Summary:

- In this article, I will attempt to unpack concerns about Microsoft around its recent Activision Blizzard deal, ChatGPT, etc. I think these investments are here to last.

- The deceleration in Azure’s growth appears temporary, and it is expected that once the PC market rebounds to pre-pandemic levels, Azure’s growth may strengthen.

- I anticipate Azure to become the central hub for Microsoft in the future. I also think the company is a solid investment opportunity with the potential for significant growth.

Editor’s note: Seeking Alpha is proud to welcome Cloud Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Jean-Luc Ichard

Introduction (thesis)

I’m convinced that Microsoft (NASDAQ:MSFT) has some untapped potential that the market hasn’t fully priced in yet. The company’s recent move to acquire Activision Blizzard (ATVI) is expected to go through, which could provide a significant boost to Microsoft’s already impressive financials. Additionally, I’m excited about the growing impact of ChatGPT, which has the potential to revolutionize the IT industry and bring in huge cash flows for Microsoft.

On top of that, Microsoft’s financial moat and high switching costs for customers give the company a strong competitive advantage. With Azure continuing to grow and expand, it’s clear that Microsoft is positioning itself to be the next cash cow for investors.

Overall, I think Microsoft is a solid investment opportunity with the potential for significant growth in the years ahead.

Coverage of special events

Acquisition of Activision Blizzard

On January 18, 2022, Microsoft announced its intent to acquire Activision Blizzard for $68.7 billion in an all-cash deal, or approximately $95 per share. The deal has come under pressure from Microsoft’s competitors in gaming, such as Sony due to anti-competitive regulations. The proposed goal of deal completion by June 2023 is questionable at this point.

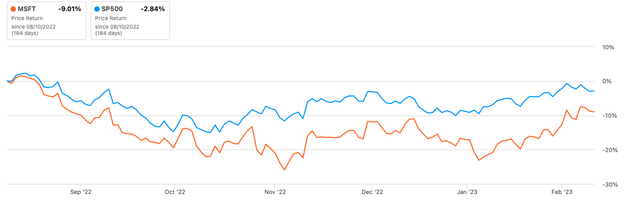

Price Return MSFT vs SP500 (Seeking Alpha)

Key Acquisition rationales

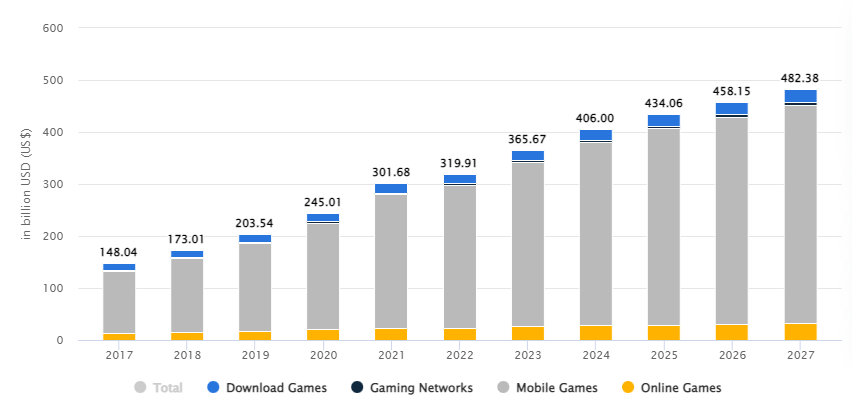

The video gaming industry is poised for significant growth in the coming years, with projections indicating a compound annual growth rate of 9.1% until 2028. This presents an opportunity for Microsoft to tap into this thriving market, leveraging the substantial user base of Activision Blizzard, which currently boasts approximately 40 million monthly active users.

By offering exclusive games through its monthly subscription service, Microsoft could potentially attract a substantial number of these users, thereby expanding its reach in the gaming industry. Moreover, the growth of the mobile gaming segment, which is the fastest-growing segment of the industry, is particularly noteworthy. Currently, Microsoft does not have a significant presence in this market, making the acquisition of Activision Blizzard a strategic move that would provide Microsoft with an entry point into this lucrative and rapidly growing sector.

Revenue of video game industry (Statista)

Common Concerns over the Acquisition

On December 8, 2022, the Federal Trade Commission (FTC) filed an administrative complaint aimed at preventing Microsoft’s acquisition of Activision Blizzard. The FTC claimed that the acquisition would give Microsoft the ability to withhold or limit access to Activision games from rival videogame consoles and subscription services. As the market for video games is highly concentrated, the FTC’s concern mainly revolves around the potential for Microsoft to restrict access to competitors such as Sony and Nintendo. The FTC’s complaint specifically cites the popular videogame franchises of ‘Call of Duty’, ‘Overwatch’, and ‘Diablo’ under Activision.

