Summary:

- 2022 will soon be in the history books and it’s been quite a ride.

- Tech collapse, inflation, recession: the macro environment looks stressful, but this market definitely has its advantages.

- Let’s look at what worked, what didn’t, and whether it’s time to take profits in AbbVie and VICI or cut losses in Alphabet into 2023.

Marcin_P_Jank

In the waning days of 2021, I wrote the article 3 Best Long-Term Stocks For Investors In 2022 recommending AbbVie (NYSE:ABBV), VICI Properties (NYSE:VICI), and Google-parent Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL).

It’s time for an update with 2022 drawing to a close. My apologies in advance for the length of the article (I know you’re busy!), I cut where I could, but I wanted to include all the critical info.

Time truly flies, and it’s hard to believe nearly a year has passed. At the same time, so much has happened that it’s tough to believe it all happened in only one year. Time is a fascinating phenomenon.

Many investors will be glad to see 2022 in the history books, but I wonder if I am one of them. I am much more comfortable building long-term positions in this market than in 2021.

The drop has provided a terrific chance to open new positions like Adobe (ADBE) and reinitiate others, like Cloudflare (NET). There have also been fantastic chances to add to holdings like Texas Instruments (TXN) and average down in others, like CrowdStrike (CRWD).

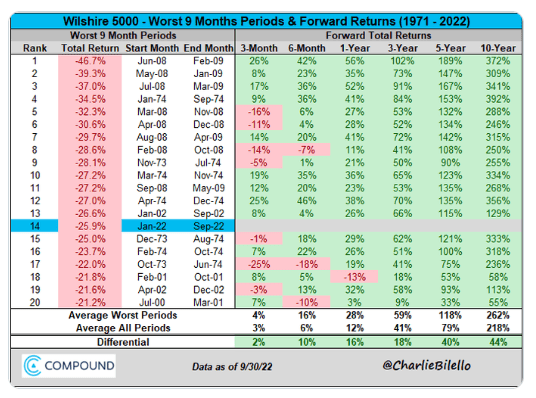

Multiple reputable studies show that investors underperform the market by trying to time it. This happens because missing just a few of the market’s best days crushes long-term returns. And many of these days come when we would least expect them – within a few weeks of the worst days. Returns following a bear market are typically excellent for long-term investors, as shown below.

Compound Advisors

Dollar-cost averaging is an excellent strategy. So is setting limit orders on favorite stocks at the desired price and lower intervals in increasing numbers of shares. The advantages are that you get your price and then leverage it down. The disadvantages are that the stock may not drop to the desired price and that it takes patience.

Now back to the business at hand.

Let’s review the situation in late 2021.

Interest rates were still near zero, inflation was near 7%, Russia hadn’t invaded Ukraine, many of us were still under COVID-19 mask mandates, and the Nasdaq (QQQ) was near 16,000 when the article was written. Oh, and Elon Musk hadn’t even started the Twitter rumblings.

However, the writing on the wall was coming into focus, so two of the three recommendations focused on lucrative dividends rather than growth. This worked out tremendously well. On the other hand, I expected Alphabet to weather the tech storm much better than it did. Now Google is facing severe headwinds in advertising and cloud services, and it’s decision time.

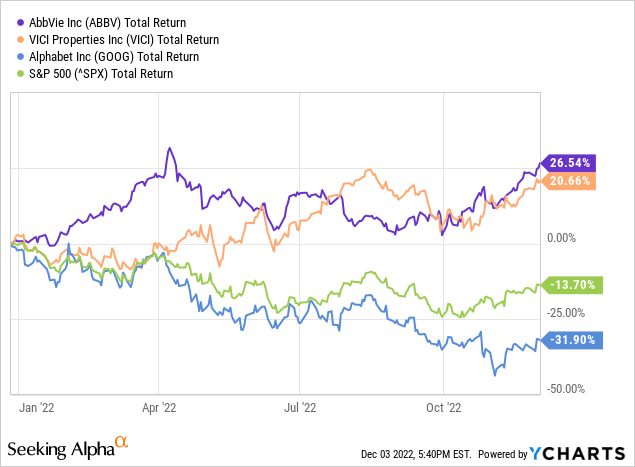

The result is two outstanding performers and one massive disappointment, as shown below.

