Summary:

- Wall Street cheered NFLX’s earnings results, which led to an 8% pop of the stock on the following trading day.

- While the results do not seem that outstanding at first glance, the management succeeded in convincing the Wall Street in a bright future and shaking off growth worries.

- Based on my fair value calculation, the stock seems undervalued and could offer a profitable entry point. With regard to the technical analysis, the stock has further room to run.

- The digital advertising market seems to offer a great potential going forward.

- Considering the fundamentals and technical analysis as well as the management’s future projections, I rate the stock as a strong buy.

stockcam

Introduction

Netflix (NASDAQ:NFLX) reported earnings for Q4 2022 on January 19, 2023. Wall Street cheered the results and on the next trading day, the stock popped by more than 8%.

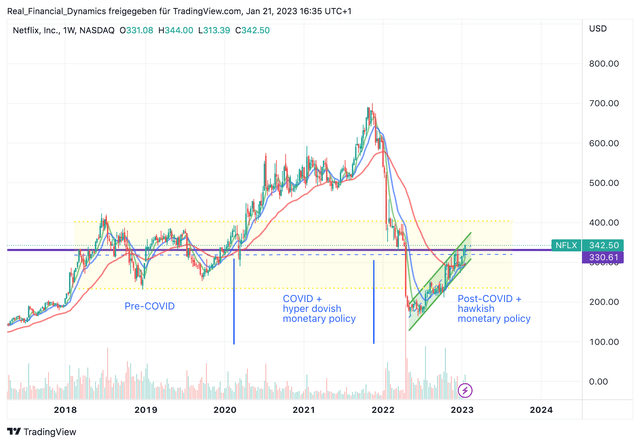

Previously, the stock had fallen over 77% from just about $700 to roughly $162 in May 2022 as part of the bear market, until it has since more than doubled from its low to $342.50 (see chart).

NFLX chart 2022-2023 (YCharts)

The purpose of this analysis is to discuss whether the results are really as good as they have been interpreted by Wall Street? What is NFLX’s fair value? From a chart perspective, where does the stock stand? Which risks could an investment in NFLX bear?

Wall Street is cheering the results and earnings call

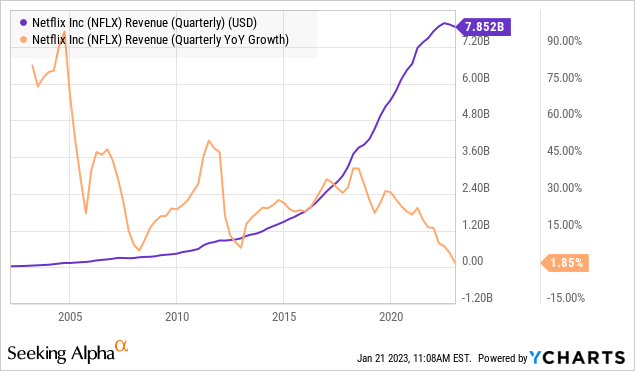

For Q4 2022, NFLX reported revenue of $7.85B, representing a year-over-year growth of 1.9%, in-line with estimates (or solid 10% on a foreign exchange (F/X) neutral basis).

According to the management, the revenue growth was driven by a 4% or 7.7 million increase in average paid memberships (ARM). This exceeded the company’s own forecast of 4.4 million by far. However, average revenue per membership declined 2% year over year but grew 5% on an F/X neutral basis.

On the other side, operating income of $550 million in Q4 2022 was down compared to $632 million in Q4 2021, primarily due to higher-than-expected revenue, a slower than forecasted hiring, and the appreciation of the US dollar.

EPS in Q4 2022 was $0.12 vs. $1.33 in Q4 2021. This was below the company’s own forecast of $0.36, mainly due to a $462M non-cash unrealized loss from the F/X remeasurement on Euro-denominated debt as a result of the depreciation of the US dollar vs. the Euro.

For Q1 2023, the company forecasts revenue growth of 4% (8% on an F/X neutral basis), driven by a combination of year-over-year growth in average paid memberships and ARM. The company expects modest positive paid net adds in Q1 2023.

In terms of free cash flow, management expects at least $3B of FCF for FY 2023 and over $4B in FY 2024, representing an 87.5% growth year over year for FY 2023 (vs. $1.6B in FY 2022). The management expects to generate sustained, positive annual FCF going forward. Beyond that, the company intends to return excess cash to its shareholders or add it to the buyback program.

