Summary:

- Microsoft has had an incredible profitable last decade, with strong revenue growth and healthy net margins.

- Recent macroeconomic headwinds have resulted in a softer-than-anticipated Q2 of FY23.

- A bullish AI-driven rally has led to recent increases in share prices.

- Long-term fundamentals suggest the company is set for significant revenue and profit growth.

FinkAvenue/iStock Editorial via Getty Images

Investment Thesis

Microsoft (NASDAQ:MSFT) is one of the world’s largest technology corporations. Their extensive portfolio of products and services has become an integral part of everyday life for most individuals and enterprises alike.

Their unrivalled levels of product integration, significant scale and the subsequent network effect have allowed the company to expand their operations into a multitude of robust and “moaty” business segments.

Recent macroeconomic headwinds have resulted in weaker than anticipated FY23 Q2 results. However, the company’s robust fundamental revenue streams remain intact leaving Microsoft in a good position for the future.

Nonetheless, conflicting valuation indicators suggest a deeper understanding of the company’s operations structure is required to deduce how good of an investment case exists in the current market for value-oriented investors.

Company Background

Microsoft Brand Guidelines

Microsoft is an American MNC technology corporation headquartered in Redmond, Washington. Known for their operating system Windows, Surface and Xbox line-up of personal electronic devices and their Azure cloud computing service, the company is undoubtably a tech powerhouse in the current market.

Microsoft is one of the most established technology companies in the world and their level of expertise, scale and market penetration is arguably unrivalled in the sector.

The company’s primary revenue streams arise from their productivity and business services (such as Office and Cloud Storage) as well as from the sale of personal computers, Xbox content and services as well as from the sale of Windows OEM operating system licenses.

The firm’s recent push into AI through significant investment and the partial acquisition of OpenAI’s ChatGPT has created a wave of significant positive sentiment across Wall Street for the company.

The immense scale on which Microsoft operates allows the company to exploit significant economies of scale and gives the firm a huge networking effect with their products. Their continued expansion into cloud computing as a service (in particular to rival Amazon (AMZN) and Google’s (GOOG) competing products) has proven to be an incredibly lucrative strategy.

While the company continues to innovate and is undeniably popular in Q1/2 of FY23, it is important to conduct a comprehensive fundamental analysis of the company’s value to deduce whether or not an investment opportunity exists at the present time.

Economic Moat – In Depth Analysis

Microsoft has an incredibly broad economic moat compared to most other technology companies given the immense breadth present in their product portfolio. The primary drivers for their moat are their Productivity and Business Processes segment, their dominant presence in the PC market and the rapid expansion of their cloud computing service Microsoft Azure.

Microsoft – Office 365

The company is an absolute market leader when it comes to the provision of Business Processes oriented products. Their extensive portfolio of Office applications such as Word, Excel and Teams are the most used business productivity software solutions in the world.

Furthermore, a competitive pricing ladder attracts both small and large-scale business into the software ecosystem which further drives increased market share and product penetration metrics.

Microsoft has also made a crucial pivot over the last decade towards offering their Office suite of applications as a subscription service in the form of Office 365, rather than primarily selling lifetime licenses.

The switch to a subscription model allows Microsoft to guarantee most users continue to pay for the new and improved versions of Office applications. While lifetime licensed copies of Office are still available for around $150, many prefer to purchase the cheapest Office 365 subscription for $6 monthly to ensure they avail of all the newest features and integrations within the ecosystem.

While Office does have multiple free competitors such as Google’s Docs, Sheets and Slides services, the lack of integration from these complimentary alternatives with the rest of the Microsoft ecosystem places them at a clear disadvantage on Windows-oriented solutions.

Microsoft – 365

Microsoft’s Office solution and it’s tight integration with other Microsoft products such as Windows and Azure have made it a truly invaluable asset to the company. Furthermore, the firm continues to innovate within the sector with constant improvements (most notably in the promised introduction of AI into Office products) suggests the firm is not willing to loosen its grip on the productivity market anytime soon.

The tight integration Microsoft has achieved between Office applications also ensures consumers and businesses alike face significant tangible and psychological switching costs should they choose to switch to an alternative provider.

Not only would most customers lose out on many proprietary features, but the almost universal utilization of Office would make it more difficult for users of other productivity services to communicate with the majority of others using Office.

