Summary:

- Consumer electronics market is starting to sequentially grow, providing a significant tailwind for Micron.

- Memory chip market has entered a phase of sequential growth as a result of CAPEX cuts, AI datacenter demand, and growing consumer electronics demand.

- Micron’s valuation is undervalued, with a reasonable forward price-to-earnings ratio compared to industry peers.

JHVEPhoto

Introduction

In my previous article, I had a buy rating on Micron (NASDAQ:MU). At the time, my bullish thesis revolved around two main reasons. First, there were initial signs of consumer electronics demand recovery, which could positively impact Micron through a recovery in the memory chip demand. After a subdued demand environment throughout 2023, consumer electronics vendors were starting to see positive year-over-year growth at the time of writing. Further, signs of memory chip market recovery were starting to take shape after the memory chip makers including Micron aggressively cut the CAPEX.

Today, I continue to stand by this reasoning supporting the bullish view, and I am maintaining a buy rating on Micron as there have been clear indications that the consumer electronics demand has entered a sequential growth phase of the market cycle along with the memory chip market after over a year of subdued growth and contraction. Further, despite a significant stock price increase since the publication of my previous article, I believe that Micron’s valuation is still undervalued. Therefore, I am maintaining my buy rating on Micron.

Consumer Electronics Market Growth

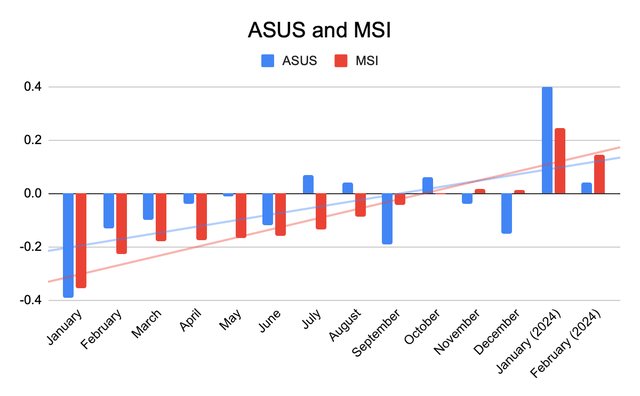

Consumer electronics demand has been attempting to recover for the majority of 2023. In my previous article, I argued that the consumer electronics market is seeing signs of recovery as the year-over-year growth figures for ASUS and MSI, a consumer electronics provider, became positive after an entire year, 2023, of a contraction.

Today, the data shows that these companies are not just recovering but started to see sequential year-over-year growth in the early months of 2024. Starting with ASUS, the company saw a year-over-year growth in January and February of 40% and 4%, respectively. MSI saw year-over-year growth in January and February of 24.60% and 14.47%, respectively. These positive figures are a significant improvement from a similar magnitude of contraction in the prior year

I believe the data, as shown in the chart below, tells a clear story. Throughout 2023, the consumer electronics market was contracting leading to the industry players attempting to recover. Today, as the market has finally recovered, the industry players are seeing growth. The implication of consumer electronics market growth provides a significant tailwind for Micron as all consumer electronics devices require a memory chip, a product that Micron provides.

ASUS, MSI

[Chart created by author using source 1 and source 2]

Further, I believe the current growth trajectory could continue for the foreseeable future. The peak demand in consumer electronics happened during the pandemic or around 2021, which was about two to three years ago from today. Consumers, on average, switch phones in about 2.5 years while they switch their laptops in about 4 years. Thus, as we enter 2024 and head into 2025, the consumer electronics market is entering a phase where a massive number of consumers who bought electronics during the pandemic will likely start looking for an upgrade, which could continue the growth trajectory of the consumer electronics market creating a meaningful tailwind for Micron.

Memory Chip Market Growth

As is the case with the consumer electronics market, the memory chip market has likely also entered the phase of sequential growth from the recovery phase that it was in for the entirety of 2023.

In my previous article, I said that the memory chip market environment is improving as the supply and demand imbalance is easing after the significant CAPEX cut imposed by Micron and its industry peers, SK Hynix and Samsung (OTCPK:SSNLF). Today, the market is finally seeing sequential growth.

During Micron’s 2023Q4 earnings report, the company made it clear that the memory chip market is seeing an environment of tight supply not an environment of demand catching up to the supply as it was the case in previous quarters. According to the management team, “Micron drove robust price increases as the supply-demand balance tightened.” The quick turnaround in the supply-demand environment from the previous quarter was a result of AI server demand, a healthier demand environment (consumer electronics), and an implementation of supply reductions. As such, the company is seeing “a positive ripple effect on pricing across all memory and storage end markets” leading to an expectation for a continued price increase throughout 2024 and 2025.

Looking at the company’s earnings report, the message is clear. The memory chip market has been a headwind for Micron throughout most of 2023; however, after supply reductions and return in demand, the company is expecting a significant tailwind going forward in 2024 and 2025.

I believe this argument by the management team to be reasonable. The Memory chip industry is highly cyclical. It is one of the first industries to contract in hard economic times while it is one of the first industries to see recovery in an industry growth environment, and it is the case today that the customer demands are returning. AI investment is picking up, CAPEX cuts place, and consumer electronics demands are returning. Thus, Micron will likely see a significant tailwind for the foreseeable future.

Valuation

Since the publication of my previous article, Micron’s stock price has seen about 24.86% growth, which could raise a concern regarding the company’s valuation. However, I believe Micron’s valuation multiple is undervalued.

Micron currently has a forward price-to-earnings ratio of about 186. On the surface level, if only examining the current forward multiple, the company may seem overvalued. However, the valuation multiple is only high as a result of the company returning to profitability in 2024 from reporting losses due to the market conditions in 2023. Thus, when examining the 2025 forward price-to-earnings ratio, the company’s valuation multiple sits at only about 14.74 while semiconductor industry peer Nvidia (NVDA) and AMD (AMD) have a 2025 forward price-to-earnings multiple of 37.97 and 32.77, respectively.

Beyond comparing the forward valuation multiple relatively, it is evident that Micron’s current valuation is reasonable. As discussed earlier in the article, the company is expecting a significant industry tailwind. Consumer electronics demand and memory chip market is showing signs of sequential growth after a period of market contraction. Therefore, I believe Micron is undervalued today.

Risk to Thesis

Amid a record boom in AI stocks in the past several months, many investors are concerned that some aspect or sections of the boom is a bubble. A significant portion of the AI boom may be backed by a real demand and business case; however, if it is the case that some sectors of the boom are a bubble leading it to burst, negative rhetoric in the market could be created causing the valuation multiple of some of the companies exposed to the AI investment to contract. While Micron’s management team has not identified the exact quantifiable impact AI data center demand had on the company, it is clear that Micron saw a significant benefit from this investment. As such, if it is the case that some aspects of AI investments are a bubble. Micron’s stock price could see a significant fluctuation.

Summary

Micron is expecting a strong tailwind going forward. The consumer electronics market has evolved from seeing signs of recovery to seeing signs of sequential growth with an expectation for this trajectory to continue for the foreseeable future as the replacement demand from pandemic purchases starts. Further, as a result of CAPEX cuts, AI data center demand, and an increase in consumer electronics demand, memory chip prices have also started to see signs of sequential growth from a recovery phase providing a significant tailwind for Micron. Therefore, I believe Micron is a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.