Summary:

- Microsoft experienced diminishing growth and resorted to standard means to support operating margins going forward.

- MSFT is well positioned to capture more share in the high-margin cloud and software business from competition due to the “artificial” growth drivers and digital transition trends.

- The current valuation appears in line with the sector, although the upside is still present.

4kodiak

The tech sector is gradually acquiring the features of the conventional industries that are highly related to the macro picture. Microsoft Corporation (NASDAQ:MSFT) reflected that transition as the rest of the tech sector, and despite its position at the forefront of the sector, the revenue growth began to slow down even in the cloud segment. However, the company is starting to create an early moat against the competition by proceeding with the introduction of AI in all products and services. I believe MSFT has good prospects to build key competencies in the AI-powered solutions in cloud products and benefit from the digital transition environment. I am bullish on Microsoft’s prospects, despite the valuation suggests a limited upside from the current levels.

Overview and Outlook

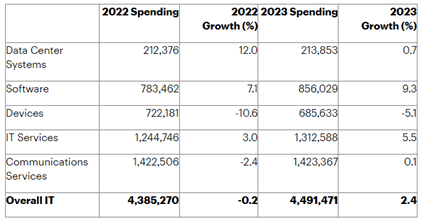

In 2022 we have witnessed a significant growth in the IT spending for digital business initiatives, especially in the area of data center systems. As I wrote in the piece for Amazon (AMZN), the focus of global IT expenditures is now expected to shift to software, thus benefiting the growth of cloud solutions. Despite the deterioration of the global economy leading to reduction of enterprise IT budgets, I expect the cloud computing industry will remain resilient on the back of the forecasted 9.3% growth in worldwide software spending.

Worldwide IT Spending Forecast (Millions of U.S. Dollars) (Gartner January 2023)

The cloud segment remains the main driver of Microsoft’s revenue growth in Q2’23. Total revenue registered a moderate increase of 2% YoY to $52.8 billion driven by Intelligent Cloud’s strong performance and Productivity&Business Processes contribution. Microsoft Cloud revenue hit $27.1 billion during the quarter and despite the growth has been slowing down, the revenue from the Azure platform and other cloud services surged by 31% YoY (up 38% YoY in constant currency).

Locking in Q3’23, the company expects Azure growth to come below 30% YoY. In my view, Microsoft can be confident in the growth prospects of the cloud business in light of positive trends of cloud transition and a favorable software spending outlook. Additionally, as of the end of Q2, the obligations under the concluded contracts amounted to $189 billion which is 28.6% higher compared to the year-ago.

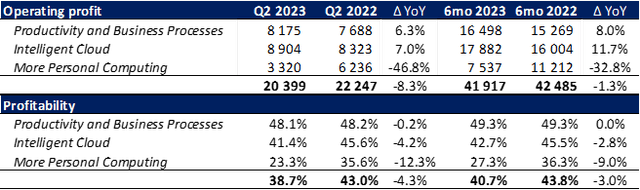

On the downside, the Personal Computing segment looks the most problematic, with revenue down by 18.8% YoY in Q2 resulting in an 8.3% YoY decrease in EBIT and 433bps deterioration in overall operating profitability. The same goes for the outlook, as Devices expenditures are forecast to decrease significantly by 5.1% in 2023 due to the expended device refresh cycles, adding to the 10.6% drop in 2022.

Operating profit and margin (company reports)

During the latest earnings call, the company boasted more than $20 billion in revenue from the information security business over the last 12 months. With the growing use of the cloud and remote work environments, the need to ensure the user’s data and applications with the proper level of cybersecurity will follow. Microsoft has achieved good results in this field, although the company has to compete with the specialty cyber providers. I expect the cyber security industry will outperform IT spending in terms of growth due to the ongoing digital transition trends and increased awareness of digital security. Also, the development of cybersecurity could limit hacker activities, which are hurting Windows and other new licensed products, especially in the consumer part of business.

