Summary:

- A top 2023 black swan event is another 70% drop in Bitcoin prices to ~$5,000, according to research from Standard Chartered Bank.

- Such a black swan event could generate sizable impacts on Nvidia stock prices (through psychological effects) and also earnings (through fundamentals impacts).

- Based on my results, I view that Nvidia management is still underestimating the impact of their crypto exposure, likely as they did back in 2018.

by Martin Nancekievill/iStock via Getty Images

Black swan events and thesis

Recently, Eric Robertsen, the head of research at Standard Chartered Bank, made a list of a few black swan events that could happen in 2023. Top on the list is the possibility for Bitcoin (BTC-USD) prices to drop by another 70% to around $5000. And at the same time, gold prices would rise by about 30% (and full disclosure, I do not have Bitcoin exposure but I have some gold exposure). His reasons are quoted below, and I view them as quite plausible:

Eric Robertsen stated in the note that, considering a number of factors like insufficient funds or bankruptcies resulting in more crypto service providers packing up, more investors will likely begin to develop cold feet and will proceed to withdraw their assets. This, he said, will most likely lead to investors’ attention being directed to the good old gold. Robertson predicted that the price of gold could rise to about $2,250 for an ounce, which is about a 30% increase.

The rest of this article focuses on the impacts of such a black swan event on Nvidia (NASDAQ:NVDA). Black Swan events, by definition, are difficult or impossible to predict but generate sequential events, which I think is exactly what NVDA is facing here in terms of its Bitcoin exposure.

NVDA used to report its exposure to crypto mining. But it has stopped reporting it recently. Management repeatedly emphasized that crypto mining does not generate a significant impact on NVDA anymore in its earnings reports in recent quarters, while at the same time, they acknowledge that a variety of mechanisms exist for potential impact. The following exchange taken from its 2022 Q3 earnings report provides a good example. The quotes are slightly edited with emphasis added by me.

Question from Joseph Moore from Morgan Stanley: Wonder if you could talk to looking backward at the crypto impact. Obviously, that’s gone from your numbers now, but do you see any potential for liquidation of GPUs that are in the mining network, any impact going forward? And do you foresee blockchain being an important part of your business at some point down the road?

Answers from Jensen Huang (CEO of NVDA):We don’t expect to see blockchain being an important part of our business down the road. There is always a resell market. If you look at any of the major resell sites, eBay, for example, there are secondhand graphics cards for sale all the time. And the reason for that is because a 3090 that somebody bought today, is upgraded to a 4090 or 3090 they bought a couple of years ago is upgraded to 4090 today. That 3090 could be sold to somebody and enjoyed if sold at the right price. And so, the volume of — the availability of secondhand and used graphics cards has always been there. And the inventory is never zero. And when the inventory is larger than usual, like all supply demand, it would likely drift lower price and affect the lower end of our market.

Admittedly, it is difficult to estimate the impact. But I will try nevertheless in the remainder of this article. And my conclusion is that NVDA management probably underestimated the impact of a crypto crash. As you will see next, I am still seeing large crypto impacts on both the prices of NVDA (which reflects psychological impact) and also the profitability of NVDA (which reflects fundamental impact).

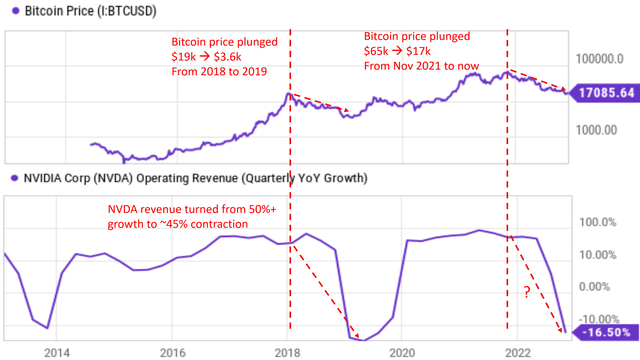

Historical perspective: the 2018 crypto crash

The last time we experience a similar cryptocurrency crash dates back to 2018, as displayed in the charts below. As you can see from the top panel, the Bitcoin USD prices dropped from ~$19k to ~$3.6k in about 1 year, translating into an annual decline of 81%. And in tandem, the YoY growth rates of NVDA’s operating revenue (on a quarterly basis) turned from about +50% to -45%. At that time, NVDA was still reporting its exposure to crypto mining. Specifically,

Quoting from NVDA’s own estimates: its crypto-related sales were about $0.6B (about 5.7% of its $10.6B total sales. While other independent analysts (such as Mitch Steves at Business Insider) provided a much higher estimate of $1.95 billion of revenue related to crypto/blockchain (about 18.4% of its then overall revenues) at that time.

Source: Author based on Seeking Alpha data

How about now?

As aforementioned, NVDA stopped providing breakdowns of its crypto-related revenues. But my view is that its management is still underestimating the impact today just as it did in 2018, for at least two reasons as detailed next.