Acquisition of Activision Blizzard faces rough investigation (Engadget)

In response, Microsoft initiated a public relations campaign, including an op-ed written by the company’s president, Brad Smith, published in the Wall Street Journal. In his op-ed, Smith argued that it would be both economically and strategically irrational for Microsoft to deny third-party access to Activision content and pointed to the ten-year agreement that the company had offered with Sony to make ‘Call of Duty’ available on the Sony PlayStation and other third-party platforms, which would be enforceable by regulators. Microsoft had promised to provide wide distribution of Activision content since the deal was first announced in January 2022.

The key issue in the case lies in the potential evolution of video gaming beyond traditional consoles and into new forms of delivery, such as cloud-based subscription services like Microsoft’s Game Pass. This shift may tempt Microsoft to make Activision content exclusive in order to attract subscribers to its service.

Will the acquisition go through?

I think FTC has a tough case to prove. The Federal Trade Commission’s complaint against Microsoft’s proposed acquisition of Activision Blizzard may face significant challenges. Microsoft’s current position in the videogame market is not one of dominance, with a global market share of 35%, compared to Sony’s 64% share, according to Statista. Microsoft’s own statistics reveal an even more modest presence, with its Xbox console accounting for only 16% of unit sales in 2021, compared to Sony PlayStation’s 50% and Nintendo’s 34%. Microsoft’s exclusive videogame titles also hold a relatively small market share, with only 10% compared to Sony’s 50% and Nintendo’s 40%. These statistics do not paint a picture of Microsoft as a dominant player in the industry. It is important to note that the case may have more to do with future market conditions than current market trends. The FTC’s complaint was also weakened by its allegations that Microsoft had misled European Commission regulators regarding its 2021 Zenimax acquisition, which was an attempt to demonstrate a history of anticompetitive behavior. However, these allegations were denied by the European Commission in a public response. Meanwhile, the European Commission and the UK Competition and Markets Authority are continuing to review the proposed merger.

Overall thoughts on the Acquisition

It is evident that Microsoft is taking steps to contest the FTC’s complaint with regard to its acquisition of Activision Blizzard, however, the possibility of reaching a settlement prior to the scheduled trial in August 2022 still exists. In the event that Microsoft decides to withdraw from the deal, it would incur a break-up fee of $3 billion payable to Activision. Due to the ongoing litigation, it is likely that the resolution of the deal will be postponed beyond the originally projected closing date of June 2023 by the company’s management.

Nonetheless, I think this presents a great merger arbitrage moment for investors. Whenever the market is faced with new uncertainty, investors with adequate risk appetite would see this as a perfect opportunity. Merger arbitrage happens in a merger or acquisition. In this case, The acquirer ((Microsoft)) usually offers to buy the target company’s ((Activision Blizzard’s)) shares at a premium (($95)) to the current market price (($75)). However, the uncertainty around whether the deal will be completed can cause the target company’s stock price to trade at a discount on the offer price.

Back to Microsoft, I believe that the market has incorrectly priced the acquisition deal, as the Q2 earnings call outlook for the second half of 2023 did not account for the potential revenue and cash flow that the acquisition of Activision Blizzard could bring to Microsoft. Therefore, if the deal is approved in late 2023 as expected, it could create a significant opportunity for investors to benefit from the price discrepancy and potential upside.

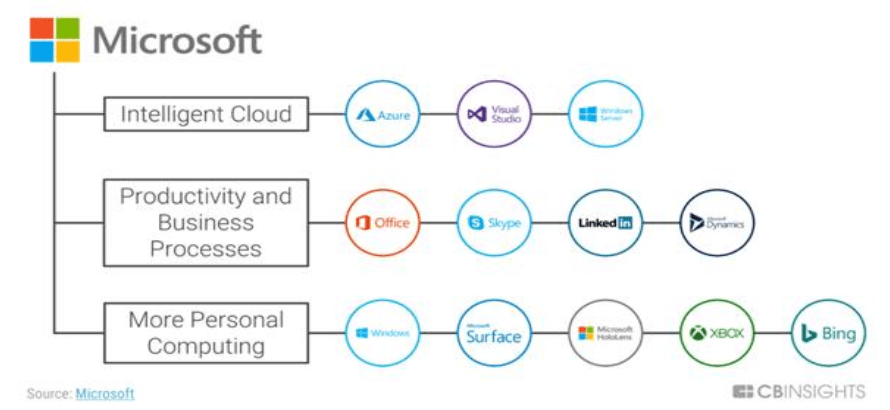

CBINSIGHT

Microsoft invests in Open AI’s ChatGPT

Microsoft is said to be putting $10 billion into OpenAI, creators of the AI chatbot ChatGPT. ChatGPT has received widespread attention since its launch in November 2022. Within a week of its release, it gained over a million users, sparking a new discussion about the impact of AI in the professional arena. Microsoft’s investment is aimed at providing Microsoft access to cutting-edge artificial intelligence systems. The company is in competition with Alphabet (GOOGL), Amazon (AMZN), and Meta Platforms (META) to be the leading player in the rapidly expanding field of AI, which involves creating text, images, and other content based on short inputs. At the same time, OpenAI requires Microsoft’s financial support and cloud computing capabilities to process huge amounts of data and operate its advanced models, such as DALL-E, which creates lifelike images from a limited number of words, and ChatGPT, which generates human-like conversation.

