Summary:

- NVIDIA Corporation’s run higher since October, mainly on AI excitement, has pushed the valuation to an extreme.

- The stock has quickly become the most overvalued in Big Tech during early 2023, using fundamental ratio analysis.

- A 50% price decline in a recession scenario is not out of the question. I am downgrading my share rating to Sell or Avoid.

Justin Sullivan

While you could have made a legitimate argument Tesla, Inc. (TSLA) was the most overvalued stock on Wall Street a year and a half ago, it has lost the meme-mantle for nuttiness. Perhaps CEO Elon Musk’s take-private Twitter fiasco has turned off large numbers of both electric vehicle (“EV”) buyers and equity strategists. Musk is no longer considered the easy-money winner whatever he touches.

The new king for a crazy Big Tech valuation in February 2023 is NVIDIA Corporation (NASDAQ:NVDA). It’s now perceived as the cannot-miss Artificial Intelligence [AI] chip exposure for your portfolio. A rush of AI excitement has pushed valuations into nosebleed territory. Everywhere you read, AI bots are going to revolutionize the world overnight. And, every company and computer maker will need upgraded semiconductor chips made by Nvidia.

If you are skeptical by nature, like me, this sounds like another rush to instant riches originally promised by cryptocurrency trading and meme stocks in 2021-22. My suggestion is, don’t fall for the same shtick again, while being bamboozled out of extra wealth. The sad part is get-rich-quick schemes have always existed and always will.

A smarter tack might be to sell your Nvidia shares into the early 2023 strength, before the spontaneous AI boom sentiment turns to bust.

Basic Valuation Overview

To illustrate how extreme the overvaluation setup is for Nvidia, I thought I would compare some data points to fellow Big Tech meme stock Tesla, plus a similar semiconductor firm Qualcomm Incorporated (QCOM). Why Qualcomm? It is also a major, high-margin semiconductor business selling diversified product lines, with reasonable growth rates projected into 2025. I have also included Ford Motor Company (F) to contrast with Tesla. Ford is moving rapidly into EV production, with an outlook perhaps better than many investors understand. I am not trying to contrast Nvidia with Ford, but want readers to look at the relative spreads between NVDA and QCOM, plus TSLA and F.

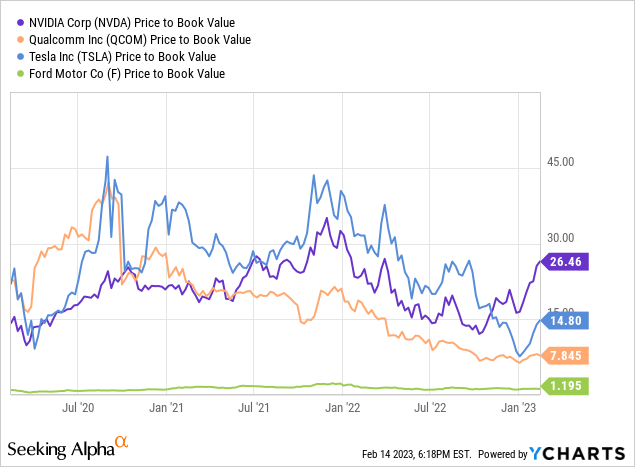

My first statistic to review is price to book value. While Tesla was the most stretched for a valuation on this metric in early 2022, Nvidia is now far and away the leader (in a bearish way) for stock value vs. underlying net assets. At 26x BV, shares are well above the equivalent 4x ratio for the S&P 500, while DOUBLE Tesla’s 14x and TRIPLE Qualcomm’s 8x.

