Summary:

- After a healthy increase in 2023, can Netflix’s upcoming earnings report provide the impetus for continued rise in 2024?

- While the company’s recent improvements in paid memberships and healthy operating profits go in its favour, reduced per member revenue and higher costs are risks to the outlook.

- Netflix’s Q3 2023 figures were encouraging and even if it underperforms on expectations in Q4, its leadership position, otherwise strong fundamentals, and market multiples work in its favour.

Nanci Santos

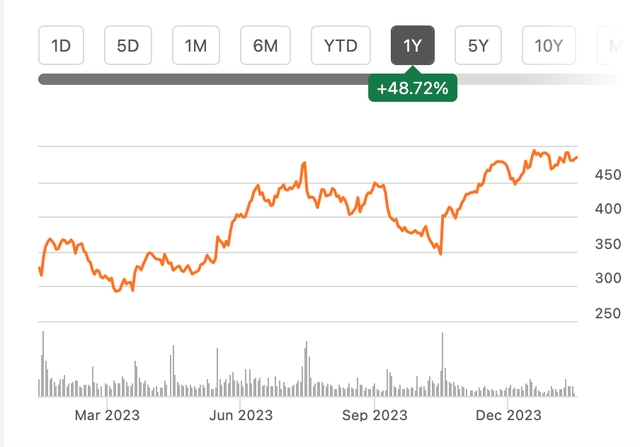

2024 might have started on an underwhelming note for streaming services provider Netflix (NASDAQ:NFLX), with its price barely having moved, but there are very clear signs that it can see another good year after rising by 48.5% in 2023. Its good financials and decent market multiples, from a historical standpoint, both go in its favour.

But as it readies for its earnings release next week, the key question is whether its stock price will necessarily see an uptick in the near term. The question is important to the extent that there are arguments for why it might not happen.

Price Chart (Source: Seeking Alpha)

Revenue target achievable, but risks exist

The company expects revenues for the final quarter of 2023 (Q4 2023) of 10.7% year-on-year (YoY). If achieved, this would be the highest quarterly growth in two years. On the face of it, this does sound like a stretch after the softening it experienced after the post-pandemic highs. But there are supportive factors to note here.

Revenue growth strategy is working

The steps taken to achieve higher growth last year are working, for one. These included a crackdown on password sharing last May, permitting password sharing at a higher price, the option of advertisement-based subscriptions at reduced prices and increased prices for regular subscribers.

Come Q3, 2023, and their positive impact was evident in the following outcomes:

- In its letter to shareholders for Q3 2023, it also noted that despite these measures, the cancellations were lower than expected (see discussion on ‘Monetization and Growth’ on page 5 of the link).

- It reported net paid additions of 8.76 million, the biggest increase since Q2 2022 during the height of the pandemic, when it added 10.1 million subscribers.

- Its paid membership growth rate also jumped to 10.8%, the biggest since Q1 2021.

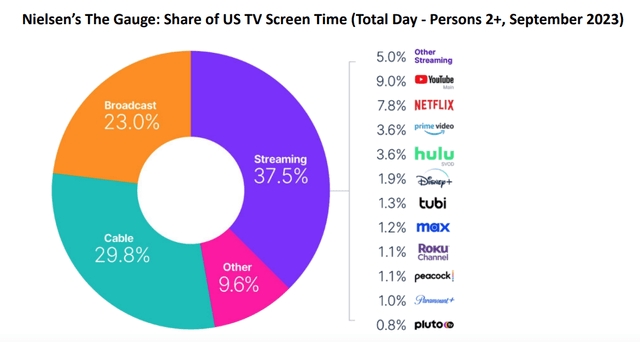

This is no small feat, especially considering the increased competition in its market. Netflix has, however, maintained a healthy lead in share of screen time over its closest competitors, Amazon Prime Video and Hulu in its big US market, which, as part of its UCAN market accounted for 43% of its Q3 2023 revenues.

Source: Netflix

Can membership growth rates accelerate?

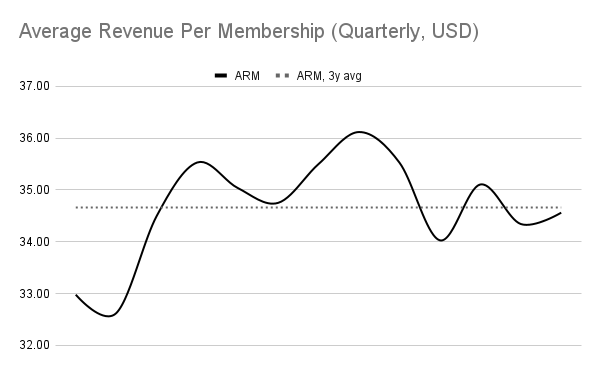

However, the measures have come at a price. And that price is the average revenue per membership [ARM]. At USD 34.56 for the latest quarter, the number is lower than the three-year average of ~USD 35 (see chart below). Further, Netflix expects the number to remain flat in YoY terms in Q4 2023, which means a sequential drop of 1.5% and would also make it the lowest ARM per quarter in the past year.