The investment has conditions, including Microsoft receiving 75% of profits until the $10 billion is recouped. After reaching this point, Microsoft’s ownership would reduce to 49%, with other investors owning an equal amount and the non-profit parent company holding the remaining 2%.

Key rationales

Microsoft’s reported investment of $10 billion into OpenAI, the AI chatbot firm, presents both opportunities and risks for the tech giant. By controlling 75% of the profits until the investment is recouped, Microsoft will have the advantage of integrating OpenAI into its cloud business. Microsoft’s large investment in OpenAI is not concerning due to its strong financial position. They hold a net cash position of $59 billion and have recently returned $9.7 billion to shareholders in the previous quarter.

Concern over the investment

One of the main questions raised doubting the profitability of Azure is its deceleration in revenue growth. Is the pace of Azure deceleration purely a function of macro?

In my opinion, the state of the economy is affecting the growth of software across the industry, however, research suggests that the cloud infrastructure market is starting to reach maturity with the easiest workloads already moved and more difficult workloads presenting greater challenges in migration. Optimization efforts are at an all-time high and may continue throughout 2023, and there have been reports of slower migration of on-premise workloads to the public cloud, not only due to cost-saving reasons but also due to the complexity of migrating more intricate workloads. These factors are expected to affect the rate of growth in Azure’s revenue in 2023.

Overall thoughts on the investment

I truly believe that Microsoft’s investment in OpenAI has huge upside potential, despite some investors remaining skeptical about the transformative power of AI. Some say that OpenAI is just another overhyped technology that won’t deliver, but that’s not true.

In fact, Microsoft committed to building Azure into an AI supercomputer as early as 2016, and the recent release of ChatGPT and other cutting-edge AI technologies has only reinforced the platform’s potential. These innovations have captured imaginations and introduced large-scale AI as a powerful, general-purpose technology that has the potential to transform businesses and even everyday life. Personally, I’m excited about the integration of ChatGPT, Edge, and Bing search engines and believe it has the potential to revolutionize how we interact with technology.

When combined with the recovering demand for personal computers, this could provide Microsoft with a strong revenue stream and solid cash flow. Overall, I have great confidence in Microsoft’s investment in OpenAI and believe it has the potential to deliver long-term value for investors.

Microsoft restructuring measure should come as no surprise

17 January 2023, Microsoft announced that it will be cutting 10,000 jobs (~5% of the workforce) and consolidating real estate as part of a broader restructuring program. This move was likely anticipated by investors considering rumblings in the community and the recent commentary by Satya Nadella on customers optimizing spend, and the need for opex to be aligned to this new growth reality.

Along with the program, the company is expected to take a $1.2 billion charge in Q2, which would mean a $0.12 negative impact on diluted earnings per share in the quarter. The actions are expected to be completed by the end of Q3, and also include changes to the hardware portfolio. Assuming $200k saved per job, we can get to a potential $2 billion annual cost savings (assuming no reinvestment and savings timing assumptions), or approximately 100bps of positive operating margin improvement for the FY. Additionally, it was noted that hiring in even key areas, like Azure and security, has been paused.

Key positives

Microsoft’s dominance and strong financials will continue to support continued growth. Microsoft has a dominant market position in the personal computer operating system market with its Windows operating system, and in the productivity software market with its Office Suite. The company’s brand and reputation for developing quality products provide a strong competitive advantage, which has helped to maintain its market share. Revenue for the productivity and Business Processes segment was $17 billion and still increased 7% YoY. Unsurprisingly it was dynamics products and cloud service that saw the fastest growth for this business segment as this saw growth of 13% driven by dynamics 365 growth of 21%. Dynamics 365 has been growing at a rapid pace as cloud capabilities of the product are easy to integrate by businesses in times when consumer spending is falling and businesses need to maximize customer contact, these solutions from Microsoft become increasingly important to drive sales and margins for all sorts of businesses. In addition, LinkedIn also saw 10% revenue growth, and Office commercial products and cloud services revenue increased by 7% YoY. The one setback in this business segment was Office consumer products, which saw a 2% decrease in revenue, reflecting the decrease in consumer spending, which I believe is cyclical. Still, Office consumer products were up 3% on a constant currency and total subscribers grew to 63.2 million. Microsoft has a strong financial track record, with consistent revenue and earnings growth, and a strong balance sheet. The company also has a history of returning value to shareholders through dividends and share buybacks.

