Summary:

- Netflix runs a profitable SVOD business and is now rolling out a highly profitable 1P AVOD business that will soon take off.

- The company’s quarterly ARPU is expected to grow from $12 to $17 in 2022 to 2026E, driven by the growth of its AVOD.

- NFLX’s 3-year business outlook suggests a +33% to +47% upside from its current stock price of $298.

Brandon Bell/Getty Images News

Netflix (NASDAQ:NFLX) is my top pick in 2023. This article covers its business overview and a recap of the Connected TV (”CTV”) Ad space, my investment thesis, stock valuation, and my thoughts around what investors might be concerned about.

Business Overview

Netflix operates as a leading SVOD and an emerging AVOD platform, offering TV series, documentaries, feature films and mobile games across a wide variety of genres and languages, and has attracted 223 million paid members in over 190 countries.

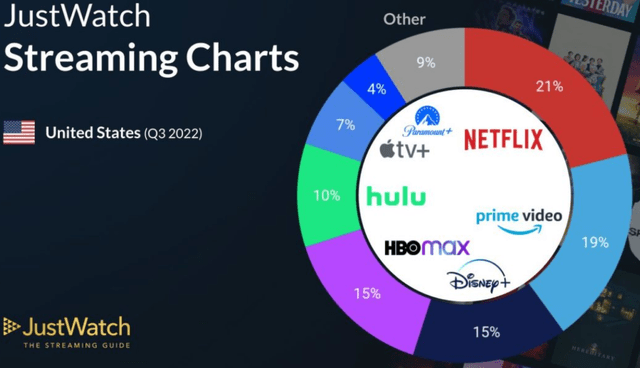

In this increasingly crowded streaming market, Netflix has the No.1 market share (21%) according to JustWatch.

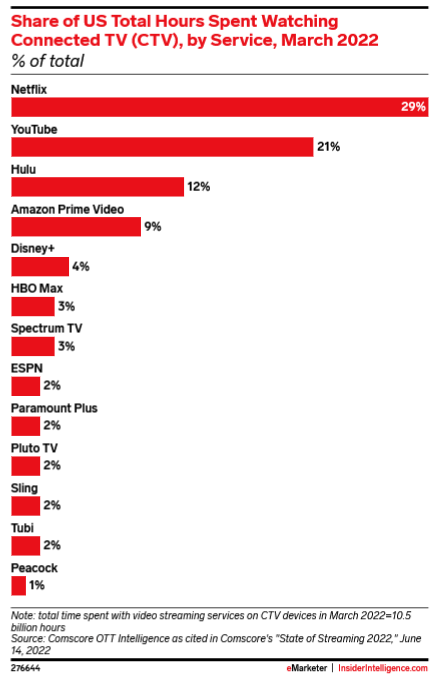

If we look at share of total hours spent watching, a key differentiator in ad monetization, Netflix accounts for 29%, clearly ahead of other players according to eMarketer.

