Summary:

- Our previous Hold rating has not panned out well, with Micron already running away by +44.2%, well outperforming the wider market at +4.5%.

- It is apparent that we have underestimated the bullish support surrounding the stock thus far, as the management also won the HBM3E contract for NVDA’s next few launches.

- Perhaps this is why MU continues to report excellent FQ2’24 earnings while offering a promising FQ3’24 guidance and intensifying its long-term capex plans.

- Despite so, the stock has pulled forward much of its upside potential and does not offer a compelling dividend investment thesis.

- With much of the premium already baked through 2026, we do not believe in chasing MU stock at these inflated levels.

Klaus Vedfelt

We previously covered Micron Technology (NASDAQ:MU) in January 2024, discussing why Mr. Market continues to reward the stock with the premium valuations, attributed to the refreshed PC replacement cycle and potential tailwinds from generative AI.

While we had concluded that the stock was likely to trade sideways over the next few quarters (if not years) as it grew into its pulled forward upside potential, we had been very wrong indeed, as it further rallied by +44.2%, well outperforming the wider market at +4.5% since then.

It is apparent that we have underestimated the bullish support surrounding the MU stock thus far, as the management won the HBM3E contract for Nvidia’s (NVDA) next few launches.

Despite missing out on the great upside ride thus far, we maintain our belief that MU does not offer any more upside potential at current levels, with most of the optimism already baked in through 2026.

We maintain our Hold rating.

The Memory Investment Thesis Has Bottomed Indeed, Though MU Is Overly Inflated Here

For now, MU has reported a double-beat FQ2’24 earnings call, with revenues of $5.82B (+23% QoQ/ +57.7% YoY) and adj EPS of $0.42 (+114.2% QoQ/ +121.9% YoY).

With the memory market bottoming by Q1’23 and gradually recovering over the past four consecutive quarters, it is apparent that the management’s capacity tightening has worked as intended, with Samsung (OTCPK:SSNLF) reporting a similar uptrend thus far.

The same has been reported by Western Digital (WDC), “with supply shortage observed both in HDD and SSD as demand exceeded expectations” and the supplier opting to adjust prices upwards by up to +20%.

These are promising developments indeed, further aided by the fact that storage is a critical part of the generative AI trend, which requires immense “storage solutions that can handle vast volumes of data, deliver high throughput, offer low-latency access, and store data securely.”

For example, NVDA’s H200 Tensor Core GPUs will come with MU’s 24GB 8H HBM3E, with the recently unveiled next-gen Blackwell GPU architecture-based AI system, B100, also featuring MU and SK Hynix as the memory supplier.

This is on top of the increasing HBM3E content by +33% per GPU for the B100, further demonstrating why MU has largely benefitted from this new super cycle.

With data center server unit shipments expected to grow by mid to high single digits in 2024, driven by the insatiable generative AI demand, it is unsurprising that the MU management has offered a promising FQ3’24 earnings guidance, with revenues of $6.6B (+13.4% QoQ/ +76% YoY) and adj EPS of $0.45 (+7.1% QoQ/ +131.4% YoY) at the midpoint, further aided by the easier YoY comps.

The same optimism has also been reported by NVDA, based on the next quarter revenue guidance of $24B (+8.5% QoQ/ +233.7% YoY) and Super Micro Computer (SMCI) at $3.9B (+6.5% QoQ/ +204.6% YoY) at the midpoint, against the consensus estimates of $21.9B (-0.9% QoQ/ +204.5% YoY) and $2.99B (-18.3% QoQ/ +133.5% YoY), respectively.

These developments demonstrate that the demand for storage in data centers may remain healthy moving forward, with it likely to digest MU’s elevated inventory levels of $8.44B (+2% QoQ/ +0.7% YoY/ +65.1% from FY2019 levels of $5.11B) as of FQ2’24, supporting its long-term recovery.

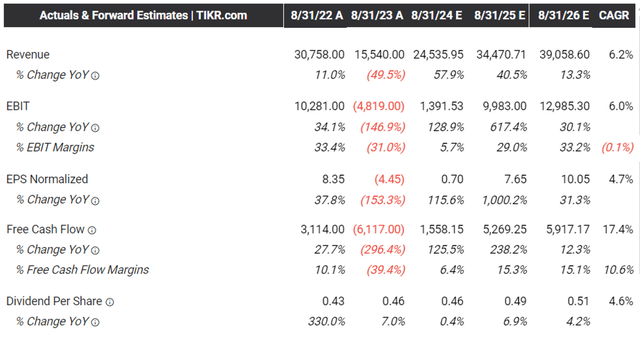

The Consensus Forward Estimates

Tikr Terminal

The same optimism has also been observed in the consensus raised forward estimates, with MU expected to record an accelerated top/ bottom line recovery at a CAGR of +6.2%/ +4.7% through FY2026.