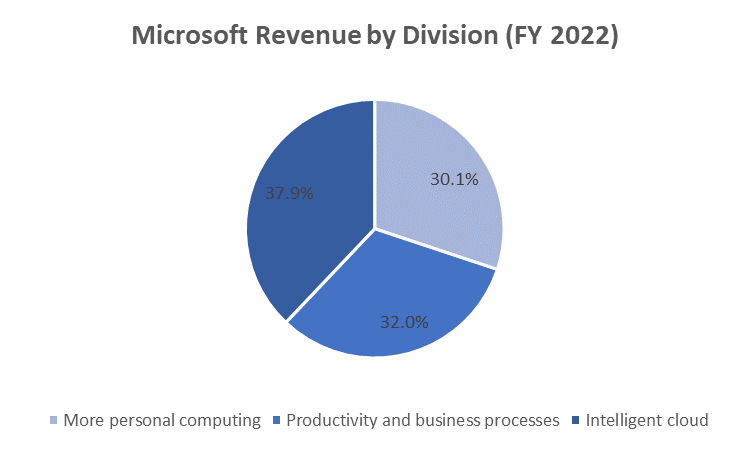

Azure is a future hub for Microsoft, as it serves as the platform on which the company can develop new products and services across its key portfolios. Azure’s capabilities allow Microsoft to build more monolithic businesses and expand its cloud computing, artificial intelligence, and machine learning offerings. Though investors are wary of recent slowness in Azure and higher energy costs that are adversely impacting margins, I believe those issues are transitory due to the macro environment. Currently, the intelligent cloud takes 37.9% of total revenue in FY 2022.

Microsoft revenue by division (FY 2022) (Microsoft 10K)

Over the long term, the Azure Platform is large and well-established enough to be used to build entire new ecosystems in other operating segments. This turns Azure into the hub of the wheel, and I believe the critical spokes of the wheel we expect to leverage Azure over the next decade to build significant new businesses with large end markets for Microsoft to address. Microsoft is well-positioned to benefit from the growth of cloud computing, the increasing use of artificial intelligence and machine learning, and the shift towards subscription-based business models. The company’s investment in these areas is expected to drive future revenue and earnings growth. According to Fortune Business Insights, the global cloud computing market size is expected to grow at 19.9% CAGR through 2029. The total market size in 2028 will be $791.48 billion, creating a massive opportunity for Microsoft. Microsoft’s Azure is well-positioned to increase its market share as it has been doing over the last few years. This is a secular tailwind for Microsoft.

Intrinsic valuation

Discounted Cash Flow Valuation Methodology

I employ a rigorous academic approach to a three-stage Discounted Cash Flow (DCF) analysis to derive the intrinsic value of any Software stock, using conservative assumptions where appropriate. I typically assume a terminal free cash flow (FCF) margin of about 28%, which I believe is about the FCF margin for a relatively mature Software company at a scale that is growing at about the long-term growth rate of the economy. In other words, we assume the company is run relatively efficiently in the terminal period during which it has ceased trying to grow the company at elevated rates. For some companies, such as third-party tolls not experienced by typical Software businesses, or in cases that have demonstrated higher FCF margins at steady state.

