long-term / permanent reduction in prices.

Micron Market Outlook

Micron has drastically reduced its expectations for growth but still sees growth potential.

The company expects single-digit growth in both DRAM and NAND, both below long-term expectations. The company does expect some recoveries into the 2H of the year, but again well below the long-term potential. The company expects supply growth to be negative, which is exciting to see for profitably, but it needs to continue keeping production growing into 2024.

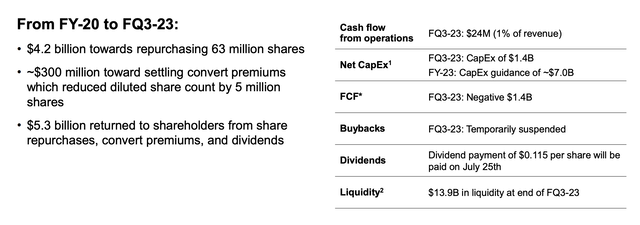

The company is working to reduce supply dramatically. Its guidance for capex is $7 billion in 2023, down 40% from last year. WFE is down more than 50% and 2024 is expected to be down again YoY. Again, there’s weakness to be seen here. The company’s capex is $1.8 billion / quarter in 2023 and $2.5 billion / quarter in a normal market.

That hurts the company’s FCF long-term. Its CFFO was $24 million in the last quarter and it still has to spend this capital on top of that. That puts the company in a tough position.

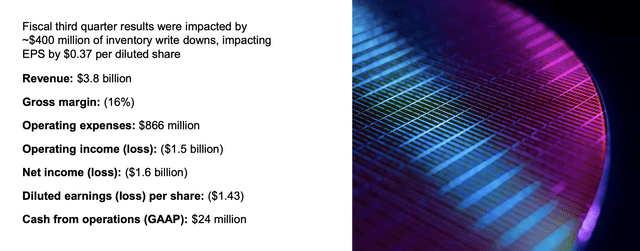

Micron Quarterly Performance

The company’s quarterly performance for the company was incredibly weak.

The company earned $3.8 billion in revenue with almost $900 million in operating expenses. The company’s operating income was a $1.5 billion loss and net income was a $1.6 billion. That still means the company only has roughly 7 quarters of runway. CFFO was $24 million which was then impacted by capital spending pushing FCF to -$1.4 billion.

It might be the worst quarter overall, but we expect next quarter FCF to be similarly negative, something that impacts the company dramatically and needs to be eventually made up.

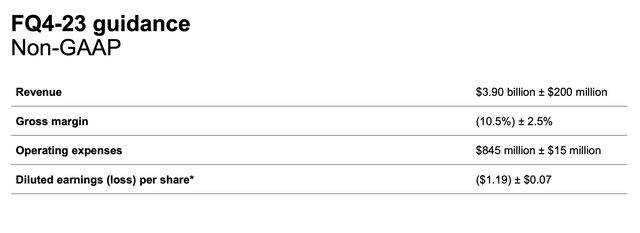

Micron Guidance

The company’s guidance shows that perhaps the worst financially is over, but guidance remains weak.

The company expects $3.9 billion in revenue at the midpoint, just a hair above this last quarter. Gross margins are expected to improve some to -10.5%, with operating expenses down just a few %. That indicates that perhaps the worst is over. However, even then, the company’s guidance is incredibly weak from a financial perspective.

The company is expecting a diluted loss per share of just under $1.2 / share. That continued weak guidance, when as we’ve seen before the company can’t perform well in a bull market, makes it a poor investment.

Micron Bull Market Performance

Micron’s historic performance during a bull market shows that there’s much to be desired.

The company spent $4.2 billion towards repurchasing 63 million shares, our just under $66.7 / share. That’s roughly around current prices. The company also spent $300 million towards reducing the diluted share count by 5 million shares. It’s worth noting that the company’s outstanding shares only reduced from 1.13 billion shares to 1.09 billion shares.

That’s because of continued share issuance to employees, which wiped out ~20 million of those repurchases. Overall, the company returned $5.3 billion to shareholders, a single-digit return across multiple years combined. That’s incredibly weak given that it included one of the company’s strongest periods. It shows even performance in a strong market doesn’t justify overall performance.

Given that the company is in the midst of a tough transition period, there’s no guarantee that it’ll improve from negative FCF anytime soon. For now, all the company is giving shareholders is a single-digit dividend.

Thesis Risk

The largest risk to our thesis is that DRAM / NAND are commodities, and in times of shortage, ramping volume is incredibly tough. That means incredibly high profits, and as the industry consolidates that’s more likely. That could enable higher shareholder returns for longer, making Micron potentially a better investment.

Conclusion

Micron investors might be celebrating that the worst is over. However, the worst being over doesn’t mean that the company is all of a sudden on the path to generating strong shareholder returns. The company still earned -$1.5 billion in FCF, and that’s still including a substantially reduced capital spending from “the good times.”

Micron has specific risk from China that could potentially have a double-digit impact on revenue. Best case, it’d delay the recovery of the markets outside of China dramatically. The company needs billions in positive FCF per year, post capital spending to justify its valuation, and it doesn’t have a path for that, making Micron Technology, Inc. stock a poor investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.