This is compared to the previous estimates of +0.6%/ -5.3%, while building upon the historical expansion at +16.3%/ +127.6% between FY2016 and FY2022, respectively.

With the US government recently confirming the $39B in CHIPs Act Subsidies, with MU likely to obtain $5B in subsidies, we believe that the memory market headwinds are behind us indeed.

This is further aided by ASML’s promising FQ4’23 earnings report, with the lithography equipment producer highlighting a growing Memory booking share of 47% (+27 points QoQ/ +13 YoY) at approximately €4.32B (+730.7% QoQ/ +101.8% YoY).

This is against Logic at 53% (-27 points QoQ/ -13 YoY) at approximately €4.87B (+134.1% QoQ/ +17.3% YoY), further underscoring MU’s renewed investment cycle to “support the R&D and CapEx investments needed (in China, India, Japan, and the US) for long-term innovation and supply growth.”

With its HBM capacity also fully sold out in 2024 and overwhelmingly allocated in 2025, we can understand why the market is increasingly optimistic about MU’s near-term prospects as we enter the next cloud super cycle.

So, Is MU Stock A Buy, Sell, or Hold?

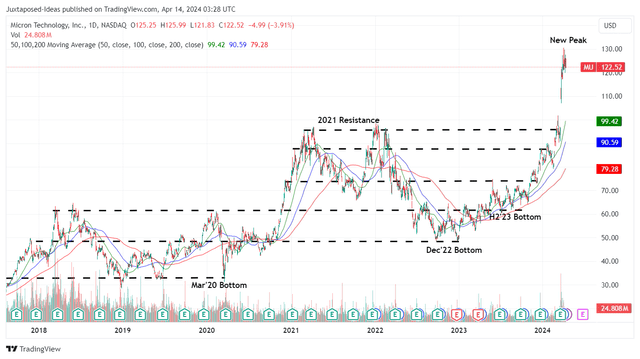

MU 6Y Stock Price

Trading View

For now, MU has already charted a nearly vertical upward climb by +27.2% after the recent FQ2’24 earnings call, while hitting new heights and running away from its 50/ 100/ 200 day moving averages.

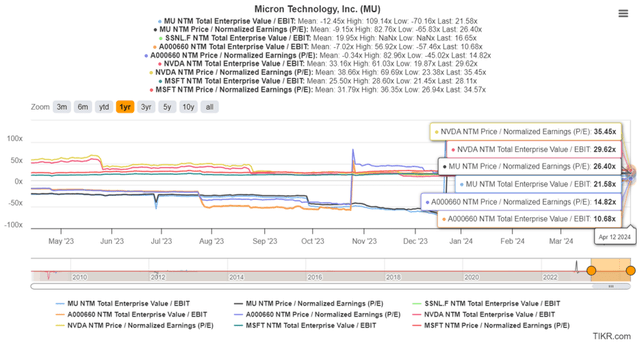

MU Valuations

Tikr Terminal

Just when we thought that MU was overvalued at FWD EV/ EBIT valuations of 42.82x and FWD P/E valuations of 48.68x in the previous article, the market had finally moderated its valuations to 21.58x/ 26.40x by the time of writing, though still elevated from the 5Y FWD mean of 14.85x/ 13.39x, respectively.

These numbers bring MU nearer to the generative AI market leader, Nvidia (NVDA), currently trading at 29.62x/ 35.45x and Open-AI’s partner, Microsoft (MSFT), at 29.63x/ 36.06x, respectively.

Then again, with MU still trading above its South Korean memory peers, namely SSNLF at 12.33x/ 37.43x and SK Hynix at 10.68x/ 14.82x, respectively, it is apparent that the former is still rather expensive here.

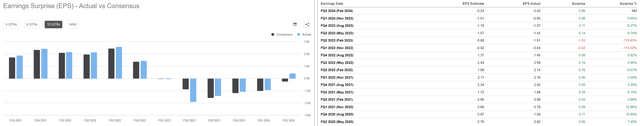

MU’s Lumpy Earnings

Seeking Alpha

Given the semiconductor demand headwinds and the memory correction over the past two years, MU’s earnings have been rather lumpy with an adj FY2024 EPS estimates of $0.70 (+115.6% YoY)

Even so, based on the consensus FY2026 adj EPS of $10.05 and the 5Y P/E mean of 13.39x, there seems to be a minimal margin of safety to our long-term price target of $134.50 for now.

Lastly, with MU already hitting a new peak in stock prices, it does not offer a compelling dividend investment thesis, based on the forward yield of 0.38%, compared to the sector median of 1.38% and the US Treasury Yields of between 4.52% and 5.38%.

As a result of the uncertain investment thesis, we prefer to continue rating the MU stock as a Hold here. Do not chase this over the cliff.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA, ASML, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.