Source: Netflix, Author’s Estimates

To then achieve the target revenue growth rate, total paid memberships would have to rise by the same rate as the target revenue growth of 10.7%, which doesn’t sound right. Here’s why. In the past year, membership growth has been higher at an average of 7% over this time than the revenue rise of 4%.

Even in the last quarter, which takes into account the growth measures, memberships grew by a bigger 10.8% compared to the 7.8% revenue figure, which can be explained by the introduction of lower price options. This suggests that for the revenue target to be achieved, Netflix would probably have to see even higher membership growth. Whether it can pull this off remains to be seen.

Risks to profit forecast

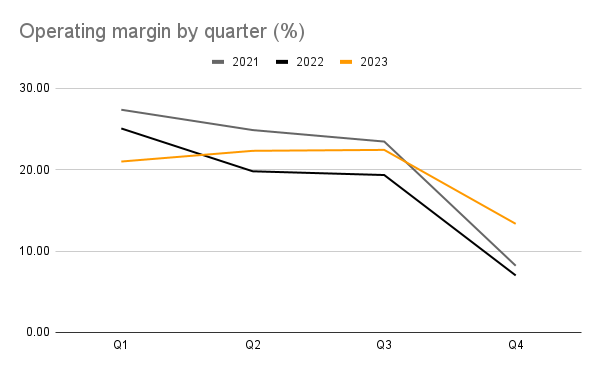

In contrast with the robust revenue expectation, however, the company expects the operating margin to decline to 13.3% from 22.4% in Q3 2023. This isn’t as bad as it looks at first glance. There’s a seasonality to Netflix’s final quarter margins, which have been substantially lower compared to the rest of the year (see chart below).

Source: Netflix

Lower margin drop differential

However, I do believe that the margin figure is worth watching out for in the upcoming results for two reasons. First, purely from a numerical perspective, the expected drop of 6.43 percentage points [pp] in Q4 margins compared to the average (expected) for the year of 19.7%, is smaller compared to earlier years. The differential has been at 10.8 pp and 12.8 pp in 2022 and 2021 respectively.

Declining inflation and the Hollywood writers’ strike have likely had a positive impact on costs, with the trailing twelve month [TTM] cost of revenues at a minuscule 0.72% YoY and operating expenses growth at 1.3%, which can explain why Netflix expects a lower margin differential.

Potentially increased costs

However, the Hollywood writers’ strike was called off by the end of Q3, 2023, and with improved packages, costs can be impacted. How big the impact is, however, remains to be seen considering that as per the Writers Guild of America’s estimates, the new package will only be around 0.2% of Netflix’s annual revenue. Still, it does put a question mark on the operating profit figures going forward.

What to expect from Q4 2023 figures

The key takeaway from the discussion so far is that while Netflix can continue to grow and improve profits, there are risks to the extent to which it can happen. If they don’t turn out quite as planned, particularly keeping in mind that its growth strategy is relatively recent, there could be a sentimental impact on the stock on the release of results. And of course, it’s likely to be the reverse if they turn out as expected, or better.

Attractive market multiples

In any case, as the stock’s multiples indicate, even if the results don’t turn out as expected, there’s a significant upside to the price right now.

First, consider the forward price-to-earnings (P/E) ratio. As per Netflix’s forecasts, 6.2% revenue growth for the full year 2023 is seen, along with an operating margin of 19.7%. Assuming that the net profit comes in at 82% of the operating profit, as seen for the first nine months of the year, the number would come in at USD 5.4 billion. This gives the forward GAAP price-to-earnings (P/E) ratio of 38.8x. This is significantly lower than the 55.35x average over the past five years.

Similarly, the TTM GAAP P/E is at 47.9x, compared to the five-year average of 66.4x. Even though Netflix has come a long way since its membership numbers shrank YoY in the first half of 2022 and earnings declined during the year, the price hasn’t fully caught up to the improved trends.

If it can continue to better its numbers as seen in 2023, its price has a significant upside of around 40% right now based on both the forward and TTM multiples.

What next?

Competition in the streaming services market is heating up, but Netflix has managed to keep its lead intact. Its growth has benefited from steps taken to ensure its sustained attractiveness and if continued, its Q4 2023 revenue and paid membership numbers can see a healthy rise.

There is some risk to the outlook as the average revenue per membership is expected to stay flat YoY and the operating margin can also be impacted due to seasonality and the improved package for writers, but how far remains to be seen.

Even if Netflix underperforms on its forecasts, however, its fundamentals and the market multiples make it clear that there’s considerable potential upside for the stock, making it a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—