AbbVie and VICI outperformed the S&P500 by 40% and 34%, respectively, while Alphabet lagged by 18%.

My last article focused on the success of AbbVie and Alphabet’s downfall, but VICI deserves some of the limelight, so let’s start there.

VICI defies the REIT crumble: Is it still a buy?

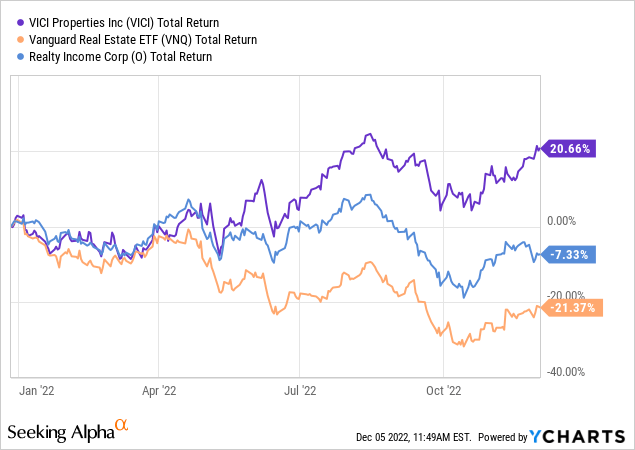

Real estate investment trusts (REITs) have had a rough time in 2022 as rising interest rates have caused investors to flee. But at least one has thwarted the trend massively.

VICI Properties has outperformed the Vanguard Real Estate ETF (VNQ) by over 40% since the article’s publishing date. As shown below, even the highest quality REITs, like Realty Income Corp (O), have struggled.

What separates VICI?

VICI is one of the world’s largest casino and entertainment property holders. Its ownership of “trophy properties” like Caesars Palace, The Venetian and Palazzo, Mandalay Bay, and numerous other one-of-a-kind locations sets it apart.

VICI is somewhat shielded from inflation due to automatic rent escalators tied to the consumer price index (CPI) – rents increase automatically when inflation is high. Many of the increases are capped, typical of rental agreements; however, 47% are uncapped.

Some might wonder if owning entertainment properties heading into a recession is risky. VICI collected rent and even raised dividends during the worst pandemic casino closures in 2020. Investing in the landlord is not the same as investing in the casinos themselves. In fact, VICI has reported 100% rent collection since it was formed in 2017.

What happened in 2022?

-The accretive acquisition of MGM Growth Properties was completed in Q2 2022, which solidified the portfolio. In total, VICI holds 44 properties in 15 states.

-VICI joined the S&P 500 index in June.

-Achieved investment-grade debt ratings from all three major agencies.

-Adjusted funds from operations (AFFO) rose 57% YOY through Q3 2022 and 83% YOY in Q3. However, the share count also rose considerably to finance acquisitions. AFFO per diluted share is marginally higher this year. It’s critical to examine AFFO on a per-share basis with REITs.

Is VICI still a buy?

VICI’s dividend is the name of the game. The dividend has risen 8% compounded annually since the company’s creation and 8.3% this year. The share price rise has pushed the yield down near recent historical lows, as shown below.

Seeking Alpha

VICI still needs growth, and the plan has several initiatives. VICI has a fund that provides capital to tenants for expansion. Basically, VICI provides money for the tenant to expand and then collects rent on the development, which VICI owns. An example is the Century Casinos deal just announced.

The company also looks at gaming opportunities abroad and non-gaming properties in the U.S., like golf courses and resort lodges.

The dividend is safe as VICI hovers near its targeted payout ratio of 75% of AFFO. The company’s debt is 100% fixed rate with an average of 7 years to maturity. This is vital, with interest rising fast this year.

In short, VICI is a terrific vehicle for a solid and growing yield; however, near-term share price increases could be muted, barring a significant acquisition.

For my money, VICI Properties is now a solid hold.

Can AbbVie keep crushing the market?

AbbVie made the top pick list because of its desirable yield and resilience to an economic downturn. Pharmaceuticals outperform during market turmoil because their products are generally not luxuries. As predicted, investors flocked to AbbVie as a haven this year.