Valuation Scenarios

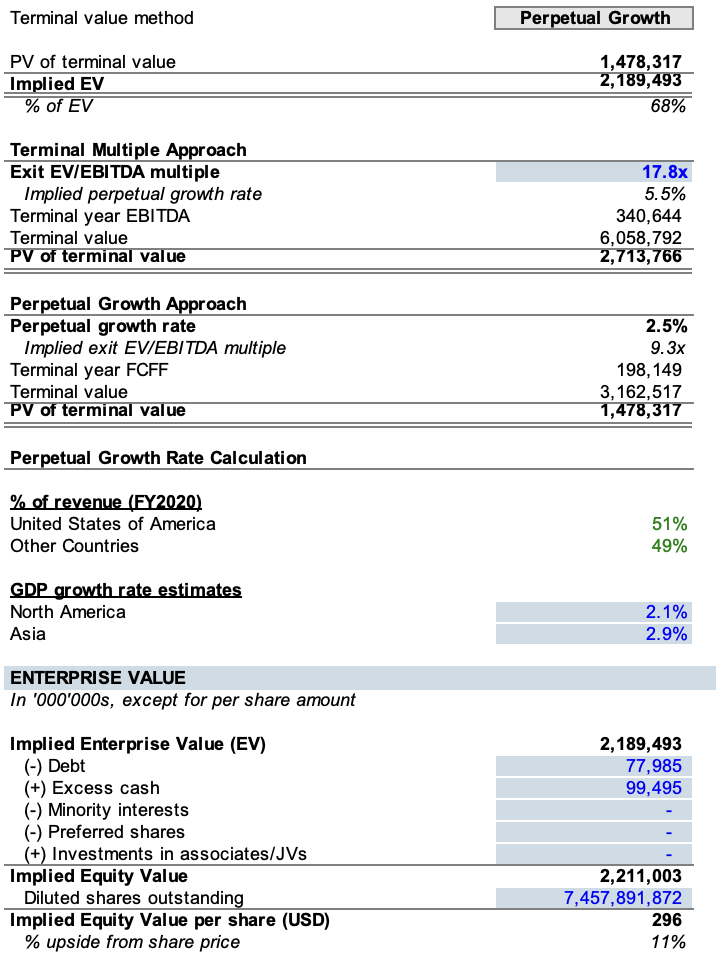

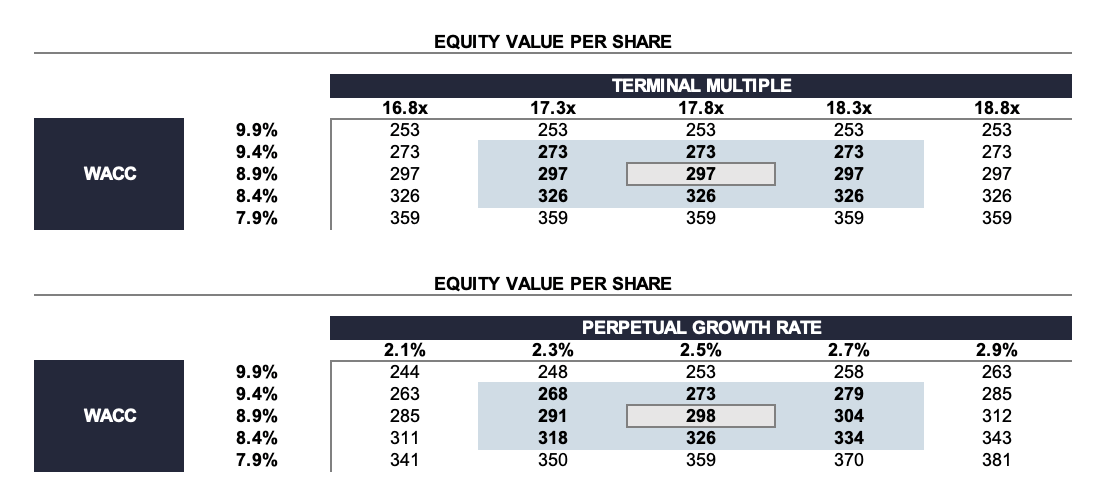

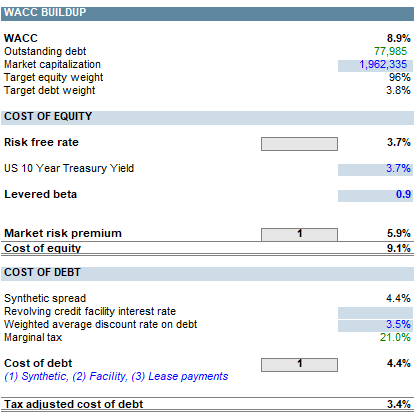

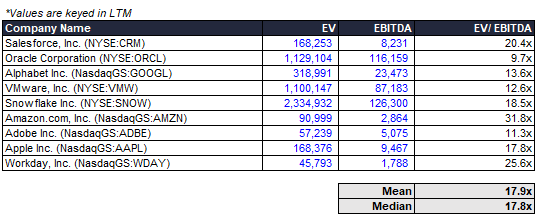

My base case DCF analysis, which assumes mid-teens revenue growth over the next three years and an average of 28% free cash flow margins, yield a target price of $297, implying approximately 11% potential upside vs. current levels.

My bull case DCF analysis assumes high-teens revenue driven by more sustainable Azure growth, stronger Commercial Office 365 revenue growth (from a combination of sustainable double-digit unit growth and high-single-digit ASP growth), Windows OEM growth above market forecasts, and stronger gaming revenue. Applying the same free cash flow margins to our upside revenue case yields a fair value of $369, or 38% potential upside from current levels.

My bear case DCF analysis assumes high-teens revenue, driven by less sustainable Azure growth, driven by 0% new ARR growth, a deterioration in Commercial Office 365 revenue growth (from a combination of deteriorating unit growth and flat ASP growth), Windows OEM growth below market forecasts, and weaker gaming revenue. Applying the same free cash flow margins to our downside revenue case yields a fair value of $213, or 20% below current levels.