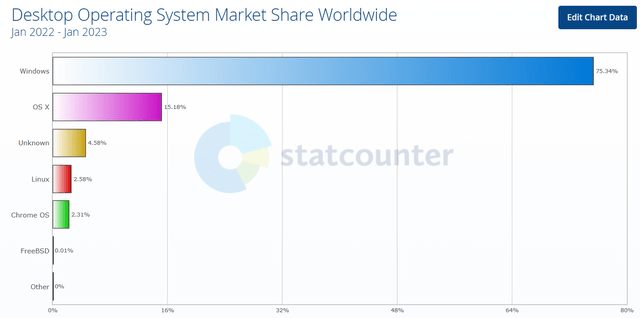

Statcounter.com

Another key driver for Microsoft’s historic growth and their significant economic moat is their dominant presence in the PC market. Microsoft’s PC operating system Windows has been the most widely used OS for well over two decades.

Windows 11 is the most current iteration of the software which Microsoft has made sure is tightly integrated with their Office suite of applications along with their host of other business oriented software solutions.

While the company does face competition in the PC OS marketplace, particularly from Apple and their Mac line of computers, the network effect derived from having such a huge userbase makes it almost impossible for a new competitor to enter the space. I believe this provides a huge degree of moatiness to the company.

The firm’s extensive server business combined with their new Intelligent Cloud segment comprised primarily of Microsoft Azure have proven to be crucial in the company’s revenue generation strategies.

Microsoft | Windows Server

The integral nature of Windows Server to most businesses core IT structures has proven to be a key driver of moatiness for the company. Should an organization wish to switch to a different provider, the loss of integration, general switching costs and possibility for significant operational disruptions has only acted to further cement Windows Server’s position as the dominant market player.

When combined with the once more extensive network effect the company derives from their Windows software adoption and Office utilization, it is no surprise that the Server segment remains such a lucrative and moat generating aspect of their business.

Furthermore, the willingness of Microsoft to keep their Windows Server solution open to the integration of Apple Mac OS running devices allows the company to further expand the reach of their service.

This ability for external integration also serves to increase the penetration of their Office and Business applications into devices which otherwise would have required a switch to a different competing software solution.

Microsoft Azure

Microsoft’s Intelligent Cloud computing service Azure is a direct competitor for Amazon and Google’s IaaS solutions. The platform has become the fastest growing IaaS solution and has provided the company with over 70% annual rates of growth.

While the service at its core is similar to Amazon’s AWS or Google’s Compute products, the high levels of integration with existing Windows Server and Windows running devices increases the attraction for enterprises to adopt Azure thanks to the promised ease of integration the service would provide.

Microsoft’s Azure provides enterprises with the same benefits as other IaaS products with a primary focus being on allowing businesses to reduce the complexity of their own in-house IT departments. The adoption of an IaaS product for most companies would yield significant cost reductions compared to traditional proprietary solutions.

Azure has been playing catch-up with AWS for the past decade due to the head start Amazon has in the segment. However, I believe thanks to Azure’s higher levels of integration with most of Microsoft’s other products and services, their IaaS service will prevail in the long run.

Microsoft also produces a host of consumer-oriented products such as their Xbox line-up of gaming-oriented products and their Surface line of in-house PED hardware. While these segments do provide Microsoft with notable sources of revenue, it is difficult to assign any economic moat to these business segments due to the competitive nature of these markets.

Nonetheless, these services and devices could play a crucial role in attracting new users to the Microsoft ecosystem of products and services thus acting to further drive revenues in other business segments.

Overall, it is clear to see the significance of the various business segments Microsoft has built for themselves over the past three decades. Their unrivalled levels of system, software and server integration makes adopting their suite of products easy while switching away becomes prohibitively difficult.

I believe Microsoft will continue to enjoy a wide economic moat for a significant portion of time moving into the future.