eMarketer

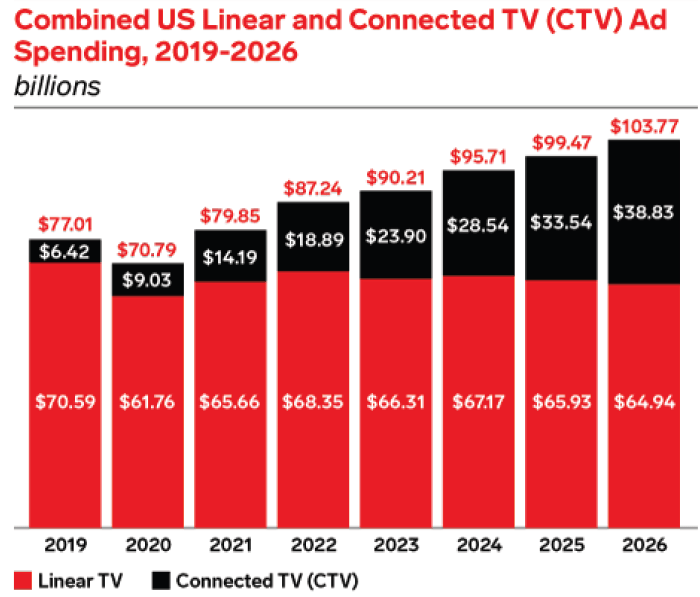

On Oct.13 2022 Netflix announced the launch of its ad-supported plan, officially marching towards CTV Ads, the best bet of digital advertising. My previous article, CTV Stocks to Invest In, discussed the secular growth of CTV Ads, as well as key Ads metrics used to understand and evaluate CTV stocks. CTV is gaining popularity across the world, and is the only way to reach two critical audiences on the household’s biggest screen: Cord-cutters (91 million in US in FY22) and Cord-nevers (34 million in US in FY22) according to eMarketer. In the US today, 56% of viewers watch video content through connected TV apps, and by 2023, that number is expected to reach 82% (data source: tvScientific). The CTV Ad spend in US is $19B in FY22, growing to $39B in FY26 (’22-’26 CAGR of 20%).

eMarketer

1. Netflix runs a profitable SVOD business, and is now rolling out a highly profitable 1P AVOD business that will soon take off.

The streaming TV space is getting crowded, but Netflix is likely the only established and profitable player, capitalizing on its 15-year efforts in content investments and customer acquisitions. Netflix reported 18%-21% in operating margin in 2020-2022E.

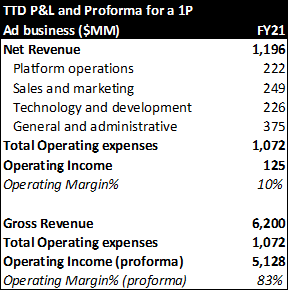

Ad monetization on an already profitable 1P publisher business is highly attractive. The way to think about its operating margin for Ads business is like the profitability of The Trade Desk (TTD), which runs a 100% 3P Ad business, and only better since Netflix does not have to pay media costs to 3P parties. The following figures represent TTD’s P&L in 2021, 10% operating margin, and 83% pro forma operating margin if TTD were not paying media costs to supply side partners.

For the partnership between Netflix and Microsoft, I would think Microsoft likely will take ~17%-20% of Ads revenue share for its efforts in tech stack and selling, based on the economics we understood from the TTD’s business. Therefore, when Netflix runs its Ad business at a comparable scale to TTD (in three years), over 80% of its Ad revenue will go into its bottom line.

TTD’s 10K

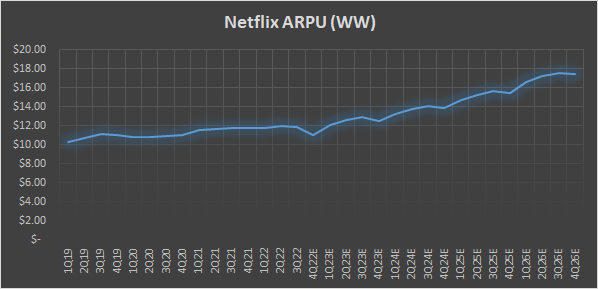

2. Netflix quarterly ARPU is expected to grow from $12 to $17 in 2022 to 2026E driven by growth of its AVOD.

Netflix’s revenue growth dropped from 19%, in 2021 to 7% in 2022E, driven by both flattened ARPU for its SVOD and decelerated growth of subscribers. It was crucial for Netflix to tap into advertising, and turn around its growth trajectory. In my financial modeling I assumed 1) 10% mix in Ad-supported subscribers starting in Q1-23, and an increase of 5 ppts QoQ; and 2) Ads Full Year ARPU of $50 (+10% YoY) in US, $40 (+5% YoY) in EMEA, $30 (+5% YoY) in LATAM, and $15 (+2% YoY) in APAC. As a result, I expect Netflix’s quarterly ARPU to grow from $12 to $17 in the next four years.