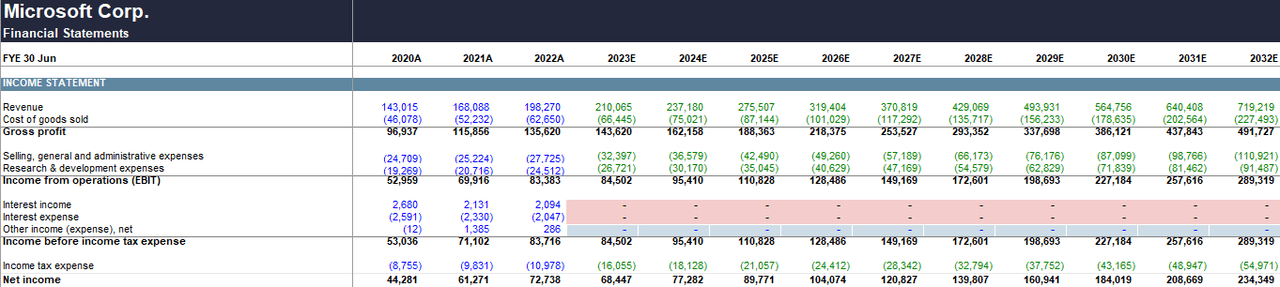

Income statement (Author’s estimates)

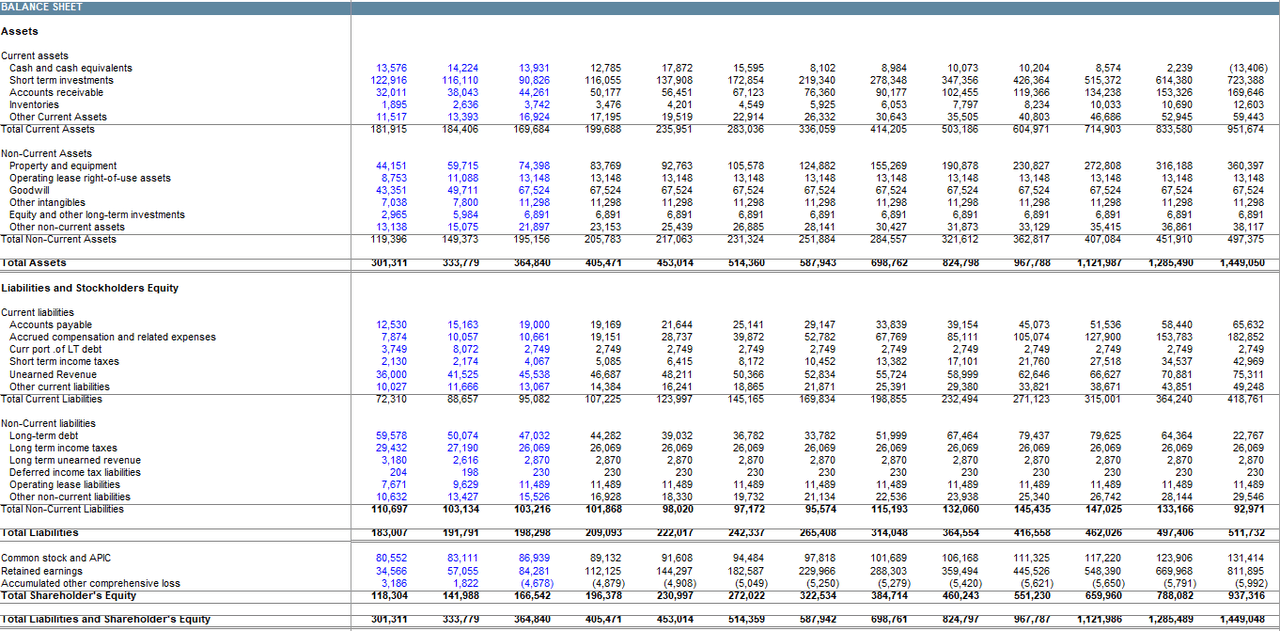

Balance sheet (Author’s estimates)