Financial Situation

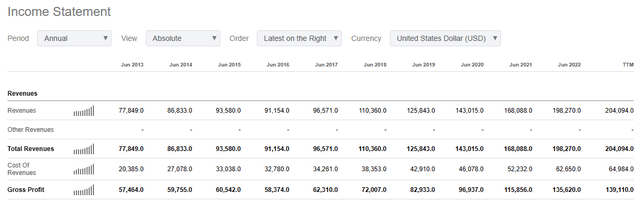

Seeking Alpha | MSFT | Income Statement

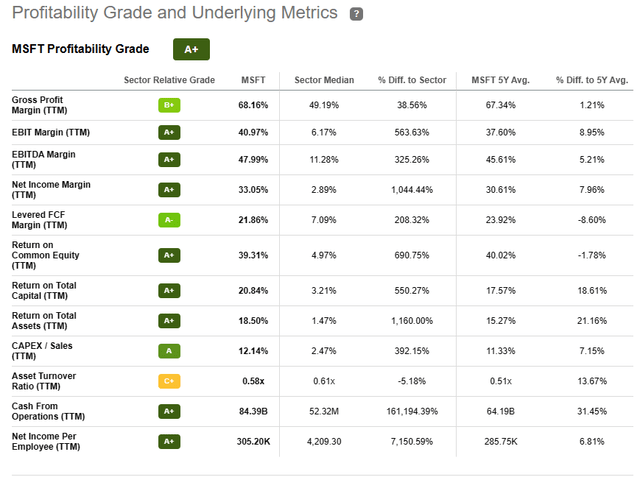

Microsoft has been a hugely profitable firm for the greater part of the last two decades. Their consistent EBITDA margins of 47.99% combined with a 5Y average ROIC of 25% gives just a small insight into their undeniably profitable history.

In FY22, Microsoft generated $198B in revenue. This represents a huge growth of 18% compared to the previous year with the firm’s total revenues having grown a whopping 106% since FY17.

These strong historical revenue statistics illustrate the consistent rate at which Microsoft has been increasing their cashflows for the past five years.

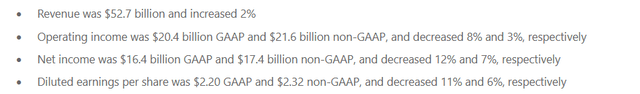

MSFT Earnings Release FY23 Q2

FY23 Q2 results showed a 2% increase in revenues compared to the same period last year. Unfortunately, operating income GAAP decreased 8% while net income fell down to $16.4B GAAP; a 12% decrease compared to Q2 FY22.

The primary drag on earnings was the 19% decrease down to $14.2B the company saw in it’s personal computing segment with Windows OEM license revenue falling a massive 39%.

Operating income was particularly hurt by a difficult macroeconomic environment which has significantly increased the COGS for the firm.

Nonetheless, Microsoft’s Azure Cloud revenue increased 22% (29% with constant currency) compared to the same period last year illustrating the robust nature of the segments business case.

The companies constant currency financial metrics for Q2 look significantly better with net income only being -4%. However, while this does illustrate that nothing exceptionally significant has happened with Microsoft’s core business segments popularities, the hard truth for investors is that the company has had a rather weak second quarter of 2023.

Considering the incredibly difficult environment technology companies have had to navigate over the past year, the ability for Microsoft to generate any form of revenue growth into Q2 is impressive.

On a longer time-frame, the company has managed to generate 10Y average gross margins of around 65% with average net margins for the same period resting at around 30%. Compared to other companies such as fellow tech giants Apple, Microsoft has managed to achieve a net margin over 10% greater than Apple’s.

This suggests Microsoft has managed to find the balance innovation and the provision of great services with the elimination of excessive COGS to create an almost unrivalled money-making formula.

Seeking Alpha | MSFT | Quant Profitability

Seeking Alpha’s Quant assigns Microsoft with an “A+” Profitability rating which I am absolutely in agreement with. Their strong profitability metrics are fundamental proof that the company has a robust business model and therefore could be an attractive pick for investors.

Microsoft’s balance sheet looks to be in healthy shape too. Their total current assets for FY22 are $170B while current liabilities for the same period amount to just $82B. This leaves the firm with a fantastic debt/equity ratio of just 0.33.

Their quick ratio (current assets minus inventory divided by current liabilities) is 1.66.

These fiscal stability metrics illustrate the healthy nature of Microsoft’s business from a balance sheet perspective. The company has strategically managed their debt situation.

While cashflows used in financing increased $10.4B in FY22, this was primarily due to a $5.3B increase in the repayments of debt. Overall, the company saw unlevered FCF increase a healthy $7.2B between FY21 and FY22.

