Summary:

- The stock rallied after the earnings release in late January ’24, with EPS and revenue estimates rising nicely for 2024 and 2025.

- I’m a little worried about the number of analyst upgrades on NFLX coming into the release Thursday night.

- NFLX revenue estimate trends are improving for 2024, while 2025 has improved at a faster rate.

hapabapa

Netflix (NASDAQ:NFLX) reports their financial results for their first calendar quarter of 2024, after the market closes on Thursday, April 18th, 2024.

The 12/31/23 quarter was the big upside surprise as Netflix saw 13.2 million subscriber adds, vs. the 8.8 million expected, with 2.8 million coming from US and Canada, the slower-growing region. The stock rallied after the earnings release in late January ’24, with EPS and revenue estimates rising nicely for 2024 and 2025.

Personally, I’m a little worried about the number of analyst upgrades on NFLX coming into the release Thursday night. I’d rather have sentiment more negative coming into the call, since it limits downside for a growth stock.

Looking further back, the stock bottomed in mid-2022, near $160-170 per share, while the fundamentals bottomed in Q4 ’22, which will be gotten into in a minute.

Since that time, the stock has rallied back from those levels to back over $600 on better subscriber growth, ad tiering, the pressure on password sharing and the newest positive, Netflix’s deal with WWE’s RAW and their first foray into live sports.

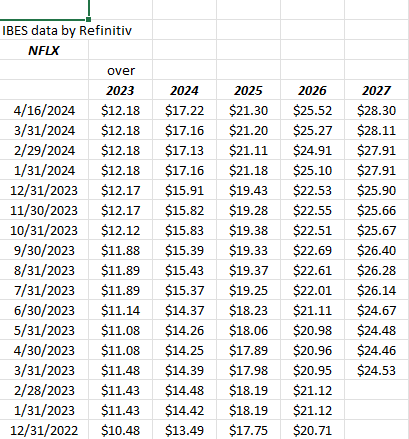

NFLX EPS estimate trends:

Source: LSEG

Even with better margins, I thought NFLX’s EPS estimates would have increased a little faster than they did, particularly for 2024 and 2025.

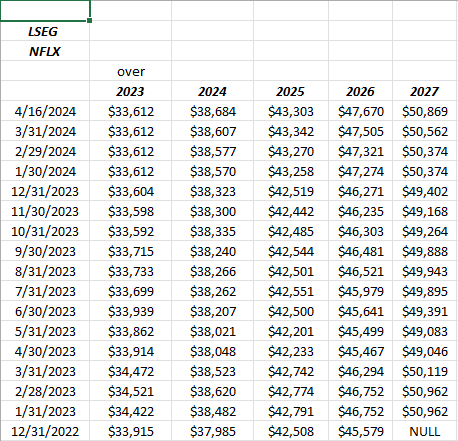

NFLX revenue estimate trend:

NFLX revenue estimate trends are improving for 2024, while 2025 has improved at a faster rate.

With a growth stock like Netflix and its very rich valuation, watching EPS and revenue estimate trends should provide some investors with a little more confidence that the stock’s valuation will continue to improve.

But even if EPS and revenue estimates continue to increase, a stock with Netflix’s valuation could drop 10-15% post earnings on analysts citing management “body language”.

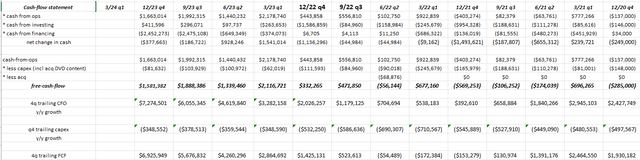

Cash Flow, Free Cash flow and Quality of Earnings

The big improvement in Netflix’s fundamental story since the early 2020s is the improvement in free cash flow, which has also improved Netflix’s quality of earnings.

Since the stock bottomed in mid-2022, here’s a quick summary of the improvement in Netflix’s cash flow and free cash flow (FCF):

Here’s the progression in 4-quarter trailing free cash flow since March ’22 (line 50 on the spreadsheet):

- Dec ’23: $6.9 billion

- Sept ’23: $5.7 billion

- June ’23: $4.26 billion

- March ’23: $2.86 billion

- Dec ’22: $1.4 billion

- Sept ’22: $523 million

- June ’22: ($54 million)

- March ’22: ($172 million)

While stable capex helped the streaming giant, it was the explosion in cash flow that drove the free cash flow gains. This blog has modeled NFLX going back to 2015, and NFLX was “cash flow” negative on a trailing twelve-month basis from December ’15 through June 2020.