Moving forward, AI technologies are among the key areas of investment for tech companies, around which the future competitive landscape will be shaped. Despite AI being at the starting point of development, Microsoft has already initiated a moat from afar with $10 billion investment in OpenAI. ChatGPT, which has already become buzzy, will strengthen the cloud services of the Azure platform and the Bing search engine against the backdrop of Google (GOOG) (GOOGL).

Although the cloud business could ensure Microsoft a prosperous future, the company continues to look forward to increasing its addressable market. It’s becoming clear that the deal for Activision Blizzard (ATVI) may not go through under pressure from regulators. At the same time, Microsoft does not lose hope to close the $69 billion deal by the end-2023. However, Microsoft has nothing to lose. Moreover, the company is rumored to have Netflix as the next item on the shopping list. It can be inferred that the company is actively trying to increase its consumer offerings, based on the management’s ambitions.

According to Gartner, 25% of people will spend at least one hour a day in the metaverse by 2026 for work, shopping etc. Microsoft also has exposure to creating a metaverse experience. Back in 2021, the company announced the Mesh platform, which could be integrated into many Microsoft products (Teams, Azure, Dynamics 365) in the future. In addition, the functionality of the Azure platform allows for work with digital twins, and many customers, in particular manufacturers, already use this feature.

Going forward, in order to preserve profit margins and respond to inflation pressure, Microsoft resorts to the standard means and announced a 10k employee lay off. This measure should support operating profitability. Still, given that gross margin remained flattish at 67%, Microsoft is coping quite well. Add to that the negative effect of currency fluctuation, which will weaken subsequently.

Valuation

For the FY23 Q3, Microsoft forecasted the Intelligent Cloud segment to outperform in terms of growth with revenue at $21.7-22.0 billion (up 14-16% YoY). In the Productivity&Business Processes segment, revenue is forecast to grow moderately by 7-9% YoY, reaching $16.9-17.2 billion. When it comes to the Personal Computing segment, revenue is anticipated in the range of $11.9-12.3 billion, thus contributing negatively to the performance with a 16% to 18% YoY decrease.

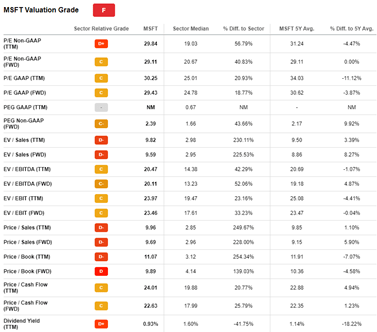

Turning on to the valuation screener on Seeking Alpha, we can see that Microsoft is fairly valued through the overwhelming majority of multiples, compared to the sector median level.

Microsoft valuation (Seeking Alpha data)

The analyst estimates of $233.2 billion of revenue and EPS of $10.8 for FY2024 suggests forward sales and earnings multiples of 8.5x and 25.3x, respectively. Looking at the 5Y historical readings, MSFT have traded closer to 9x on EV/Sales and 30x P/E multiples. Based on this, I expect a moderate upside potential from current levels of 9.8% to the target price of $298 per share.

In terms of capital return to shareholders, Microsoft returned $9.7 billion to shareholders during the quarter through repurchases and dividends. While the new fiscal year began with higher quarterly dividends of $0.68 per share, the buyback was significantly reduced from $6.2 billion to $4.6 billion per quarter in line with the FCF decline. Still, the company is solidly committed to shareholder returns and stock performance.

Risk factors

Although software spending is anticipated to increase solidly in 2023, the macro uncertainty could further tighten up the IT budgets and add up to ongoing optimization of spending. This could restrain Microsoft’s commercial, as well as consumer business, and depreciate the demand for Azure and Office offerings.

Conclusion

Albeit the tech sector was considered to be defensive to some extent with stable earnings, especially after the Covid-induced economic recession, even the leaders have now experienced a growth slowdown. Optimization of operating costs has also become relevant for Microsoft, as a result of the forthcoming reduction of 10k employees. I am bullish on MSFT stock, as the company is well positioned to capture growth opportunities with the expected AI-incorporated features in its offerings and gain lucrative market share away from the current leaders of the cloud and search engine solutions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.