Summary:

- Micron reported blowout earnings that exceeded expectations.

- Company faces looming challenges in the memory chip market.

- The recent surge in stock price may not reflect the underlying fundamental challenges, and investors should exercise caution.

mesh cube

Micron Technology, Inc. (NASDAQ:MU) surprised the market with blowout earnings that surpassed all expectations. However, this impressive short-term performance should not obscure the looming challenges for the memory chipmaker. The current surge could be a fleeting reprieve amidst broader market headwinds. As demand and supply eventually rebalance, I expect Micron’s profitability and long-term growth prospects to face significant pressure, and I look forward to reading your take and learning from you in the comments below this article.

Business Overview

Micron is a leading player in the global semiconductor industry, specializing in the design, manufacturing, and sale of memory and storage solutions. Micron’s core products include DRAM (Dynamic Random Access Memory) chips, essential for computers and servers, and NAND flash memory, widely used in smartphones, solid-state drives (SSDs), and other data storage devices.

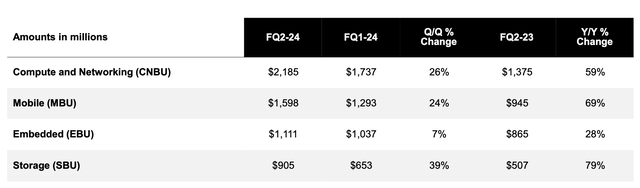

Micron generates its revenue primarily by selling these memory and storage chips directly to major device manufacturers. This includes computer and server makers, smartphone companies, data center operators, and other businesses that require large quantities of memory and storage components for their products. The following graph illustrates the company’s revenue by business unit:

I note that the company’s revenue growth is balanced across its business units.

Recent Results

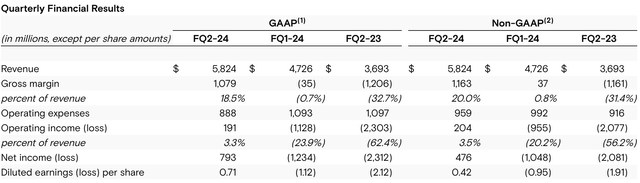

On Wednesday, Micron announced its financial results for Q2 2024:

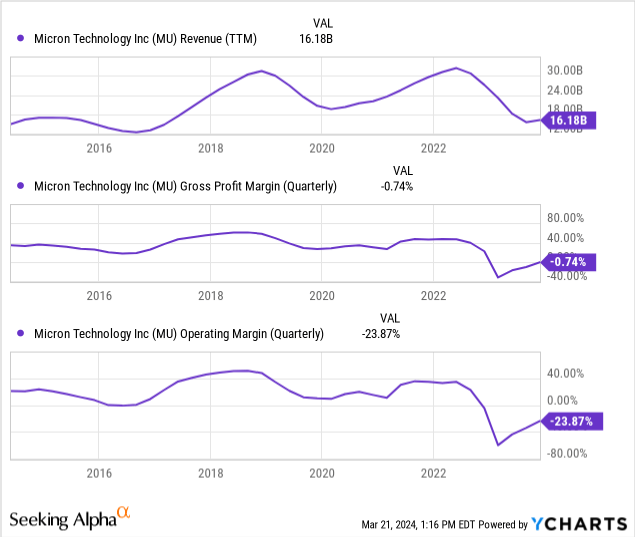

A key takeaway from the above table is that even though Micron’s revenue has grown year-over-year in Q2 2024, its bottom line just turned barely profitable after being negative in recent quarters, as the following graph illustrates:

Another key takeaway is that Micron’s trailing 12-month revenue has not grown in the last decade, and combined with its barely positive margins with a volatile history for both fundamental metrics, let’s now turn to valuation.