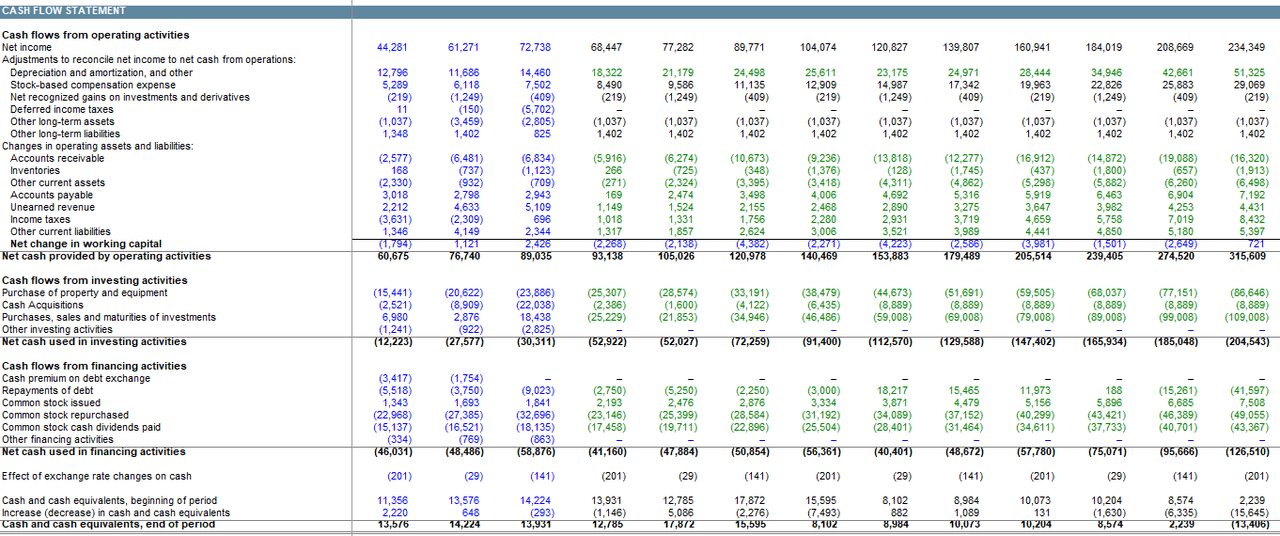

Cashflow statement (Author’s estimates)

Valuation (Author’s calculations)

Sensitivity analysis (Author’s calculations)

WACC (Author’s calculations) Comps (Author)

Investment risks

Microsoft’s cloud computing platform, Azure, has been a key contributor to the company’s growth in recent years, however, its growth trajectory may be facing a slowdown. Analysts predict that this slowdown could be more severe in the fiscal years 2023/2024 than what is currently anticipated by the market. This deceleration may be a result of the market’s maturity, in addition to the current macroeconomic environment. This could have a short-term impact on Microsoft’s financial performance. Additionally, Office 365, the subscription-based version of Microsoft’s Office Suite, which has been a reliable source of revenue growth for the company, may also be vulnerable to a slowdown in 2023 as the number of users slows down. Despite a boost from the server depreciation change, Microsoft’s margins have declined year-over-year in the first half of 2023. The current earnings per share estimates for the fiscal year 2023 are dependent on a reversal of this trend in the second half of 2023, however, there may be continued margin pressures that could affect the company’s financial performance. In consideration of these risks, the analyst is lowering their fiscal year 2024 revenue and earnings per share estimates, forecasting revenue of $243.2 billion and earnings per share of $11.27, slightly above the current consensus estimates from the market. The slowdown in PC demand has also had a significant impact on Microsoft’s core Windows operating system business.

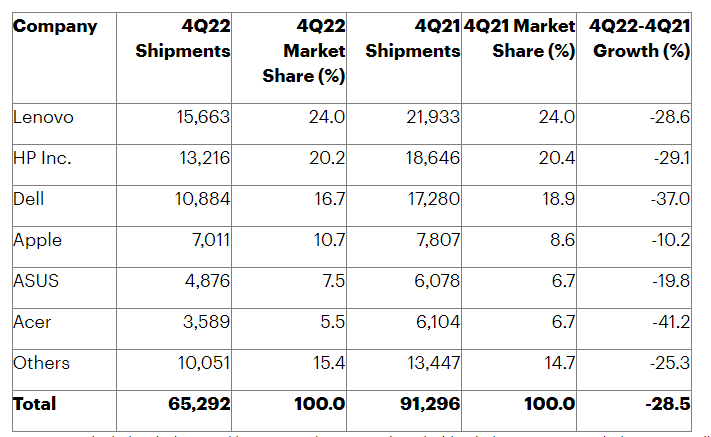

Microsoft’s financial performance and valuation likely to be impacted by headwinds in PC market. The decrease in the PC market is likely to have a significant impact on Microsoft’s financial performance and valuation, as indicated by market research firm IDC with a predicted 13% decrease in 2022 and a 2% decrease in 2023. The slowdown in the PC market can be attributed to multiple factors such as the saturation of the remote work demand, decreased demand from educational institutions, geopolitical tensions between Russia and Ukraine, inflationary pressures, and unfavorable comparisons. These factors pose challenges for Microsoft’s Windows OEM revenues, Windows Consumer revenues, and Surface PC sales, as confirmed by Gartner research. In 2022, worldwide PC shipments reached 65.3 million units in the fourth quarter of 2022, a decrease of 28.5% from the fourth quarter of 2021, as per preliminary results from Gartner, Inc. This marks the largest quarterly decline in shipments since Gartner started tracking the PC market in the mid-1990s. For the year 2022, PC shipments reached 286.2 million units, a decrease of 16.2% from 2021.

