Summary:

- There are plenty of speculations around the newly introduced ChatGPT, backed by Microsoft.

- Many potential investors and MSFT stockholders are highly enthusiastic about the new artificial intelligence launch.

- There is quite a race between high-tech giants on “who will get there first”.

- I do not recommend buying Microsoft based on these speculations alone.

- Many of you remember how much money has been lost due to the general public’s enthusiasm about internet technologies and the new names. Something similar might actually happen to artificial intelligence brands now.

Jean-Luc Ichard

Microsoft (NASDAQ:MSFT) stock is considered to be almost as reliable as US Treasuries, thanks to its enormous cash reserves and excellent profitability record. The high-tech sector, however, took a substantial hit in 2022. Many giants’ valuations have been largely affected due to the fact the Fed took plenty of liquidity off the market. MSFT stock plunged in value too. Many analysts, prospective investors, and the company’s existing stockholders point out that ChatGPT, an artificial intelligence (‘AI’) application, can change all for the company. In other words, it can even beat Google (GOOG) and become a brilliant source of income. I will explain why one should not buy MSFT stock based on that speculation alone.

MSFT stock and ChatGPT

A lot has already been said about ChatGPT. Many professionals use it to generate simple articles and descriptions. Schoolchildren use it as an essay-generation tool. Many corporate managements use it to write earnings reports.

According to its own official description, ChatGPT is “an AI-powered chatbot developed by OpenAI, based on the GPT (Generative Pretrained Transformer) language model. It uses deep learning techniques to generate human-like responses to text inputs in a conversational manner.“

In simple English, ChatGPT is a tool that allows users to enter written prompts and receive new human-like text. The quality of the content, however, is still hard to compare to that generated by a human being.

ChatGPT was developed by San Francisco-based startup OpenAI. OpenAI, in turn, was co-founded in 2015 by Elon Musk and Sam Altman and is backed by well-known investors – most notably Microsoft. Therefore, Microsoft Corporation has a substantial financial interest in the app. So, ChatGPT’s success or lack of success can affect MSFT as well.

The Dot.com bubble and AI

There is nothing wrong with the idea of artificial intelligence, really. As time passes, new technologies get developed and introduced to the mass market. This was the case with internet technologies back in the 1990s. These proved to be highly useful and got widely adopted. However, not all the companies operating in this field survived when the famous Dot.com bubble burst. The market was slowly getting crowded. Financial indicators of many high-tech businesses were often very poor. Many of these, therefore, went bankrupt. Only a few companies survived this period. Investors or better-said speculators, meanwhile, were fascinated by the idea of internet technologies. The idea was good, indeed. But their bet on the companies with poor fundamentals that did not survive competition was not good.

Microsoft is a brilliant company by many criteria. However, it would be quite a speculation to say that ChatGPT would outperform its peers and become a large source of income for MSFT. I do not have anything against the idea of artificial intelligence. And yet, even betting on the idea of AI and making bold predictions still carries some risks. After all, many experts criticize artificial intelligence for its lack of creativity as opposed to that of a human brain. Even more of a risk is saying a particular AI app is better than others. That is because a few alternatives to ChatGPT have already been developed.

ChatGPT and other AI products

Some experts worry ChatGPT is inferior to Google’s Bard AI, a reasonable substitute for ChatGPT. But I have also read about Baidu’s (BIDU) decision to launch a ChatGPT-like Ernie Bot in March this year. Also, so far, several other companies have developed apps that are similar to ChatGPT. The functions of these apps are different. Some are effective for writing, some are useful for researching, translating, and even coding.

For some reason, it is also expected that ChatGPT would overtake Google’s search engine. But, in my view, ChatGPT will not kill Google in the near future. ChatGPT offers users a more interactive experience. Google, in turn, presents users with comprehensive up-to-date results, making it a perfect search engine. I am not saying that ChatGPT’s developers cannot make changes to the app to make it a great alternative to Google’s search engine. But right now this does not seem likely.

The point I am making is that the AI race has started. And the outcomes of this competition are still unclear.

MSFT stock – a great long-term investment

Microsoft stock has been somewhat shattered in the past 2022. Yet, the company can safely be called a cash-producing machine. With excellent debt ratios, MSFT has an AAA rating. From non-government-owned companies, only Johnson & Johnson (JNJ) can boast such a sky-high credit rating. MSFT is an absolute champion in terms of dividend stability. The company has been generating profits and positive cash flows for ages. It has a very strong cloud division.

That being said, the corporation’s revenue growth rate has slowed down. This is almost always the case with mature businesses. Analysts hope that ChatGPT can change this situation. Whilst all is possible, it is very speculative to bet on that for the reasons I have explained above.

That being said, MSFT stock is a sound component of a conservative investor’s portfolio. Generally speaking, it is worth buying after major corrections.