Along with the roll-out of its ad-supported tier and password-sharing restriction initiatives, the company seems to be confident to return to double-digit revenue growth coupled with upward margin trajectory and rising free cash flow generation.

Linear TV, which is the company’s first target to gain market share in the ad business, is estimated at $50-60B, while the digital advertising market, which is estimated at about $180B globally (excluding China and Russia) is much larger and seems to offer a huge potential going forward for NFLX, according to analysts.

While I assume that the company’s revenue guidance was estimated conservatively given the fact that NFLX’s advertising business is now picking up steam, I also trust the company to achieve its FCF targets. On the one hand, the company has strong cost discipline and plans to increase profitability by 1-2 percentage points. Second, content spending is expected to remain at current levels, which sounds plausible as the market leader and ‘king of content’, considering also the fact that the company intends to increase shareholder value. Thirdly, the company forecasts an increasing number of subscribers, which should also help to achieve the growth targets.

It was also announced that co-founder and current co-CEO Reed Hastings, who has been Netflix’s defining face, will step down from his role as co-CEO and serve only as executive chairman. Investors seemed to receive this announcement very soberly and analysts are assuming one of the smoothest transitions in the media industry.

In terms of a smooth transition, I agree with the analysts. First, Reed Hastings had already prepared this leadership transition when he recently appointed Chief Content Officer Ted Sarandos as co-CEO. Second, he is leaving the role from a position of strength. The company has a clear strategy going forward, such as the implementation of the ad-supported plan, and has even issued FCF guidance for the fiscal year 2025. In this respect, the first task of the new CEOs will be to implement this strategy. Third, he is not leaving the company completely but will stand by the company as Executive Chairman and have an eye on strategy implementation and could back up the co-CEOs as needed.

Valuation

In terms of valuation, I have chosen three valuation models:

- the first valuation method is based on a DCF calculation.

- the second is based on the P/S ratio.

- the third valuation method is based on the rule of 40 by using the revenue growth rate and EBITDA margin, which is mainly used for evaluating growth stocks.

The valuation method based on a DCF calculation

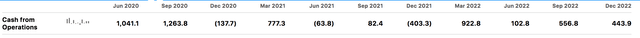

With regard to the valuation method based on a DCF calculation, it is really difficult to make a prediction of NFLX’s future free cash flow (FCF) development, as the metric is very volatile. For example, the following overview illustrates the ups and downs of operating cash flow (OCF) over the last quarters.

NFLX quarterly OCF (Seeking Alpha)

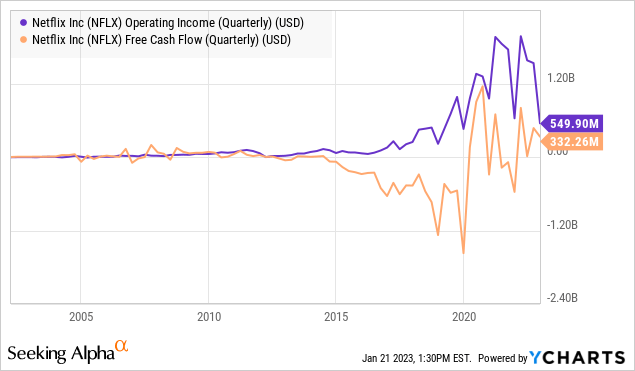

The following chart illustrates the development of FCF and operating income in graphical form. Once again, it is noticeable that both metrics are prone to fluctuation.

NFLX’s OCF and FCF development (YCharts)

However, according to MarketScreener, analysts’ consensus predicts an FCF growth of 111% in FY 2023 corresponding to an FCF of $3.4B and 39% in FY 2024 corresponding to an FCF of $4.7B.

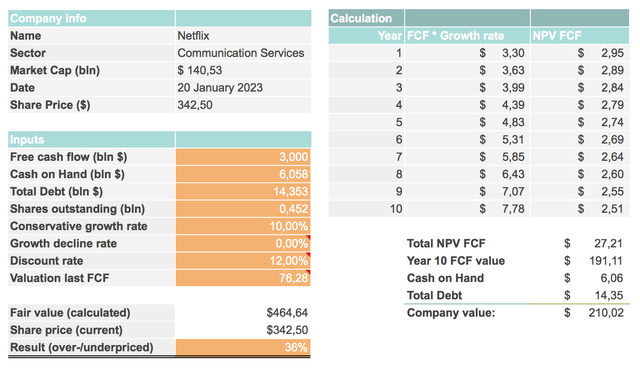

Since I always prefer a conservative approach, NFLX’s FCF is very bumpy and the future is highly uncertain, I have chosen a growth rate of 10% per year in terms of the FCF. According to my calculation, NFLX’s present value of its FCF in five years would correspond to the same amount as the analysts’ prediction for the FCF in 2025.