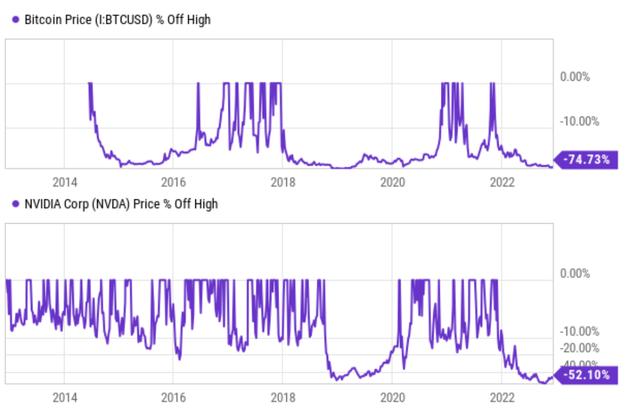

First, the stock prices of NVDA are still tightly correlated with Bitcoin prices. Of course, correlation does not reveal a causal relationship. And as a result, such correlation is best interpreted as a psychological impact. But nonetheless, psychological impacts are equally important as fundamental impacts in investing. To wit, thus far since 2022, Bitcoin prices are going through a similar correction as it did in 2028. As seen from the bottom panel of the chart above, Bitcoin prices contracted from a peak of ~$65k at the end of 2021 (in the November timeframe) to ~$17.1k now, about 1 years’ time again. Such a decline translates into an annual decline 74%, close to the 81% decline seen in the 2018 episode. In the meantime, you already know what has happened to NVDA stock price: it corrected by about 52% from its peak value in about a year in tandem.

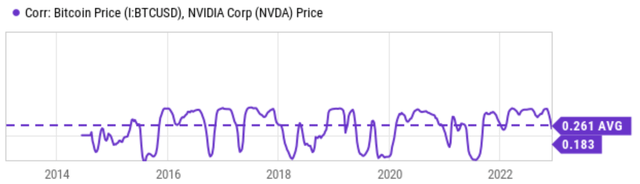

The above correlated movements are also observed over a wider time frame as shown in the next picture below. This chart shows the correlation between Bitcoin price movement and NVDA price movement during the past ten years since 2014. As seen, the average correlation is a positive 0.26 in the past, and the current creation is a positive 0.183.

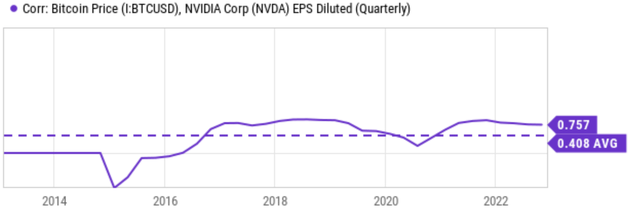

Second, the earnings of NVDA are also correlated positively with Bitcoin prices too. The next chart illustrates the correlation between Bitcoin prices and NVDA’s diluted EPS on a quarterly basis. As you can see, the average correlation is an even stronger 0.408 in the past ten years. And currently, the correlation hovers around 0.757, a quite strong level.

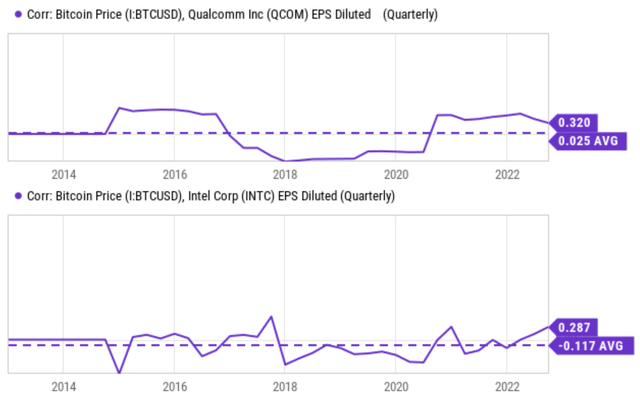

But of course, correlation does always equate to causality. However, in this case, I suspect there is a good possibility that it does. As you can see from the next chart, I am plotting the correlation between Bitcoin prices and QCOM and INTC’s diluted EPS on a quarterly basis this time. I know for a fact that these two chip makers have little or no exposure to Bitcoin mining. And indeed, their EPS shows little or negative correlation to Bitcoin prices (0.025 average in the case of QCOM and -0.117 in the case of INTC).

Source: Seeking Alpha data Source: Seeking Alpha data

Summary of risks and final thoughts

To recap, top on Robertsen’s 2023 black swan events is another 70% drop in Bitcoin prices to around $5000. And I view this as plausible considering factors like insufficient funds, bankruptcies, and investors’ psychological shift to more familiar safe-haven assets like gold.

Such a black swan event could have a large and negative impact on NVDA prices from a combination of physical impact and also fundamentals – which are both important and intertwined in investing. Based on my results, my view is that NVDA management is still underestimating the impact of their crypto exposure, likely as they did back in 2018. In the past year, BTC prices have dropped from ~$65k to ~$17k (translating into an annual decline of ~74%), and the YoY growth rates of NVDA’s operating revenue (on a quarterly basis) turned from a ~50% expansion to a 16.5% contraction. According to this recent Reuters report, NVDA’s supply of crypto-mining chips is still contributing to its sales to a substantial extent. In the meantime, investment in NVDA also entails substantial valuation risk at this point. Its FY1 P/E is about 48x, more than double that of AMD’s 20x and almost quadruple that of INTC (14x) and QCOM (11x).

All told, I do not recommend engaging at this point. The downside is simply too large with the combination of negative psychological impacts from Bitcoin prices, earnings impacts, and also the valuation risks.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

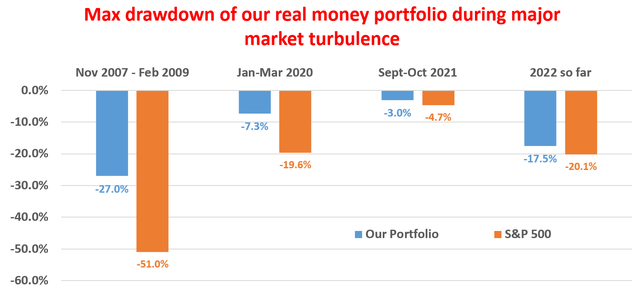

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.