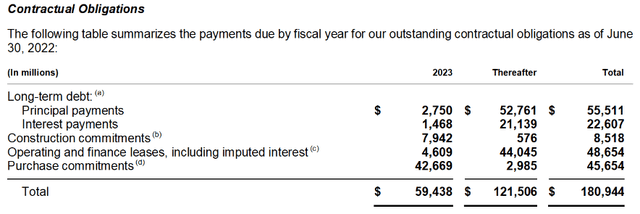

MSFT 10K FY22

Microsoft’s total long-term debt amounts to just $55.5B. This is welcomed news for investors and illustrates the conservative style the firm’s management has applied in their financial planning. Furthermore, only $2.8B of this debt will be maturing in 2023.

Overall, it is safe to say that from a long-term perspective, Microsoft has an incredibly solid financial platform to build upon. Their strategic debt management, incredible FCF, and net margins illustrate that the company has managed to create a fantastic profit-generating business model.

Valuation

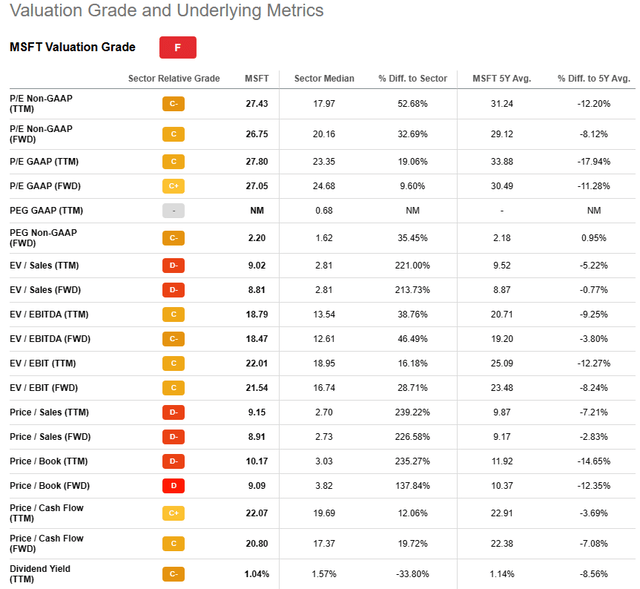

Seeking Alpha | MSFT | Valuation Metric

Seeking Alpha’s Quant has assigned Microsoft with an F Valuation rating. I am largely inclined to disagree with this assessment as it suggests the firm’s shares are materially overvalued, which I do not fully believe to be the case.

The firm is currently trading at a P/E GAAP ratio of 27.80 and a P/CF ratio of 20.80. Their FWD Price/Book ratio is just 9.09 and the companies EV/Sales FWD is 8.81. While these valuation metrics do not suggest that a significant undervaluation is present, it would be difficult to argue a significant overvaluation either.

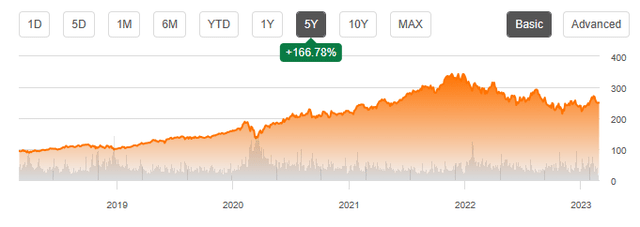

Seeking Alpha | MSFT | Summary Graph

From an absolute perspective, Microsoft’s shares have decreased on a one-year basis by around 16%. Over the past five years, the company has returned investors a healthy 166%.

While the past five years leading up to 2021 have been stellar for the company, it is important to remember the slow start the firm had after the 2008 financial crisis.

However, even if a downturn in the economy is experienced in 2023, I believe Microsoft’s business relies on a significantly more robust strategy for revenue generation.

The strength and moatiness of their current main profit drivers suggest the firm is much better equipped to endure even the most difficult of macroeconomic conditions.

