Summary:

- Wall Street analysts now love Micron stock.

- Micron is expected to benefit from the AI revolution and increased demand for its memory products.

- I will argue it is near/at its cyclical high under current conditions, judging by the stock price advancements and revenue growth.

- MU has historically experienced cyclical patterns of rapid growth followed by deep corrections, and I expect the same this round, too.

justhavealook

Wall Street loves MU now

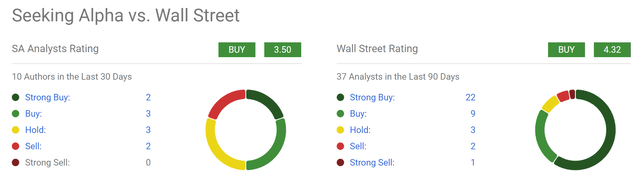

Wall Street now loves Micron (NASDAQ:MU) stock. The chart below summarizes the sentiment on MU between Seeking Alpha writers and Wall Street analysts. As seen, Seeking Alpha writers are already pretty bullish on the stock, giving it an overall rating of 3.5. Wall Street is even more bullish. Of the 37 analysts who wrote on it in the past 90 days, 22 of them recommended Strong Buy (i.e., 61% of them). Their overall rating is 4.3x.

Of course, there are good reasons for Wall Street’s enthusiasm (and Main Street’s too). There is wide anticipation that MU would benefit from the ongoing AI revolution. Demand for its Dynamic Random Access Memory (“DRAM”) and NAND products is expected to grow and propel the company’s bottom line. Moreover, Micron is lining itself up to benefit from the AI explosion, as additional memory content will be needed in the use of more AI operations. Micron’s arrangement to support Nvidia’s newest AI chip (“H200”) will likely drive the top line even higher in the years to come. In February 2024, Micron started volume production of its memory product that will be part of the H200.

I certainly agree with all the above. There is not too much to disagree with, as most of them are just plain facts. However, my experience with highly cyclical stocks like MU is very simple – buy near cyclical lows and sell near cyclical highs.

In the remainder of this article, I will argue why we are near/at a cyclical high.

MU is enjoying a cyclical high

Thanks to the change of sentiment, MU’s stock prices have enjoyed a marvelous ride over the past year. Currently, the stock price is near the 52-week high of ~$130 and more than double its 52-week low of ~$58. The stock is expecting an EPS drop in the FY ahead. Combined with the price advancement, the stock now trades at an FWD P/E of 176x – a little red flag.

However, I am not too concerned about the P/E and neither do I suggest other potential investors to be overly concerned with usual valuation metrics like P/E. For deeply cyclical stocks like MU, the earnings (especially accounting earnings) fluctuate so widely that the P/E ratio provides little insight (see the next chart).

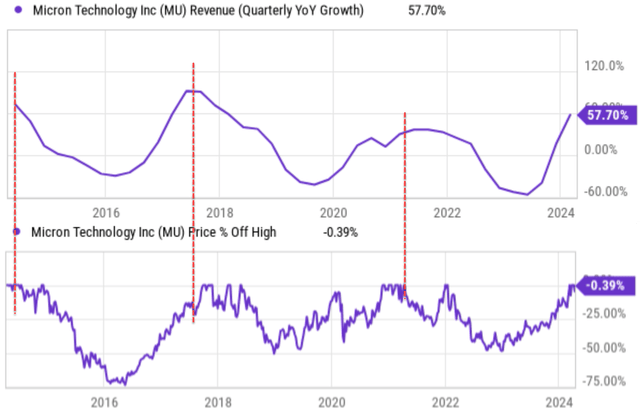

My experience is to focus on its revenue growth. As argued in an earlier article, MU has demonstrated regular cycles in the past – for good reasons. At good times, the business overly expands and plants the seed for the bad times to come. You can see this pattern multiple times even in the past 10 years alone, as shown in the next chart. I see the cycle happened at least 3 times since 2014 – i.e., about once in 3 years, as marked by the red dotted line arrows in the chart below.

Each time, the super growth (we are talking about 40%+ quarterly revenue growth YOY here) was quickly followed by a deep stock correction. This time, MU has enjoyed a ~58% quarterly revenue growth. If history is of any guidance, I expect the cycle to repeat itself again.

Other risks and final thoughts

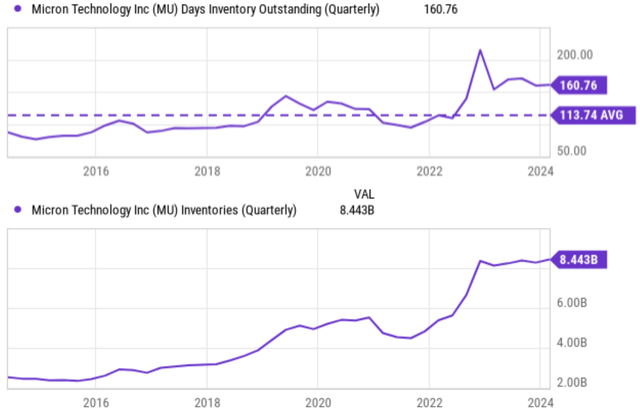

There are a few other risks that I’d like to mention before closing. My other concern involves MU’s current inventory. The chart below depicts MU’s day’s inventory outstanding (“DIO”) on a quarterly basis. DIO is a metric used to assess how long it takes a company to sell its inventory on hand. As seen, Micron’s DIO has been fluctuating around an average of 120 days before 2022. It reached a peak of approximately 220 days at the end of 2022 amid the COVID-19 pandemic. Its current inventory hovers around 160 days, a lot better than the peak but still far above the historical average.

This concerns me more considering the absolute dollar amount, which is more than $8.4B as seen in the bottom panel. To better contextualize things, MU’s net profit was a bit over $9B in 2022 – its record year thus far. It’s been reporting negative profit in 2023 and most likely in 2024 too. An $8.4 billion inventory thus entails a large risk in my mind. Storing excess inventory ties up capital that could be used for other purposes, like research and development. Additionally, there are storage and maintenance costs associated with holding inventory. For a technology firm like MU, there is also considerable Obsolescence Risk. As technology advances rapidly, some inventory may become obsolete before it can be sold, leading to write-downs and balance risks.

Another concern involves the earthquake that recently happened in Taiwan. I also expect that impact MU production and profitability negatively in the near term. More specifically, according to this SA news:

The U.S. tech giant estimates that due to the earthquake, there will be an impact of up to a mid-single-digit percentage of a calendar quarter’s company-level DRAM supply. However, the company noted that there was no permanent impact on facilities, infrastructure or tools and there is no impact on its long-term DRAM supply capability.

I want to close by iterating that I am optimistic about MU’s long-term prospects. I used to own the stock myself until recently, and would definitely consider it again in the future. Its long-term growth potential is well supported by secular trends for memory chip demand as we fully embrace the digital future. My sell thesis is largely a result of the cyclical risk in the short term.

As a value-oriented and long-term investor, I tend to do exactly the opposite of what momentum investors do: buy near cyclical lows and sell near cyclical highs. Specific for MU, I think we are near/at its cyclical high under current conditions judging by the stock price advancements, neck-breaking revenue growth, and its CAPEX plans. Finally, its current high level of inventory compounds these risks further.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.