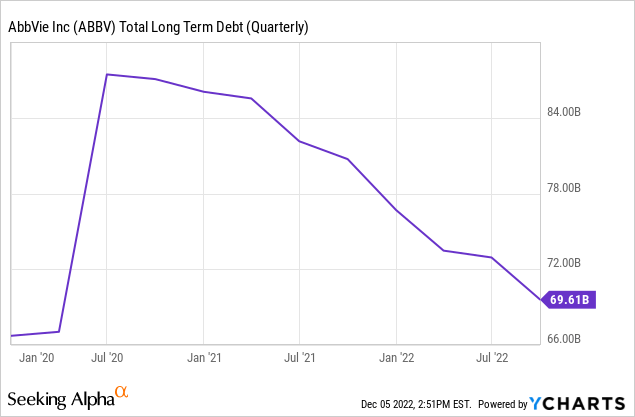

Revenues through Q3 rose 4% to reach $42.9 billion. Cash from operations fell 1% to $17.5 billion. Meanwhile, management continued to aggressively pay down debt taken on in 2020 when the company acquired Allergen, as shown below.

The acquisition continues to pay off with significant gains in sales from Botox Cosmetic (+23%), Botox Therapeutic (+12%), Vraylar (+19%), and steady sales of Juvederm.

What about the Humira biosimilar threat?

AbbVie’s blockbuster drug, Humira, will have competition in the U.S. from biosimilars starting in 2023.

The sales gains above are critical to filling the gap that will be left once biosimilars for Humira hit the market. Judging by the decline in sales internationally, where biosimilars are already available, Humira sales will likely be cut in half within three years. This will be a massive blow; however, management has made significant strides to address the issues.

As recently as Q1 2020, Humira accounted for 55% of total revenue. This was down to 38% in Q3 2022. Meanwhile, combined Skyrizi and Rinvoq sales rose 68% through Q3 2022 to $5.3 billion. AbbVie has confirmed guidance of $15 billion in sales from these two by 2025. All told, the company is on track to replace lost Humira sales.

Is AbbVie still a buy?

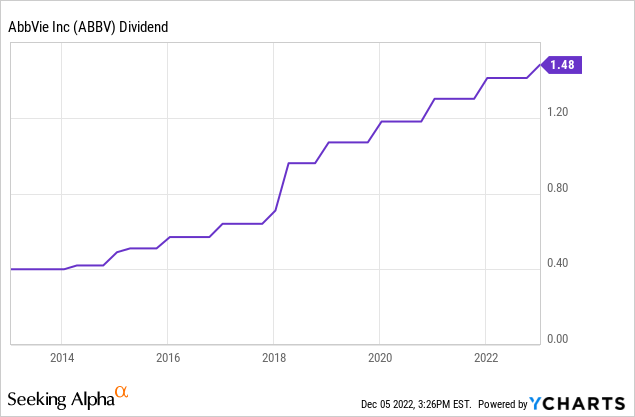

Like VICI, AbbVie’s main draw is the safe and rising dividend. AbbVie has raised the dividend each year since its inception, as shown below.

Shareholders got a modest 5% raise this year.

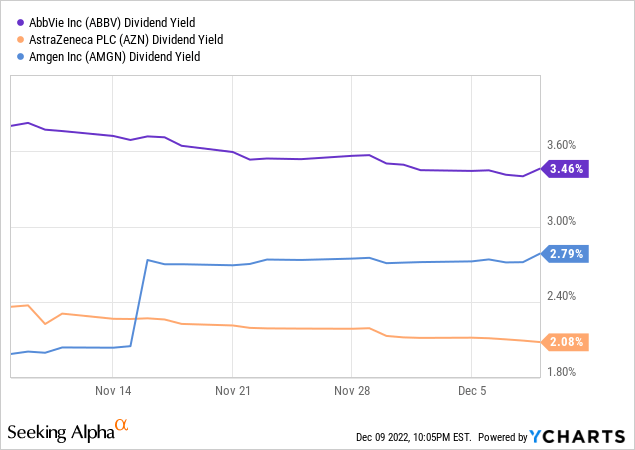

Mostly, shareholders get a solid stock that is not prone to wild downswings and a safe yield that opportunistic investors can snag over 4%. The yield is higher than competitors like Amgen (AMGN) and AstraZeneca (AZN) because of the concern over Humira, as shown below.

