Summary:

- Micron is positioned for a significant upswing as eFY25 HBM chips are sold out; I anticipate the firm will generate $21.5b in aEBITDA firmwide.

- I believe this recent sell-off post-earnings has created a good buying opportunity for investors seeking to take advantage of this cyclical upswing.

- Capacity for their HBM chips will begin to improve in 2027 with the Idaho fab bringing in meaningful production; the New York fab is expected to begin production in 2028.

sankai

It’s no secret that Micron Technology’s (NASDAQ:MU) share performance has been relatively lackluster since reporting q3’24 earnings at the beginning of July 2024. Though investors may have been spooked by the higher-than-expected capital investment forecast for eFY25, this should not have come to anyone’s surprise as Micron is in the process of transitioning their chip manufacturing equipment to cater to higher powered chips using EUV lithography as well as breaking ground on their Idaho fab, which is expected to contribute production in 2027. While this is in the process of being constructed, the New York fab remains in purgatory as Micron awaits permitting and regulatory approval to break ground and isn’t expected to meaningfully impact the income statement until 2028.

I believe one of the other challenges afoot is that Micron’s HBM sales for eFY25 are fixed at this point, which may result in the firm not reaching their full pricing potential for the newest piece of technology. Management mentioned that capacity for their HBM chips is sold out in 2025, which may be a limiting factor when considering growth. I believe that one of the benefits of this is that Micron has a guaranteed book of sales for eFY25, and it proves that the demand for their HBM chips is there. I anticipate that the success of HBM3E will drive sales for their next generation HBM4 & HBM4E chips.

Given Micron’s recent performance and the anticipated margin expansion that will be driven by HBM sales and the market’s reaction to q3’24 earnings, I am increasing my eFY25 aEBITDA forecast to $21.5b with a modest change to my price target from $235/share to $208/share and reiterate my BUY recommendation.

Be sure to catch up on my previous reports covering Micron:

Micron Technology Is Positioned For AI Factory Growth

Micron Will Experience Strong Tailwinds As GPU Capacity Loosens Up

Micron Operations

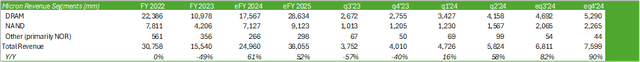

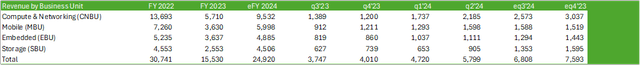

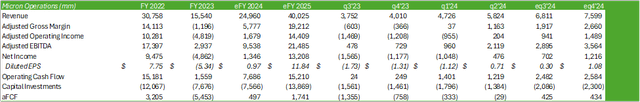

Micron is positioned for significant growth in eFY25 both in terms of revenue generation and margin expansion. This growth will primarily be driven by the ramp-up process of their new HBM chips. In q3’24, HBM3E generated over $100mm and is expected to bring in multiple-hundreds of millions in eq4’24 and several billions in eFY25. HBM production will take some share of their fab away from DRAM; however, HBM is said to be margin accretive, suggesting that the share of manufacturing allocated to HBM will profitably scale. Modeling out the financials, I anticipate HBM to drive DRAM growth in q4’24 above the 76% year-to-year growth rate in q3’24. This should also drive stronger gross and operating margins to 35% and 19.60%, respectively.

Corporate Reports

Despite the cyclicality of the memory and storage chip industry, Micron may be heading into an elongated upcycle driven by the AI factory megatrend. The biggest appeal is the firm’s HBM3E chip that has been ramping throughout 2024 and will experience a full production cycle in eFY25. Given that power consumption is one of the biggest challenges faced in AI factories, the HBM chip should be expected to be heavily adopted as it offers a 30% reduction in power consumption and offers better performance when compared to competing chips.

