Summary:

- Nvidia is a leader in the GPU space and is expanding into new areas.

- However, competitive threats are looming, and the market seems to forget that it’s in a cyclical industry.

- The share price appears wildly overvalued, even by optimistic standards.

Justin Sullivan

Having been invested in stocks for well over a decade, I know that market prices often do not reflect what I would consider to be a fair value for the company. More often than not, a stock is either well undervalued or overvalued, and if they are fairly priced, that’s usually just a stopping point on their way to either end of the valuation spectrum.

This brings me to Nvidia (NASDAQ:NVDA) which may well be a great company, but this happens to also be a case of “everybody knows”, and savvy investors know that if everybody likes a company, then its price is going to reflect that, setting the company up for potentially underwhelming returns going forward.

Prepare To Be Underwhelmed

Starting with the positives, Nvidia is a company that seemingly has a lot going for it. Gamers are likely to be familiar considering its roots in GPUs (graphics processing units), including its well-respected and broadly used GeForce line. NVDA has also expanded in recent years to more complex opportunities, notably in artificial intelligence, data center, and autonomous driving, which leverage the high-performance capabilities of its GPUs.

While Nvidia is considered by many to be a growth company, it’s also highly cyclical. This is reflected by challenges in the current macroeconomic environment, with total revenue being down by 17% YoY and 12% sequentially during its third fiscal quarter (ended October 30th). This was largely driven by a massive 51% revenue drop in the gaming segment, partially offset by a 31% increase in data center revenues. The automotive segment saw 86% YoY sales growth, but it’s starting from a much smaller base, with just $251 million in sales during the third quarter.

Outlook

Looking ahead, Nvidia faces a number of challenges, including the aforementioned macroeconomic environment, as well as a competitive landscape with Intel (INTC) and AMD (AMD) both vying for market share in the lucrative graphics space. While Intel’s recently released Arc GPUs have been underwhelming, the online review platform, Tom’s Guide, noted that Intel’s GPUs are far more affordable while delivering good performance to boot. Plus, they noted that NVDA may need to be concerned should future iterations of Intel’s Arc GPUs continue to deliver the goods.

Moreover, NVDA’s foray into data center and automotive is far from being a slam dunk, as AMD has well-entrenched positions in the former space, and Mobileye can put a damper on NVDA’s growth ambitions in the automotive space. This is considering the fact that Mobileye is a pure-play in the driverless automotive space, and is widely recognized as the industry leader, especially considering its recently released Supervision product, which contributed meaningfully to its revenue growth in its recent quarter.

Valuation

Considering the cyclical nature of the industry and headwinds on the horizon for Nvidia, it’s simply hard to justify paying $173 per share for the stock with a 53x PE. I’m generally wary of any stock that trades above a 30x PE and NVDA trades well above that. While analysts project around 30% annual EPS growth over the next two years, the forward PE would still be at around 30x two years from now, and that’s only “IF” NVDA can deliver that sort of growth.

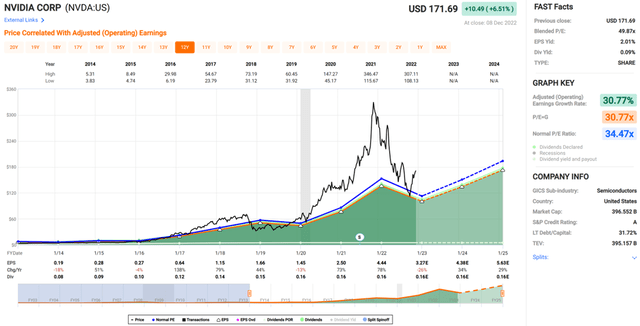

As shown below, NVDA still appears to be wildly overvalued at present, with a PE that’s far above its normal PE of 34x over the past 10 years. Notably, the share price would appear to be even more overvalued if we used a 20-year timeframe, but we’re not going to be that mean. Investors looking for other growth companies may do well to consider Google (GOOG) (GOOGL), which is far less cyclical and trades at a much more reasonable valuation.

(Note: The following chart is based on market close on 12/8)

Investor Takeaway

Nvidia may well be a solid company, but its stock price already more than reflects that. Despite its growth ambitions, Nvidia is highly cyclical and faces a number of headwinds that could put the kibosh on those ambitions, especially considering competitive threats on the horizon. Given the very high valuation of the stock, it seems set up for potentially underwhelming returns in the future. As such, there are other tech stocks that offer much more value than NVDA at present.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!