YCharts – NVIDIA, Qualcomm, Tesla, Ford, Price to Book Value, 3 Years

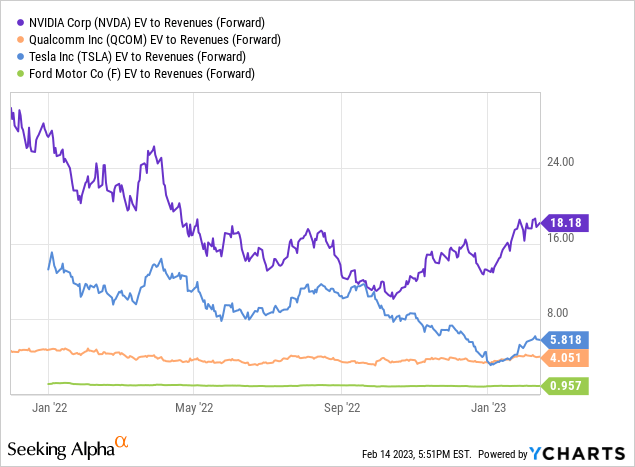

When we include debt and equity market capitalization together (minus cash holdings), the enterprise value number can often provide an intelligent, apples-to-apples comparison between different companies. If you are an owner, you want to know what kind of stripped-down valuation exists vs. revenues, zeroing out all debt and cash holdings between similar businesses. EV to “forward” estimated sales of 18x is TRIPLE the Tesla number and almost QUADRUPLE Qualcomm. I am using forward numbers to account for expected growth over the next 6-12 months for each of the four stocks.

YCharts – NVIDIA, Qualcomm, Tesla, Ford, EV to Forward Estimated Revenues, 1 Year

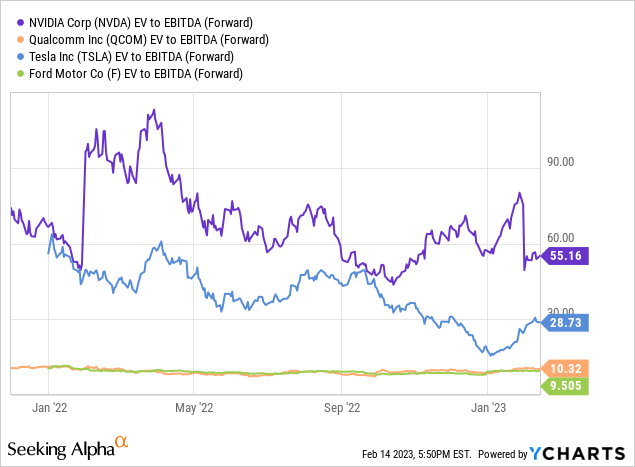

EV to cash EBITDA (on a forward expected basis again) is also way beyond the valuation of nearly every other blue-chip trading in America. A multiple of 55x is far above the S&P 500 number around 15x, DOUBLE Tesla’s 28x and QUINTUPLE Qualcomm’s 10x ratio. Is Nvidia’s long-term business growth worth 5x the EBITDA cash flow valuation of QCOM? Hmmm…

YCharts – NVIDIA, Qualcomm, Tesla, Ford, EV to Forward Estimated EBITDA, 1 Year

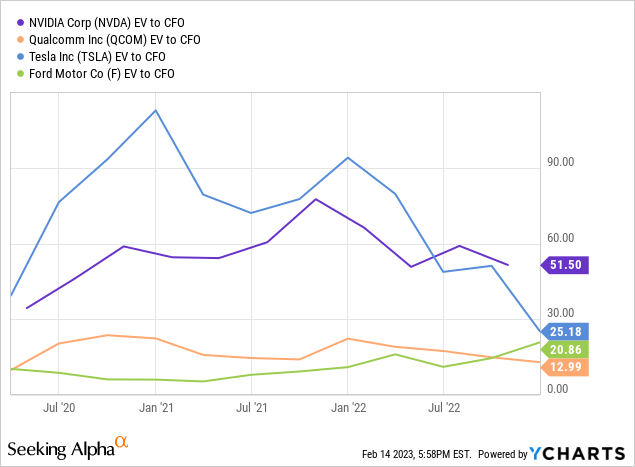

EV to “trailing” cash flow of 51x is close to the same setup as EBITDA, and likewise a premium of 2x to 4x Big Tech peers and competitors.