Netflix 10Q, and my own estimation

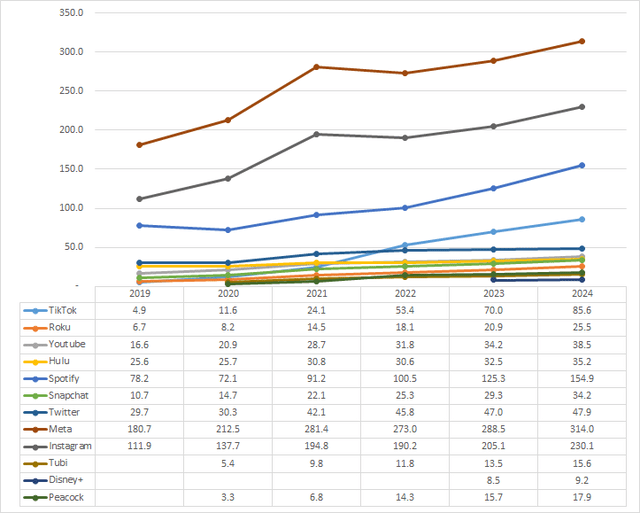

The following figure shows the US Ads ARPU of each Ad player (based on eMarketer data). I expect Netflix’s US Ads ARPU to land between Hulu’s and TikTok’s based on how strongly Netflix is going to perform in terms of the following key metrics including Reach, CPM and ROAS, Sell-Through-Rate and Upfront.

Reach – The total number of unique audience exposed to a campaign

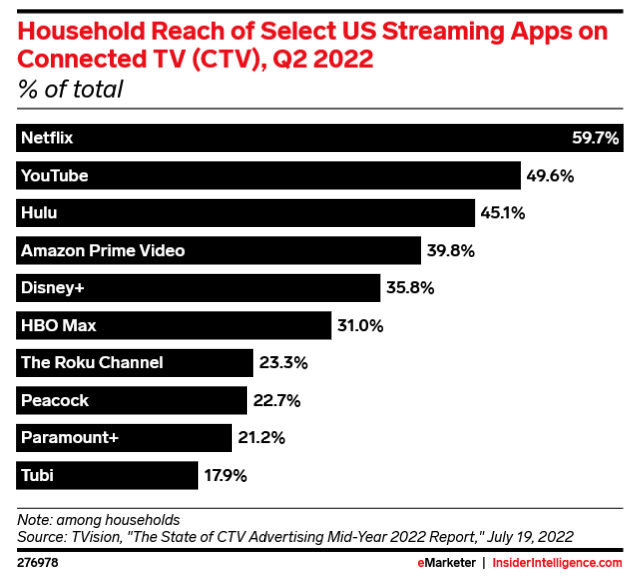

Netflix has 223 million subscribers, but a much higher potential reach with its 647 million viewers, according to eMarketer. As shown in the following figure, Netflix’s share of household reach is 60%, significantly higher than any of the other streaming Apps.

eMarketer

Cost Per Mille (CPM) – cost of one thousand impressions

Return on Ad Spend (ROAS) – how much value advertisers get from a campaign, which is a ROI measurement from an advertiser perspective

According to SpiceWorks, “Programmatic CTV Will Fuel a Race to $100 CPMs”. Investors might be mildly concerned about the price elasticity of CTV Ads, especially when that doubles or triples what Cable TV Ads charge. I think we should make a distinction between CPM and ROAS.

CPM represents Advertiser’s willingness to pay, considering the advantage of CTV Ads in audience targeting and campaign performance optimization. For CTV transactions, part of them go through Open Internet, where every party can bid and an efficient/or a semi-efficient market exists in theory. The remainder of CTV transactions are done within selected parties (Private Market Place, PMP), or done with exclusive guaranteed manner where pricing is pre-negotiated at premium. High CPM could be a reflection of CTV’s value proposition vs Cable TV, supply premium for platforms such as Netflix, and supply and demand parity.

What Advertisers should really care is ROAS. Advertisers can run CTV Ad Campaigns for brand awareness, then advertisers want incremental reach. Or Advertisers may want performance channels then the results should be measured as website visit attribution, online purchase attribution, offline conversion tracking, etc. Advertisers who are interested in Netflix Ads, such as Anheuser-Busch InBev, L’Oréal, Louis Vuitton, Tiffany & Co., and Bulgari, seem to be brand lift (reach) focused, and Netflix can obviously score well on that front.

