NextEra Energy: Still Overvalued After Its Recent Tumble – Don’t Buy The Dips

Summary:

- NEE has underperformed the broad market significantly since our previous Sell rating, as we argued it was significantly overvalued.

- We discuss why utility analysts remain overly optimistic in their estimates, even as a recessionary scenario is the base case.

- We assess that NEE is close to re-testing a critical support zone that could see buyers defending it vigorously. However, NEE’s overvaluation remains a distinct red flag.

- As its near- and medium-term oversold, we move to the sidelines for now. But we urge investors not to add the dips, as we believe further value compression is likely.

Feverpitched

Thesis

Investors in NextEra Energy, Inc. (NYSE:NEE) who heeded our previous call to cut exposure would have saved themselves some pain. NEE underperformed the SPDR S&P 500 ETF (SPY) since we published our Sell rating, as we emphasized that its valuations were not sustainable.

Accordingly, NEE has fallen more than 15% since our article, compared to the SPY’s 3.2% decline. NEE’s YTD total return of -20% is also underperforming the Utilities ETF’s (XLU) -9% total return. Despite that, NEE continues to trade at a significant premium against its peers, predicated on its clear visibility toward its renewable energy future.

Our analysis suggests that NEE is at a critical juncture, as its near- and medium-term oversold. While its valuations remain well above its 10Y mean, the value compression has sent its price action close to its medium- and long-term moving averages.

As such, NEE could be moving into a medium-term downtrend if the coming recession is anticipated to hit the utility sector harder than anticipated. Moreover, the market de-rated NEE even though utility analysts remain optimistic over NextEra’s and its peers’ prospects through the coming recession. Therefore, we believe further value compression cannot be ruled out, as the Street has yet to transit into panic mode, cutting the earnings estimates on utility companies “furiously.”

Therefore, we believe revising our rating on NEE from Sell to Hold is appropriate, as we think the re-test against its near-term support is imminent. Furthermore, we anticipate a short-term rally could follow as the market draws in buyers before forcing it toward the re-test, given its oversold momentum.

Hence, we urge investors to be patient and not add NEE as it remains overvalued.

Street Analysts Are Still Unperturbed With The Potential Coming Recession

Bloomberg Economics has revised its probability of a recession to 100% over the next twelve months. The consensus estimates of a recession have also risen to a 63% probability over the next twelve months, up from 49% in the previous survey. Therefore, economists’ base case is now firmly a recessionary scenario for the US economy.

The recent updates from the Fed Beige Book also corroborate the view of a potential recession, moving further away from the possibilities for a soft landing.

However, if investors look at the utility analysts’ earnings estimates revisions through September, we could hardly glean the impact of a recession factored into their forecasts.

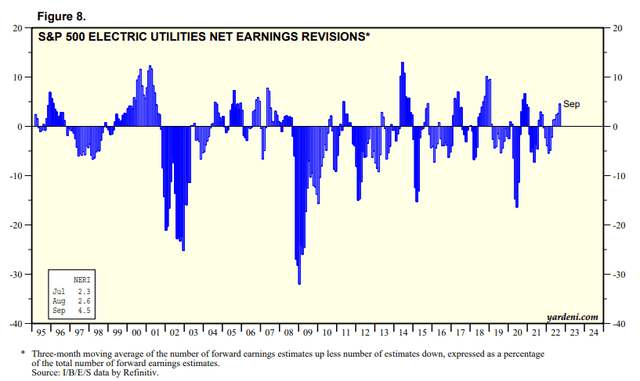

S&P 500 Electric utilities net earnings revisions % (Yardeni Research, Refinitiv)

As seen above, utility analysts remain favorable over utility companies’ prospects under their coverage. These industry analysts raised their earnings estimates for electric utilities through September with more fervor than the previous two months.

Notwithstanding, we urge investors not to understate the significant estimates cuts as seen above in a severe recession. Furthermore, if we expect a recession to be the base case now, we believe it’s not reasonable to expect NEE and its peers to escape unscathed, despite the analysts’ optimism.