Looking to segments, it appears that Micron may be positioned to improve across nodes. Dell Technologies (DELL), in their q1’25 results, reported flat year-over-year storage segment sales, which could potentially be the end of the cyclical downturn. Though it is too early to tell whether this is a trend or a one-off data point given that FY24 experienced a decline in each quarter, the reversal does appear promising. The same can be said about the firm’s traditional server and network segment, as the sales trajectory experienced a major reversal in q1’25. Hewlett Packard Enterprise (HPE) experienced a similar improvement in their traditional server segment in q2’24. I believe that this may be the beginning of an upcycle for general compute servers, which may help drive Micron’s CSS sales in the coming quarters.

Within Micron’s data center presence, the firm announced the beginning of the sampling phase of their multiplexed rank dual inline memory module, or MRDIMM, which is expected to perform with 40% lower latency and a 39% increase in effective memory bandwidth when compared to their RDIMMs. The MRDIMM integrates with Intel Xeon 6 processors and is expected to be utilized to accelerate memory-intensive virtualized multi-tenant, HPC, and AI data center workloads. Similar to the IT infrastructure companies listed above, I anticipate much of the growth for Micron to be concentrated in data center as regional AI factories are built out by firms like Oracle (ORCL), Microsoft Azure (MSFT), and Amazon AWS (AMZN). Oracle alone is investing $10b in eFY25 to build out their OCI platform and regional data centers.

As far as mobile chips are concerned, I do anticipate some push-pull to the segment that may lead to mixed results. The “push” is that AI-enabled smartphones require more content per device and will provide more revenue on a per-device basis. The “pull” is that smartphone sales may remain relatively flat for the time being as consumers aren’t flocking to upgrade to the newest devices. I anticipate the same for AI-enabled PC sales as well. Though I do expect consumers to begin refining their devices to the newest models, I do anticipate that this cycle may take longer than one may expect as consumers remain grappled with inflationary pressures. My broader thesis is outlined in my recent report covering Nvidia (NVDA): Nvidia Faces Macro Headwinds And Micro Tailwinds. If this turns out to be true, I do believe that mid-to-late CY25 will be the timeframe for device refreshes.

Corporate Reports

For the embedded segment, I anticipate Micron to realize strength as more content is concentrated on vehicles in the automotive industry. Though I do anticipate some headwinds in terms of vehicle sales and growth in automotive as EV sales continue to return net losses to the automotive OEMs, I do anticipate that a flat market can provide significant benefits to Micron given that content per vehicle is growing. Ford announced in their q1’24 earnings call that the firm will be pushing back production of their next generation of EVs as the firm awaits lower-cost battery technology. In terms of growth within the segment, I anticipate CY26 to be a ramp-up period, with CY27 to result in a more meaningful impact to growth. Industrial IoT may realize strength in the meantime as firms seek to automate more processes. Statista forecasts this market to grow with a CAGR of 13.79% between 2024-2029. Accordingly, IIoT devices can have the capacity to drive increased sales for network equipment and storage devices, given the vast amount of data collected by sensors and other devices.

Corporate Reports

Funneling this into my financial forecast, I am raising my expectations for eFY25 given the forecast for eq4’24. Micron has a few factors that will work to their advantage when it comes to cash generation, including the higher sales growth of their HBM chips that will result in accretive margins and an inventory drawdown. Despite management guiding mid-30%’s capex for eFY25, I anticipate Micron to be in a position of strength for cash generation and will likely be in a greater position with these investments. Much of these investments will be dedicated to the foundry buildouts and manufacturing equipment for their DRAM chips. Though the ~$14b in capital investments in eFY25 will create some headwinds to free cash flow, I anticipate this to create more benefits to the firm as opposed to setbacks.

Operational Risks For Micron

Bull Case For Micron

Micron is positioned for a major cyclical upswing in their data center chips. I anticipate the growth of regional data centers being built-out by the hyperscalers will result in substantial growth in data center storage and memory chips for the foreseeable future, regardless of whether the US economy falls into a contractionary state. Given that AI applications are said to margin-accretive for enterprises as they automate administrative tasks, I anticipate enterprises to continue to invest in these applications. The ramp-up of their HBM chips is expected to be highly accretive to margins and revenue growth. A baseline for sales generation for eFY25 is almost guaranteed, given their HBM chip capacity is sold out.

