Summary:

- The FTC wants to stop Microsoft from consummating its proposed acquisition of Activision on anti-competitive grounds. But the deal is not entirely lost yet.

- Microsoft likely sees Activision as a critical gateway toward fulfilling its ambitions in the consumer ecosystem, with its reported “super app” as a key milestone.

- We discuss why paying $69B in the current environment should be reconsidered. With the bear market, it’s also looking increasingly overvalued.

- Microsoft should reconsider reallocating the investments to its core business, as its competitors pull back.

David Ramos

Thesis

Microsoft Corporation’s (NASDAQ:MSFT) deal for Activision Blizzard, Inc. (ATVI) has come to an official standstill with the US FTC, as it sued to block the acquisition. But, the WSJ also highlighted that “it is too soon to tell whether the FTC can succeed in blocking the acquisition.” Notwithstanding, its targeted completion date before June 30, 2023, is doubtful for now.

Columbia Law School Professor Eric Talley argued that the FTC’s case would need to be very strong, as he articulated:

The case could be difficult for the [FTC] to win because courts have traditionally not seen deals among companies that specialize in different phases of the same industry’s production process – so-called vertical mergers – as competitive dangers. It may require the commission to convince a judge to change the law somewhat. That makes it a difficult case for the FTC to win, though they presumably knew this going in. – WSJ

Hence, Microsoft’s ambitions to build out its consumer mobile ecosystem are far from over, even as the FTC and Sony (SONY) disapproved of the Microsoft-Activision deal. The FTC fears it could upend the competition in the US gaming market, with consumer interest inevitably harmed if the deal was given the green light.

Despite that, the equity markets have not reacted negatively to the deal, as Microsoft’s growth in its critical cloud and enterprise markets is unlikely to be impacted. However, it could scupper Microsoft’s ambitions to venture deeper into the consumer mobile ecosystem, which could hinder its ability to build out its “super app” to thwart Google’s (GOOGL) (GOOG) Play Store/Apple’s (AAPL) App Store duopoly and limit its growth algorithm into advertising.

Coupled with China’s recent rejection of a simplified review of the acquisition, Microsoft’s bid to land ATVI’s prized assets has undoubtedly stumbled. Microsoft Gaming’s growth has also slowed remarkably. However, despite the slowdown in the mobile gaming market since its pandemic surge, Activision continues to see constructive recovery, in line with the bottoming of its monthly active users (MAU) decline.

Despite that, we don’t think Microsoft’s near- and medium-term growth drivers in its core business have been harmed. Even if the courts were to side with the FTC and call the deal off, Microsoft could be spared a “pyrrhic victory of executive distraction and expensive regulatory concessions.”

As investors, we aren’t so sure whether the distraction makes sense now for CEO Satya Nadella and his team. But, while the potential outcome is still too early to conclude, we believe the stakes have changed with the recent tech downturn.

With Cloud growth slowing as enterprise spending turned more cautious, we believe that Microsoft has significant leverage in the enterprise space instead of consummating its $69B ATVI acquisition. Furthermore, with Salesforce’s (CRM) executive ranks in disarray, Microsoft should leverage the problems at its leading Cloud SaaS arch-rival to its advantage.

Moreover, recent estimates from Newzoo suggest that the gaming market is a slow-growth market, with much of the growth through 2025 captured in the pandemic-driven boom.

Therefore, ATVI’s $69B price tag is looking increasingly overvalued (well above its peers’ median), given the bear market in 2022. No doubt, there likely isn’t another asset like ATVI’s Call of Duty, World of Warcraft, and Candy Crush; we think paying the $3B breakup fee to ATVI and walking away is a sensible proposition in the current environment.

Why The FTC Wants To Stop The Microsoft-Activision Deal

The FTC highlighted that it believes the deal is anti-competitive and, therefore, illegal. Notably, the FTC believes ATVI’s acquisition “would give Microsoft the ability to control how consumers beyond users of its own Xbox consoles and subscription services access Activision’s games.”

Sony’s objection to the deal’s consummation also drew the ire of Microsoft Gaming chief Phil Spencer, as he accentuated:

There’s been one game industry participant that’s really been raising all the objections, and that’s Sony, and they’ve been fairly public about the things that don’t meet their expectations. From where we sit, it’s clear they’re spending more time with the regulators than they are with us to try and get this deal done. – Bloomberg

We believe the FTC’s objection could be linked to the nascent cloud gaming market, the most promising growth vertical in the slow-growth gaming market.