Sell-Through Rate (”STR”): the amount of inventory sold as a percentage of the amount of inventory available

Upfront: TV/CTV advertising upfront cycle when TV networks, CTV platforms and streaming services can pitch their programming and ad products to advertisers and agencies

For a CTV publisher, it’s important to look at its sell-through rate and how well the upfront season is going. Netflix has verified the interests from a wealth of advertisers based on the fact that “it has been almost booked out before 2023 launch.”

3. Netflix continues to seed for its mobile gaming business, which will provide additional upside for the company

Netflix has 40 exclusive mobile games, included in Netflix membership, no ads, no extra fees, and no in-app purchases. In Q3-22, Netflix announced its partnership with Ubisoft, and Ubisoft will develop three exclusive mobile games for Netflix users.

It’s too early to speculate the impact on its current stock price, but it appears clear that mobile gaming fits well into Netflix’s ad strategy. I think Netflix is building valuable assets to fuel its future growth, e.g. game streaming, mobile ad, etc.

4. What is Netflix stock worth?

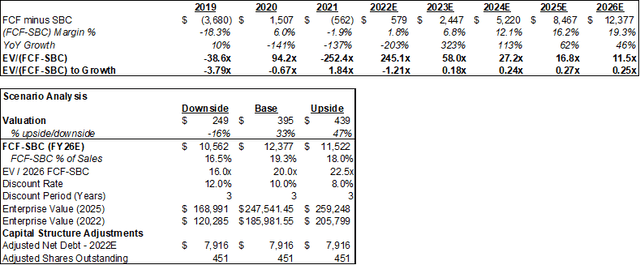

It will likely take three years for Netflix’s AVOD growth potential to fully play out. I used its EV/2026E FCF-SBC multiple to value Netflix in three cases. The base case suggests a +33% upside from its current stock price, and the upside case indicates a +47% upside.

– Increasing blended ARPU for its SVOD and AVOD business (increasing from $12 in 2022 to $17 in 2026E

– Operating Margin increase from 18% in 2022 to 27% in 2026E driven by the enhanced topline with AVOD, and the business mix shift towards AVOD which has higher profitability

5. What investors may worry about, and why those might not be as concerning as they sound?

There are several things that investors may worry about: 1) Competition in Streaming services; 2) Cannibalization between SVOD and AVOD; and 3) Tech capabilities.

Competition in Streaming services: Admittedly, the streaming world is getting crowded with a few others with deep pockets. That said, there is still a high barrier to entry, considering the upfront costs of building up the contents. Also, this is not a winner-taking-all market, especially when each player is moving towards more exclusive content arrangements; streaming services won’t be perfect substitutes for each other. On average, one could subscribe to ~3 networks.

Cannibalization between SVOD and AVOD: The cannibalization between its SVOD and AVOD will last for a while. However, my opinion is that the revenue hit for subscribers opting in a lower-rate service will be much more than offset by its revenue contribution from AVOD. To me, the Ad Basic is like Netflix’s Ad Pilot, and it can pull more of the levers when success is proved. By then, Netflix will be able to accelerate its growth of subscribers.

Tech capabilities: There might be mild concerns on Netflix’s tech capabilities, e.g. Insertion Order as opposed to Header Bidding. It does take years to build a tier-1 Ad Tech business. But that is not what Netflix is heading into. Netflix is a premium publisher business focusing on selling premium ad inventory to sophisticated advertisers in pre-negotiated manner (programmatic guaranteed deals) and ahead of TV budget season (upfront).

6. Conclusion

Netflix, a leading and profitable streaming service player, is looking to accelerate its business growth via AVOD by capitalizing on what it has spent 15 years building. Netflix is well positioned to be a leader in the AVOD space in just a couple of years. Investors who are interested in CTV stocks should definitely follow Netflix, and seize the investment opportunity.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.