Valuation

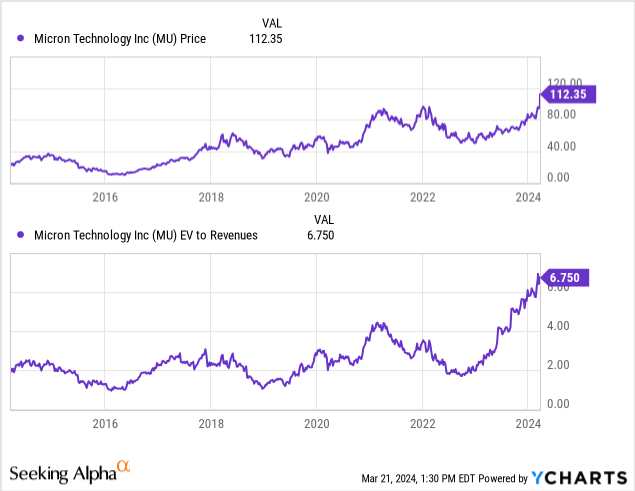

The following graph contrasts the company’s stock price with its EV to Revenue valuation multiple throughout the last decade:

Two key takeaways:

- The company’s stock price movements are mostly explained by the expansion or contraction of its EV to Revenues valuation multiple; and

- Today, the company’s EV to Revenue multiple is at its highest level ever.

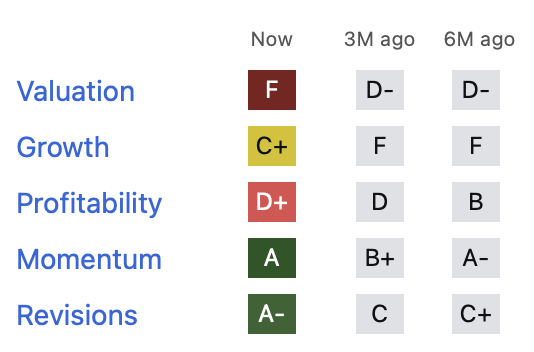

The following table from Seeking Alpha Premium Tool breaks down the stock’s current valuation and recent stock price movements into five factors:

Seeking Alpha Premium Tool

I agree with the above table that the recent surge in Micron’s stock price has been primarily driven by the Momentum factor rather than key fundamental measures such as growth or profitability.

Animal Spirits

I believe that the Artificial Intelligence theme is making its waves through various stocks, and I’ve been covering the sector in my recent articles and have discussed the red flags I see from extreme sentiment and recent insider selling at Nvidia to low margins and intensifying competitive threats at AMD, to elevated supplier and customer credit risks at Super Micro. I recommend reading those three articles as well for a full picture of my skepticism on the theme. If you have any feedback for me or would like to ask any questions, I’m active daily in the comments sections below my articles, and I’d love to learn from you.

One More Thing

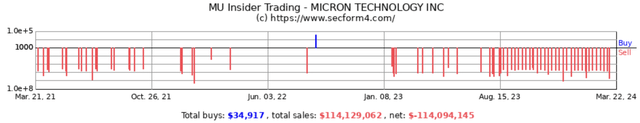

Insider selling in Micron stock seems to have accelerated in recent months:

I note that the CEO sold $5 million in Micron stock in separate transactions on March 8 and March 15 in conjunction with stock option exercises and that his cumulative sales in the year-to-date period approached $20 million.

Risk To My Analysis

There are three primary risks to my investment thesis:

- Short-Covering Rally: The surprisingly strong earnings could trigger a “short squeeze,” where short sellers are forced to buy back shares to cover their positions, driving the price even higher in the short term;

- Market Optimism: Investors might interpret Micron’s blowout results as a sign of resilience within the semiconductor sector, despite broader economic concerns. This could lead to renewed optimism about the industry’s prospects, lifting Micron’s stock along with its peers; and

- If the market believes that supply constraints will continue longer than previously anticipated, it could fuel a belief that memory prices will stay elevated, benefiting Micron.

If you think of other reasons why Micron stock will continue to push higher, please let me know in the comments below. I’d love to learn from you.

Conclusion

While Micron’s recent earnings may provide a temporary boost to the stock price, I believe the stock’s current valuation is unsustainable in the long run.

The company’s historical track record of volatile fundamentals, coupled with the cyclical nature of the memory chip market, suggests that investors should exercise caution. The recent surge, fueled by momentum and potential short covering, may not reflect the underlying fundamental challenges facing the company. Therefore, I recommend investors consider selling their Micron holdings to capture gains and look for more promising opportunities with stronger long-term growth prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.