AbbVie’s average yield in 2021 was 4.5%, down to 3.7% this year because of the share price increase. Wall Street is starting to believe the company will thrive even with the Humira cliff.

AbbVie remains a rock-solid pick for consistent returns; however, it is much more attractive above a 4% yield. For this reason, I consider the stock a hold until the price drops below $150 per share.

Google: Average down or cut losses?

Google stock has been slaughtered this year, falling more than 30%. Revenue growth has been acceptable, but controlling costs has proven difficult.

The way I see it, long-term investors have two reasonable choices: stick with Google stock by averaging down (purchasing more stock at a lower price to reduce the cost basis) or cut losses and invest elsewhere.

There are convincing arguments on both sides, so it will be fun and hopefully informative to make each case and see which is more powerful.

Point: Investors should stick with Alphabet – and buy more while it slumps.

1. We all know that sales growth like we saw in 2020 and 2021 wouldn’t last forever, but Alphabet is still growing. Sales are up more than 13% YOY so far in 2022.

2. Operating income is strong at $57 billion through Q3 – matching last year’s total despite record inflation. Operating cash flow increased slightly, reaching $68 billion on a 33% margin. Times are tough, but this isn’t exactly a crumbling business.

CEO Sundar Pichai has disclosed the goal of becoming 20% more efficient, which is welcome news.

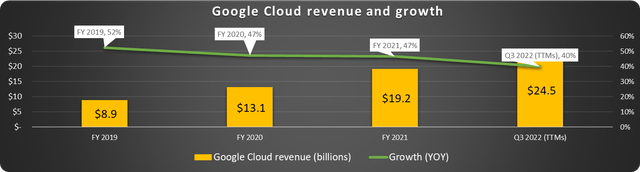

3. Google Cloud has made giant strides in growing sales, as shown below.

Data source: Alphabet. Chart by author.

Revenue has nearly tripled since 2019, and this segment still has massive potential. It trails only Amazon Web Services (AMZN) and Microsoft Azure (MSFT) in market share.

4. The balance sheet is rock solid. Alphabet has $166 billion in current assets against just $66 billion in current liabilities and only $14.5 billion in long-term debt (a piddly 1% of the current market cap).

5. Finally, the most compelling reason to increase holdings at these levels is the indispensability of Google Search. Google Search is so pervasive that Google is now a verb. Seriously, it’s listed in Merriam-Webster’s dictionary. Advertisers know they need to be on page one, which gives Alphabet tremendous pricing power.

Counterpoint: It’s time to sell Alphabet stock.

1. Expenses are ballooning faster than revenue because management is not controlling costs.

The company increased its headcount by 24% in the last year from 150,000 to nearly 187,000. Unfortunately for employees, layoffs may be in order now. Hiring and onboarding are expensive, and this looks like poor foresight.

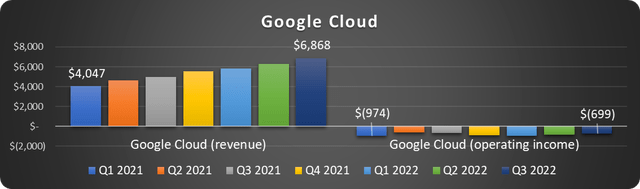

2. Sure, the Google Cloud segment is growing, but it’s a major money pit. I have written about this in detail here. While Amazon is raking in cash from AWS, Alphabet has lost $15.8 billion from the Google Cloud segment operations since 2019.

I’ve shared below recent revenue growth juxtaposed with the continued operating losses.

Data source: Alphabet. Chart by author.

Sales growth will further slow in 2023 if recent industry results are indicative.

3. 2023 could see advertisers make sizable budget cuts, further cutting into growth and profits. This is nearly a given, and it will be up to management to streamline operations. They haven’t proven this ability yet.

What we ultimately do depends on belief in management, time frame, and risk appetite. I added modestly at $85.50.

All in all, 2022 was a frustrating year. Yet there were successes like AbbVie and VICI. Bear markets can be terrific for long-term investors to set up tremendous future profits. Remember to dollar-cost average, focus on the long haul, and keep a comfortable risk profile.

Watch for 2023 picks coming soon!

Disclosure: I/we have a beneficial long position in the shares of ABBV, ADBE, AMZN, CRWD, GOOG, MSFT, NET, O, VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors’ goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.