Summary:

- Can you believe the run that Nvidia’s stock is experiencing?

- While I called the Nvidia bottom in the $100-120 range, the 135% rally has surpassed even my bullish expectations.

- However, now that Nvidia’s more than doubled, its stock price is far from cheap anymore.

- The Fed will likely continue pivoting toward easier monetary policy, providing a constructive backdrop for many stocks.

- Nevertheless, Nvidia is getting highly overbought in the near term, and I will consider re-entering Nvidia and several other high-quality chip stocks at lower levels.

David Becker

Nvidia (NASDAQ:NVDA) has been a top-performing stock in my All-Weather Portfolio “AWP” over the years. However, the chip stock has been on a wild rollercoaster ride since the tech crash started in November 2021. Before the epic drop, I advocated for selling Nvidia. However, in this “Now It’s Time to Buy Nvidia” article, I called the stock a strong buy as it hit my long-term buy-in range of $100-120.

Several months have passed, and Nvidia is not $110 anymore but has skyrocketed by a staggering 135%. Shares are approaching the critical $260-270 resistance level, but perhaps more importantly, Nvidia is far from cheap here. After the recent run-up, the company’s market has swelled to roughly $630 billion, with its stock trading at more than 20 times sales and its forward P/E ratio approaching 60 now.

Nvidia’s bubble-like valuation may not be sustainable due to the general market slowdown and challenging macroeconomic factors that could last longer than anticipated. Furthermore, the market may be overly optimistic regarding the future path of interest rate hikes. Additionally, Nvidia’s technical image has numerous red flags.

Therefore, Nvidia’s stock could correct by a significant margin as we advance. Moreover, provided that Nvidia remains a top tech darling, the stock’s decline could correlate with drops in other overbought stocks and sectors, leading to another selloff before a significant buying opportunity materializes.

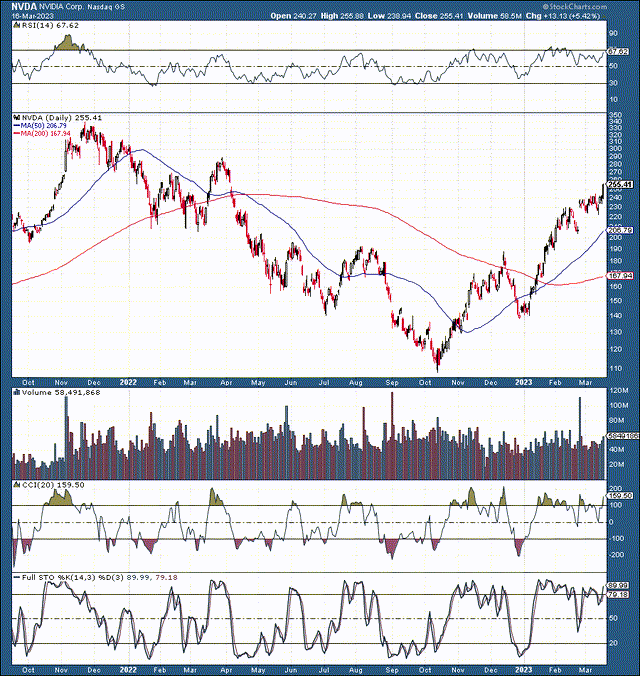

Technical Image – Getting A Little Stretched

Nvidia’s rally over the last few months has been sensational. However, the downside has plenty of risks if volatility picks back up and sentiment shifts. Therefore, we may purchase Nvidia in the $200-180 range or lower in the coming weeks. If we get the 25-30% correction I’m looking for, Nvidia’s stock will become a strong buy again. Nevertheless, despite the impressive gains, Nvidia is probably due for a pullback. We see the nice reverse head and shoulders pattern, but how much higher can Nvidia run in the near term? There’s the $260-270 resistance level, but it’s challenging to see Nvidia move significantly higher after that. FOMO investors may chase Nvidia up to $280-300 resistance, but without a comprehensive catalyst, any near-term gains may be transitory. Thus, I’d consider selling into strength and buying back at lower levels or hedging here.

Why The Significant Run-Up Lately?

Several factors are responsible for the significant gain in Nvidia’s share price and the appreciation of many other stocks, especially chip companies. First, many chip (and other high-quality tech) companies became deeply oversold and significantly undervalued recently. This dynamic occurred when there was nothing wrong with their underlying businesses. I wrote about some of my favorite tech stocks leading markets higher at the start of this year, and Nvidia has been one of the hottest names.

High-Quality Stocks Got Way Oversold

Here are several examples of top-chip stock performance since the recovery began:

- Nvidia: $110-260 (135% gain).

- AMD (AMD): $55-97 (76% gain).

- Taiwan Semiconductor (TSM): $58-105 (81% gain)

- Broadcom (AVGO): $410-640 (56% gain).

These stocks are just several examples. The chip sector, and Nvidia especially, have performed exceptionally well during these last few months. In general, many top chip and technology stocks likely bottomed late last year and should be bought on pullbacks as we advance from here.

The Fed And The Shift in Sentiment

The most significant catalyst in propelling many oversold tech stocks is the Fed and the shift toward a more positive sentiment.