YCharts – NVIDIA, Qualcomm, Tesla, Ford, EV to Trailing Cash Flow, 3 Years

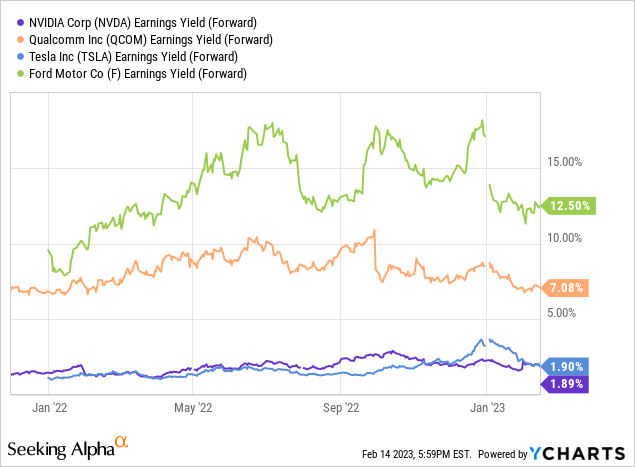

Lastly, let’s look at forward estimated earnings vs. the present quote. This basic earnings yield calculation is important to consider, with 2023 growth factored into the equation. 1.9% is quite anemic, about the same as faster growing Tesla, while a massively lower real-world yield return vs. Qualcomm (7%) or Ford (12%) as investment alternatives.

YCharts – NVIDIA, Qualcomm, Tesla, Ford, Forward Estimated Earnings Yield, 1 Year

My Inflation Minimum-Return Argument

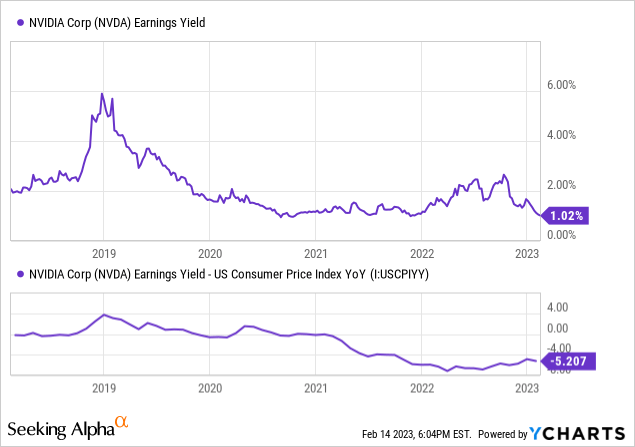

I have been harping on this point since 2021. Big Tech names are not even close to being able to cover general CPI increases of 6% to 9% annually from earnings or free cash flow. Shareholders and new buyers are willing to fall behind inflation-adjusted wealth changes in regular parts of the economy on the “promise” of rapidly rising earnings a year or two down the road. Then you get a recession in auto demand for Tesla or a routine cyclical slide in semiconductor sales for Nvidia. All of a sudden, investors are left holding an overly optimistic position and price at a clear overvaluation that requires a monster stock price slide to rebalance lower profits with still high inflation rates (assuming inflation does not decline much in 2023).

This situation is quite rare and extraordinary. For example, Nvidia has usually traded with a trailing earnings yield ABOVE the prevailing inflation rate over the last 20 years. But the meme-stock boom and sharply rising inflation since early 2021 mean this normal circumstance has been turned upside down. New investors are receiving a “trailing” 1% earnings yield vs. 6%+ CPI, a total imbalance and mismatch. A negative inflation-adjusted business return rate of -5.2% is a huge hole to plug, even with decent growth in underlying operations.