Bear Case For Micron

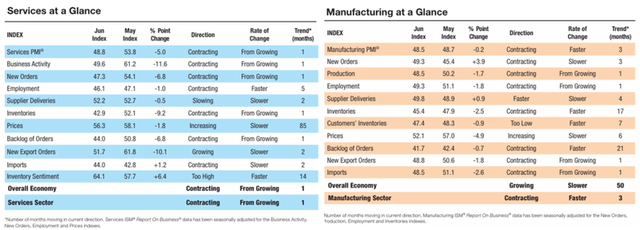

HBM capacity being sold out for eFY25 can be a limiting factor, as the firm may not necessarily be able to participate in dynamic pricing and may have priced the chips too low. Micron will be investing $50b through 2030 to develop their next leading-edge foundries to support domestic production, which may create some pull on free cash flow generation. Consumer handhelds and PCs may undergo a cyclical downturn as consumers remain stretched from inflationary pressures. According to the recent retail sales report, electronics and appliance store sales grew 80bps for 1h24 when compared to 1h23, suggesting minimal growth across consumer electronics. From a macro perspective, the general business outlook as reported in the June ISM-PMI readings suggests that the broader economy may be undergoing a contractionary state and may result in less investment across enterprise IT.

ISM-PMI

Valuation & Shareholder Value

Corporate Reports

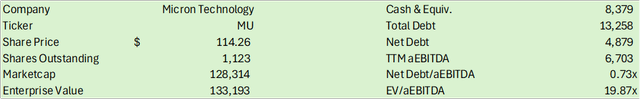

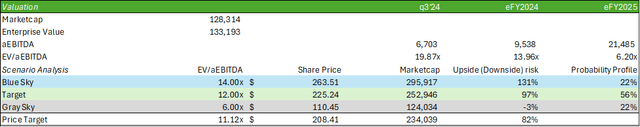

MU shares currently trade at 19.87x EV/aEBITDA as the firm reaches the beginning of a major cyclical upswing. Forecasting out to eFY25, I believe MU shares’ valuation will moderate at the midpoint of ~11x EV/aEBITDA on $21.5b in aEBITDA generation.

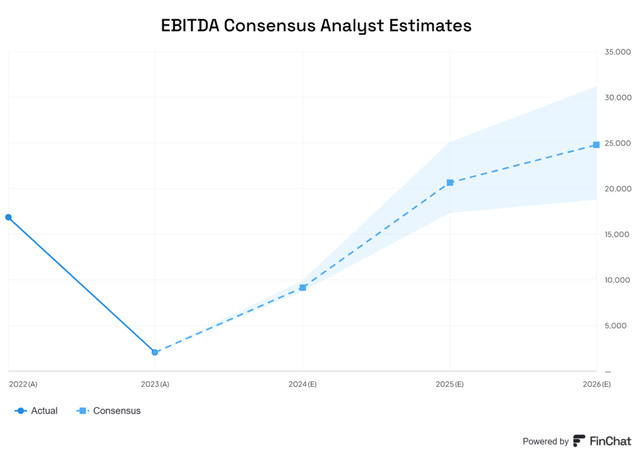

FinChat

Taking into consideration analysts’ forecasts for eFY25 EBITDA of $17-25b, I believe Micron’s growth trajectory is significantly undervalued. I believe Micron’s shares may be a “show me” story and will sharply react to quarterly updates as HBM is cycled into production.

TrendSpider

Given the market’s reaction to Micron’s q3’24 results, I am adjusting my probability analysis in my valuation table below to more heavily weigh the midpoint. Given this factor, I am incrementally lowering my price target from $235/share to $208/share at 11.12x EV/aEBITDA and reiterate my BUY recommendation.

Corporate Reports

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.