After 10 years, this growth rate would equate to $7.78B of FCF, which would be approximately double the projected FCF for 2024. I think this target is absolutely realistic and could even be achieved much earlier. For one, there should be a few more Netflix subscription price increases between now and then, which would lead to more revenue. Second, there is the additional revenue from the advertising business, which should pick up considerably by then, especially since Netflix is the market leader in streaming. Third, the company should continue to achieve growing membership numbers globally through successful original content productions and economies of scale. Fourth, as mentioned earlier, the company has very good cost discipline.

In terms of Price/Cash flow multiple, I have chosen a multiple of 76.28 for the last FCF, which represents the current multiple of NFLX. This Price/Cash flow multiple is well below NFLX’s 5-year average of 205.91 but higher than the S&P 500 multiple of 14.60, according to Morningstar. So NFLX’s Price/Cash flow multiple has always been highly valued, and there’s no indication that’s going to change anytime soon.

I have chosen a conservative approach by using a discount rate of 12% due to the monetary tightening phase of central banks on a global scale and the related rapidly rising interest rate environment. Other factors favoring a conservative approach include the uncertain macroeconomic and political environment and rising recession risks, which have probably not yet been fully priced in.

Based on the DCF calculation, my conservative fair value is $464.64, which corresponds to a current undervaluation of at least 36% (see figure below).

NFLX fair value calculation based on DCF (Author’s calculation)

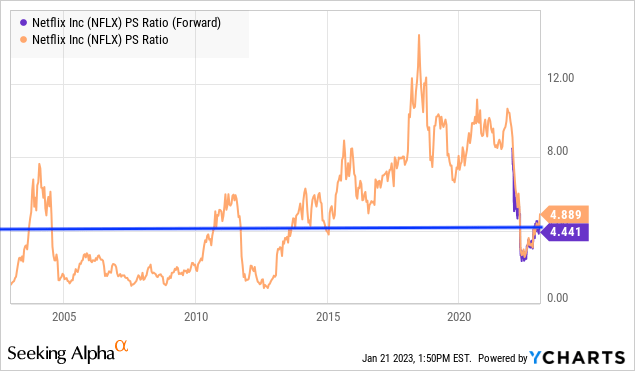

The valuation method based on the P/S ratio

With regard to the P/S ratio, it can be stated first of all that the valuation has declined rapidly during the current bear market. Looking at the P/S ratio, it can be seen that a valuation of below 4 appears fundamentally favorable (see blue line). The current valuation is 4.9 and the forward P/S ratio is 4.4. Thus, an attractive buying opportunity seems to have existed when the stock fell to around $162.

NFLX P/S ratio over years (YCharts)

However, as can be seen in the following figure, NFLX’s growth rates have also fallen sharply from double-digit to single-digit growth rates in the course of the last few years. In this respect, the lower valuation does appear to be justified. However, management seems to be pretty confident to return to double-digit growth rates going forward, according to the earnings call.

NFLX quarterly revenues and revenue growth (YCharts)

The valuation method based on the rule of 40

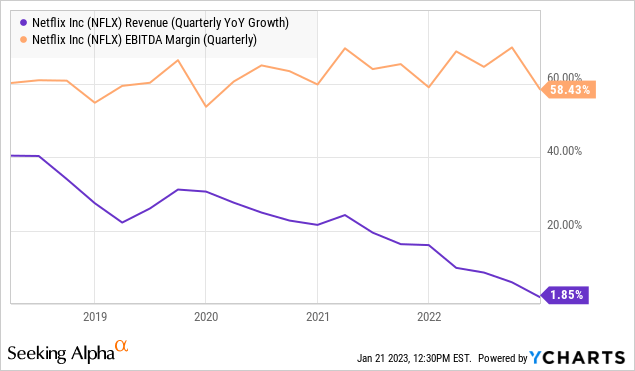

With regard to the rule of 40 and a revenue growth rate of 1.9% in the most recent quarter, it can be stated that the ratio of 60.28 (58.43 plus 1.85) seems very solid (see chart). According to the rule of 40, a promising investment should have a ratio of 40 or more. The more this ratio exceeds 40, the better.