YCharts – NVIDIA, Trailing Earnings Yield vs. CPI Inflation, 5 Years

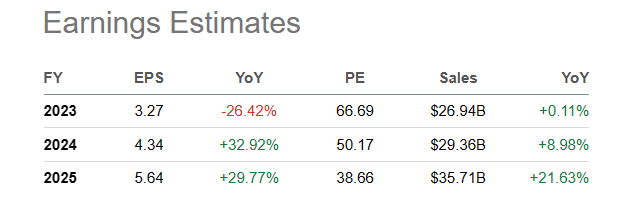

Applying currently projected strong growth rates of 20% to 30% annually from Wall Street analysts, it could take 5 to 10 years for income generation results from Nvidia to rebalance the risk of a cyclical semiconductor industry properly with inflation (assuming 3% to 5% annual rates are the future for CPI). Why not purchase a company throwing off 5% to 10% in free cash flow or earnings upfront, with growth adding gravy to the pot? A stock like Qualcomm fits this description, which I explained several times during the end of 2022, including October here. My point is the math logic to own a business with 1% or 2% in earnings yield today can only by justified with 50% to 100% income growth compounded annually for at least 2-3 years.

Seeking Alpha Table – NVIDIA, Analyst Estimates for 2023-25, Made on February 14th, 2023

Technical Momentum

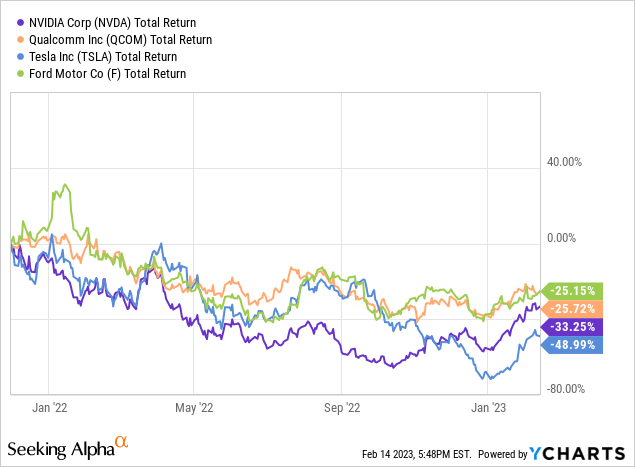

Following the Big Tech mania peak in November 2021, believe it or not, Qualcomm has outperformed Nvidia, while Ford has bested Tesla for total return investment performance. Granted, they have all lost money. My view is a recession in 2023 will cause overvalued favorites to continue underperformance trends another year, at a minimum.

YCharts – NVIDIA, Qualcomm, Tesla, Ford, 15-Month Total Returns

NVIDIA’s daily technical trading chart is starting to mimic the patterns outlined near the all-time $340 peak in November 2021. The AI euphoria of today is creating a remarkably similar effect on NVIDIA shares.

In particular, short-term relative price strength over a few months has led to an “overbought” condition. When you review 14-day Average Directional Index (red circles) and Money Flow Index (blue circles) calculations, a repeat major top could be forming.

StockCharts.com – NVIDIA, 18 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

I know commenters will argue Nvidia Corporation is sitting in the perfect spot to benefit from AI spending trends and interest. No doubt, they will. However, the valuation is so out-of-whack with other equities in the U.S. and basic cost-of-living changes that positive operating results may not support share price gains from today. Such is my best-case scenario – a flat quote in 12 months.

On the opposite side of the spectrum, a recession in the economy may translate into sales and EPS stagnating this year vs. last. In this case, the share valuation will come crashing down with price, back to a level equivalent with the pre-meme world before 2021’s euphoria appeared.

My 12-month “fair value” target price for Nvidia Corporation is closer to $120 per share, not the current $229 quote. I have written on the company’s overvaluation since 2021, even predicting here a price closer to $100 was coming when $300 was the trading value. Price did subsequently decline all the way to $109, where I switched to an official Hold rating. I did not foresee the latest AI excitement. So, the double in price from October has forced me back into the Sell camp for a rating in recent weeks.

What could keep price high or support a continued advance? A bunch of variables will have to play out just right is my answer. Inflation has to come down; the economy has to avoid recession; and, Nvidia chips have to survive increasing competitive threats. If AI is the new driver of results, Intel (INTC), Advanced Micro Devices (AMD), Qualcomm, and a long list of major semiconductor peers will come up with their own competing chip products. Nvidia does not operate in a vacuum. For me, real-world investment risks far outweigh the potential for minor gains.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.