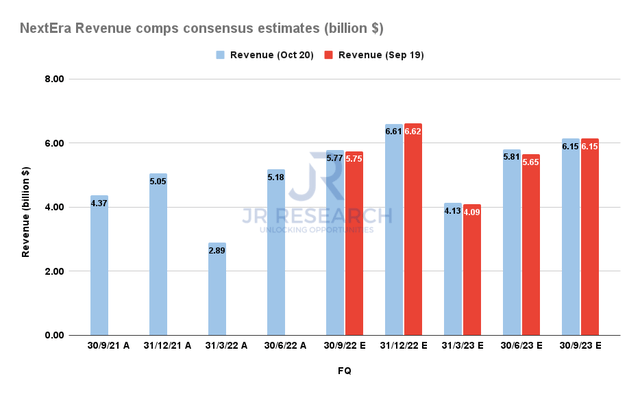

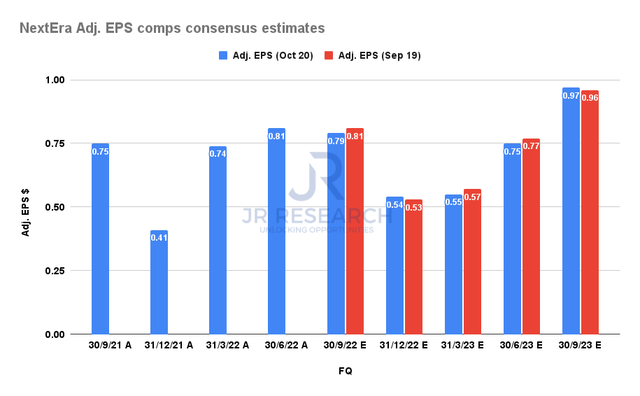

NEE Revenue comps consensus estimates (S&P Cap IQ) NEE Adjusted EPS comps consensus estimates (S&P Cap IQ)

As seen above, we gleaned that NEE’s analysts have clearly yet to factor in the impact of a recession into its estimates. Therefore, investors could hardly be blamed for being thrown a curveball by the market over the past month.

However, the market’s positioning suggests that it anticipates further cuts to NextEra’s estimates, behooving a de-rating.

Is NEE Stock A Buy, Sell, Or Hold?

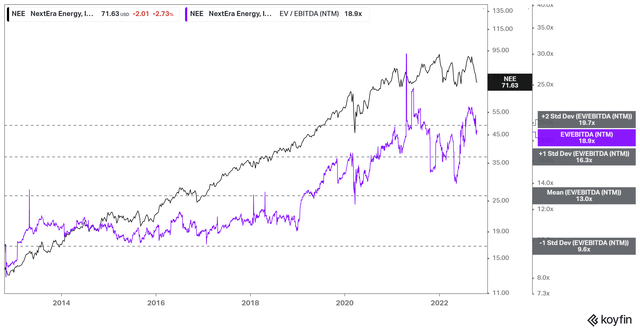

NEE NTM EBITDA multiples valuation trend (koyfin)

NEE last traded at a NTM EBITDA multiple of 18.9x, just below the two standard deviation zone over its 10Y mean. It has moved down from its significantly overvalued levels in September, but not by much.

Its NTM earnings multiple of 27.9x is also well above its peers’ mean P/E of 17x. Therefore NEE is still priced at a significant premium against its 10Y mean and its peers’ average.

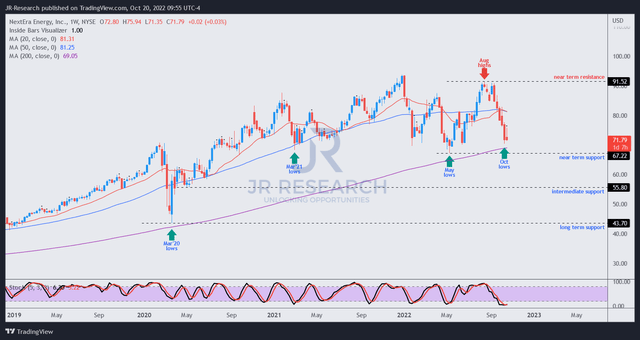

NEE price chart (weekly) (TradingView)

We assess that it’s looking increasingly likely that NEE could re-test its critical near-term support, even as its momentum is near- and medium-term oversold.

Buyers are expected to hold this level robustly, as its lows go all the way back to March 2021. Hence, we expect this level to be defended vigorously. Furthermore, it coincides with the 200-week moving average (purple line), arguably NEE’s final defense line before a decisive break of its medium-term bullish bias.

Note that the 200-week moving average supported NEE’s COVID lows robustly, which turned out to be an astute bear trap.

However, NEE traded at much lower valuations in March 2020 (NTM EBITDA: 12.8x) compared to its current NTM EBITDA multiples of nearly 19x. Hence, we believe NEE may find significant challenges holding on to its final defense line and urge investors to watch the battle closely.

Given its near- and medium-term oversold momentum, coupled with an impending re-test of its critical support zone, we move to watch the action from the sidelines for now.

As such, we revise our rating on NEE from Sell to Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!