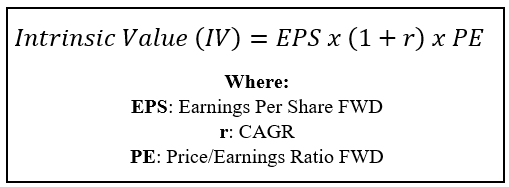

By accomplishing a simple financial valuation based on the calculation below and utilizing an EPS of $9.65, a conservative r value of 0.08 (8%) and the firm’s current P/E FWD GAAP of 27.80, we get an IV for Microsoft of $289.73.

Even with this ultra conservative CAGR value for r, Microsoft would appear to be intrinsically undervalued by about 13% (given a current share price $250). Furthermore, when considering the absolute profit generating abilities of the company combined with their powerful market dominance, the expectations for future value generation are high.

The Value Corner

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe the stock may begin to exhibit some bearish tendencies moving towards the third quarter of FY23. Given the recent bear rally and AI hype, a drop in valuations in the short-term could absolutely be a possibility.

Thereafter, much depends on the prevailing macroeconomic conditions and the ability of the US and global economies to achieve a soft landing on inflation to ensure the technology sector avoids a significant gulley.

In the long term (4-10 years) I fully expect their position as a leader in the industry to become even stronger. Their strong product portfolio combined with the undoubtable network effect places little doubt in my mind over the expected great returns the company should be able to provide to shareholders.

Therefore, it is absolutely possible to argue that the current share price leaves value oriented investors with some room to become involved with the stock. While a deep intrinsic value proposition is currently not present, the slight undervaluation combined with an expectedly bright future places Microsoft’s shares in a potentially attractive position.

Risks Facing Microsoft

The primary risk facing Microsoft is the emergence of more innovative and left-field competition which could drastically impact the tech giant’s key revenue streams.

The company must continue to focus on innovation in the Business and Consumer segments while ensuring profit and operating margins remain intact. Simultaneously, the company must ensure that any new products are suitable for the markets they are intended to serve. Loyalty to key areas such as Windows Server and Azure must not be compromised by the companies continued push into the no-moat consumer hardware market.

Azure also faces some risks from competing products AWS and Google Compute. These competitor product offerings have very similar characteristics to Microsoft’s IaaS thus making them direct competitors. However, I believe Microsoft’s ability to integrate Azure with the rest of their product and service range creates a tangible competitive advantage for the firm.

Potentially, a complete move away from IaaS to an alternative or new form of cloud technology could leave Microsoft’s Azure dead in the water. However, such a development would take years to accomplish by a competitor meaning Microsoft would have plenty of time to adapt or launch a competitor.

The firm also harbors some risk from their investment into AI. While the public sentiment has been fantastic with ChatGPT, the firm is yet to face any real competition from chief AI rivals Google.

Nonetheless, it is important for investors to assess how quickly Microsoft may be able to begin creating real returns on their AI projects. As the technology is still in it’s infancy – albeit maturing quickly – the time frame required to reach profitability is incredibly difficult to judge.

The risk for Microsoft is that it’s AI department becomes much like Alexa did for Amazon: a critical drain on resources and profits.

From an ESG perspective, Microsoft is relatively well protected. They have pledged to be carbon negative by 2030. While the company has faced some issues over employee harassment and claims of a toxic company culture.

Microsoft also faces the risk of a possible cyber-security breach as the firm holds huge amounts of sensitive customer, enterprise, and mission critical information on their servers.

Summary

Microsoft has had an impressive last five years from an investor standpoint. Their robust, broad business model, excellent operational efficiency and iconic brand reputation have allowed the company to become a true profit generation powerhouse.

In my opinion, current share prices represent a small undervaluation in the company form an intrinsic value perspective. The promise of strong future cashflows and a truly diverse set of revenue streams suggests significant returns could be on the horizon for Microsoft.

As a short-term investment, I believe there is some volatility in-store for the stock as tricky macroeconomic conditions continue to dominate the marketplace. However, in the long-term I believe their undeniable position as a market leader places Microsoft firmly in position to generate great shareholder value.

I therefore believe Microsoft warrants a Buy rating, even after the recent AI boosted rally. However, while I believe the company is a great buy even at its current prices ($250), I will personally wait to see what the second half of 2023 brings along with it with particular regards to the possibility of a recession.

Ideally for me, an undervaluation of 25% (share prices around $225) would provide a satisfactory margin of safety to begin building a position from a pure value perspective, ignoring all speculative growth estimates.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.