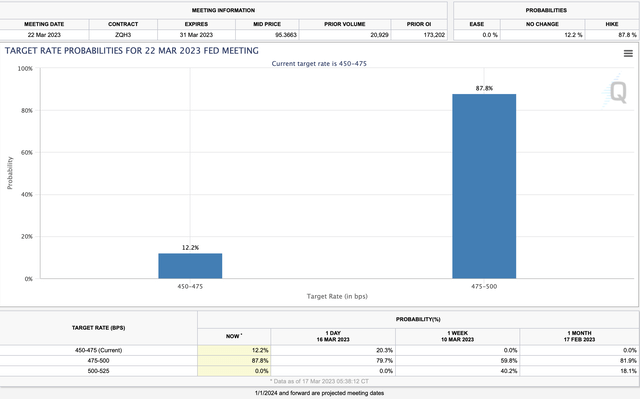

Rate probabilities (CMEGroup.com )

The FOMC meeting is next week, but expectations are becoming dovish. Just one week ago, there was a 60/40% chance for a 25/50 bps increase. However, now there’s an overwhelming probability that the Fed will raise by only 25 bps and may even not raise at all this month. One thing appears clear and the Fed is likely nearing the end of its tightening process. Moreover, the Fed will likely reverse its tightening policy and begin easing by the end of this year.

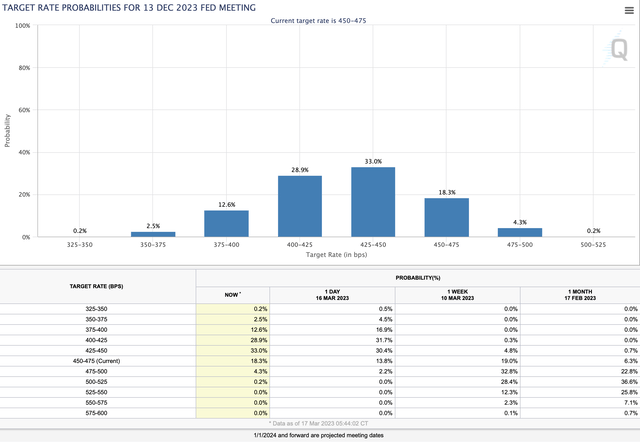

Year-end Target Rate Probabilities

Rate probabilities (CMEGroup.com )

Here, we also see the “pivot” essentially occurring in real time. A week ago, there was an overwhelming chance that the benchmark rate would be around 5% by year-end. However, now there’s about a 75% chance that the benchmark rate will be about 4.25-4.5% or lower when the year ends. Thus, the benchmark rate should be 25-50 bps below its current level when the year ends. This dynamic illustrates a significant change in the rate hike expectations in the near term. Therefore, the market is looking to get what it wants (lower interest rates and other stimuli). Thus, we’re seeing substantial short covering and heavy buying in high-quality tech stocks that got battered, becoming significantly oversold.

The Bottom Line: Buy The Dips

With the Fed likely to continue “pivoting” in the coming months, it seems highly probable that Nvidia and many other quality tech companies likely reached long-term bottoms late last year. We’ve seen remarkable rallies from many market-leading stocks, but some market darlings are getting highly overbought here again.

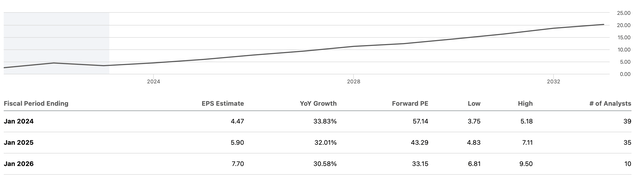

I don’t mean to pick on Nvidia, but it’s the poster child of a tech stock gone wild again. I was bullish on Nvidia’s stock when trading around 20-30 times forward earnings estimates. However, now that its valuation is approaching 60 times forward EPS estimates (and 21 times sales projections), Nvidia is expensive again.

Approaching 60 times non-GAAP Forward EPS estimates

EPS estimates (SeekingAlpha.com)

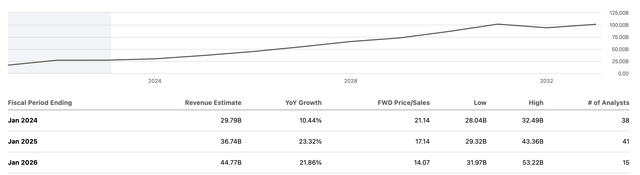

Consensus Revenue Estimates: 21 Times Sales – Very Expensive Again

Revenue estimates (SeekingAlpha.com )

Moreover, the company’s business may not return to the ultra-high profitability level we saw before the crisis. It may require more time to improve margins and overcome specific challenges from the broader economy and on Nvidia’s side. Furthermore, many quality technology companies face a similar dynamic. While some tech names may be good buys at current levels, I’ll buy Nvidia if it reruns back to the $180-220 range.

Five Other Chip Stocks I’m Considering On a Pullback

AMD: Buy-in zone – $75-$80

TSM: Buy-in zone – $70-80

Broadcom: Buy-in zone – $550-600

Qualcomm (QCOM): Buy-in – $100-120

Intel (INTC): Buy-in zone – $22-25

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NVDA, AMD, TSM, INTC, QCOM, AVGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diverse portfolio with hedges.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!