In this context, it is noteworthy that although sales growth has fallen over the last few years, the company has succeeded in keeping the EBITDA margin fairly stable at around 60%. This is a signal for operational excellence, operating performance, and a disciplined cost structure.

Rule of 40 – NFLX quarterly revenue growth rates and EBIDTA margin (YCharts)

Technical Analysis

With regard to the chart analysis, it can be noted that while the overall trend is still negative (falling 200-day moving average, 20- and 50-day moving averages below the 200-day moving average), the NFLX stock trades in an ascending channel. On the one hand, this indicates potentially further rising share price. On the other hand, the stock seems to be at a resistance level that now needs to be broken.

Should the stock continue its upward trend, it could rise to around $400, which would correspond to the Pre-COVID high. As it can be seen in the chart, the stock was unable to break the $400 mark before COVID and the Fed’s ultra-loose monetary policy during that time.

Since the overall trend is still negative, the Fed is currently pursuing a hawkish monetary policy, and the recession issue is unresolved, I could imagine that the stock could move in a sideways channel for the time being without creating a significant breakout (see yellow marking).

However, NFLX reported strong results in the most recent quarter and succeeded to impress the Wall Street. Consequently, buying pressure could prevail for the time being.

For the sake of completion, it is noteworthy that the stock has formed a gap at $316 after the publication of the quarterly figures, which should be closed sooner or later and, depending on the situation, serve as a future buying opportunity.

NFLX chart – bottomed or not? (TradingView)

Execution Risks

While NFLX management sounds very optimistic and the plans are very promising, there are a few execution risks in the mix.

First of all, the streaming market is very competitive and an increasing number of players – especially large players – such as Apple (AAPL), Amazon (AMZN), and Disney (DIS) are entering the market, increasingly offering their own content and competing for the favor of subscribers. This could lead to NFLX’s future projections not working out or subscribers migrating to other providers if they don’t like the offered content.

Second, since the alternative of streaming providers is now very large, subscribers may only subscribe on a monthly basis and bounce from provider to provider, which could create significant competition between streaming providers and decrease profitability.

Third, it could happen that more and more users opt for the ad-supported plan, mainly to save costs in case there is indeed a recession. This could lead to NFLX’s potentially higher-margin subscription revenue being cannibalized by the ad-supported plan. This is a development to watch in the future, despite the immense potential of the digital advertising market.

Fourth, the advertising market as a whole is very competitive with global players from other sectors, such as Snap (SNAP), Meta (META), and Google (GOOGL). In this respect, Netflix would also enter into direct competition with these players in the future to grab a share of the digital advertising market.

Fifth, should there actually be a recession, it could happen that companies reduce their advertising spending and, as a result of the lower advertising revenues, NFLX would have to subsidize subscribers from the ad-supported plan. However, this could possibly be offset by an increase in the subscription fee.

Conclusion

I have to admit that I was skeptical when I saw the results and the initial pop of the stock. But, after a deeper dive into the results and the earnings call, the stock’s pop does not seem surprising.

The projections of NFLX’s management sound very promising. In addition to a return to double-digit growth rates and an increase in profitability, the company also plans to distribute excess capital to shareholders or buy back shares.

Additionally, according to my conservative fair value calculation based on a DCF calculation, the stock is undervalued at least by around 36%. The valuations with regard to a forward P/S ratio of 4.4 seems to be attractive considering NFLX’s historical valuation. Moreover, with respect to the rule of 40, the company has a ratio of 60.28, which indicates a very attractive valuation.

Turning to the technical analysis, while the overall trend of the stock is still bearish as it applies to the general stock market, the stock has formed an ascending channel, which could push the stock up to $400 or more in the short term. However, the stock could potentially move sideways if there is no recovery in the overall market.

Investors who are convinced of the digital advertising business and its potential, but do not want to invest in a streaming provider such as NFLX, are welcome to read my recent analysis on The Trade Desk (TTD): ‘Why The Trade Desk Could Be Your Portfolio-Booster’.

In summary, the outlook for NFLX appears to be very bullish, so I’m giving the stock a strong buy rating for now.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.