According to Newzoo’s estimates, the cloud gaming market could triple by 2025, reaching $8.2B from 2022’s estimated $2.4B (up 74% YoY). While still a very small pie within 2025’s global gaming revenue projections of $211B, it holds tremendous promise, as Newzoo accentuated:

Cloud gaming’s serviceable obtainable market (SOM) is growing. [Notably,] cloud gaming’s SOM will grow from 160.2 million people in 2021 to 220.2 million this year. From now until 2025, the number will more than double. Simply put, cloud gaming’s target audience will almost triple between 2021 and 2025, edging ever closer to the half-billion mark. – Newzoo

Little doubt that the FTC’s rebuttal likely touched on Cloud gaming, given Microsoft’s ambition to integrate Activision’s massive and diversified MAU base. The FTC accentuated:

We seek to stop Microsoft from gaining control over a leading independent game studio and using it to harm competition in multiple dynamic and fast-growing gaming markets. – FTC

Why Microsoft Is Fighting To Keep The Deal: Super App Ambitions

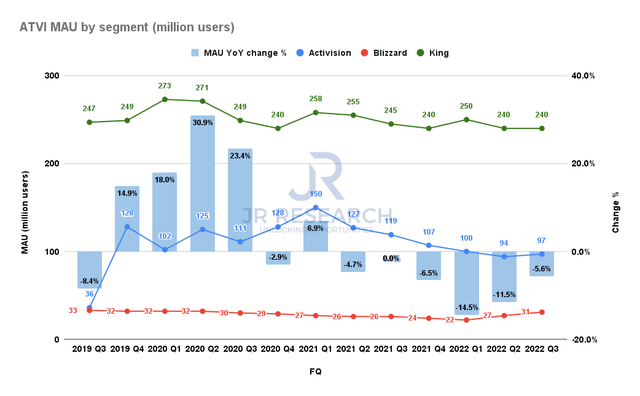

ATVI MAU by segment (Company filings)

As seen above, the deal would give Microsoft Gaming a significant leg-up in its competitive moat, integrating nearly 368M users, including 240M from King. We discussed why King is so critical and highlighted Microsoft’s ambitions in cloud gaming in our January article on the Activision deal.

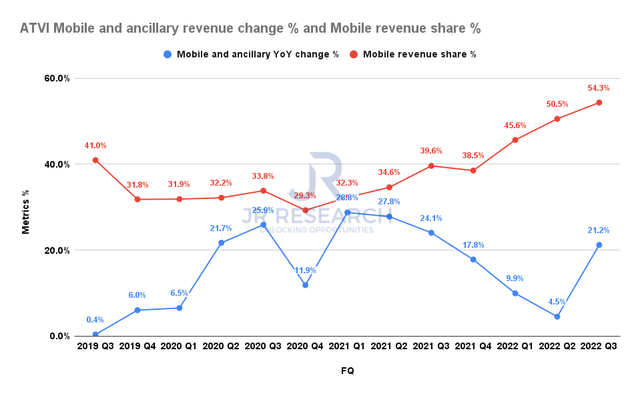

ATVI Mobile revenue change % (Company filings)

Coupled with Activision’s robust mobile segment performance, we believe Microsoft is seeking to fill a significant gap in Xbox’s strategy that could be instrumental toward its reported super app ambitions. The Information articulated in a recent commentary:

Microsoft recently considered building a “super app” that could combine shopping, messaging, web search, news feeds and other services in a one-stop smartphone app, in what would be an ambitious move by the software giant to expand further into consumer services. Unlike Apple and Google, Microsoft doesn’t operate a mobile app store for smartphone users. By creating an all-in-one app that people don’t need to leave to access its other offerings, Microsoft hoped to emulate a mobile strategy that has worked for Tencent. – The Information

With ATVI’s massive leadership and MAU base in mobile gaming, we believe it could help spur Microsoft’s ability toward its super app ambitions, instrumental toward its goal to boost ad revenues.

However, the critical question is whether paying $69B while being saddled with the FTC’s challenges and the concomitant PR nightmare is still worth it in the current environment.

Microsoft Should Just Walk

Some Wall Street analysts opined that the deal no longer favors Microsoft, given the FTC’s objections. For example, Cowen analysts highlighted in a recent commentary:

While Microsoft might have a strong chance of beating the FTC’s challenge, the odds of the company also coming out on top in potential challenges from regulators in the UK and Europe are slim. Similar moves from authorities in the UK or Europe-and maybe both-are likely to follow that of the FTC. At a certain point, Microsoft may decide that the total litigation, distraction, and public relations costs are too high, and choose to walk away from the transaction – WSJ

We agree. Microsoft’s $69B acquisition of Activision is looking increasingly overvalued when its gaming peers are valued at much lower valuations, given the bear market. Accordingly, ATVI’s gaming peers trade at an NTM EBITDA of 8.6x, well below ATVI’s NTM EBITDA of 13.6x.

Coupled with slow-growth projections in gaming, we believe Microsoft should leverage its $69B more appropriately in its core cloud and enterprise business. With its SaaS peers pulling back, and Salesforce undergoing a significant Co-CEO transition, Microsoft could pull more levers on its core business to push further ahead, improving its competitive edge against its hyperscaler peers and SaaS competitors.

Rather than getting saddled with the regulatory battle with the FTC in the courts, and unglamorous PR optics, with Sony calling out the “bully,” Microsoft should choose to walk.

With MSFT continuing to bottom out, as we highlighted in our previous article, we assess that the market does not appear to be currently concerned with Microsoft’s legal battle with the FTC.

However, we believe that investors could give MSFT a further liftoff if Nadella and his team could consider saving that lofty price tag and invest it accordingly to pursue growth in its core business.

Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!