Looking at NFLX from a cash flow valuation perspective, when the stock was bottoming in mid-2022 near $150-160, the stock was trading (seriously) at 100-125x cash flow at $150-160 per share, but with the stock back at $620, NFLX is now trading – as of Dec ’31 metrics – at 34-35X cash flow and free cash flow. Still lofty but dramatically improved.

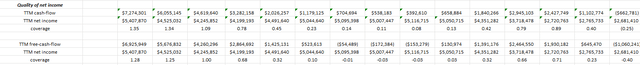

Since “quality of earnings” are monitored, which is cash flow (and free cash flow) divided by net income, here’s what the history of those metrics look like:

Both cash flow and free cash flow now cover net income at 1.38x and 1.25x. That’s better than most of the S&P 500, at least from free cash flow coverage.

Netflix convinced me to join in 2005 at $10.59 per month, and today I’m paying $25.09 per month, so readers can thank me for my steady contribution to cash flow. (That’s a bad attempt at humor.)

Summary/conclusion

The big technical level for NFLX is now the all-time-high in November ’21 at $700 per share.

With the kind of valuation on Netflix, i.e. the stock trading at 36x the expected ’24 EPS estimate of $17.22 per share, (44% EPS growth expected in ’24), the multiple is lower than the expected growth, with 15% revenue growth expected too.

That doesn’t happen too often, but it’s clear that investors may be less convinced of NFLX’s expected 44% EPS growth and 15% revenue growth this year.

A metric which is undoubtedly helping cash flow is NFLX’s operating margin, which averaged 9% from 2016 through 2019, but has improved materially to the mid 20% range this decade. In Q4 ’23 it was 17%, but the guide for Q1 ’24 was 24%, which is a nice bump.

The interesting part of NFLX’s business is live sports and the entry with WWE’s RAW. While talking to a few analysts with JPMorgan’s growth team, they thought that RAW would give Netflix a way to cut their teeth on the live sports segment and then gradually expand into other areas.

Plus there is NFLX’s emerging advertising business, which is still very small, but looking at other tech giant entrants into advertising, it tends to ramp quickly.

Street consensus is expecting $4.52 in EPS and $9.275 billion in revenue for Q1 ’24, which is expected YoY EPS and revenue growth of 58% and 14%. The operating margin guide was 24% for Q1 ’24 and the “net adds” were guided to be lower than Q4 ’23’s big upside, but ahead of Q1 ’23’s number of 1.8 million. (Sourced from Briefing.com).

The operating income consensus estimate is $2.4 billion, +42% over last year’s Q1 ’23.

Netflix’s “flywheel” as the Street calls it, is starting to spin (shall we say), with paid sharing improving, the new foray into live sports, advertising and even subscriber growth.

However, this doesn’t mean the stock can’t be down $50-75 on Friday morning after the call. No question management seemed to be cautious about subscriber growth, at least for Q1 ’24, partly due to it’s a non-seasonal quarter, and part due to the big beat in Q4 ’23.

Having never been a big fan of buying a higher P/E growth stock in front of an earnings report, readers should be cautious. Stocks like this trade like futures.

If readers are looking for a lower-risk entry on NFLX in order to buy the stock, a clean breakout over $700 would be one level. On the weekly chart, solid support is down near $450, or $150 lower. At present, the stock is stuck in this 18-month trading range.

Netflix’s long-term story is encouraging. Thursday night and Friday morning’s trade is a toss-up. The stock has crept up to a 10th or 11th position in client’s top 10 holdings, mainly on its appreciation since mid-2022.

None of this is advice or a recommendation. Past performance is no guarantee of future results. Investing can and does involve loss of principal even for short time periods. All EPS and revenue estimates are sourced from the LSEG. The fundamental spreadsheet work is my own. Markets can change quickly for both the good and the bad.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.