Valuations

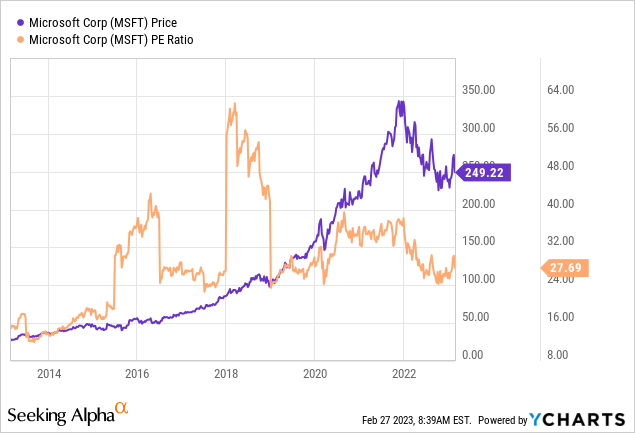

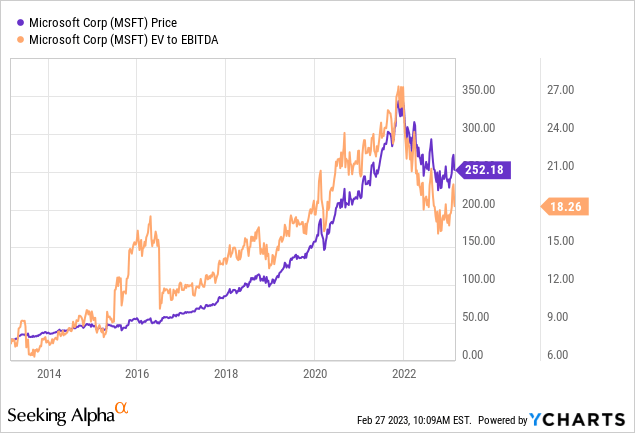

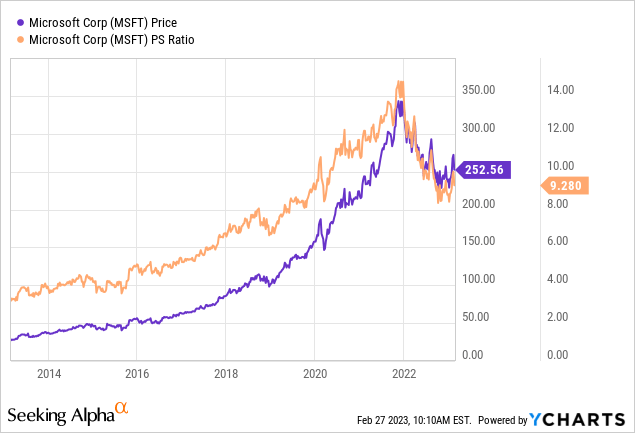

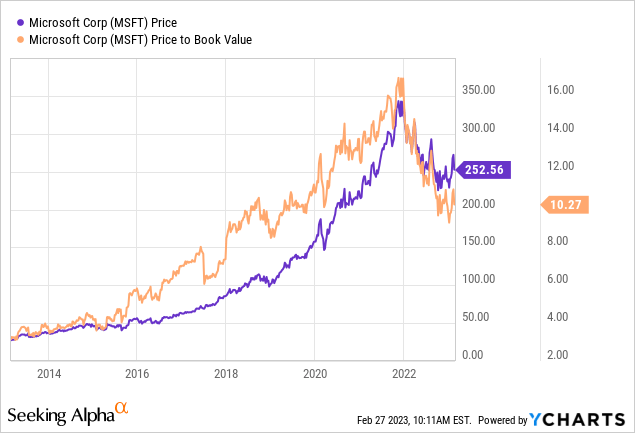

I used a few measures to judge how overvalued or undervalued MSFT stock is. I would say it is overvalued. But let me explain why.

If we have a look at the graph above, we can say Microsoft’s shares are not trading at a record-high price-to-earnings (P/E) ratio. At the same time, on its own a P/E of 28 is quite high, especially given the fact Microsoft is a profitable business.

Not particularly healthy is MSFT’s EV-to-EBITDA ratio, which is now lingering around the 18 mark. A good EV-to-EBITDA should ideally be under 10. But again, 18 is not too high for Microsoft, given its EV-to-EBITDA history.

MSFT’s price-to-sales (P/S) is also high, even exceeding the 9 mark. As well all know, a good P/S should not be higher than 3.

MSFT’s price-to-book (P/B) ratio is also high, over and above the ideal 1 to 3 range.

Risks

Here are some major risks facing Microsoft now:

- First of all, Microsoft has many competitors. This is not only true of ChatGPT. It is also the same story with cloud technologies. After all, Amazon (AMZN), Apple (AAPL), and many other high-tech companies compete with MSFT in this area.

- There is plenty of guesswork to be done on whether ChatGPT would turn out to be a great revenue source.

- Then, MSFT’s revenue growth is not particularly high right now.

- Finally, Microsoft’s valuations are quite high. The ratios might not be particularly high for a popular high-tech company. But they are too high for a value investor.

- There is a recession risk as well. A recession will be a problem for many stocks. Given the fact MSFT stock is overvalued, long-term investors would take a substantial risk by buying Microsoft’s shares now at such a price.

Conclusion

By all means, Microsoft is a safe and reliable company with a long history. It is stable and profitable. Yet, I would not personally recommend buying its stock just because of the great ChatGPT expectations. After all, there are many alternatives already available on the market and many more will come. There is plenty of guesswork to be done on which artificial intelligence app will eventually win. I would not personally invest in MSFT stock right now due to its high valuations. But I do consider Microsoft to be a brilliant corporation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.