Microsoft faces risk to Azure growth due to IT spending downturn and budget constraints. The current macroeconomic conditions are presenting a challenge for Microsoft. The downturn in business and consumer sentiment could impact the growth of its newer businesses, including Azure, which has been a key driver of its recent success. This presents a significant risk, as Azure’s growth depends on companies’ willingness to invest in technology, which may be impacted by budget constraints. According to a recent survey by Gartner, worldwide IT spending is forecast to decline by 8% in 2020, primarily due to the COVID-19 pandemic. This trend is expected to continue, with IT spending expected to grow at a slower rate in the coming years. This slower growth rate is due to an expected reduction in capital expenditures, as well as a reduction in operational expenses, as companies focus on cost containment.

Street Consensus

The streets consensus has a mean target price of $291.81 and a median target price of $290.00, the standard deviation is 32.67. This implies a potential upside of 10.91%.

PC Market (Garner)

Hyper-scale cloud market is competitive; AWS and Google Cloud present challenges for Microsoft, but growth potential remains. From an analytical standpoint, the hyper-scale cloud market presents a highly competitive landscape, with prominent players such as Amazon’s AWS and Alphabet’s Google Cloud dominating the sector. These companies possess significant financial resources and a dedicated focus on the cloud business, making it challenging for Microsoft to maintain a competitive edge. In FY 2023, AWS recorded a total of 80 billion in net sales, constituting approximately 16% of Amazon’s total net sales. With a consistent growth rate in the 30% range in recent quarters, AWS presents a formidable rival to Microsoft Azure. Conversely, Google Cloud has recently reported an LTM revenue of $26.3 billion, exhibiting a year-on-year growth rate of 37%. It is evident that Amazon, Microsoft, and Google will increasingly rely on their cloud businesses to drive revenue growth and earnings. The global cloud computing market is projected to reach over $1 trillion by 2028, presenting a substantial opportunity for these companies to expand their market share.

Catalysts to watch in 2023

The cloud computing trend offers significant growth opportunities for Microsoft’s Azure platform. The ongoing trend of businesses moving their operations to the cloud presents a significant opportunity for growth for Microsoft and its Azure cloud computing platform. As more companies adopt cloud technology, the demand for Azure’s offerings is expected to increase, providing a potential catalyst for revenue and earnings growth for the company. This shift towards cloud computing represents a major growth opportunity for Microsoft and could potentially drive long-term success for the company and its shareholders.

Growing demand for AI and ML technologies presents significant growth opportunities for Microsoft. With the increasing demand for AI and ML, Microsoft’s offerings in these areas are poised to become increasingly popular. This is due to the numerous benefits that these technologies bring to businesses, such as improved efficiency, cost savings, and better customer experiences. The growing popularity of AI and ML is also driving investment in these technologies, and businesses are likely to increase their spending in this area in the coming years. This presents a significant opportunity for Microsoft, as the company has a wide range of AI and ML services that can help businesses to realize their goals. The company’s strong brand, expertise in AI and ML, and comprehensive services offering make it a natural choice for businesses looking to invest in these technologies. As a result, the growth in demand for AI and ML technologies is expected to drive growth for Microsoft, and the company is well-positioned to take advantage of this growth opportunity.

Acquisition of Activision Blizzard may boost financial performance and create strategic advantages, driving the stock price increases. The proposed deal between Activision Blizzard and a potential buyer has garnered significant attention in the market, as it could have a significant impact on the stock price of Activision Blizzard. If the deal is successful, there are several factors that suggest the stock price will likely increase. Firstly, the company will likely experience a boost in its financial performance, as the acquisition will bring in new sources of revenue and help expand its reach in the market. Additionally, the deal may also bring in strategic advantages, such as access to new technologies or market segments, which can further enhance the company’s growth prospects. Moreover, the acquisition is expected to create synergies, such as cost savings and increased operational efficiency, that can have a positive impact on the company’s bottom line. These benefits are likely to result in increased earnings per share and a higher valuation, both key drivers of stock prices.

Conclusion

In my opinion, it is important to consider the current macroeconomic environment and the potential impact on Microsoft’s financial performance in the short term. At this point, it seems that the secular headwind will result in fluctuation of the pricing in the near term. In the long term, however, the company’s long-term growth prospects and commitment to innovation make it a compelling investment opportunity for those with a long-term investment horizon.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.